for the period ended 30 June 2011

Note 1: Summary of significant accounting policies

1.1 Objectives of the Treasury

The Treasury is an Australian Government controlled entity.

The Treasury's mission is to improve the wellbeing of the Australian people by providing sound and timely advice to the Government, based on objective and thorough analysis of options, and by assisting Treasury Ministers in the administration of their responsibilities and the implementation of government decisions.

The Treasury is structured to meet one outcome:

Outcome 1: Informed decisions on the development and implementation of policies to improve the wellbeing of the Australian people, including by achieving strong, sustainable economic growth, through the provision of advice to government and the efficient administration of federal financial relations.

The reporting entity, hereafter referred to as 'the Treasury', comprises the Treasury and the Australian Government Actuary.

Activities contributing towards the outcome detailed above are classified as either departmental or administered. Departmental activities involve the use of assets, liabilities, revenues and expenses controlled or incurred by the Treasury in its own right. Administered activities involve the management or oversight by the Treasury on behalf of the Government, of items controlled or incurred by the Government.

Departmental activities are identified under Program 1.1. Administered activities are identified under programs 1.1 to 1.10 listed below:

- Program 1.1 — Department of the Treasury

- Program 1.2 — Payments to International Financial Institutions

- Program 1.3 — Support for Markets and Business

- Program 1.4 — General Revenue Assistance

- Program 1.5 — Assistance to the States for Healthcare Services

- Program 1.6 — Assistance to the States for Schools

- Program 1.7 — Assistance to the States for Skills and Workforce Development

- Program 1.8 — Assistance to the States for Disability Services

- Program 1.9 — Assistance to the States for Affordable Housing

- Program 1.10 — National Partnership Payments to the States

Program 1.2 provides for administered payments to International Financial Institutions as required to:

- promote international monetary cooperation, exchange stability and orderly exchange arrangements;

- strengthen the international financial system; and

- support development objectives through the multilateral development banks.

Program 1.3 provides for administered activities in respect of:

- insurance claims arising from the residual Housing Loans Insurance Corporation (HLIC) portfolio;

- assistance under the HIH Claims Support Scheme (HCSS);

- the Guarantee of State and Territory Borrowing in assisting state and territory governments to access funding;

- the Guarantee Scheme for Large Deposits and Wholesale Funding to promote financial system stability in Australia; and

- support for car dealership financing through the OzCar Special Purpose Vehicle (SPV).

Program 1.4 provides for administered payments of general revenue assistance to the States and Territories, including payments of revenue received from the GST.

Programs 1.5 to 1.9 provide for administered payments to the States and Territories for healthcare services, schools services, skills and workforce development services, disability services and affordable housing services; according to the payment arrangements specified in the Intergovernmental Agreement on Federal Financial Relations.

Program 1.10 provides for administered payments to the States and Territories, according to National Partnership agreements, providing financial support for the States and Territories to be spent on improving outcomes in the areas specified.

The continued existence of the Treasury in its present form and with its present programs is dependent on government policy and on continuing appropriations by parliament for the Treasury's policy advice, administration and programs.

1.2 Basis of preparation of the financial statements

The financial statements are required by section 49 of the Financial Management and Accountability Act 1997 and are general purpose financial statements.

The Financial Statements and notes have been prepared in accordance with:

- Finance Minister's Orders (FMOs) for reporting periods ending on or after 1 July 2010; and

- Australian Accounting Standards and Interpretations issued by the Australian Accounting Standards Board (AASB) that apply for the reporting period.

The financial statements have been prepared on an accrual basis and are in accordance with the historical cost convention, except for certain assets at fair value. Except where stated, no allowance is made for the effect of changing prices on the results or the financial position.

The financial statements are presented in Australian dollars and values are rounded to the nearest thousand dollars unless otherwise specified.

Unless alternative treatment is specifically required by an accounting standard or the FMOs, assets and liabilities are recognised in the balance sheet when and only when it is probable that future economic benefits will flow to the Treasury or a future sacrifice of economic benefits will be required and the amounts of the assets or liabilities can be reliably measured. However, assets and liabilities arising under Agreements Equally Proportionately Unperformed are not recognised unless required by an accounting standard. Liabilities and assets that are unrecognised are reported in the schedule of commitments and the schedule of contingencies.

Unless alternative treatment is specifically required by an accounting standard or the FMOs, income and expenses are recognised in the statement of comprehensive income when and only when the flow, consumption or loss of economic benefits has occurred and can be reliably measured.

Administered revenues, expenses, assets, liabilities and cash flows reported in the Schedule of Administered Items and related notes are accounted for on the same basis and using the same policies as for departmental items, except where otherwise stated at Note 1.22.

1.3 Significant accounting judgments and estimates

In consultation with the Department of Finance and Deregulation (Finance), the Treasury has changed the accounting treatment of payments made to States and Territories under the Natural Disaster Relief and Recovery Arrangements (NDRRA). This accounting policy change has resulted in the recognition of a liability equal to the discounted value of estimated future payments of Commonwealth assistance to States and Territories under the NDRRA for disasters that have already occurred (see Note 1.26 for more information).

The NDRRA liability represents the Treasury's best estimate of payments expected to be made to States and Territories as at balance date under NDRRA and is based on information provided by States and Territories to the Attorney General's Department, the Commonwealth agency responsible for the administration of disaster relief. The estimates provided by States and Territories are based on their assessment of the costs expected to be incurred that would be eligible for assistance under NDRRA for disaster occurring prior to 1 July 2011. Given the extent of recent disasters and uncertainty around the costs and timing of the reconstruction effort, the liability may require adjustment in future reporting periods.

Apart from the Australian Government Actuary's reconsideration of its 2008-09 review of employee benefits, which resulted in changes to on-cost calculations and discount factors, no accounting assumptions or estimates have been identified for departmental items that have a significant risk of causing a material adjustment to carrying amounts of assets and liabilities within the next accounting period.

In the process of applying the accounting policies for administered items listed in Notes 1.29 and 1.30, the Treasury has obtained independent actuarial assessments of the HCSS liability and HLIC premiums, recoveries, claims and acquisition costs.

In relation to uncalled shares disclosed in the administered contingencies table, the Treasury has judged the risk of these shares being called as low for the foreseeable future. This judgment is based on historic and current performance of the international financial institutions. Some of the factors considered are the financial strength of the development banks (that is, most have AAA credit ratings), established risk management policies, healthy debt ratios and no adverse financial statement audit opinions.

Changes in Australian Accounting Standards

Adoption of new Australian Accounting Standard requirements

No accounting standard has been adopted earlier than the application date as stated in the standard. None of the new standards, amendments to standards and interpretations issued by the AASB that are applicable to the current period have had a material financial impact on the Treasury. The following standards or amendments to standards have become effective but have had no financial impact to the operations of the Treasury.

