This Chapter addresses findings and recommendations across three key topics related to ASIC's strategy capabilities:

- Strategy development: the process by which ASIC prioritises and sets its strategy, and the results of this strategy as articulated in its Corporate Plan.

- Strategic communication: the methods used to communicate the strategy to internal and external stakeholders, as well as ASIC's broader communications strategy.

- Resource allocation: the process by which ASIC decides how resources are allocated across the organisation to align with and execute on strategic priorities.

Strong strategy capabilities are important for a regulator for a range of reasons, including:

- Systemically allowing for identification and prioritisation of a clear and transparent set of strategic objectives that respond to current and emerging risks and market trends, within the context of a broad statutory mandate.

- Providing a basis for accountability in relation to strategy execution.

- Providing guidance for tactical and operational decision-making throughout the organisation.

- Ensuring a shared understanding across the organisation and with external stakeholders around what the regulator will and will not be doing, and hence helping manage any gaps in expectations.

- Aligning the deployment of resources to the most strategically important uses.

The Panel has made a number of observations and recommendations relating to ASIC's strategic management processes. These are summarised in Table 10 below.

| Observations | |

|---|---|

|

Strategy development |

ASIC has a well-established strategy setting process involving both bottom-up and top-down elements. However there is some variability in the quality of the bottom-up plans. ASIC's 2015 Corporate Plan is built around a sound strategic framework and represents a major step forward in the articulation of its strategy, although there is some scope for greater clarity of language. While ASIC has an established Emerging Risk Assessment process to inform its strategy development, this is not as well developed or resourced as similar functions in international peer regulators, and external inputs are not being sufficiently utilised in this process. While the identified strategic priorities (referred to by ASIC as focus areas) in the Corporate Plan are broadly comprehensive, and well aligned to international regulatory and market trends, the Panel does see a number of potential gaps related to high-priority issues in the local market context (for example, the ageing population and evolving retirement financing needs. Notably, the Corporate Plan document (as well as the underlying, non-public Business Unit plans) is silent on delivery for some important strategic priorities, including in relation to possible registry separation — not articulating how ASIC will execute on the plan over the short and medium-term. The Corporate Plan is not contributing as much as it could to ensuring accountability for ASIC's strategy execution because of the limited delivery detail (for example in the delivery of its deregulatory agenda), as well as a lack of alignment across:

|

|

Strategic communication |

ASIC's communication of its mandate and strategic priorities to stakeholders does not clearly highlight its expectations about the impacts and limitations of its activities, nor does it provide clear guidance on how the strategy will be delivered. More broadly, while ASIC has a Communications Policy, it does not have a clearly-articulated strategic approach to its communications. As a result, communication does not always have a clear purpose and is at times reactive in nature (for example, focusing on responding to media and public scrutiny). ASIC could more effectively communicate what it does and why it does it, in a way that better manages the expectations gap. ASIC leadership's public articulation of its role places too heavy an emphasis on enforcement, and risks driving strategic focus and staff orientation too much towards this single aspect of the regulator's toolkit. |

|

Resource allocation |

ASIC's resource planning is not sufficiently flexible or responsive to changing strategic priorities. ASIC's resource allocation to enforcement is significantly greater than peer regulators. |

| Recommendations | |

|---|---|

|

Strategy development |

Recommendation 13: ASIC to substantially improve the intended approach for delivery of the Corporate Plan in both the public document itself and the underlying Business Unit Plans. This should include greater specification of intended actions as well as timing, resourcing and organisational implications. Recommendation 14: ASIC to improve the selection of performance indicators to ensure that the measures associated with the Key Activities for each Focus Area are:

Recommendation 15: ASIC to review and introduce a more outcomes focused and dynamic use of advisory panels to ensure these forums input more directly into strategy development, and introduce a broader public consultation element into the strategy setting process. |

|

Strategic communication |

Recommendation 16: ASIC to further clarify and emphasise its expectations and risk tolerances (what the regulator will and will not be doing) and actively advertise and promote the strategy broadly (see Chapter 2 for further recommendations related to the SoI). Recommendation 17: ASIC to ensure the strategic framework used in developing the Corporate Plan is used consistently throughout the communications. Recommendation 18: ASIC to develop a comprehensive communications strategy that places greater emphasis on communication of the organisation's strategic priorities. Recommendation 19: ASIC to rebalance its public and internal communications about its role as an enforcement agency. |

|

Resource allocation |

Recommendation 20: ASIC to ensure the top-down allocation of resources are deployed across the organisation based on the strategic priorities. |

3.1. Strategy development — strong process and framework, but delivery and variability to be addressed

ASIC develops its strategy through a series of formalised annual planning activities. The process involves both top-down and bottom-up elements, reflecting the decentralised nature of ASIC's organisation structure.

The results of these exercises are captured in a variety of internal and external strategy documents, including:

- Internal planning and goal-setting documents for each of the Stakeholder Groups and other key teams, known as the Business Unit Plans.

- ASIC's SoI (discussed in the context of external governance in Chapter 2).

