Tracy Oliver and Scott Bartley1

This paper examines some of the factors that influence the level of tax system complexity and taxpayers’ compliance costs. The policy trade-offs and legislative and administrative design choices that are made during the development and implementation of a new provision have a direct bearing on the complexity of the tax system and the compliance costs of taxpayers. Private interest in minimising tax liabilities can also be an important driver of tax system complexity. This paper shows how tax-minimising behaviour can lead to a level of tax system complexity and compliance costs in excess of that which is likely to be optimal from the perspective of society as a whole.

Introduction

The level of tax system complexity and the level of taxpayer compliance costs are important matters for taxpayers, government and policy makers for a number of reasons.

The purpose of this paper is to highlight some of the factors that influence tax system complexity including the economic and social environment faced by taxpayers, taxpayer behaviour, and the development, implementation and administration of tax policy. The paper begins by explaining why complexity and compliance costs are important and shows how the cumulative impact of many ‘simple’ tax measures can create an overly complex set of tax law. The paper then examines how tax policy design can influence the level of complexity, for example when policy makers trade off simplicity to achieve other tax goals such as equity and efficiency. Lastly, the paper shows that taxpayers may be willing to accept, and even demand, complexity if potential tax savings outweigh any increase in their compliance costs. The analysis indicates how such demands can move the tax system beyond a socially or privately optimal level of complexity.

Why complexity and compliance costs are important

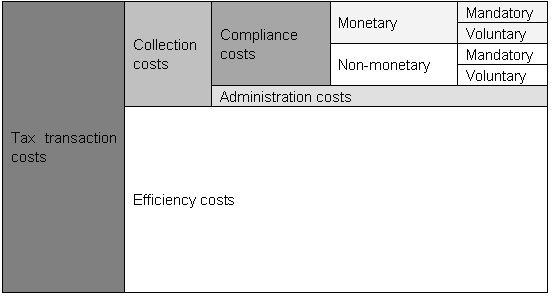

Figure 1 provides a schematic representation of the types of costs incurred in raising revenue. There are two main types of cost associated with raising revenue: collection costs and efficiency costs. By far the largest of these are the efficiency costs, being several multiples of collection costs.2 Notwithstanding the importance of efficiency costs, which to a reasonable extent are an unavoidable consequence of raising revenue, the focus of this paper is on collection costs.

Collection costs comprise government administration costs and the compliance costs incurred by taxpayers in meeting their obligations under the tax assessment Acts. Compliance and administration costs have been estimated to be around 2 percent of GDP.3

Figure 1: A breakdown of tax transaction costs

Compliance costs can be further categorised into mandatory costs and voluntary costs. Mandatory costs are those costs that taxpayers must incur to meet their statutory obligations. For example, the law requires that taxpayers report all forms of income identified within the statute and be able to substantiate any claimed deductions, rebates or offsets. Voluntary costs are those additional costs that the taxpayer may choose to incur to determine or minimise their tax liability. For example, taxpayers may choose to evaluate alternative methods of complying with the law to determine which produces the most favourable tax outcome. They may also seek advice to identify tax-effective ways to structure transactions. Voluntary costs may also be incurred in calculating and applying deductions, rebates and other concessions for which the taxpayer is eligible but not legally required to claim.

A certain level of collection costs will always be associated with raising the revenue to be spent by government on redistribution and the provision of goods and services. The higher these costs, the lower the socially desirable level of these goods and services, other things equal.

To illustrate how compliance costs affect economic output, consider an economy that produces two goods, a public good and a private good.4 Figure 2 shows a possible production possibility curve (PP) for the two goods. A production possibility curve shows the boundary between the attainable and unattainable levels of production. It is the limit of what an economy can produce from its resources and technology. If a tax system is associated with excessive levels of compliance costs, the economy will not be performing on its production possibility curve.

Point A on Figure 2 shows such a sub-optimal level of production. At point A the highest attainable level of social utility is represented by the social utility curve U1. At this point the level of goods produced by the private and public sectors will be Pv1 and Pb1 respectively. Reducing the level of compliance costs would allow society to move to a higher level of production and utility. Note that a decrease in the level of compliance costs does not necessarily result in a higher level of either the public good or the private good, but the production of at least one of the goods must increase.