Standards

- AASB 1 — First–time Adoption of Australian Accounting Standards (Compilation)

- AASB 2 — Share–based Payment (Compilation)

- AASB 3 — Business Combinations (Compilation)

- AASB 7 — Financial Instruments: Disclosures (Compilation)

- AASB 8 — Operating Segments (Compilation)

- AASB 118 — Revenue (Compilation)

- AASB 121 — The Effects of Changes in Foreign Exchange Rates (Compilation)

- AASB 128 — Investments in Associates (Compilation)

- AASB 131 — Interests in Joint Ventures (Compilation)

- AASB 132 — Financial Instruments: Presentation (Compilation)

- AASB 139 — Financial Instruments: Recognition and Measurement (Compilation)

- Interp. 19 Extinguishing Financial Liabilities with Equity Instruments (Principal)

Future Australian Accounting Standard requirements

Of the new standards, amendments to standards and interpretations issued by the AASB that are applicable to future periods, it is estimated that the impact of adopting the pronouncements when effective will have no material financial impact on future reporting periods, but may affect disclosures in future financial reports.

1.5 Revenue

Revenue from Government

Amounts appropriated for departmental outputs for the year (adjusted for any formal additions and reductions) are recognised as revenue when the agency gains control of the appropriation, except for certain amounts that relate to activities that are reciprocal in nature, in which case revenue is recognised only when it has been earned.

Appropriations receivable are recognised at their nominal amounts.

Other types of revenue

Revenue from the sale of goods is recognised when:

- the risks and rewards of ownership have been transferred to the buyer;

- the agency retains no managerial involvement or effective control over the goods;

- the revenue and transaction costs incurred for the transaction can be reliably measured; and

- it is probable that the economic benefits associated with the transaction will flow to the entity.

Revenue from rendering of services is recognised by reference to the stage of completion of contracts at the reporting date. The revenue is recognised when:

- the amount of revenue, stage of completion and transaction costs incurred can be reliably measured; and

- it is probable that the economic benefits associated with the transaction will flow to the entity.

The stage of completion of contracts at the reporting date is determined by reference to the proportion that costs incurred to date bear to the estimated total costs of the transaction.

Receivables for goods and services, which have 30 day terms, are recognised at the nominal amounts due less any impairment allowance account. Collectability of debts is reviewed at balance date. Allowances are made when collectability of the debt is no longer probable.

Gains

Resources received free of charge

Resources received free of charge are recognised as gains when and only when fair value can be reliably determined and the services would have been purchased if they had not been donated. Use of those resources is recognised as an expense.

Contributions of assets at no cost of acquisition or for nominal consideration are recognised as gains at their fair value when the asset qualifies for recognition, unless received from another government agency or authority as a consequence of a restructuring of administrative arrangements (refer to Note 1.7).

Resources received free of charge are recorded as either revenue or gains depending on their nature.

Sale of Assets

Gains from disposal of non-current assets are recognised when control of the asset has passed to the buyer.

1.7 Transactions with the Government as owner

Equity injections

Amounts appropriated which are designated as 'equity injections' for a year (less any formal reductions) are recognised directly in contributed equity in that year.

Restructuring of administrative arrangements

Net assets received from or relinquished to another Australian Government agency or authority under a restructuring of administrative arrangements are adjusted at their book value directly against contributed equity.

Other distributions to owners

The FMOs require that distributions to owners be debited to contributed equity unless in the nature of a dividend.

1.8 Employee benefits

Liabilities for services rendered by employees are recognised at the reporting date to the extent that they have not been settled.

Liabilities for 'short-term employee benefits' (as defined by AASB 119 Employee Benefits) and termination benefits due within twelve months of balance date are measured at their nominal amounts.

The nominal amount is calculated with regard to the rates expected to be paid on settlement of the liability.

Other long-term employee benefits are measured as the total net present value of the defined benefit obligation at the end of the reporting period minus the fair value at the end of the reporting period of the plan's assets (if any) out of which the obligations are to be settled directly.

Leave

The liability for employee benefits includes provision for annual leave and long service leave. No provision has been made for sick leave as all sick leave is non-vesting and the average sick leave taken in future years by employees of the Treasury is estimated to be less than the annual entitlement for sick leave.

The leave liabilities are calculated on the basis of employees' remuneration, including the Treasury's employer superannuation contribution rates to the extent that the leave is likely to be taken during service rather than paid out on termination.

The liability for both annual and long service leave has been determined by reference to the work of the Australian Government Actuary as at 30 June 2009. The estimate of the present value of the liability takes into account attrition rates and pay increases through promotion and general pay increases.

Separation and redundancy

No provision has been made for separation and redundancy benefit payments during the year (2010: Nil).

Superannuation

Staff of the Treasury are members of the Commonwealth Superannuation Scheme (CSS), the Public Sector Superannuation Scheme (PSS), the PSS accumulation plan or other defined contribution scheme.

The CSS and PSS are defined benefit schemes of the Australian Government. The PSSap is a defined contribution scheme which opened for new employees on 1 July 2005.

The liability for defined benefits is recognised in the financial statements of the Australian Government and is settled by the Australian Government in due course. This liability is reported by the Department of Finance and Deregulation as an administered item.

The Treasury makes employer contributions to the employee superannuation scheme at rates determined by an actuary to be sufficient to meet the cost to the government of the superannuation entitlements of the Treasury's employees. The Treasury accounts for the contribution as if they were contributions to defined contribution plans.

The liability for superannuation recognised as at 30 June 2011 represents outstanding contributions for the final fortnight of the year.

1.9 Leases

A distinction is made between finance leases and operating leases. Finance leases effectively transfer substantially all the risks and benefits incidental to ownership of leased non-current assets from the lessor to the lessee. In operating leases, the lessor effectively retains substantially all such risks and benefits.

Where a non-current asset is acquired by means of a finance lease, the asset is capitalised at either the fair value of the leased property or, if lower, the present value of minimum lease payments at the inception of the contract. A liability is recognised at the same time and for the same amount.

The discount rate used is the interest rate implicit in the lease. Leased assets are amortised over the period of the lease. Lease payments are allocated between the principal component and the interest expense. The interest rate implicit in leases was zero as all leases had expired by 30 June 2011 (2010: 5.92 per cent).

Operating lease payments are expensed on a straight line basis which is representative of the pattern of benefits derived from the leased assets.

1.10 Borrowing costs

All borrowing costs are expensed as incurred.

1.11 Cash

Cash and cash equivalents includes notes and coins held and any deposits in bank accounts with an original maturity of 3 months or less that are readily convertible to known amounts of cash and subject to insignificant risk of changes in value. Cash is recognised at its nominal amount. Any interest receivable is credited to revenue as it accrues. The Treasury maintains bank accounts with the Reserve Bank of Australia for administration of the receipt and payment of monies.

1.12 Financial risk management

The Treasury's activities expose it to normal commercial financial risk. As a result of the nature of the Treasury's business and internal and Australian Government policies dealing with the management of financial risk, the Treasury's exposure to market, credit, liquidity, cash flow and fair value interest rate risk is considered to be low.