- An annual flagship public strategy document. In 2015, this was ASIC's Corporate Plan 2015-16 to 2018-19 (the Corporate

Plan), which supersedes and expands upon the Strategic Outlook document that was issued in 2014. The Corporate Plan includes coverage of:- ASIC's enduring mandate objectives (described as 'Strategic Objectives' in the language of the Plan);

- identification of key environmental trends (described as 'Challenges' in the language of the Plan) and emerging risks to the objectives;

- focus areas for the year based on these trends and risks;

- activities to be conducted in each focus area;

- performance indicators for the organisation as a whole and for specific focus areas.

The outputs of the strategy development work are also used as in input to ASIC's annual resource allocation and budgeting exercise.

Strategy setting process

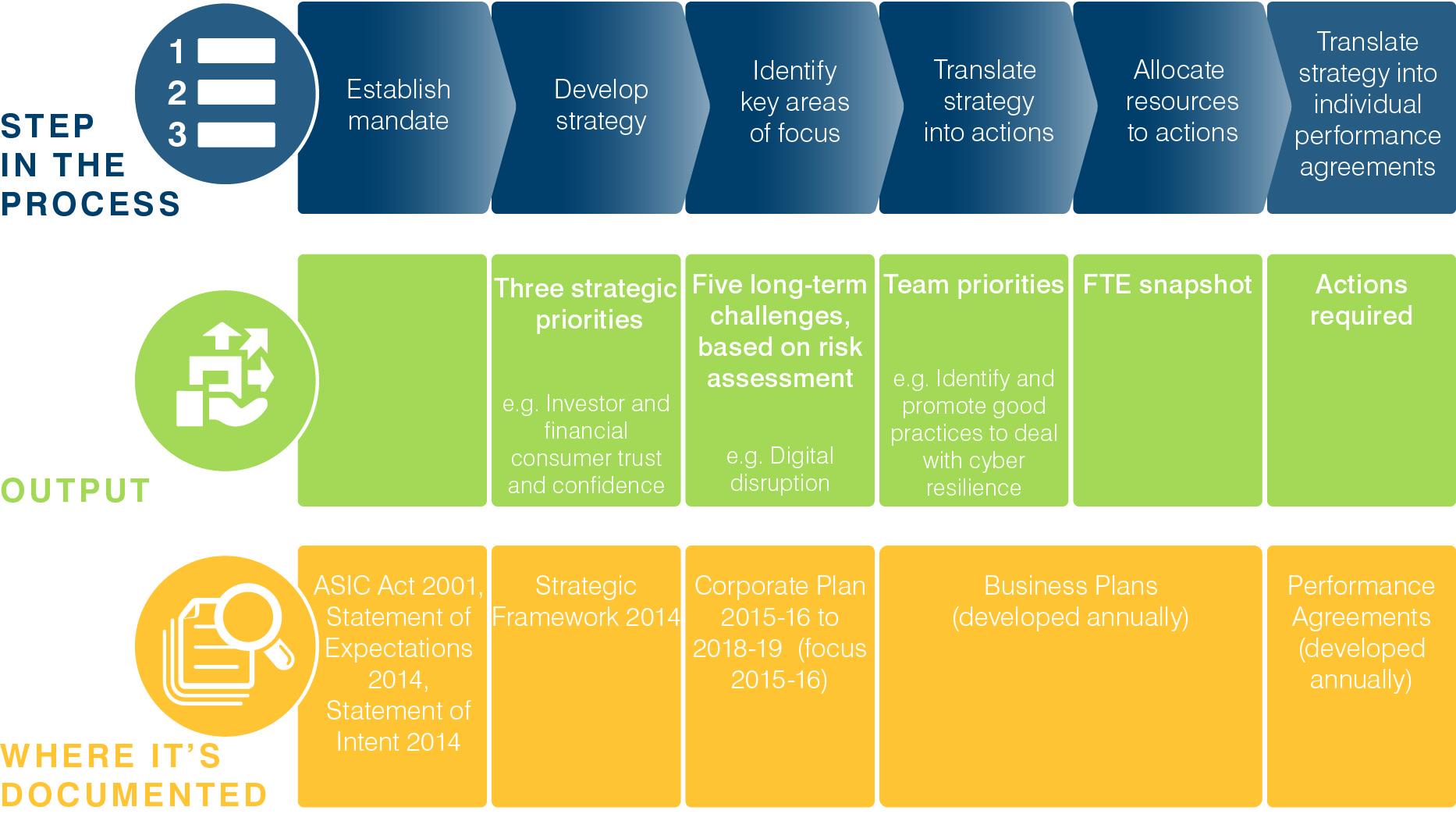

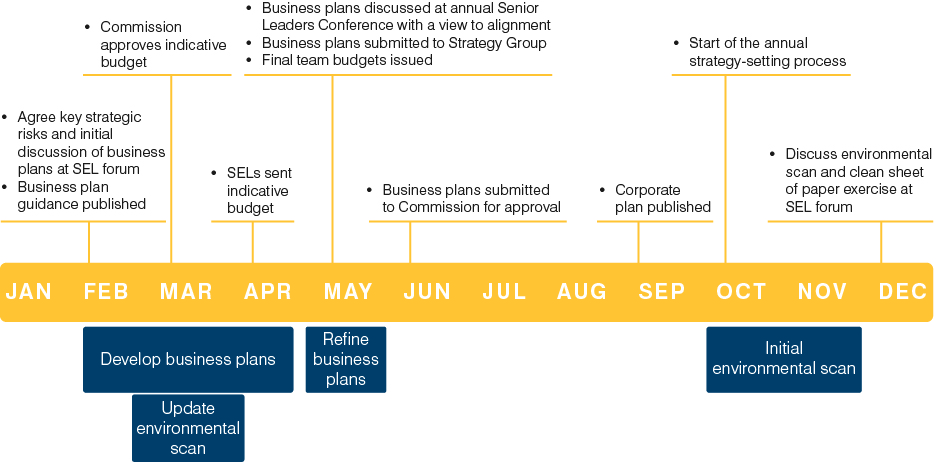

Both the top-down and bottom-up strategy setting processes are well established across the organisation, although ASIC acknowledges that these processes continue to evolve and improve each year. Further, there is also horizontal alignment achieved through Commission involvement. Figure 20 and Figure 21 outline the annual strategy-setting process as it currently stands.56

Figure 20: ASIC's annual strategy-setting process57

Figure 21: ASIC's annual strategy-setting process calendar58

The bottom-up elements of the process are driven by each cluster/team across ASIC. This process is led by each SEL, with input from their team as required. The business plans are discussed at Commissioner/SEL forums throughout the year, reviewed by the Strategy Policy team to ensure they align to strategic objectives and risks and are finally submitted to the Commissioners for approval.59

The core elements of the top-down process occur following the finalisation of the cluster/team business plans. The process draws on the results of the bottom-up prioritisation analysis as well as other inputs including an SEL 'clean sheet of paper' exercise, environmental scans and external panels/stakeholder engagement.60

The Panel agrees with ASIC's assessment that its approach to setting key strategic priorities is 'decentralised' and 'mixes strategy and operational considerations' in line with its relatively decentralised organisation structure.61 In principle, the Panel appreciates the strengths of this approach for an organisation with as diverse a mandate as ASIC.

However, in practice, such a process can contribute to a lack of alignment across business units. Indeed, PwC found that ASIC's Business Unit Plans vary in quality across clusters/teams.62 In particular, it was noted by PwC that 'the level of detail is inconsistent, and because [the plans] align to the strategic objectives and long-term challenges, which are high level and not specific, it is difficult to determine whether the activities drive towards intended outcomes'.63

