Veasna Kong, Adam McKissack and Dong Zhang1

China's economic transformation since 1978 has been remarkable. At the commencement of the reform period, China's per capita GDP was lower than India's, Pakistan's, Indonesia's, and Thailand's, and about 3 per cent of that of the US. Today, it is multiples above Indian, Pakistani and Indonesian levels, and equivalent to 20 per cent of that of the US. Through a process of reform and opening-up, the utilisation of a vast endowment of labour, the rapid accumulation of capital and technological catch-up, China has been transformed from a rural agrarian economy to an urban industrial force.

However, the structural transformations associated with industrialisation are giving rise to economic challenges and pressure for policy change. Following over three decades of rapid growth, China has reached a period where a heavy reliance on investment and exports has led to the build-up of a number of economic, social, and environmental challenges that need to be addressed. While there remains potential for further impressive growth, the favourable conditions that China has benefited from in the past are, in many respects, reaching their 'use by date'. This presents a range of policy challenges for China's incoming leadership.

Introduction

It was over thirty years ago now, under the stewardship of Deng Xiaoping and his policy of reform and opening-up, that China embarked on its path to economic modernisation. While the principal factors behind China's success are not unique compared with other countries, what makes China's case special is the sheer size and pace at which this transformation has taken place. In the decade to 1990, China contributed an average of 10 per cent to world growth; between 1991 and 2000, it contributed almost one fifth; and in the decade to 2010, the contribution increased to around one quarter. In the process China has lifted 600 million people out of poverty and transformed city skylines across the country. Based on current trends, China could overtake the US as the world's largest economy by 2020.

China's economic transformation since 1978 has been remarkable. A relaxation of state controls and the creation of market incentives allowed the private sector to prosper and encouraged improvements in resource allocation and overall economic efficiency. Policies encouraging foreign trade and investment have allowed China to achieve significant gains from its greater integration with the world economy and international competiveness. A more open economy allowed China to exploit its comparative advantages, including favourable demographics and a vast pool of surplus rural labour. In addition, accession to the WTO, and an active state capable of quickly mobilising resources have helped enable China to grow at an unprecedented rate.

Now at a more mature phase of its industrialisation, and amid growing structural challenges in the economy, it is widely acknowledged that China needs to adapt its growth model if it is to sustain a rapid pace of development. This paper discusses how China's growth model has transformed the economy over the past 30 years, the acknowledged problems with the current model, and some of the key policy challenges facing the economy as China ushers in a new leadership and undergoes a new economic transition.

Characteristics of China's growth — past and present

China's economic development since the establishment of the People's Republic of China in 1949 can be characterised by two distinct periods of performance — the pre-reform period before 1978, and the reform period post 1978.

During the pre-reform period, China pursued an autarchic socialist command economy system based on the Soviet model, with a strong focus on government directed resource allocation, development of heavy industry, large state-run enterprise and price controls. This period was a tumultuous time for China, including episodes of economic or political turmoil such as the Great Leap Forward (1958-60) and Cultural Revolution (1966-76). It was not until the commencement of economic reforms in the late 1970s, under the leadership of Deng Xiaoping, that economic growth gathered momentum. Decentralisation and a more reformist policy stance have improved the efficiency of the economy. The state's control of the economy was loosened, market incentives were created, private enterprise was encouraged, protectionist policies were relaxed, and the economy was opened to greater foreign trade and investment. These strategies laid the groundwork for China's rapid growth, enabling China to exploit its comparative advantages and harness the opportunities flowing from a more open economy.

Convergence and catch-up

At the commencement of the reform period, China was a poor, insular economy, with per capita GDP lower than India's and only 3 per cent of that of the US. Since 1978, China's economy has grown by an annual average rate of 10 per cent, doubling in size around every eight years to be 22 times larger than it was 1978. This exceptional performance has propelled China to three decades of rapid economic convergence or 'catch-up', a process in which relatively fast per capita income growth is experienced in poorer economies, resulting in the narrowing of income disparities with high-income economies.

Chart 1: China's convergence

Panel A: GDP per capita

Source: The Conference Board Total Economy Database and authors. Note: GDP per capita in purchasing power parity (PPP) terms.

Panel B: Evolution of labour productivity relative to the US

Source: The Conference Board Total Economy Database and authors.