1.13 Other financial instruments

Loans and receivables

Trade receivables, loans and other receivables that have fixed or determinable payments that are not quoted in an active market are classified as 'loans and receivables'. They are included in current assets, except for maturities greater than 12 months after the balance date. These are classified as non-current assets. Loans and receivables are measured at amortised cost using the effective interest methods less impairment. Interest is usually recognised by applying the effective interest rate. Collectability of debts is reviewed regularly throughout the year and at balance date. Provisions are made when collection of the debt is judged to be less rather than more likely. Credit terms are net 30 days (2010: 30 days).

Trade creditors

Trade creditors and accruals are recognised at amortised cost. Liabilities are recognised to the extent that the goods or services have been received (and irrespective of having been invoiced). Settlement is usually made net 30 days.

1.14 Impairment of financial assets

Financial assets are assessed for impairment at the end of each reporting period. No indicators of impairment were indentified assets as at 30 June 2011.

Financial assets held at amortised cost

If there is objective evidence that an impairment loss has been incurred for loans and receivables or held to maturity investments held at amortised cost, the amount of the loss is measured as the difference between the asset's carrying amount and the present value of estimated future cash flows discounted at the asset's original effective interest rate. The carrying amount is reduced by way of an allowance account. The loss is recognised in the statement of comprehensive income.

Available for sale financial assets

If there is objective evidence that an impairment loss on an available for sale financial asset has been incurred, the amount of the difference between its cost, less principal repayments and amortisation, and its current fair value, less any impairment loss previously recognised in expenses, is transferred from equity to the statement of comprehensive income.

Financial assets held at cost

If there is objective evidence that an impairment loss has been incurred the amount of the impairment loss is the difference between the carrying amount of the asset and the present value of the estimated future cash flows discounted at the current market rate for similar assets.

1.15 Contingent liabilities and contingent assets

Contingent liabilities and contingent assets are not recognised in the balance sheet but are reported in the relevant schedules and notes. They may arise from uncertainty as to the existence of a liability or asset, or represent an asset or liability in respect of which the amount cannot be reliably measured. Contingent assets are reported when settlement is probable but not virtually certain and contingent liabilities are recognised when the probability of settlement is greater than remote.

1.16 Acquisition of assets

Assets are recorded at cost on acquisition except as stated below. The cost of acquisition includes the fair value of assets transferred in exchange and liabilities undertaken. Financial assets are initially measured at their fair value plus transaction costs where appropriate.

1.17 Property, plant and equipment

Asset recognition threshold

Purchases of property, plant and equipment are recognised initially at cost in the balance sheet, except for purchases costing less than $2,000 which are expensed in the year of acquisition (other than where they form part of a group of similar items which are significant and total $20,000 or more).

Assets acquired at no cost, or for nominal consideration, are initially recognised as assets and revenues at their fair value at the date of acquisition, unless acquired as a consequence of restructuring of administrative arrangements. In the latter case, assets are initially recognised as contributions by owners at the amounts at which they were recognised in the transferor agency's accounts immediately prior to the restructuring.

Revaluations

Fair values for each class of asset are determined as shown below.

Following initial recognition at cost, property, plant and equipment are carried at fair value less subsequent accumulated depreciation and accumulated impairment losses. Valuations are conducted with sufficient frequency to ensure that the carrying amounts of assets do not materially differ from the assets' fair values as at the reporting date. The regularity of independent valuations depends upon the volatility of movements in market values for the relevant assets.

Revaluation adjustments are made on a class basis. Any revaluation increment is credited to equity under the heading of asset revaluation reserve except to the extent that it reverses a previous revaluation decrement of the same asset class that was previously recognised through the operating result. Revaluation decrements for a class of assets are recognised directly through the operating result except to the extent that they reverse a previous revaluation increment for that class.

Any accumulated depreciation as at the revaluation date is eliminated against the gross carrying amount of the asset and the asset restated to the revalued amount.

The Treasury performed a valuation of leasehold improvements, infrastructure, plant and equipment assets on 30 November 2007. The valuation was performed by independent valuers Preston Rowe Paterson NSW Pty Limited and was based on valuing the assets at fair value. Preston Rowe Paterson NSW Pty Limited confirmed that net asset values materially reflected fair value at 30 June 2011.

Depreciation

Depreciable property, plant and equipment assets are written-off to their estimated residual values over their estimated useful lives to the Treasury using, in all cases, the straight-line method of depreciation.

Depreciation rates (useful lives), residual values and methods are reviewed at each reporting date and necessary adjustments are recognised in the current, or current and future reporting periods, as appropriate.

Depreciation rates applying to each class of depreciable asset are based on the following useful lives:

The aggregate amount of depreciation allocated for each class of asset during the reporting period is disclosed in Note 3D.

Impairment

All assets were assessed for impairment at 30 June 2011. Where indications of impairment exist, the asset's recoverable amount is estimated and an impairment adjustment made if the asset's recoverable amount is less than its carrying amount.

No indicators of impairment were found for departmental assets at fair value during the year.

The recoverable amount of an asset is the higher of its fair value less costs to sell and its value in use. Value in use is the present value of the future cash flows expected to be derived from the asset. Where the future economic benefit of an asset is not primarily dependent on the asset's ability to generate future cash flows, and the asset would be replaced if the Treasury were deprived of the asset, its value in use is taken to be its depreciated replacement cost.

1.18 Intangibles

The Treasury's intangible assets comprise internally developed and purchased software for internal use. These assets are carried at cost less accumulated depreciation and any accumulated impairment losses. Software is amortised on a straight-line basis over its anticipated useful life. The useful lives of the Treasury's software are 3 to 5 years (2010: 3 to 5 years).

The Treasury's largest intangible asset is for Standard Business Reporting (SBR). SBR is a multi-agency initiative that will simplify business-to-government reporting by introducing a single secure way to interact on-line with participating agencies. For further information visit www.sbr.gov.au.

All software assets were assessed for indications of impairment as at 30 June 2011. No indicators of impairment were identified as at 30 June 2011.

1.19 Taxation/competitive neutrality

The Treasury is exempt from all forms of taxation except Fringe Benefits Tax (FBT) and the Goods and Services Tax (GST).

Revenues, expenses and assets are recognised net of GST:

- except where the amount of GST incurred is not recovered from the Australian Taxation Office; and

- except for receivables and payables.

1.20 Foreign currency

Transactions denominated in a foreign currency are converted at the exchange rate at the date of the transaction. Foreign currency receivables and payables are translated at the exchange rates current as at balance date.

1.21 Insurance

The Treasury is insured for risks through the government's insurable risk managed fund, Comcover. Workers compensation is insured through the government's insurable risk managed fund, Comcare Australia.

1.22 Reporting of administered activities

Administered revenues, expenses, assets, liabilities and cash flows are disclosed in the schedule of administered items and related notes.

Except where otherwise stated below, administered items are accounted for on the same basis and using the same policies as for departmental items, including the application of Australian Accounting Standards.