Figure 2: Compliance costs and the production possibility curve

Cumulative impact of many changes

A new tax measure does not have to be complex itself to increase the level of tax system complexity. Often, government is asked to make a ‘simple’ change to the tax law, but the compounding effect of many separate relatively simple tax measures can result in complex interrelated provisions. As the number of provisions increases, understanding the relationships between them can become more difficult. Figure 3 shows how the addition of one extra measure can compound the number of possible interactions that may need to be considered.

Figure 3: The exponential relationship between measures

and complexity

The cumulative complexity generated by many individual provisions may be further compounded by the rate of change in the law. Even relatively simple changes to the law may collectively impede the ability of taxpayers to understand the requirements of the law without needing to seek professional assistance.5

Drivers of complexity

Tax system complexity is the product of a range of influences, both external and internal to the development, implementation and administration of tax policy. The following sections provide a brief overview of some of the key factors influencing the level of tax system complexity. These factors are organised accordin

g to whether they originate from the policy process or as a result of the private interests of taxpayers.

Tax policy drivers of complexity

In developing and implementing tax policy, policy makers are faced with a range of trade-offs. Notwithstanding the importance of simplicity, most policy decision-making requires judgments on how simplicity is to be balanced with other policy objectives. These other objectives may include equity, efficiency, social issues, certainty, choice, transparency and revenue protection.

Tax axiom trade-offs

Policy makers must decide on the relative trade-off between the competing tax axioms of simplicity, equity and efficiency when raising a given level of revenue. For instance, both a poll tax and a perfect set of Ramsey taxes might have relatively low efficiency costs.6 However, the former is likely to have a low level of complexity, while the latter would require extreme complexity as each commodity transaction requires a different tax rate. Points in between these two polar cases (that is, all real world tax systems) will have higher efficiency costs. In the same way, the relationship between equity and simplicity is not linear. A simple poll tax is usually considered to be inequitable but so might a complex Ramsey tax system.

To allow for a simple two-dimensional analysis, the following framework considers equity and efficiency as one element. It is reasonable to expect that a degree of complexity is necessary to raise revenue in a way that is both equitable and efficient. The framework proposes, however, that excessive complexity will begin to reduce equity and/or efficiency as more and more concessions, exemptions and anti-avoidance measures are introduced.

Whether excessive complexity results in equity or efficiency losses, or both, will depend on the extent of any associated behavioural change.7 For example, suppose that an arbitrary concession is granted to a particular industry. Such a concession would reduce horizontal equity as that particular industry would pay less tax than other industries with similar characteristics. If the concession induced a large shift into that industry, then there would also be efficiency losses due to the distortion of economic activity.

Figure 4 presents a simple graphical representation of the trade-off between equity, efficiency and compliance costs. If there were no costs associated with complexity then the optimal complexity level would simply be where equity/efficiency is maximised (represented by the point C0). However, as there are costs associated with complexity, the optimal level will fall as these costs are taken into account. By introducing a compliance cost curve, the optimal point will be where the net benefit of equity/efficiency less compliance costs is greatest. As discussed previously, compliance costs increase exponentially with the level of complexity (see Figure 3). The new optimum is at the point where the marginal benefit of an extra unit of complexity is equal to the marginal cost of complying with the increased complexity. The point Cs* indicates the socially optimal level of complexity. Going beyond this level of complexity would mean that the compliance cost would be larger than the associated integrity benefit; hence the total net benefit would be reduced.

Figure 4: Socially optimal level of complexity

While it may be theoretically possible to determine the socially optimal level of complexity, when it comes to policy design and implementation the difficulties are substantial. The conceptual model implies that equity, efficiency and compliance costs can be measured in dollar terms, but this is virtually impossible to do in the real world with any level of certainty or confidence. Careful subjective judgments are required. Nevertheless, this conceptual framework highlights the way in which costs associated with complexity should be factored into decision-making.