The Panel views the issue of Business Unit Plan quality variability as a result of insufficient focus on detailing delivery plans in the strategy process, and as a potential indicator of a lack of accountability for delivery on behalf of plan 'owners'. Both of these topics are discussed further below.

Corporate plan framework

The table below summarises the key messages of the 2015-16 to 2018-19 Corporate Plan.64

| Plan element | Key points |

|---|---|

|

Strategic priorities (Enduring mandate objectives) |

|

|

Challenges (Trends and risks) |

|

|

2015-16 Focus areas (Strategic priorities) |

|

|

Actions |

|

|

Performance indicators |

|

Overall, the Panel finds the framework by which the Plan is organised is soundly designed, and comprehensive. It represents a major step forward in the sophistication and rigour of strategic planning represented in the previous Strategic Outlook document. For example, the Corporate Plan also provides readers with information around how ASIC will evaluate its performance.

The Panel does note, though, that some of the language used to describe the different elements of the framework appears idiosyncratic and may be confusing to some readers. For example, the use of the term 'Strategic Priorities' to describe what in reality are its enduring mandate objectives.65 This is likely confusing to many readers given that strategic priorities are generally understood to be the top priorities for an organisation at a given point in time as a means of achieving its enduring objectives. The Panel finds the term 'Enduring Mandate Strategic Objectives' more useful and accurate in this context.

There are several other examples of potentially confusing language in the framework. For the purposes of the following discussion, the Panel uses the language it finds accurate and in line with mainstream strategic planning practices, but also notes for clarity the terminology used by ASIC.

The Panel also notes that while the Plan's title indicates that it is a four year plan, the content is substantially that of an annual plan, with a relatively superficial overlay of priorities over a four-year time horizon. In particular, the Corporate Plan puts almost all of its

focus on 2015-16 priorities. The references to 2018-19 are limited and lacking in detail and there is no discussion of the period between 2015-16 and 2018-19. This represents an opportunity for ASIC to more effectively make next year's Corporate Plan a genuine long-term plan, although doing this successfully may require some refinement of parts of the strategy development process to develop longer term views and plans.

Trend and risk identification process

The Corporate Plan and the broader strategy development process both require evidence-based assessment of key environmental trends (referred to by ASIC in the Corporate Plan as Challenges) and risks. This is necessary to identify where the enduring objectives of the regulator may be at risk over the near to medium term and to identify strategic responses to these risks.