1.23 Administered cash transfers to and from the Official Public Account

Revenue collected by the Treasury for use by the Australian Government rather than the Treasury is administered revenue. Collections are transferred to the Official Public Account (OPA) maintained by the Department of Finance and Deregulation. Conversely, cash is drawn from the OPA to make payments under Parliamentary appropriations on behalf of the Australian Government. These transfers to and from the OPA are adjustments to administered cash held by the Treasury on behalf of the Australian Government and reported as such in the reconciliation table in Note 21. The schedule of administered items largely reflects the Australian Government's transactions, through the Treasury, with parties outside the Australian Government.

1.25 Administered revenue

All administered revenues relate to the course of ordinary activities performed by the Treasury on behalf of the Australian Government.

Reserve Bank of Australia dividend

Dividends from the Reserve Bank of Australia (RBA) are recognised when a determination is made by the Treasurer and thus control of the income stream has been established. On this basis, the RBA's dividend for a particular financial year is recognised in the Treasury's financial statements in the subsequent financial year. Dividends are measured at nominal amounts.

The Treasurer is able to determine what portion of the RBA's earnings is made available as a dividend to the Australian Government having regard to the Reserve Bank Board's advice and in accordance with section 30 of the Reserve Bank Act 1959.

International Monetary Fund remuneration

Remuneration is interest paid by the International Monetary Fund (IMF) to Australia for the use of its funds. It is paid on the proportion of Australia's IMF capital subscription (quota) that was paid in Special Drawing Rights (SDR), and on the money lent by Australia under the IMF's Financial Transaction Plan, under which members in a strong external position provide quota resources to support IMF lending to borrowing member countries.

Where the IMF's holdings of Australian dollars fall below a specified level, it pays remuneration on Australia's average remunerated reserve tranche position. The rate of remuneration is equal to the SDR interest rate. This rate is then adjusted to account for the financial consequences of overdue obligations to the IMF which are shared between members and reflected in Note 16 as 'burden sharing'.

Remuneration is calculated and paid at the end of the IMF's financial quarters. An annual maintenance of value adjustment is made to the IMF's holdings of Australia's quota paid in Australian dollars to maintain their value in terms of the SDR.

Australia also receives interest on amounts lent to the IMF under the New Arrangements to Borrow (NAB). Interest on the NAB is paid quarterly. The NAB provides supplementary resources to the IMF when quota resources are insufficient.

Guarantee Scheme for Large Deposits and Wholesale Funding

Under the Guarantee Scheme for Large Deposits and Wholesale Funding, a fee is paid to guarantee the portion of eligible deposits over $1 million and for wholesale funding issuances.

The fees are reported as a fee for service in accordance with AASB 118 — Revenue. The Guarantee Scheme closed to new deposits on 31 March 2010.

The Guarantee of State and Territory Borrowing

Under the Guarantee of State and Territory Borrowing, a fee is paid to provide the guarantee over new and nominated existing State and Territory securities. The fees are reported as a fee for service in accordance with AASB 118 — Revenue. The guarantee closed to new issuances of guaranteed liabilities on 31 December 2010.

Financial Guarantee Contracts

Financial guarantee contracts are accounted for in accordance with AASB 139 — Financial Instruments: Recognition and Measurement. They are not treated as contingent liabilities, as they are regarded as financial instruments outside the scope of AASB 137 — Provisions, Contingent Liabilities and Contingent Assets. The Treasury's administered financial guarantee contracts relate to components of the Guarantee Scheme for Large Deposits and Wholesale Funding and the Guarantee of State and Territory Borrowing.

1.25 Administered capital

Appropriations of administered capital are recognised in administered equity when the amounts appropriated by Parliament are drawn down. For the purposes of the Treasury annual report, administered equity transactions are not disclosed separately.

1.26 Grants

In 2010-11 the Treasury reviewed the accounting treatment of payments made to States and Territories under the Natural Disaster Relief and Recovery Arrangements in consultation with Finance. The accounting treatment previously applied by the Treasury was to recognise grant liabilities under NDRRA to the extent that (i) the services required to be performed by the State or Territory had been performed or (ii) the grant eligibility criteria had been satisfied, but payments due have not been made. The change in accounting treatment has resulted in the Treasury recognising a liability equal to the discounted value of estimated future payments to States and Territory's under NDRRA regardless of whether or not a State or Territory has completed eligible disaster reconstruction work or submitted an eligible claim under the NDRRA. As disclosed in Note 1.3, States and Territories were requested to provide an estimate of costs expected to be incurred for disasters affecting States and Territories that occurred prior to 1 July 2011 which would be eligible for assistance.

The new accounting treatment provides readers of the financial statements with an estimate of the amount yet to be paid to States and Territories for eligible disaster assistance which was not provided under the earlier accounting treatment.

Consistent with the disclosure requirements of the FMO's and relevant accounting standards, the comparative year figures for administered grant expenses and provisions have been adjusted as if the new accounting policy had always applied.

In Note 17: Expenses administered on behalf of Government, the 2009-10 administered grants expense has increased by $807.7 million, and in Note 19: Liabilities administered on behalf of Government, a provision for NDRRA payments of $1,089.4 million has been recognised as at 30 June 2010. An adjustment of $293.8 million has also been included in Note 20: Administered reconciliation table to reflect the increase in 2009-10 opening liabilities under the new accounting policy.

With the exception of the accounting treatment of payments to State and Territories under NDRRA detailed above, grant liabilities are recognised to the extent that (i) the services required to be performed by the grantee have been performed or (ii) the grant eligibility criteria have been satisfied, but payments due have not been made. A commitment is recorded when the Australian Government enters into an agreement to make grants but services have not been performed or criteria satisfied.

Grants to the IMF

This represents Australia's contribution to the IMF's Poverty Reduction and Growth Trust (interest subsidy account) to support increased IMF concessional lending to low-income countries in the context of the global financial crisis. This contribution is part of the Government's commitment to increase Australia's overseas development assistance over the long term. No contribution was made by Australia during 2011 (2010: $30 million).

Grants to States and Territories

The current framework for federal financial relations, introduced on 1 January 2009, provides a strong foundation for the Council of Australian Governments (COAG) to pursue economic and social reform to underpin growth, prosperity and wellbeing into the future. Under the framework, the Treasurer is accountable for the efficient payment of National Partnership payments and general revenue assistance to the States and Territories. Portfolio Ministers are accountable for relevant government policies associated with those payments. In addition, the Treasurer is accountable for payments and policies associated with GST payments and National Specific Purpose Payments (National SPPs). An overview of the Government's policy in respect of accountabilities under the new financial framework is presented in the 2011-12 Budget Papers, Appendix A of Budget Paper No. 3, Australia's Federal Relations.