Measuring the tax base

One of the key elements of complexity is the choice of the tax base. The three most common methods involve using a measure of consumption, income or wealth. Each approach has its own set of measurement issues and each provides a different indication of ‘ability to pay’. In reality, all OECD countries rely on a mixture of these three tax bases. Although this adds to complexity, it reflects the history of tax systems, judgments about the most appropriate balance between the tax axioms and the fact that too heavy reliance on a narrow base results in distortions and tax planning incentives.

Over time, the definition of taxable income in Australia has undergone significant change with, for example, the addition of capital gains to the tax base and the introduction of a fringe benefits tax. While measuring these types of income may not in itself be inherently complex, the number of exemptions and concessions results in complexity.

Choice

While it seems reasonable that providing choice is of benefit to taxpayers, there are significant costs associated with choice. Whenever choice is provided taxpayers have an incentive to investigate the tax consequences of all options. This may result in some taxpayers incurring the costs of performing multiple tax calculations for no benefit. Therefore, though some taxpayers will benefit, providing choice may be associated with a net cost to society.

Using tax law for social or economic policy objectives

Using the tax system to redistribute income or to deliver other social policy objectives (such as environmental objectives) has a direct impact on the complexity of the tax system. The pursuit of these objectives often requires that tax provisions be implemented in a targeted manner, increasing complexity because they often depend on characteristics and information that are not required for tax purposes. However, while it is clear that moving these social functions outside of the tax system would decrease the complexity of the tax system, it is less clear whether this would increase or decrease society’s overall level of complexity.

Protecting the revenue base

A degree of complexity, in the form of anti-avoidance measures, is necessary and reasonable to minimise revenue losses through tax avoidance and evasion activity. The presence of enforcement procedures and penalties may also lead to an increase in the compliance costs that taxpayers are willing to incur in order to reduce the risk of penalty. The extent to which anti-avoidance measures are needed depends, in part, on community attitudes towards paying tax, which, in turn, are a function of the perceived ‘fairness’ of the tax system and the perceived merits of the goods and services that government provides.

Legislation and the tax interface

The use of legal concepts, technical tax and accounting terms and prescriptive rules can reduce the ability of taxpayers to understand their rights and obligations. As a consequence taxpayers may need to engage professional assistance or else may choose not to comply. In addition to being complex, legislation giving rise to ambiguity may create loopholes that can potentially be exploited. A lack of consistency, in particular with tax definitions, can also increase complexity.

A preference for overly-detailed, prescriptive law may also add to the level of complexity because that law needs to be very explicit and comprehensive to ensure that anomalies are not created and the provision is not abused.8 Law written in this way must also be regularly updated to take account of situations that were not known or considered when t

he law was drafted.

The complexity that taxpayers face in complying with their tax obligations can be reduced by improving the interface between the tax law and the taxpayer. The extent to which taxpayers are willing to rely on the use of an interface will be determined by the level of underlying complexity in their particular circumstances and the degree to which they are willing to sacrifice transparency for simplicity.9

Administration versus compliance costs

Administration costs can sometimes be direct substitutes for compliance costs. For instance, a move towards greater self assessment may reduce administration costs while increasing taxpayer compliance costs. As the final incidence of administration costs also falls on taxpayers, any suggested proposals to reduce compliance costs must take account of any resultant increase in administration costs. There may be economies of scale from moving more of the revenue collection responsibility to the tax administration, which would spread the costs over all taxpayers. However, this could also reduce the cost to taxpayers of seeking and complying with more complex tax provisions and, as a result, could lead to a higher level of complexity and total collection costs than might otherwise be the case. This issue is discussed in further detail later in the paper.

Private drivers of complexity and compliance costs

In addition to the public policy drivers of complexity, market complexity, taxpayer objectives, and community attitudes also play a part in determining the level of tax system complexity and the resulting level of compliance costs.