Over the past few decades, a number of economies have demonstrated economic convergence, including Japan, Hong Kong, Taiwan and South Korea (Chart 1, Panel A). While China's growth performance has been remarkable, China's economic catch-up is comparable with that experienced in South Korea from the mid-1960s, and Japan from the mid-1950s (Liu and McDonald, 2010). Indeed, the principal factors behind China's success are similar to those that have previously driven growth elsewhere in East Asia. These include very high rates of physical capital accumulation and mass mobilisation of labour towards industries of comparative advantage, augmented by improvements in human capital, export-led growth through the production of low cost manufactured goods for international markets, and the process of technological catch-up.

These developments have seen labour productivity — a key driver of growth of incomes — improve significantly since the commencement of the reform period (Chart 1, Panel B). Labour productivity has risen from around 3 per cent of the US level in 1978 to around 16 per cent in 2011. This is equivalent to a nine-fold increase in China's labour productivity between 1978 and 2011, more than any other economy in the world.

Convergence is partly determined by a country's ability to take advantage of the ideas and knowledge possessed by higher income economies. During the pre-reform period, China's ability to both import and adopt new technology was limited. This reflected China's relative isolation from western economies as well as an institutional environment hostile to markets. The pre-reform period was thus a period of technological divergence and during the early stages of reform, industrial equipment was up to 30 years behind international standards (World Bank 1983, cited in Chai 19

98).

Box 1. Accounting for China's growth

While many studies have attempted to explain China's past growth experience, whether growth has mainly been driven by productivity gains or factor accumulation remains the subject of considerable debate.

Typically utilising the standard growth accounting framework, studies have attempted to decompose GDP growth into its factor inputs, namely the contributions from labour, capital and 'total factor productivity' (TFP). TFP is a measure that captures many residual components, among which are technological progress and efficiency in the use of inputs.

Wu (2011) categorises China growth accounting studies into two camps, either representing China 'bulls' or 'bears'. The bulls, typified by Bosworth and Collins (2008), attribute over two fifths of China's reform period growth to TFP, equivalent to annual TFP growth of 3.6 per cent during 1978-2004. According to Bosworth and Collins (2008, p.53, 64), the large gains from TFP sets China 'apart from the East Asian miracle of the 1970s and 1980s, which was more heavily based on investment in physical capital'. They conclude that the 'supply-side prospects for continued rapid growth in China … in terms of labor, physical capital and reallocation across sectors, are very good'.

Wu (2011) is less positive about China's productivity performance. After accounting for data deficiencies, Wu (2011) finds that the contribution from TFP to growth between 1978-2008 has generally been low. According to his study, growth in the reform period was mainly attributed to high levels of physical capital accumulation, which implies China could be another example of the so called 'East Asian miracle' (Krugman, 1994).

Chart 1: Growth accounts

Panel A: Bosworth and Collins

Source: Bosworth and Collins, 2008.

Panel B: Wu

Source: Wu, 2011.

Studies that fall in-between these two extremes include those by Wang and Yao (2003) and Kuijis (2009), who estimate TFP growth of 2.4 per cent per annum (1978-99) and 3 per cent (1978-94) respectively.

If the bulls are correct, and TFP has been the largest contributor to growth, the expected slowing in factor accumulation does not spell the end of the road for China's growth model. On the other hand, if China's growth has been mainly driven by factor accumulation, then China's growth model of recent decades may have run its course. There are limits to the growth that can be achieved by simply adding capital and labour. Long run growth depends largely on continuous productivity gains — in effect how these inputs are used. As Krugman (1994) argued in the context of the East Asian miracle, growth based on factor accumulation is inherently unsustainable. Instead, China would need a significantly improved TFP performance in order to maintain the momentum of growth as its labour supply growth and capital accumulation inevitably slow.

The relative backwardness of China's economy prior to the reform period, and China's ability to exploit this, enabled China to absorb technologies and know-how more quickly and at a lower cost than those economies at the technological frontier (Lin, 2011). This ability to adopt higher quality technology and accumulate capital, combined with significant increases in educational attainment, favourable demographics, and vastly improved labour force utilisation, have enabled China to narrow its income disparity with high-income economies.

The demographic dividend and reallocation of labour

China's strong economic performance over the past 30 years has been assisted by favourable demographics, with the working age population growing at a much faster rate than overall population growth. This has given rise to a 'demographic dividend', a period associated with a declining birth rate (an important driver of which is the 'One Child Policy' introduced in 1978), which has for a period meant a larger working age population relative to young and elderly dependents (the dependency ratio) (Chart 2, Panel B).

Chart 2: Demographic transition

Panel A: Working age population

Source: UN population statistics and authors.

Note: working age is 15-64.

Panel B: Dependency ratios

Source: UN population statistics and authors.