There are four main types of grant payments under the framework, as follows:

- National SPPs — a financial contribution to support a State or Territory to deliver services in a particular sector;

- National Partnership payments (NPs) — a financial contribution in respect of a National Partnership agreement to a State or Territory to support the delivery of specific projects, to facilitate reforms or to reward those jurisdictions that deliver on national reforms or achieve service delivery improvements;

- GST revenue payments — a financial contribution to a State or Territory which is available for use by the States and Territories for any purpose; and

- general revenue assistance (GRA) other than GST revenue payments — a financial contribution to a State or Territory which is available for use by the States and Territories for any purpose.

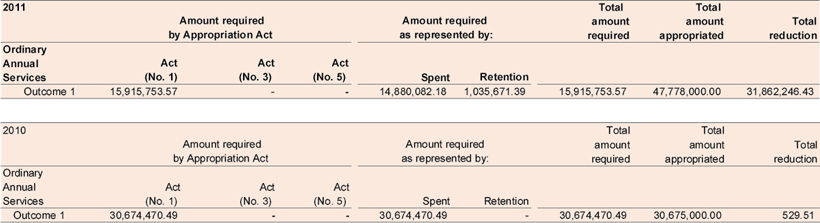

The National SPPs and GST revenue grants are paid under a special appropriation from the Federal Financial Relations Act 2009. After the end of the financial year, the Treasurer makes a determination of the amounts that should have been paid and an adjustment is made in respect of advances that were paid during the financial year. The authority to determine the amount and timing of advances has been delegated to the General Manager, Commonwealth-State Relations Division.

The NP and GRA payments are paid under the Federal Financial Relations Act 2009 through a determination process wherein the Treasurer may determine an amount to be paid to a State or Territory for the purpose of making a grant of financial assistance. Once determined, this amount must be credited to the COAG Reform Fund and the Treasurer must ensure that, as soon as practicable after the amount is credited, the COAG Reform Fund is debited for the purposes of making the grant. In addition, the Treasurer must have regard to the Intergovernmental Agreement. The Treasury advises on the amount to be determined, based on certified payment advices received from the Chief Financial Officers of Commonwealth agencies.

In 2010-11, several payments made under National Partnership agreements were discovered to have been made in error and were subsequently recovered at the next opportunity. In these circumstances the payments were made to the State or Territory without any legislative basis, which constitutes a technical breach of section 83 of the Constitution. The Treasury process to complete the 2010-11 financial statements identified 8 incorrect payments (2010: 6 incorrect payments). The incorrect payments totaled $25,963,775 (2010: $100,997) or 0.141 per cent (2010: less than 0.001 per cent) of payments from the COAG Reform Fund special account. All incorrect payments have been recovered from the States and Territories.

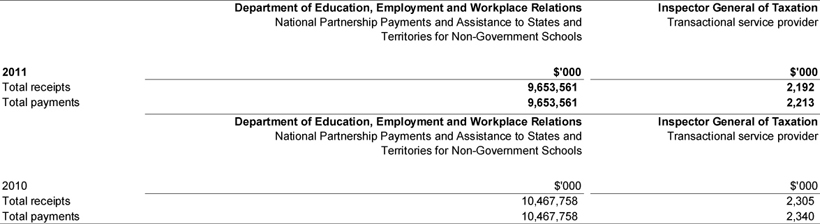

In 2009-10, the Treasury recorded revenues and expenses in relation to payments to States and Territories for assistance to non-government schools under the Digital Education Revolution and the Building the Education Revolution programs. During 2010-11 it was agreed that the Department of Education Employment and Workplace Relations (DEEWR) would recognise expenses and revenues for these payments and that the Treasury would act as paying agent for these amounts to the States and Territories. The Treasury has therefore not recognised any expenses or revenues for these amounts in 2010-11. Cash receipts from DEEWR and cash payments made to States and Territories in relation to amounts paid in 2010-11 have been recorded in the Schedule of Administered Cash Flows and Table D of Note 25: Appropriations.

Payments to the States and Territories through the Nation Building Funds

The Nation-building Funds Act 2008 (the Funds Act) outlines the requirements for payments to be authorised from the three Nation building funds (collectively known as 'the Funds'); the responsibilities of Ministers; and the process for channeling payments to recipients through portfolio special accounts.

The Funds were established to provide financing sources to meet the Government's commitment to Australia's future by investment in critical areas of infrastructure.

The three Funds are the:

- Building Australia Fund — make payments in relation to the creation or development of transport, communications, eligible national broadband network matters, energy and water infrastructure;

- Education Investment Fund — make payments in relation to the creation or development of higher education infrastructure, vocational education and training infrastructure, eligible education and research infrastructure; and Health and Hospitals Fund — make payments in relation to the creation or development of health infrastructure.

The Treasury receives funds from the relevant portfolio agency and pays the amount to the States and Territories. These amounts are recorded as 'COAG receipts from Government Agencies' to recognise the income and a corresponding grant expense is recognised for the payment to the States and Territories.