Market complexity

To a considerable extent, complexity in the tax system is a reflection of the complexity in markets for factors of production, goods and services. A growing number of Australian taxpayers now own equity investments, are involved in complicated business structures, or invest or work overseas. Increasing globalisation and the advent of e-commerce have led to a rapid expansion in cross-border transactions and increased the need to deal with the double-taxation issues that arise when two (or more) tax jurisdictions are simultaneously involved in an economic transaction. This complexity is compounded where there are significant differences between Australia’s tax treatment of transactions and that of our trading partners. Financial innovation has also blurred the distinction between debt and equity and led to the need for more sophisticated tax rules to ensure that hybrid financial instruments are taxed according to their economic substance.

Maximisation objectives of taxpayers

Within a given tax structure, optimising taxpayers may willingly incur compliance costs until the point where an extra dollar spent returns a dollar of tax saving.10 For example, a taxpayer might bear the costs of testing alternative tax calculation methodologies, searching for tax-effective ways to structure transactions, or engaging in other tax minimisation activities. In addition, taxpayers may seek to reduce their tax liability by seeking preferential tax treatment through targeted concessions. These behaviours and their implications for tax system complexity and compliance costs are explored in detail in the following sections.

Private demand for tax system complexity

Tax minimisation

The following chart shows how a taxpayer’s optimal level of complexity would, at least theoretically, be calculated. In the analysis, the tax saving from undertaking increasingly complex tax calculations or more sophisticated tax arrangements produces a declining incremental reduction in tax liability. The cost curve is the same as the curve used for the social analysis (Figure4), which exhibits rising costs for an additional dollar of tax saved. If the level of tax and compliance costs were the only considerations of the taxpayer, the optimal complexity level would be where the tax saving net of compliance costs is largest.

As well as tax minimisation, it is also reasonable to expect that taxpayers care about equity and efficiency, otherwise tax collections would be eroded and the quantity and/or quality of public goods and services would decline. The equity/efficiency function from the social model can be added to the taxpayer model to produce a new total benefit curve. Figure 5 shows this new curve and its impact on the optimal level of complexity. If the taxpayer behaves in an individualistic way, assuming that their behaviour is of such inconsequence it has no significant implications for society more generally, then the private benefit curve will be an additive function of the social benefit and the tax that they save. The additional consideration of the tax saved implies that that privately optimal level of complexity will always be higher than the socially optimal level.

If administration and efficiency costs were added to the model the divergence between the two points (Cs* and Cp2) would be even larger. This is because administration and efficiency costs would reduce the socially optimal level of complexity but not the privately optimal level. This assumes that most taxpayers would not consider these costs when optimising their tax outcomes.

Figure 5: Tax integrity and tax saving incentives

The extent to which taxpayers are able to target an optimal level of complexity will depend on the transparency of the compliance costs associated with a particular level of complexity and the degree to which taxpayers internalise costs. For example, if tax agents charge a flat fee taxpayers may find it worthwhile to take on more tax complexity than would otherwise be optimal. Some taxpayers may take a risk-based approach to tax minimisation, based on perceived audit risk and the size and timing of any penalties.

The extent to which tax minimisation behaviour occurs — and whether tax avoidance escalates to tax evasion — will depend, in part, upon each taxpayer’s acceptance of the need to pay tax, their perceptions of the integrity of the tax system and the value they place on equity and the broader objectives of revenue collection.11 If many individuals engage in tax avoidance, it will affect others’ willingness to comply and could undermine tax system integrity. This pressure is likely to lead to increased compliance monitoring and enforcement as well as a wider use of anti-avoidance legislation. Enforcement and anti-avoidance activity may provide a net benefit to society but will, of itself, increase complexity and compliance costs, in part due to increased demand for information to underpin the administration’s compliance activities.

Rent-seeking behaviour

The phenomenon of rent-seeking takes place when an entity seeks to extract uncompensated value from others through manipulation of the economic or regulatory environment. Rent-seeking behaviour in the tax system is often successful because taxpayers seeking a targeted concession are more effective in lobbying than those that stand to lose under the concession. This is because the beneficiaries of concessions are often more informed and better represented in the lobbying process than the broader community which bears the revenue cost, the compliance cost and any loss of equity and/or efficiency. In addition, the individual benefit to recipients of a targeted concession is typically more easily measurable, more tangible and of a much greater value than the less tangible and dispersed cost imposed on each member of the broader population.