PwC's review found that ASIC's strategy setting process relies on a range of inputs including:

- environmental scans (identification of trends that highlight current and potential areas of concern for ASIC);

- outcomes of regulatory actions, including surveillance;

- trends observed in misconduct reporting;

- external panels/stakeholder engagement (informally).66

As a result, the process draws upon input from across the organisation as well as from external parties (for example, market data providers). However, there is no formal channel through which external stakeholder feedback is recognised and incorporated into the process.67 PwC's evidence report concludes that external stakeholders, including the regulated population, industry groups and academics, believe they should be consulted and leveraged more effectively during the risk identification and strategy development process.68 The Panel concurs.

Of particular concern is the view (articulated to the Panel both by ASIC staff and some of its external panel members) that the inputs of ASIC's external panels are not captured and fed into the risk identification process in a structured and systematic way.69 ASIC does not have a formal channel to feed advisory panel discussions back into the strategy-setting process.70 In addition, not all panel meetings are minuted.71 This represents a lost opportunity to incorporate valuable insight given the diversity and depth of market and consumer experience of the membership of ASIC's various advisory panels.

The Panel believes that a successful strategy-setting process relies on ASIC leveraging a range of internal and external perspectives to accurately identify the most important market trends and risks. Currently, ASIC does not appear to be as effective in leveraging external inputs into this process as it could be. The Panel therefore recommends that ASIC increase its efforts in this area. Specifically this would include:

- Introducing a more outcomes focused and dynamic use of ASIC's external panels to ensure these forums input more directly into strategy development. In so doing, ASIC should evaluate and implement similar structures and processes used by other regulators on how to best achieve this. For example, the ACCC leverages subject matter committees (for example, Enforcement Committee), which help the Commission in its decision-making process.72 (See section 4 for further details on panel management and related recommendations)

- Introducing a broader public consultation element into ASIC's annual strategy setting process, as recently proposed by ASIC following receipt of PwC's evidentiary findings around stakeholder desire to provide more input in this area. In so doing, ASIC should evaluate models adopted by other regulators to assist it in achieving this. For example, the Panel has been informed that the ACCC conducts an annual stakeholder forum where they discuss and obtain input on enforcement priorities for the following year.

Objectives and focus areas

The Panel believes that ASIC's current enduring strategic objectives (summarised in Table 11, and referred to by ASIC as 'Strategic Priorities') align with its mandate and purpose as set out in the ASIC Act and that its articulation of these objectives are sound and appropriate expressions of the enduring aspects of its mandate.

The Panel has also assessed ASIC's strategic priorities (summarised in Table 11, and referred to in the Corporate Plan as 'Focus Areas'). The priorities are broadly comprehensive and are well aligned to international regulatory and market trends. For example, the focus on digital disruption is clearly warranted by ongoing market developments and is similar to the emphasis being placed on FinTech innovation and its regulatory implications by regulators globally.73 Culture in financial services is another area where ASIC's current focus is in line with that of many peer regulators.74

However, the Panel also notes that the majority of the focus areas are reflective of themes being discussed in international markets and there are potential gaps relating to a number of priority themes relevant for the domestic market. In particular, the Panel observes that a there is limited forward looking focus on Australia-specific risks. For example, there is limited discussion in the Plan of Australia's looming issues around ageing population, decumulation in superannuation and savings, and the increasing focus on retirement income streams and unlocking the value of the family home in retirement.75 The Plan makes only superficial references to the importance of sound financial advice and the challenges of funds management integration where there is an ageing population. There is no acknowledgement of the types of products that will be required in the future, and how ASIC will need to respond to outline required standards and to adapt its approach to regulating market participants and products. This is a significant emerging risk for domestic financial regulators as Government policy arguably lags the demographic shift to post retirement.

There is also a notable lack of detail in relation to the possible registry separation project. Possible registry separation is mentioned at a high level in the Corporate Plan, which notes that 'in May 2015, the Government announced a competitive tender process to test the market on the capacity of a private sector operator to upgrade and operate the ASIC registry. This work is underway and we are providing support to the Government.'76 While a government decision has yet to be made on this issue, ASIC has undertaken detailed analysis of policy and implementation options. However, this is accorded very limited attention in the Corporate Plan, and there is no detail provided as to the anticipated implications of the sale (if it progresses), including concerns around data access, government funding and resource allocation. Given its significance as a transformative change and risk management priority for ASIC, this lack of detail is a notable omission in the Plan.

Activities

ASIC's Corporate Plan contains discussion of specific activities it intends to undertake in relation to particular strategic focus areas. The activities identified in the Plan appear appropriate to the Panel and aligned to the focus areas. However, the Panel notes that the Plan, and ASIC's other internal and external strategy documentation is largely silent on the question of delivery. There is very little specification or detailing of how ASIC

will deliver on its strategy beyond the articulation of the activities. Key information that is missing includes:

- specifics on the wrong-doings to be addressed and the ways in which ASIC will detect and react to them;

- detailing of the key stakeholder groups that it will need to engage with;

- specification (in the internal documentation) of manpower requirements and key resource assignments;

- medium-term organisation resourcing and capabilities implications;

- indication of milestones on the path to success.