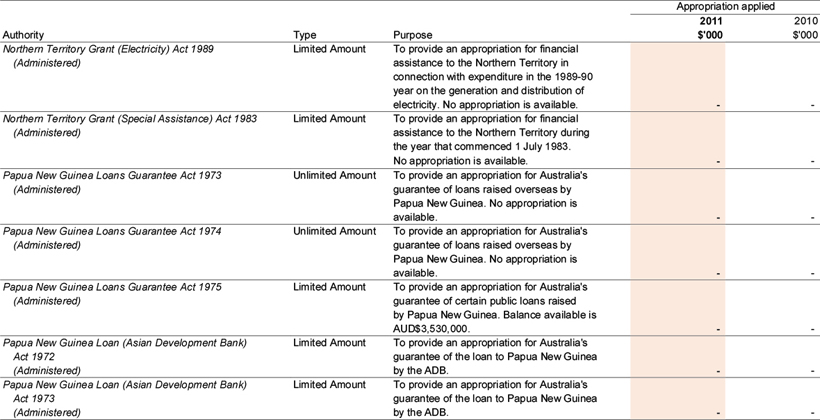

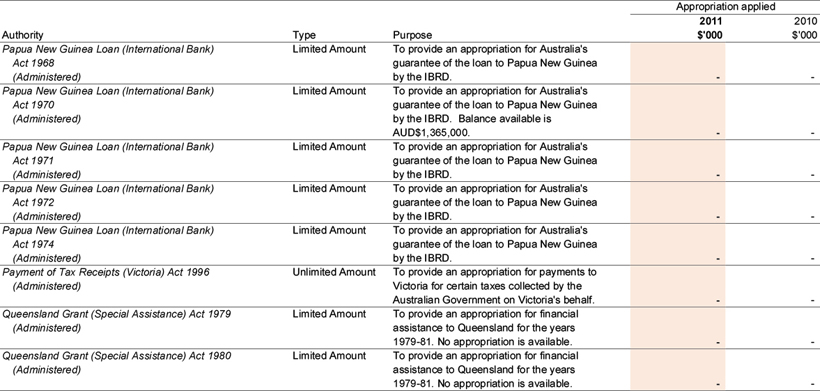

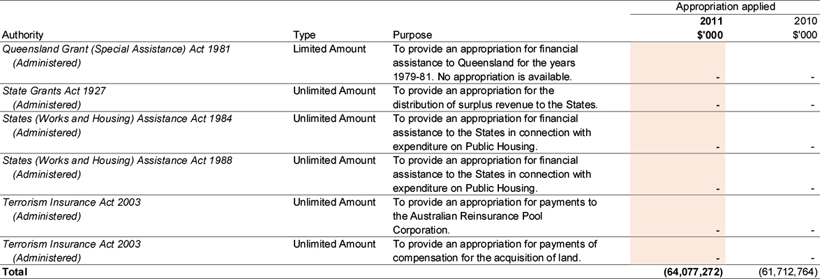

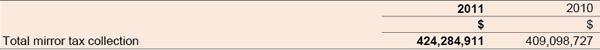

Mirror taxes collected by State Governments

On behalf of the States, the Australian Government imposes mirror taxes which replace State taxes in relation to Australian Government places that may be constitutionally invalid. Mirror taxes are collected and retained by the States, under the Commonwealth Places (Mirror Taxes) Act 1998. State Governments bear the administration costs of collecting mirror taxes. Mirror taxes are disclosed at Note 26F.

1.27 Administered investments

Development banks

Investments in development banks are classified as 'monetary — available for sale financial assets' refer Note 1.32. As such, the foreign currency value of investments is translated into Australian Dollars (AUD) using relevant foreign currency exchange rates at balance date.

International Monetary Fund

The quota is the current value in Australian dollars of Australia's subscription to the IMF. Quota subscriptions represent a member's shareholding in the IMF and generate most of the IMF's financial resources. Twenty five per cent of the quota increase will be paid in SDR and the remainder will be paid through issuing AUD denominated non-negotiable, non-interest bearing promissory notes.

Australia has agreed to increase its quota contributions to the IMF from SDR 3.2 billion to SDR 6.6 billion (AUD$9.8 billion as at 30 June 2011), in line with a doubling of overall IMF quotas. It is expected that the increase will occur in the 2011-12 financial year.

Australian Government entities

Administered investments in controlled entities are not consolidated because their consolidation is relevant only at the whole of government level.

The Australian Government's investment in controlled entities and companies in the Treasury portfolio are measured at their fair value as at 30 June 2011. Fair value has been taken to be the net assets of the entities as at balance date. These entities are listed below:

- Reserve Bank of Australia; and

- Australian Reinsurance Pool Corporation.

Impairment of administered investments

Administered investments were assessed for impairment at 30 June 2011. No indicators of impairment were identified.

1.28 Promissory notes

Promissory notes have been issued to the IMF, the European Bank for Reconstruction and Development, the International Bank for Reconstruction and Development, the Asian Development Bank and the Multilateral Investment Guarantee Agency.

Where promissory notes have been issued in foreign currencies, they are recorded at their nominal value by translating them at the spot rate at balance date. The promissory notes are non-interest bearing and relate to the undrawn paid-in capital subscriptions.

Foreign currency gains and losses are recognised where applicable.

1.29 IMF Special Drawing Rights Allocation

The SDR allocation liability reflects the current value in AUD of the Treasury's liability to repay to the IMF the cumulative allocations of SDRs provided to Australia since joining the IMF. This liability is classified as 'other payables' in Note 17.

1.30 Mortgage insurance policies written by the Housing Loans Insurance Corporation up to 12 December 1997

The Australian Government sold HLIC on 12 December 1997. Under the terms and conditions of the sale the Australian Government retained ownership of all mortgage insurance policies written up to the time of the sale.

Accounting policies adopted are:

Premiums

Premiums comprise amounts charged to the policy holder or other insurer, excluding amounts collected on behalf of third parties, principally stamp duties. The earned portion of premiums received and receivable is recognised as revenue. Premiums are treated as earned from the date of attachment of risk.

Premiums received in respect of insured loans are apportioned over a number of years in accordance with an actuarial determination of the pattern of risk in relation to the loans. Premium amounts carried forward in this way are credited to 'provision for unearned premiums'.

Given the maturity of the portfolio, the provision for unearned premiums is now zero.

Claims

Claims incurred expenses and a liability for outstanding claims are recognised in respect of insurance policies. The liability covers claims incurred but not yet paid, incurred but not yet reported and the anticipated direct and indirect costs of settling those claims. The liability has been recognised based on the estimated discounted future cash flows. Given the maturity of the portfolio, the liability is now estimated to be negligible and no provision has been recorded in 2010-11 (2010:nil).

Acquisition costs

A portion of acquisition costs relating to unearned premium revenue is deferred in recognition that it represents future benefits. Deferred acquisition costs are amortised on an actuarial basis over the reporting periods expected to benefit from the expenditure. Since the provision for unearned premium is now zero, the deferred acquisition cost asset is also now zero.

1.31 Provisions and contingent liabilities

HIH Claims Support Scheme liability

The HIH Claims Support Scheme (the Scheme) was established by the Australian Government following the collapse of the HIH Group of companies in March 2001. The purpose of the Scheme is to provide financial assistance to eligible HIH policy-holders affected by the collapse of the group. Initial funding of $640 million was provided by special appropriation through the Appropriation (HIH Assistance) Act 2001.

HIH Claims Support Limited was established by the Insurance Council of Australia as a not-for-profit company in May 2001 to manage claims made under the Scheme and to operate the HIH Claims Support Trust on behalf of the Australian Government. As the sole beneficiary of the trust the Australian Government is entitled to any residual balance of the trust.

Since 2001, a total of 10,900 claims have been granted eligibility for assistance. Each year an actuarial review of the claims portfolio has been conducted to assess the development of claims reserves and to estimate the overall liability associated with the Scheme portfolio. In 2006, approval was sought and obtained to increase the Scheme appropriation to a total of $861 million to meet the estimated cost of the Scheme portfolio. This additional funding is provided through annual appropriations.

The Australian Government Actuary reviews the portfolio annually to reassess the estimated Scheme liability in future years. The most recent review has indicated that the overall cost of the Scheme is estimated to be $730.5 million in discounted terms. This amount incorporates an allowance for future inflation and covers the expected cost of past and future claim payments and associated expenses of managing the Scheme.

1.32 Administered financial instruments

AASB 139 — Financial Instruments: Recognition and Measurement requires financial instruments to be classified into one of four categories. The financial instruments specific to the Treasury's administered items are classified in three of the four categories as detailed below.

- Loans and receivables (these are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market):

- IMF related monies receivable (measured initially at fair value and then measured at amortised cost using the effective interest rate method);

- Loans to the IMF under the New Arrangements to Borrow (measured initially at fair value and then measured at amortised cost using the effective interest rate method);

- the Guarantee Scheme for Large Deposits and Wholesale Funding contractual fee receivable (measured initially at fair value and then measured at amortised cost using the effective interest rate method); and

- the Guarantee Scheme for State and Territory Borrowing contractual fee receivable (measured initially at fair value and then measured at amortised cost using the effective interest rate method).