Note: old age 65+, child 0-14

China has benefitted from the demographic dividend through a number of channels. Firstly relatively fast growth in the working age population, which according to the UN, has increased from 550 million 1978 to 980 million in 2011, has made available a large labour supply to help drive the industrialisation process. Secondly, with a greater capacity to save than their young and elderly dependents (ADB, 2011), the large and growing working age population has contributed to the rise in savings, which has helped to finance investment and capital accumulation, and in turn, economic growth. Thirdly, the decline in the young age dependency ratio is also likely to have assisted in improving human capital, as fewer child dependents allows for greater investment in each child (Bloom, Canning and Sevilla, 2001). All things being equal, with a policy environment able to take advantage of the demographic dividend, a rising working age share of the population has helped China to achieve rapid GDP growth.

China's demographic dividend has also coincided with the large scale movement of rural surplus labour from the low productivity agricultural sector to high productivity industrial and service sectors. At the commencement of the reform period, China had significant untapped potential in labour-intensive industries, with about 70 per cent of people employed working in the agricultural sector. With much of the agricultural labour force underemployed, large productivity gains were possible from the mobilisation of rural labour to secondary and tertiary industries (Chart 3) (Garnaut and Huang, 2006).

Chart 3: Labour shares by sector

Source: CEIC China database and authors.

From the mid-1980s, rural workers began to migrate en masse to urban centres for employment in manufacturing, construction and service industries as residency restrictions were relaxed and the economy and private sector began to gain momentum, particularly in coastal areas. By 1993, the number of rural migrant workers increased to over 60 million, up from around 30 million in 1989 (Shi, 2006). Following a deceleration in rural-urban migration in the late 1990s, due to state owned enterprise (SOE) restructuring, the Asian Financial Crisis, and a tightening of administrative restrictions on rural migrants, rural-urban migration picked up after accession to the WTO in 2001, with the migrant workforce roughly doubling to reach around 150 million in 2010 (Rush, 2011).

However, a demographic profile that was once supportiv

e of growth will increasingly become a burden on the economy. The working age population is expected to peak around 2016 and slowly decline thereafter, reflecting the effect of the One Child Policy and ageing working age population (Chart 2, Panel A). As the child dependency ratio stabilises at lower levels in coming years, the dominant factor influencing the dependency ratio will be the ageing population, with the proportion of aged people expected to grow rapidly in coming years. According to UN data, in 1978, 5 per cent of the population was aged 65 or over. This reached 8 per cent in 2011, and is expected to rise to 12 per cent by 2020, equivalent to an increase of around 50 million people and growth of around 50 per cent. In contrast, the working age population is expected to increase by around 12 million people, or just 1 per cent between 2011-2020. This trend, which will continue to alter China's demographic profile in coming years, is expected to be among the most dramatic demographic transitions ever experienced in history (World Bank, 2012). This has led to suggestions that China will 'grow old before it grows rich'. As the population ages, demand for health and social welfare will rise, posing challenges to social and fiscal policy. Furthermore, an ageing population is likely to reduce household savings, a significant source of investment funds.

According to Garnaut and Huang (2006, p. 18), 'development in China was broadly consistent with the insights from the Lewis model during the first 25 years of China's economic reform'. The Lewis model (Lewis, 1954) postulates that during the early stages of industrialisation an economy benefits from a period of economic growth with virtually no rise in real wages because of the surplus supply of rural labour. With the marginal productivity of the surplus rural labour below the prevailing subsistence income level, this surplus supply of rural labour helps to develop the modern sector (manufacturing and services) by suppressing wages. This contributes to high returns on capital, rapid growth in the modern sector and therefore economic growth. However, at some point, a Lewis Turning Point (LTP) (or more realistically a 'turning period') is reached when the supply of surplus rural labour is fully absorbed by the modern sector, placing generalised upward real wage pressure on the economy.

Whether China has reached the LTP remains the subject of much debate. Despite the uncertainty surrounding the exact timing of China's LTP, it is apparent that the forces driving China towards the LTP will continue to build-up, which will have a number of implications for the development of the economy. During the LTP, profits are squeezed, lowering corporate savings and investment as the benefits to China of cheap rural labour diminish. This combination of lower profits and savings is likely to see investment slow, leading to slower growth in the absence of offsetting productivity gains. As real wages rise further, households' share of total income is likely to rise. The combination of lower corporate savings, higher real wages and reduced international competiveness in some markets will increase consumption and lower the tendency for China to have current account surpluses. Moreover, income inequality could narrow, and comparative advantages in labour intensive industries are likely to dissipate, necessitating a shift to more innovative and higher value added industries (Garnaut, 2010). China will thus need to boost productivity in order to maintain the momentum of growth.