These incentives are illustrated in Figure 6. Panel A represents th

e beneficiary of a concession where the reduction in tax liability exceeds the incremental compliance costs. Panel B represents a taxpayer that is ineligible for the concession, of which there are assumed to be many. Under a revenue neutrality constraint, the taxpayer in PanelB will bear the revenue cost of the concession provided to the taxpayer represented in Panel A. Although they are not eligible for the concession, their cost of compliance may increase slightly as an indirect consequence of a more complex tax law.

|

Figure 6: Winners versus losers |

|

|

Panel A — winner |

Panel B — loser |

|

|

|

The theory of competitive markets can be used to understand how rent-seeking activity will continue until all economic profits are exhausted. Lobbying for tax concessions has many properties of a competitive market: there are many lobby groups; there are no restrictions on entry; and lobby groups already in the industry have no (or little) advantage over new entrants. As discussed in the preceding section, taxpayers will attempt to maximise profit by equating marginal revenue with marginal cost. The theory of competitive markets predicts, however, that an industry making a profit will attract new entrants.

Assuming that there is a limited pot of concessions available to be won, it can be shown that lobbying for tax concessions will continue until it reaches a point where the net gain to any individual tends to zero. This reflects the theory that a competitive market always results in a zero-sum game. This is because there are no ‘supernormal’ profits that exist in monopolistic or oligopolistic markets. The privately optimal outcome that maximises profits could be achieved if all taxpayers agreed to reduce their demand for concessions and share the profits evenly. However, due to taxpayer information, organisation and distribution problems, the benefits are likely to be unequally shared and those taxpayers that have received little or no benefit will find it profitable to lobby for their ‘fair share’.

At the competitive equilibrium, the collective demands of these taxpayers imply a level of complexity that exceeds both the privately and socially optimal levels. A real-world example of this conflict between individual interests and the common good is the tragedy of the commons (see Box 1).

|

Box 1: The Tragedy of the Commons12 In 1832 William Forster Lloyd, a political economist at Oxford University, looking at the recurring devastation of common (not privately owned) pastures in England, asked: ‘Why are the cattle on a common so puny and stunted? Why is the common itself so bare-worn, and cropped so differently from the adjoining inclosures?’ Lloyd concluded that the destruction of the common was because each human user of the common was guided by self-interest. Because the herdsman owned his animals, the gain from adding another animal would come solely to him. However, the loss incurred by overloading the pasture would be ‘commonised’. Because the privatised gain would exceed his share of the commonised loss, a self-seeking herdsman would add another animal to his herd, then another. Following the same reasoning, so would all the other herdsmen. Ultimately, the common property would be ruined. |

- 7 below shows the competitive equilibrium level of complexity where total cost equals total benefit. While Cp2 is the point at which total private benefit is maximised, point C* shows the level of complexity where all possible profits have been extracted. As discussed, lobbying for concessions will continue up until this point, and possibly beyond if taxpayers underestimate the costs or overestimate the potential tax saving of a concession.

Figure 7: The competitive equilibrium

The complexity cycle

The competitive equilibrium described above (point C*) is not likely to be sustainable. As the cost and integrity implications of additional complexity become apparent to the broader taxpaying community and government, there are likely to be increasing calls for tax reform in order to move towards a more optimal complexity level. Whether complexity is reduced to the socially or privately optimal level will depend on the exact nature of the reform (due to asymmetric information and general measurement difficulties, it would not be possible to determine the exact level of complexity that optimises social net benefit). Post-reform, opportunities for tax savings will exist and the race for concessions will start again.

Figure 8: The complexity cycle

This complexity cycle is consistent with the existence of ongoing pressure by taxpayers to increase the concessionality of the tax system, interspersed by periodic pressure for more fundamental tax reform.

Conclusion

There are both public and private drivers of tax system complexity and compliance costs, but they are by no means independent. Taxpayer behaviour and community attitudes will influence both policy design and the administration of a tax system.