- Available-for-sale financial assets:

- investments in development banks (measured initially at cost or notional cost and then measured at fair value);

- the IMF quota (measured at cost); and

- Investments in Government Entities (measured at fair value based on net asset position of the entity at 30 June 2011).

- Financial liabilities:

- the SDR allocation (measured initially at fair value and then measured at amortised cost using the effective interest rate method);

- promissory notes (measured initially at fair value and then measured at amortised cost using the effective interest rate method);

- IMF related monies payable (measured initially at fair value and then measured at amortised cost using the effective interest rate method); and

- the Guarantee Scheme for Large Deposits and Wholesale Funding contractual guarantee service obligation (measured initially at fair value and then measured at amortised cost using the effective interest rate method).

Available-for-sale financial assets are those non-derivative financial assets that are designated as available for sale or that are not classified as (a) loans and receivables, (b) held-to-maturity investments or (c) financial assets at fair value through profit or loss.

Although a number of the Treasury's financial instruments are classified as 'available-for-sale', the Treasury does not hold these instruments for the purposes of trading. Assets that can be reliably measured at reporting date are valued at fair value, otherwise, at cost.

Promissory notes are financial liabilities that are required to be measured at amortised cost using the effective interest rate method. The contractual terms of the promissory notes are non-interest bearing making the effective interest rate zero. Therefore, the measurement would be the initial value less any repayments plus or minus movements in exchange rates as a result of translation on the balance date.

The Guarantee Scheme for Large Deposits and Wholesale Funding and the Guarantee of State and Territory Borrowing contractual fee receivable represents the requirement under AASB 139 — Financial Instruments: Recognition and Measurement for the Treasury to recognise up-front, its entitlements under the financial guarantee contract to revenue received or receivable from authorised deposit-taking institutions over the contracted guarantee period. Conversely, the Treasury is required to recognise a corresponding initial liability for its contractual obligation to provide a guarantee service over the period covered by each guarantee contract (analogous to unearned income).

Recognition of these amounts only relates to fee revenue aspects of the financial guarantee contracts. These amounts do not reflect any expected liability under the Guarantee Scheme itself as these are considered remote and unquantifiable. Administered contingent liabilities and assets are disclosed at Note 21.

Administered financial instruments are accounted for in accordance with the accounting policies detailed above and are disclosed at Note 22.

Note 2: Events occurring after reporting date

The RBA has not declared a dividend to Government for 2011.

Note 3: Operating Expenses

1 The 2010 balances have been adjusted by $0.94 million to reflect the reclassification of expenses from external entities to related entities.

2 Operating lease rentals comprise minimum lease payments only.

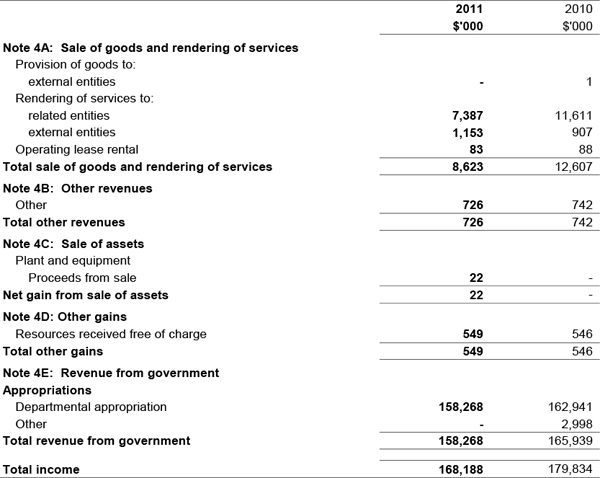

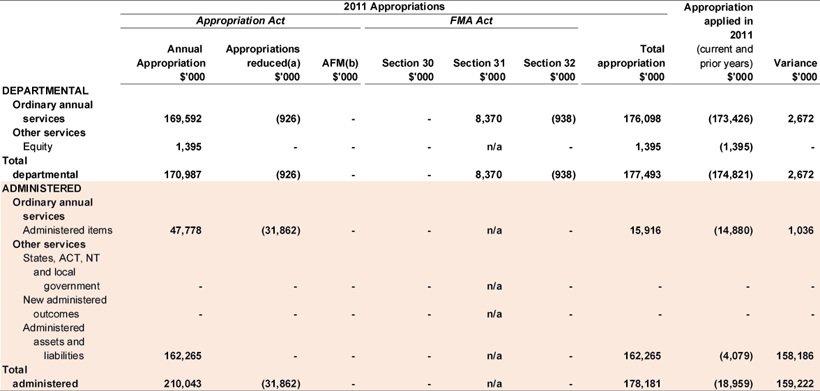

Note 4: Income

Note 5: Financial assets

Note 6: Non-financial assets

No indicators of impairment were found for land and buildings. No land and buildings are expected to be sold or disposed of within the next 12 months. All revaluations are independent and are conducted in accordance with the revaluation policy stated at Note 1.17.

No indicators of impairment were found for plant and equipment. No other plant and equipment is expected to be sold or disposed of within the next 12 months. All revaluations are independent and are conducted in accordance with the revaluation policy stated at Note 1.17.

No indicators of impairment were found for Intangibles.

Table A: Reconciliation of the opening and closing balances of property, plant and equipment and intangibles (2010-11)

* Disaggregated additions information are disclosed in the Schedule of Asset Additions

Table A: Reconciliation of the opening and closing balances of property, plant and equipment and intangibles (2009-10)

* Disaggregated additions information are disclosed in the Schedule of Asset Additions

Table B: Property, plant and equipment and intangibles held under finance lease (2010-11)

Table C: Property, plant and equipment and intangibles under construction (2010-11)

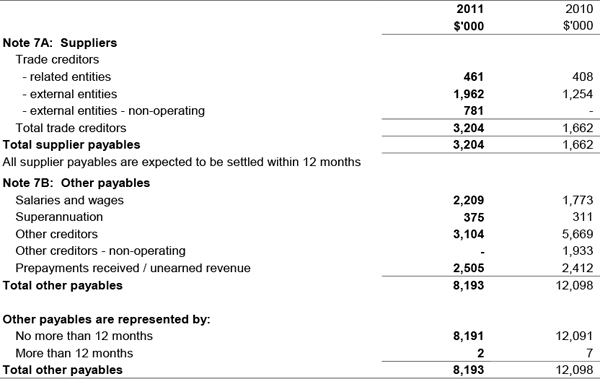

Note 7: Payables

Note: Settlement is usually made net 30 days.

Note 8: Interest bearing liabilities

Note: Finance leases existed in relation to certain major office equipment assets in 2010. The leases were non-cancellable and for fixed terms averaging 2.75 years, with a maximum of 3.25 years. The interest rate implicit was zero in 2011 as all leases have expired (2010: 5.92 per cent). The Treasury guaranteed the residual values of all assets leased. There were no contingent rentals.