Integration in world trade

A defining feature of China's growth performance has been the expansion of its international trade and integration with global markets since 1978. The economic modernisation instigated in 1978 saw a change in attitude towards international trade. Adopting an 'opening-up' policy, China followed the East Asian export-led growth model, tapping into growing world export markets while at the same time, taking advantage of the know-how and technological advances forged by high-income economies before it.

China's exports have risen rapidly over the past 30 years, and over the past 15 years alone — aided by accession to the WTO in 2001 — China's exports have risen more than tenfold, with the average annual rate of growth in nominal merchandise exports between 2002 and 2008 almost doubling that of the 1990s (Coates, Horton and McNamee, 2012). This increase has seen China become the world's largest exporter, surpassing both the United States and Germany to now account for over 10 per cent of world exports (Chart 4, Panel B).

Chart 4: China emergence as the world's factory

Panel A: The world's de-facto factory — manufacturing output

Source: UN Statistics Division.

Panel B: The world's largest source of merchandise exports

Source: WTO statistics database and authors.

A number of factors in addition to the abundance of low cost labour have formed the basis of China's international competitiveness in manufacturing exports. While China has liberalised most product markets, forcing firms to compete directly in domestic markets, China continues to provide subsidies in the form of artificially low prices for key factor inputs, such as land, labour, capital, energy and the environment. These government interventions — products of China's push to promote GDP growth — have had the effect of lowering production costs, elevating profits and returns on investment, and have created incentives in favour of production in the industrial sector.

China's greater openness to international trade and investment has helped to develop the economy through a number of key channels. First, access to growing international markets for cheap, labour-intensive manufactured goods enabled China to exploit a significant comparative advantage that had previously been idle. It has also encouraged the large scale reallocation of labour from low-productivity agriculture into high productivity industrial sector. Second, a more open economy has enabled China to absorb advanced foreign technology and know-how, thereby improving productivity. And third, a more open economy has introduced more competition, promoting efficiency and innovation (Woo, 1997).

Investment-led growth

High levels of investment have been another feature of China's growth performance over the past three decades (Chart 5, Panel A). China commenced the reform period with relatively low capital, allowing for large returns to investment and productivity gains over the reform period simply through adding capital to the economy. Kuijis and Wang (2005) estimate that growth in the capital stock, which has averaged 10 per cent per year between 1978 and 2004, has contributed more than half of GDP growth. Between 1993 and 2004, the contribution of capital accumulation to GDP growth is estimated to have been even higher at 62 per cent, although estimates vary considerably (see Box 1).

Chart 5: Investment

Panel A: Investment shares of GDP

Source: IMF WEO, October 2012. Note: ASEAN-5 comprise of Indonesia, Thailand, Malaysia, Philippines and Vietnam. NIEs comprise of South Korea, Hong Kong, Taiwan and Singapore. Investment here refers to gross capital formation.

Panel B: Gross saving b

y sector

Source: CEIC China database and authors.

In the first decade of the reform period, investment (gross fixed capital formation) averaged around 28 per cent of GDP. However, investment's share of GDP has since increased consistently, averaging almost 40 per cent in the decade to 2010 to stand at 46 per cent in 2011, above the historical peaks experienced in Japan (37 per cent, 1973), South Korea (38 per cent, 1991) and Thailand (42 per cent, 1991). While high, the significant rise in investment's share of GDP is an experience largely typical for an emerging economy, reflecting the low initial capital stock and large returns to investment (Hubbard, Hurley and Sharma, 2012).

China's extraordinary investment growth over the past three decades has been supported by government policies that have favoured investment and the industrial sector. Capital has been channelled on favourable terms from savers to large enterprises and SOEs, aiding capital accumulation during the industrialisation process. Furthermore, reforms to property rights allowing private housing in the late 1990s and an incentive structure that encourages local governments to invest heavily in search of rapid economic growth has also contributed to high levels of investment in China.

Another factor enabling China to invest to an unprecedented scale is its vast stock of savings, which is high by international standards and has grown considerably over the past few decades. Since the 1980s, saving as a share of GDP has risen from less than 40 per cent to about 50 per cent in 2011, outsizing investment for the past 18 years. The rise in saving has been driven by all three sectors of the economy — corporate, household and government (Chart 5, Panel B). The household sector is China's largest source of saving, accounting for on average almost half of China's national savings since 1992. However, contrary to some perceptions, corporate saving has accounted for most of the increase in China's national savings since 1992.