For example, ASIC has highlighted deregulation and cutting red tape as a strategic priority in relation to each of its enduring objectives. ASIC has indicated that five employees77 within the Strategic Policy team have, as an element of their workload, responsibility for overseeing deregulation initiatives. ASIC estimates that the time spent by these employees equates to approximately 45 per cent of a full-time load, across the levels.78 However, there is no substantial information contained within the Corporate Plan or other external document that outlines ASIC's approach to delivering on its deregulation objective.

In contrast the equivalent documents of the ACCC and UK FCA clearly set out practical actions that they will take to enact their overarching strategic objectives. For example, the UK FCA outlines seven practical actions, such as agreeing a common 'house view' of each of the markets and key sectors the FCA regulates.79 Further, the ACCC also provides specific examples of actions and outcomes that can provide stakeholders with a fuller understanding of how it plans to achieve its strategic objectives.80

Box B — The FCA's House Views81

The FCA has developed an organisation-wide process ('House Views') to ensure consistent development, execution and communication of its strategy.

The process brings together the intelligence collected across the organisation as well as external perspectives and data to form a house view of each of the markets and sectors regulated. This then informs:

- risk prioritisation;

- risk-based strategic and proactive engagement;

- flexible, focused resource use;

- regulatory outcomes.

The process is important as it gives the regulator the ability to:

- integrate data, information and intelligence about what is happening in the market for example, product launches and changes, whistleblowing, market intelligence and consumer sentiment;

- bring together multiple perspectives within the market;

- look across markets and make comparisons to support prioritisation decisions;

- externally communicate how it is addressing its strategic priorities (see section 3.2 below).

The Panel views the absence of detail on delivery matters in ASIC's strategic plans as a significant concern. Clearly the lack of such plans will make execution more challenging. More importantly, the absence of specific commitments around delivery can have the effect of undermining the accountability of those responsible for executing the plan, which can affect leadership performance as well as having a negative effect on organisation culture.

The Panel's judgement is that the limited emphasis on delivery is partly attributable to ASIC's internal governance model. As discussed in Chapter 2, the dual governance-executive role of the Commissioners makes it challenging for the Commission as a whole to require consistent action-oriented detailing of business units and cluster plans of its individual members. It would appear in ASIC's governance model that such matters are left to the individual Commissioners to address at a management level.

The Panel therefore believes that its recommendations on Internal Governance in Chapter 2 will help create an environment at ASIC that is more conducive to the development of disciplines around delivery detail in the strategic-planning process. However, governance change by itself is unlikely to improve delivery planning in the short term, so the Panel also recommends that ASIC substantially improve intended approach for delivery of the Corporate Plan in both the public document itself and the underlying Business Unit Plans. This should include greater specification of intended actions as well as resourcing and organisational implications.

Performance indicators

Performance management, including the enterprise-wide performance reporting framework put forward in the Corporate Plan is discussed in detail in Chapter 2. In addition to the points made in that Chapter, the Panel also observes a lack of alignment between the identified activities and the performance indicators within the Corporate Plan.82 The Panel also observed that the performance indicators identified in the Corporate Plan do not always align with those in the Business Unit Plans. For example, some Business Plans indicate that a 'success measure' is the number of cases referred to enforcement. However, this measure does not give an indication of how strong the case is and/or if successful enforcement was ultimately obtained.83

The lack of alignment between indicators suggests that the performance measurement and management framework is likely to undermine the usefulness of the indicators in driving performance and to further erode the accountability of staff for their success or failure in delivering on the plan.

The Panel therefore recommends that ASIC further improves the selection of performance indicators to ensure that the measures associated with the Key Activities for each strategic priority (Focus Area) are:

- reflective of the activities and their desired outcomes;

- aligned to the internal performance indicators captured in the relevant Business Unit Plans, and to ASIC's enterprise-wide performance indicators.

(Refer to Chapter 2 for further discussion on performance measurement recommendations)

Strategy development: recommendations summary

Recommendation 13: ASIC to substantially improve the intended approach for delivery of the Corporate Plan in both the public document itself and the underlying Business Unit Plans. This should include greater specification of intended actions as well as timing, resourcing and organisational implications.

Recommendation 14: ASIC to improve the selection of performance indicators to ensure that the measures associated with the Key Activities for each Focus Area are:

- reflective of the activities and their desired outcomes; and

- aligned to the internal performance indicators captured in the relevant Business Unit Plans, and to ASIC's enterprise-wide performance indicators.

Recommendation 15: ASIC to review and introduce a more outcomes focused and dynamic use of advisory panels to ensure these forums input more directly into strategy development, and introduce a broader public consultation element into the strategy setting process.

Strategic communication — a whole of agency strategy needed

Strategic communication encompasses communication of ASIC's strategy to stakeholders (communication of the strategy) as well as ASIC's strategy for communication more broadly (communications strategy). These topics are addressed in turn below.