A certain level of complexity, and hence compliance costs, is required to raise revenue, and to do so in an equitable and efficient manner. Even with the simplest tax system, measuring the tax base, whether it is income-, consumption- or wealth-based will be associated with a rising level of complexity as markets become more and more sophisticated.

While the design and implementation of tax policy is an important factor that influences tax system complexity, the private incentives to minimise tax are also a significant driver of complexity. Taxpayer-driven complexity can come from taxpayers minimising tax within the current structure as well as rent-seeking behaviour seeking new concessions or exemptions.

While increased efforts could be made to assess all the costs and benefits associated with any tax proposal, it is not necessarily complex measures that lead to complex tax law. Even if it were possible to conduct a full cost-benefit analysis of each separate policy proposal, the results of such analysis may indicate that each measure produces a net benefit. Nevertheless, the cumulative impact of these measures may result in a very different story. The aggregate level of complexity may become a disincentive for emerging businesses, deter sole traders from taking on staff, and prevent taxpayers from complying with the tax law (both intentionally and unintentionally).

1 The authors are from Tax Analysis Division, the Australian Treasury. This article has benefited from comments and suggestions provided by Mike Callaghan, Paul Flanagan, RickKrever and NigelRay. The views in this art

icle are those of the authors and not necessarily those of the Australian Treasury. An earlier version of this paper was presented to the OECD Committee of Fiscal Affairs, Working Party 2 meeting in June 2005.

2 These efficiency costs arise because the tax system distorts the allocation of resources relative to the optimal position (see, for instance, Harberger AC (1966) ‘Efficiency Effects of Taxes on Income from Capital,’ in Krzyzaniak M ed., Effects of Corporation Income Tax, Detroit, Wayne State University Press.)

3 Two major studies of taxpayer compliance costs have been conducted in Australia, both focused at the ‘macro’ level, these being a 1997 study by the Australian Taxation Studies Program, for the Australian Taxation Office, and an earlier study led by Jeff Pope at the Australian Tax Research Foundation.

4 A public good has two particular characteristics: non-rivalry (consumption by one person does not reduce the amount available for others) and non-excludability (once the good is provided it is impossible to stop people consuming it even if they have not paid). Common examples of public goods are national defence and lighthouses. (See Samuelson PA (1954), ‘The Pure Theory of Public Expenditure,’ Review of Economics and Statistics, vol. 36, November, pp. 387-389).

5 See the Business Council of Australia’s Taxation Action Plan — for Future Prosperity, April 2005 for more details of business concerns.

6 Ramsey taxes take account of the elasticity associated with particular commodities. The idea is that economic distortions, and hence utility losses, are minimised. Ramsey FP (1927), ‘A contribution to the theory of taxation,’ Economic Journal, 37, pp. 47-61.

7 See Kaplow L (1996), ‘How tax complexity and enforcement affect the equity and efficiency of the income tax,’ National Tax Journal, vol. 49, no. 1, March, pp. 135-50.

8 A detailed discussion of black-letter law versus coherent principles is provided in the Treasury Economic Roundup, Autumn 2005.

9 Transparency refers to the amount of information that is disclosed about an economic activity.

10 The level of compliance costs faced by a taxpayer will correspond to particular behaviours. For example, a taxpayer may have high compliance costs because they are attempting to comply fully with a complex tax system, possibly even over-complying if they are risk-averse and concerned about the uncertainty flowing from the tax system complexity, or they may have high compliance costs because they are using complex arrangements to avoid tax.

11 Tax avoidance involves taking full advantage of the law to minimise tax liability whereas tax evasion usually implies an understatement of income or an overstatement of deductions.

12 Taken from Hardin, Garrett, ‘The Tragedy of the Commons’. The Concise Encyclopedia of Economics. Indianapolis: Liberty Fund, Inc., ed. David R. Henderson, 2002. [Online] available from http://www.econlib.org/library/Enc/TragedyoftheCommons.html; accessed 4 May 2005; Internet.