A new period of transition

China's current growth model, underpinned by high savings and low factor prices that favour investment and exports, has served China well for three decades. However, while China still possesses significant catch-up potential and will continue to benefit from some of the favourable conditions that have driven its economy for some time to come, the benefits are fading, and a number of factors are likely to weigh on growth going forward.

Externally, the favourable conditions that allowed China to yield large gains from 'opening-up' appear to be diminishing. In particular, the outlook for the external environment remains highly uncertain, and with domestic wages on the rise, and growing competition from low cost producers elsewhere, China can no longer depend on exports to the extent it has become accustomed to (see Coates, Horton and McNamee, 2012).

While China has invested on an unprecedented scale over the past three decades, China experienced an even larger rise in its savings. Domestically this imbalance manifests as a low household consumption share of GDP, while externally, it implies a widening of the current account surplus. The capital intensive nature of growth — underpinned by distortions that favour industrial production over services and household consumption, alongside suppressed wages as a result of the surplus rural labour and relatively weaker import growth — has contributed to large current account surpluses. But with an external environment unable to absorb the growing production to the extent it used to, the need to adjust to a less export-reliant growth model has intensified.

Domestically, the capital intensive nature of growth has contributed to the low household consumption share of GDP, which has fallen by 11 percentage points between 2000 and 2011. Even though this could stabilise as China exhausts its supply of surplus labour, there remain formidable policy challenges (Hubbard, Hurley and Sharma, 2012).

While there remains significant scope for strong investment growth, there are question marks over the sustainability of current patterns of investment. In a remarkably short period of time, aided by distorted factor prices, China has been able to build the infrastructure that high income economies took many more years to build. In the past five years alone, China has built more high-speed rail lines than exist in France (Broderick, 2012), and in 2011, China built more residential floor space than exists in Australia (Berkelmans and Wang, 2012). However, as China approaches the standard of living enjoyed in high income economies, a continuation of these patterns of investment increasingly comes at the risk of overinvestment and excess capacity, with consequent risks to economic stability.

Furthermore, as China's economy matures and approaches the technological frontier, the scope for TFP gains from the adoption and transfer of advanced technologies will begin to fade. These challenges are set against a background of the ageing population and looming exhaustion of surplus rural labour, which suggest that China can no longer rely on the 'easy' productivity gains associated with favourable demographics and from shifting labour from agriculture to the modern sector.

In the popular debate, China's transition to a new growth model is often focussed on the need to increase households' share of income and reduce the current account surplus. In truth, there are a number of challenges arising from China's extraordinary rise that need to be addressed, including regional economic and social disparities, rising income inequality, and growing stresses on the environment. A central theme, however, is that they are all to varying degrees related to the underlying institutional and economic structure of the economy that have driven China's export- and investment-led growth. A more sustainable growth model, therefore largely centres on the need to address distortions, incentive structures and rent seeking behaviour that prevent more inclusive and sustainable growth.

Factor market reforms will play a key role in addressing these economic challenges, facilitating China's transition to a more sustainable growth model. Since the late 1970s, China's rapid growth has been closely associated with economic reforms that liberalised almost all product markets, providing price signals for consumption and production decisions. However, price controls remain in place on virtually all factors — capital, land, labour, and energy — which distort incentives in the economy. While supporting SOEs, the tradable sector and investment, factor price distortions have contributed to excess capacity in some sectors, environmental degradation and income inequality.

Financial sector reforms

In its China 2030 report, the World Bank (2012, p. 123) describes the Chinese financial system as 'repressed, unbalanced, costly and potentially unstable'. The current structure of the financial system, characterised by the artificially low cost of capital, state intervention and the dominance of the banking sector in the allocation of capital, has served China well in the past, mobilising high national savings to fund rapid investment, and thereby growth (World Bank, 2012). Indeed, 'financial repression'2, which can generally be described as the set of financial policies that channel to the state and its interests funds that would otherwise go elsewhere, has been a key element of China's development strategy over the past three decades (Johansson, 2012). This has enabled China to allocate capital on favourable terms to preferred sectors of the economy. However, there is wide recognition that carefully sequenced financial reforms are required if China is to place growth on a more sustain

able footing.