ASIC has a high public profile, and attracts significant public scrutiny, including relative to other domestic regulators. It inter

acts with the market via a number of channels. For example, the communication of ASIC's strategy and key focus areas are documented in the Statements of Expectations and Intent, Strategic Framework, Corporate Plan and the Annual Report. ASIC also communicates with industry (particularly industry bodies and large stakeholders) at team and cluster level about priority project and strategy-related issues. Key communications channels include:

- media releases (over 350 released per year);

- broadcast interviews (over 80 conducted per year);

- face-to-face meetings with journalists (12 interviews conducted per month);

- twitter (nearly 9000 followers);

- YouTube videos (over 350 released to date);

- the ASIC website (over 1.5 million visitors each month);

- information sheets (200 released to date), Regulatory guides (50 released to date);

- enforcement reports (eight released to date);

- speeches (39 published to date).

Communication of the strategy

ASIC's ability to effectively communicate its strategy is important to ensure it aligns stakeholder expectations on the extent of its powers, scope and mandate. The Panel observes that market participants do not appear to sufficiently understand ASIC's strategy. This is despite ASIC having a Corporate Plan and Annual Report which endeavour to provide readers this information.

Market participant confusion with regards ASIC's strategy was observed by the Panel in discussions with stakeholders, stakeholder survey responses, and submissions to both the FSI and Senate Inquiry during 2014.84 In particular, submissions to those two inquiries often criticised ASIC for failures that occurred (for example, Storm Financial and Commonwealth Financial Planning).85

Such critiques often appear to assume that ASIC can be expected to prevent all such failures. This suggests that some market participants have unrealistic expectations with regard to ASIC's priorities, powers and oversight responsibilities. The Panel believes that this stems in part from issues with ASIC's approach to communicating its strategy, coupled with external governance shortfalls articulated in Chapter 2.

The Panel observed five key drivers which contribute to market participants not sufficiently understanding ASIC's strategy, priorities, and realistically achievable goals:

- There is very little specification or detailing of how ASIC will deliver on its strategy beyond the articulation of the activities within the Corporate Plan and Business Plans. The Panel recognises that ASIC is essentially silent on delivery which can lead to confusion around what it will do to execute its strategy (see section 3.1). Further, while most staff report that they have a clear understanding of the strategy (76 per cent of staff), only 40 per cent are able to clearly articulate the strategy to others.86

- There is variability across public communication documents discussing ASIC's strategy. This suggests there has been no overarching strategic framework that ASIC has been seeking to communicate. However, the Panel acknowledges that the recently released Corporate Plan has a clear framework that ASIC may now be able to adapt to ensure consistency of messages in future.

- The terminology used to describe the strategy in key documents can also be unclear (see section 3.1). Some of the language used to describe the different elements of the strategy framework appear idiosyncratic and may be confusing to some readers.

- There is minimal discussion within the Corporate Plan and Annual Report regarding limitations of ASIC's activities. This can further exacerbate the unrealistic expectations of some stakeholders regarding what ASIC can achieve in the market.

- ASIC has made efforts to promote its recently released Corporate Plan, providing it directly to around 200 stakeholders, referencing it in speeches and making it available on the ASIC website. However, contemporary stakeholder feedback suggested a low degree of awareness of the Plan and its key messages, which indicates that communication may not have been effective or sufficient.87 Broader discussion of the Corporate Plan would help maximise the return on the investment that ASIC has put into developing this document.

The Panel believes that communication with the stakeholders needs to be clear, targeted and effective. To ensure ASIC communicates its strategy effectively, the Panel recommends:

- ASIC improve its approach to delivery of the Corporate Plan (see section 3.1 above);

- ASIC develop and implement a plan for consistent communication of the corporate strategy across communication channels using clear language and consistent frameworks;

- ASIC increase the emphasis on what it can and cannot do in achieving its strategic priorities in its strategy communications, especially to better manage expectations as to the protections provided to consumers and investors.

Communications strategy

PwC evaluated ASIC's overall communications strategy (covering all of its public communications, above and beyond its corporate strategy) to understand how the organisation seeks to maximise the effectiveness of its communications.

ASIC's External Communications Policy provides valuable guidance on the development and distribution of communications. However, the focus of this document is predominantly process related (for example, licensing, disclosure and cross-border business activities).88

PwC concluded that ASIC does not have a comprehensive communications strategy or framework.89 In particular, the following gaps were identified with the communications strategy:

- it does not set out with clear specification the types of communication needed for different stakeholder groups;

- it does not provide guidance on how to prioritise stakeholder groups based on their information needs;

- it does not provide guidance on the right communications tools for achieving specific strategic goals.

In practice, the Panel considers ASIC's public communications approach to be somewhat reactive and event driven. Although ASIC is a frequent public communicator on topical issues (most recently for example on robo-advice compliance),90 it is difficult to discern a clear pattern of strategic messaging underlying these communications. As such, ASIC would benefit from development and application of a more strategic communications policy.