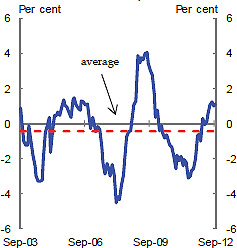

Real deposit rates have been negative for prolonged periods over the past decade, and effectively provide a subsidy from households to the corporate and state sector (Chart 6, Panel A). Rather than being determined by market forces, lending rates are bound by a floor of 30 per cent below the benchmark lending rate, while deposit rates are now capped at 20 per cent above the benchmark deposit rate. The lending rate floor and deposit rate ceiling, which is especially important given the limited alternative savings vehicles, have played a key role in promoting rapid growth through capital accumulation and supporting manufacturing capacity for exports, while securing banks' profitability with a guaranteed interest margin. China's banks have benefited from guaranteed net interest margins for many years, peaking at 3.6 per cent during 2006 and 2007, and accounting for at least 70 per cent of banks' operating income (Chart 6, Panel B). This has contributed to the nearly doubling of after-tax net profits of Chinese banks in the past five years.

This strategy, aided by China's closed capital account, has worked well in many respects, including helping to ensure a stable funding environment and the stability of the banking system over the past decade. However, the benefits of such a strategy are diminishing, with growing risks of capital misallocation and rising economic distortions (manifested as asset bubbles, over-capacity in certain sectors and debt concerns at the local government level). Artificially low deposit rates are an implicit tax on household savings, while the low cost of capital encourages leveraging and inefficient investment, putting financial stability and growth at risk. Moreover, while the banks have been able to generate significant profits, the guaranteed interest margin has not been conducive to the development of a more efficient and commercially-based banking system.

Chart 6: Interest rate distortions

Panel A: Real deposit rates

Source: CEIC China database and authors.

Panel B: Guaranteed net interest margin

Source: CEIC China database and authors.

In China, the banking sector dominates the financial landscape. While it has progressed significantly over the past three decades, the state retains control over the major banks and therefore, much of the financial sector. The Chinese banking sector is dominated by the 'big four' state banks, comprising Industrial and Commercial Bank of China, the China Construction Bank, Bank of China, and the Agricultural Bank of China. Of the further 13 other large banks that are classified as joint stock holding banks, 11 are controlled by the state (Johansson, 2012).

The banking system remains a key policy instrument of the state and credit allocation is not always channelled on commercial grounds (for example the response to the global financial crisis). On average, bank lending has accounted for approximately three quarters of credit extended in China over the past decade. In addition, state controlled banks hold approximately 70 per cent of banking assets with the 'big four' alone accounting for over 40 per cent of banking assets.

The state's control of the banks provides it with significant control over the economy, particularly one that has grown to rely heavily on investment. However, the cost is that the financial sector does not effectively price risk, leading to problems of capital misallocation. The main beneficiaries of this system are SOEs, local governments, infrastructure developers and other institutional borrowers. The losers are the Chinese savers including households, whose savings effectively subsidise investment funded by the banks. The banks offer returns that are typically low, and often below the rate of inflation, implying that there is a significant financial transfer from households to banks, SOEs and other institutional borrowers.

SOE reforms

The future of SOE reforms is central to China's transition towards a new model of growth that will rely critically on dynamic modern enterprises that are innovative, efficient, and competitive. Much of the past reforms were aimed at making SOEs market oriented business entities through withdrawing them from competitive industries, encouraging the growth of the non-state sector, and pushing remaining SOEs to improve corporate governance. These reforms, if thoroughly carried out, could lay a solid microeconomic foundation for China's sustainable growth. However, to date their success has been mixed, highlighting that SOE reforms are still very much a work-in-progress.

On the surface, SOEs have made a turnaround in their financial performance since the late 1990s, when at one stage the whole sector was close to loss making. The average return on equity (ROE) of SOEs rose from below 2 per cent in 1998 to above 15 per cent in 2007. After a two-year fall following the onset of the global financial crisis, the average ROE in 2010 recovered to just below the pre-GFC level.

However, SOEs' remarkable change of fortune has been significantly aided by preferential policies and regulations in their favour. The state has also created administrative monopolies that restrict entry and competition from non-state firms in a wide range of activities, such as services and industries that it regards as strategically important. As a result, SOEs continue to dominate in electricity, petroleum, aviation, banking and telecommunications industries.

In addition, SOEs continue to receive explicit and implicit state subsidies, including low effective tax rates, low dividend payouts, and little or no royalties on resource extraction. Compared to non-state firms, SOEs are in a much better position to receive subsidies on key inputs such as energy, water, land, and cheap capital from China's state owned banks.

Protection, subsidies, and preferential treatment have artificially propped up SOE profitability, which, if calculated on the costs of doing businesses by non-state firms, could be much lower or possibly negative. According to an estimate made by Unirule (2011), an independent Chinese think tank, the average real ROE of SOEs from 2001 to 2009 is negative if benefits from various preferential policies and fiscal subsidies were stripped from SOEs' profits, and the real cost of land, resource and capital were included as expenses. Despite numerous advantages for the state sector, ROE of SOEs is much lower than in the private sector. According to the World Bank (2012, p.111), 'in 2009, the average ROE of non-state firms remained 9.9 percentage points above that of SOEs'.

SOE profits have been largely retained for internal uses. Until very recently, SOEs were not required to distribute any dividends. While this is changing, the payout rates remain low. Not surprisingly, SOEs tend to use their retained profits for investment and internal welfare, which in turn has contributed to inefficiency and resource misallocation. At the heart of the challenge for SOE reforms is the need to transform the relationship between the state and SOEs, to separate the state's role as a provider of public goods and services from the SOEs' role as commercial entities responsible for their own profits and losses. Of course, there is also scope to increase the role of the private sector in some sectors to promote competition and new investment.

Politics of reform

At the 18th National Party Congress this year, the Chinese Communist Party held the first phase of the transition to its 'fifth generation' of leaders, a transition that wi

ll see a comprehensive turnover of the principal figures responsible for China's economic policies.

While the shape of economic policies under the new leadership remains uncertain, China's leadership has a growing sense of the economic imperative to undertake further structural reform. The leadership is fully aware that the Party's survival is dependent on continuing economic and social progress.

Previous economic reform exercises in China have involved the state loosening controls on the economy to create space for the private sector to drive economic growth and employment. For example, Deng's opening-up of the economy in 1978 and China's subsequent accession to the WTO in 2001 allowed the non-state sector to grow and exploit business opportunities, including in international trade. The SOE reforms of the 1990s unlocked resources in the economy and opened up domestic markets to greater private sector participation.

Under China's state capitalism model, the private sector has been allowed to grow within the parameters set by the state, while the state has maintained control over key strategic sectors of the economy. China's financial system is dominated by the activities of the big, state-owned policy banks. Interest rates are regulated, credit is rationed and banks have been given direction on who they should lend to. SOEs dominate other core sectors, such as communications, energy and resources. These controls are consistent with China's political model, which retains a central planning ethos.

The ability to direct capital and control strategic sectors of the economy are powerful economic levers, as well as sources of political power. The ability of a central decision-making process to efficiently guide capital in an increasingly large and complex economy is now being called into question, and most of China's pressing economic reforms involve further expansion of the role of the private sector. This is evident in a number of areas. In respect to the financial sector, there is a recognised need to better price risk and allow commercial considerations to guide the allocation of capital. Continuing state influence in the allocation of capital runs the risk of capital misallocation, mispricing of assets and bad debts.

Similarly, as China seeks to promote new growth drivers, including in the services sector, it needs to allow non-state investment to compete equally with SOEs in these industries.

Of course, letting go of these areas of control to make more room for the market raises a number of difficulties. A significant amount of wealth has been generated in China around the current model, creating strong vested interests. While there would be many winners from reform there would be a powerful group of losers. Moreover, ceding power to the market would lead to a watering down of Party influence.

All countries seeking to take on structural reform face these sorts of issues. There are always groups that benefit from the status quo, and the benefits of reform are often diffuse. But a feature of the Chinese system is that the leadership derives its power more directly from those who stand to lose from a process of further market-oriented reform.

Conclusion

Following three decades of rapid growth, China has reached a period where the build-up of a number of economic, social, and environmental challenges need to be addressed. There is no doubting the potential for further impressive growth in the Chinese economy as China seeks to continue the process of catch up. But the older means of realising these benefits are in many respects approaching their 'use by date'. The limits of the current growth model are already starting to bite on the Chinese economy, and will become more evident over the next decade. This presents a range of policy challenges for China's incoming leadership, whose ability to adapt to the new economic landscape will be tested by a range of economic and political obstacles to reform.

China has a complex domestic reform agenda ahead if it is to shift to a more sustainable growth model and transition from a middle- to high-income country. It will need to manage the contradiction between market and command elements of the economy, and overcome conflicting interests. Given the complexities that structural change entails, and the serious challenges they pose to both the current economic and political models, China's leaders will be particularly cautious during the new period of transition.

China has, since the late 1970s, been 'crossing the river by feeling the stones', basically an approach of taking reform in small incremental steps. Whether China has enough time to pursue reform at such a pace remains to be seen. Many commentators believe that pressures building up within China's economy suggest a more urgent case for reform. China's new leadership faces significant challenges, and its actions in the coming years could prove to be 'make or break' for the sustainability of China's growth model in the decades ahead.

References

Asian Development Bank (2011), 'Asian Development Outlook 2011 Update, Preparing for Demographic Transition', pp. 35-68, Asian Development Bank, Manila.