ASIC's communications strategy needs to provide greater clarity on the communication priorities for different stakeholder groups (including specifics on the messages that need to be delivered), ideal media-mix and frequency of communications, as well as guidance on matters of tone, language, and level of technical detail. In particular, the Panel recommends that the communications strategy:

- clearly describe how communications can help deliver ASIC's strategic objectives;

- specify the key messages ASIC wants to be delivering over time across its various communications;

- discuss the key principles of communication that underpin the communications strategy;

- provide a detailed description of the communications needs and preferences of ASIC's main stakeholder groups;

- provide a breakdown of each overarching strategic message into tailored messages for each of the stakeholder groups;

- for each stakeholder group identified, indicate the most appropriate channels for communicating with them;

- indicate the key communications activities, budget, and resources alloca

ted to delivering the communications strategy.

Communication emphasis

ASIC's articulation of its role, by its leadership and in its public documents, shows too heavy an emphasis on enforcement. Over the last 2-3 years, ASIC leadership has been consistently and publicly using language that portrays the organisation as an 'enforcement agency'. For example, the 2015-2016 Corporate Plan notes:

ASIC is a law enforcement agency. A big part of what we do is holding gatekeepers to account — we identify and deal with those who break the law.91

The Panel recognises that having a strong enforcement capability is central to being an effective markets and conduct regulator, and in providing a strong deterrent signal. However, ASIC's role is not limited to enforcing the law. The Panel notes that other regulatory tools also support ASIC in achieving its enduring strategic objectives including surveillance, stakeholder engagement, policy advice, licensing and education.

This heavy enforcement emphasis in communications risks prioritising strategic focus and staff orientation too much towards this single aspect of the regulatory toolkit. Further, this can affect the way ASIC is perceived by stakeholders and can create a more adversarial tone in the way ASIC and its stakeholders interact.92 Finally, the emphasis on enforcement in communications can distort public expectations of ASIC and lead to expectations that enforcement tools will be used as its primary or only regulatory approach.

The Panel therefore recommends that ASIC rebalance its public and internal communications about its purpose to increase the emphasis on its role as a conduct regulator, highlighting that it uses a range of regulatory tools including enforcement. This will require ASIC to actively promote all the regulatory tools it uses to execute its objectives.

Strategic communication: recommendations summary

Recommendation 16: ASIC to further clarify and emphasise its expectations and risk tolerances (what the regulator will and will not be doing) and actively advertise and promote the strategy broadly (see Chapter 2 for further recommendations related to the SoI).

Recommendation 17: ASIC to ensure the strategic framework used in developing the Corporate Plan is used consistently throughout the communications.

Recommendation 18: ASIC to develop a comprehensive communications strategy that places greater emphasis on communication of the organisation's strategic priorities.

Recommendation 19: ASIC to rebalance its public and internal communications about its role as an enforcement agency.

3.2. Resource allocation — greater flexibility and linkage to strategic priorities needed

Once the key risks are identified, allocating regulatory resources to best achieve desired regulatory outcomes is the next key component of overall strategy. If allocation is done well, it helps the regulator deliver its objectives in the most efficient and effective manner.