Berkelmans, L and Wang, H (2012), 'Chinese Urban Residential Construction to 2040', Reserve Bank of Australia, Research discussion paper, 2012-04.

Bloom, E D, Canning, D, Sevilla, J (2001), 'Economic Growth and the Demographic Transition', National Bureau of Economic Research, Working paper series, wp8685.

Bosworth, B and Collins, M S, (2008), 'Accounting for Growth: Comparing China and India', Journal of Economic Perspectives, Volume 22, Number 1, Winter 2008.

Broderick, F (2012), 'Is China's High-Speed Rail System Slowing Down?', East Asia Forum.

Chai, C H J (1998), 'China: Transition to a Market Economy', Clarendon Press, Oxford.

Coates, B, Horton, D and McNamee, L (2012), 'China: Prospects for export-driven growth', Economic Roundup, Issue 4.

Garnaut, R (2010), 'Macroeconomic implications of the turning point', presented at 'debating the Lewis turning point in China', Institute of Population and Labor Economics (CASS) and China Center for Economic Research (PKU), Beijing, April 6.

Garnaut, R and Huang, Y (2006), 'Continued rapid growth and the turning point in China's economic development', in Garnaut, R and Song, L (eds), The Turning Point in China's Economic Development, p. 17, Asia Pacific Press, Canberra.

Hubbard, P, Hurley, S, and Sharma, D (2012), 'The familiar pattern of Chinese consumption growth', Economic Roundup, issue 4.

Johansson, A (2012), 'Financial Repression and China's Economic Imbalances', in McKay, H and Song, L (eds), Rebalancing and Sustaining Growth in China, ANU E Press, Canberra.

Kuijis, L (2009), 'China through 2020 — a Macroeconomic Scenario', World Bank China, Research working paper, No. 9.

Kuijis, L and Wang, T (2005), 'China's Pattern of Growth: Moving to Sustainability and Reducing Inequality', The World Bank, Policy research paper 3767.

Krugman, P (1994), 'The Myth of Asia's Miracle', Foreign Affairs, Volume 73.

Lewis, W A (1954), 'Economic Development with Unlimited Supplies of Labor', Manchester School of Economic and Social Studies, Vol. 22.

Lin, Y, J (2011), 'Demystifying the Chinese Economy', The World Bank, Cambridge University Press.

Liu, J and McDonald, T (2010), 'China: growth, urbanisation and mineral resource demand', Economic Roundup, Issue 2, p. 59.

Park, D and Shin, K (2011), 'Impact of Population Aging on Asia's Future Growth', ADB Economic Working Paper Series, Asian Development Bank.

Reinhart, M C, and Sbrancia B M, 'The Liquidation of Government Debt', Peterson Institute for

International Economics, Working Paper No. 11-10.

Rush, A (2011), 'China's Labour Market', Reserve Bank of Australia, Bulletin, September 2011.

Shi, L (2008), 'Rural Migrant Workers in China: Scenario, Challenges and Public Policy', International Labour Organisation, Working Paper No. 89.

Tianze Report (天则报告) (2011), 'State-owned enterprises: nature, performance, and reforms' (国有企业的性质、表现与改革guoyou qiye de xingzhi, biaoxian yu gaige),

Woo, T, W (1997), 'Chinese Economic Growth: Sources and Prospects', in Fouquin, M and Lemoine, F (eds), The Chinese Economy, Economica, London.

World Bank 2012, 'China 2030: Building a modern, harmonious, and creative high-income society', The World Bank and Development Research Centre of the State Council, the People's Republic of China.

Wang, Y and Yao, Y (2003), 'Sources of China's economic growth 1952-1999: incorporating human capital accumulation', China Economic Review, 14/32-52.

Wu, X W (2011), 'Accounting for China's Growth in 1952-2008: China's growth performance debate revisited with a newly constructed data set', The Research Institute of Economy, Trade and Industry, Discussion paper series 11-E-003.

1 The authors are from the International Economy Division, the Australian Treasury and Treasury's Beijing Post. This article has benefited from comments and suggestions provided by Barry Sterland, Jason McDonald, Owen Freestone, Paul Hubbard, Samuel Hurley and Dhruv Sharma. The views in this article are those of the authors and not necessarily those of the Australian Treasury.

2 Reinhart and Sbrancia (2011) define financial repression as consisting of 1. Explicit or indirect control of interest rates 2. Government ownership of the domestic banks with significant barriers to entry 3. Creation or maintenance of a captive market for government debt and 4. Capital controls.