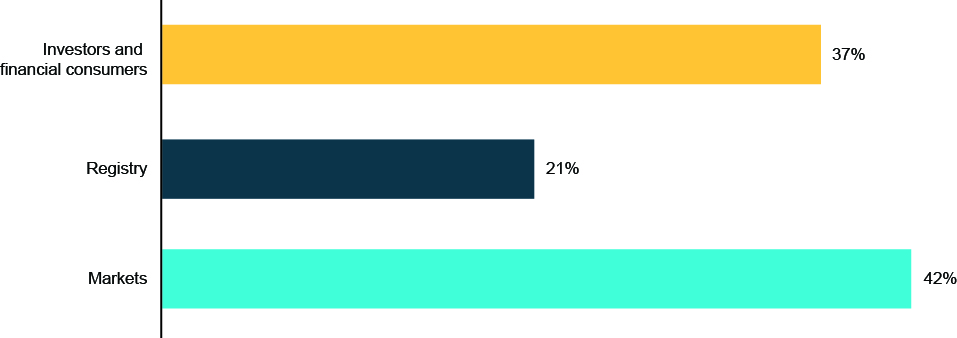

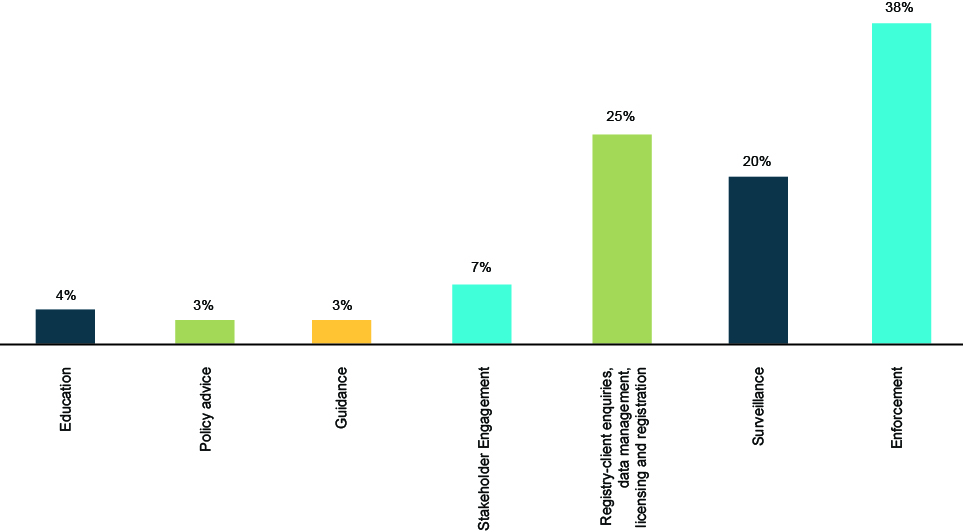

Figure 22 shows the proportion of ASIC's 2014-15 budget allocated to achieving each of its three enduring strategic objectives, and Figure 23 shows the proportion of this budget allocated to each of the tools used to achieve these objectives — engagement, surveillance, policy advice, guidance, education and enforcement, as well as its registry responsibilities. Notably, some 38 per cent of ASIC's resources are allocated to the enforcement function which is significantly greater than domestic and international peer regulators.

Figure 22: Proportion of ASIC's 2014-15 actual OPEX allocated to achieving each enduring objective93

Figure 23: Proportion of ASIC's 2014-15 actual OPEX allocated to each regulatory tool94

ASIC was unable to provide data on the extent resources have moved across teams and silos over time. Such information should be used as a management tool in monitoring the efficient and effective allocation of its resources.

The Panel views resource allocation as a critical part of the strategic management process. Effective resource allocation ensures that an organisation's resources are aligned to its strategic priorities and that scarce resources are put to the most valuable use they can be in the context of the organisation's goals.

The Commission determines budget allocation across ASIC (see Chapter 5 for discussion on the resource requirements and funding). The allocation of resources is discussed through a set of formal and informal meetings (including discussions with the respective teams based on the materials provided as part of the business planning process).95

The Panel notes that ASIC has a formal and structured process for resource allocation. However, the Panel is concerned about the flexibility of resource allocation across ASIC's four clusters and the stakeholder teams within them in practice and the degree of linkage to ASIC's strategic priorities.

Assessment of resource allocation across the different stakeholder teams and functional activities of ASIC over time proved intractable. ASIC's MIS (efficiency measurement and reporting) are such that the Panel was unable to make an informed, evidence-based assessment. As such, the Panel was left to form an impression (based on PwC staff interviews, coupled with ASIC's response to recent Budget savings measures) that relative resourcing levels have remained comparatively static, despite evolution and change in strategic priorities during the period.

The Panel notes that ASIC's response to recent government budget savings measures provides further evidence of insufficient linkage between strategy and resource allocation. Core funding reduced by 15 per cent from 2013-14 to 2014-15.96 At the same time, average FTEs reduced by 10 per cent.97 The Panel has formed a view that the process for determining resource reductions across clusters did not adequately consider the trade-offs of ASIC's strategic priorities across the clusters. Within clusters, ASIC indicated that resource cuts were skewed based on strategic priorities. However, the Panel was unable to analyse the movements of resources within each cluster, so could not verify this position. While the Panel appreciates that there are some advantages to consistent application of top-down budget reductions across clusters (for example, ease and perceived equity), it concludes that this decision represents a missed opportunity to preserve and enhance the linkage between strategy and top-down resource allocation.

The Panel concludes that in practice, resource allocation at ASIC appears to be largely determined within business units, with limited reallocation between teams, driven by top-down strategic priorities.98 The Panel also believes that ASIC's governance model and the lack of separation between governance and executive responsibilities may be contributing to this.

If an industry f

unding model is to be introduced for ASIC, this would require a greater degree of transparency and accountability (and associated supporting MIS) in relation to the efficiency and effectiveness of resource use. This in turn would increase the pressure on ASIC to demonstrate that it is able to dynamically allocate its resources in line with strategic priorities.

The Panel considers that implementation of the internal governance arrangements recommended in Chapter 2 would assist in improving the linkage between strategy and resource allocation at ASIC. In addition, the Panel recommends the following specific changes:

- ASIC to ensure that it has a transparent, flexible and dynamic approach to resource allocation across the organisation. This would entail more assertively challenging the status quo resourcing levels across the organisation and being willing to make significant changes and reallocations where merited.

- ASIC respond to future core funding adjustments more strategically in future by prioritising these impacts across teams in light of strategic priorities and de-prioritising activities non-critical to achieving their strategic priorities.

- ASIC challenge activity requests by Government that do not fit clearly within its mandate, supported by proposed changes to the SoE and SoI in Chapter 2.

Implementation of the above recommendations will ensure ASIC's resources are focused on agreed strategic priorities. In addition, as strategic priorities change overtime ASIC is able to dynamically adjust its resourcing across teams/clusters.

Resource allocation: recommendations summary

Recommendation 20: ASIC to ensure the top-down allocation of resources are deployed across the organisation based on the strategic priorities.