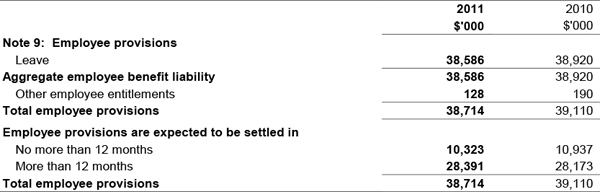

Note 9: Provisions

Note 10: Cash flow reconciliation

Note 11: Contingent liabilities and assets

Quantifiable contingencies

The schedule of contingencies reports 'other' liabilities of $299,963 (2010: $271,856). This amount represents an estimate of the Treasury's liability in respect of studies assistance.

Unquantifiable contingencies

As at 30 June 2011, the Treasury had a number of legal claims against it. The Treasury has denied liability and is defending the claims. It is not possible to estimate the amounts of any eventual payments that may be required in relation to these claims.

The courts may award legal costs against the Treasury in the event it is unsuccessful in an action before the courts. As there is uncertainty over the outcome of outstanding and pending court cases, duration of court cases and the legal costs of the opposing party, these costs cannot be reliably measured.

Remote Contingencies

The Treasury's lease on its current premises contains a make good clause which has been estimated by an independent valuer at $2.7 million. The Treasury has assessed the likelihood of the make good provision being required and has deemed it as remote.

As at 30 June 2011, the Treasury has a number of contracts which may give rise to contingent liabilities based on certain events occurring. The Treasury has assessed the likelihood of such events occurring as being remote and unquantifiable.

Note 12: Executive remuneration

Note 12A: Senior Executive Remuneration Expense for the Reporting Period

The comparative aggregate total amount has been revised and does not match what was published in the 2009-10 financial statements due to new disclosure requirements.

Note: 12A excludes acting arrangements and part-year service where remuneration expensed was less than $150,000.

Note 12B: Average Annual Remuneration Packages and Bonus Paid for Substantive Senior Executives as at the end of the Reporting Period

The comparative figures have been revised and do not match what was published in the 2009-10 annual report due to new disclosure requirements.

Notes:

1 This table reports on substantive senior executives who are employed by the Treasury as at the end of the reporting period. Fixed elements are based on the employment agreement of each individual — each row represents an average annualised figure (based on headcount) for the individuals in that remuneration package band (that is, the 'Total' column).

2 Represents average fixed allowances as per employment agreement. Six SES have a fixed allowance in their employment agreement with an average allowance of $29,647 (2010: 7 SES, average allowance $30,312).

3 Represents average actual bonuses paid during the reporting period. The 'Bonus paid' is excluded from the 'Total' calculation, (for the purpose of determining remuneration package bands). The Treasury does not pay bonuses. The bonuses included in the above table relate to secondees. No secondees received a bonus this financial year (2010: 1 secondee)

Variable Elements:

With the exception of bonuses, variable elements were not included in the 'Fixed Elements and Bonus Paid' table above. The following variable elements were available as part of senior executives' remuneration package:

- On average senior executives were entitled to the following leave entitlements:

- Annual Leave: entitled to 20 days (2010: 20 days) each full year worked (pro-rata for part-time SES);

- Personal Leave: entitled to 15 days (2010: 15 days) or part-time equivalent; and

- Long Service Leave: in accordance with Long Service Leave (Commonwealth Employees) Act 1976.

- Senior executives were members of one of the following superannuation funds:

- Australian Government Employee Superannuation Trust (AGEST): this fund is for senior executives who were employed for a defined period. Employer contributions were set at 9 per cent (2010: 9 per cent). More information on AGEST can be found at www.agest.com.au;

- Commonwealth Superannuation Scheme (CSS): this scheme is closed to new members, and employer contributions averaged 17.3 per cent (2010: 18.1 per cent) (excluding employer productivity contributions of approximately 3 per cent). More information on CSS can be found at www.css.gov.au;

- Public Sector Superannuation Scheme (PSS): this scheme is closed to new members, with current employer contributions set at 14.4 per cent (2010: 15.4 per cent) (excluding employer productivity contributions of approximately 3 per cent). More information on PSS can be found at www.pss.gov.au;

- Public Sector Superannuation Accumulation Plan (PSSap): employer contributions were set at 15.4 per cent (2010: 15.4 per cent), and the fund has been in operation since July 2005. More information on PSSap can be found at www.pssap.gov.au; and

- Other: there were some senior executives who had their own superannuation arrangements (for example, self-managed superannuation funds).

- Variable allowances available to senior executives include: Travel allowance, Overtime meal allowance, First aid certificate allowance, Motor vehicle allowance and Establishment allowance.

- Various salary sacrifice arrangements were available to senior executives including superannuation, motor vehicle and expense payment fringe benefits.

Note 12C: Other Highly Paid Staff

During the reporting period, there were two employees (2010: 1 employee) whose salary plus performance bonus were $150,000 or more. These employees did not have a role as a senior executive and are therefore not disclosed as senior executives in Note 12A and Note 12B.

Note 13: Remuneration of auditors

Note: The above amounts are exclusive of GST. No other services were provided by the Auditor General.

Note 14: Average staffing levels

Note 15: Financial instruments

Note 15A: Categories of financial instruments

Note: There is no implicit interest rate on finance leases for 2011 as all finance leases have expired (2010: 5.9 per cent)

Note 15B: Net income and expense from financial liabilities

Note 15C: Net fair values of financial assets and liabilities

The net fair values of cash and non-interest bearing monetary financial assets approximate their carrying amounts.

The net fair values of the finance leases are based on discounted cash flows using current interest rates for liabilities with similar risk profiles. The Treasury entered into finance lease arrangements in relation to certain major office equipment assets. The leases were non-cancellable and for fixed terms averaging 2.75 years, with a maximum of 3.25 years. The Treasury guaranteed the residual values of all assets leased and there were no contingent rentals.

The net fair values for trade creditors and other liabilities are approximated by their carrying amounts.

The Treasury's financial assets and financial liabilities as disclosed in Note 15A are measured under Level 2 of the fair value hierarchy as they are based on observable inputs. There have been no reclassifications between levels of the fair value hierarchy.

Note 15D: Credit risk exposures

The Treasury is exposed to minimal credit risk as loans and receivables are cash and trade receivables. The maximum exposure to credit risk is the risk that arises from potential default of a debtor. This amount is equal to the total amount of trade receivables (2011: $3,537,308 and 2010: $2,601,481). The Treasury has assessed the risk of default on payment as being minimal.

Other government agencies and staff members make up the majority of the Treasury's debtors. To aid the Treasury to manage its credit risk there are internal policies and procedures that guide employees on debt recovery techniques that are to be applied.

The Treasury holds no collateral to mitigate against credit risk.

Credit quality of financial instruments not past due or individually determined as impaired

Ageing of financial assets that are past due but not impaired for 2011

Ageing of financial assets that are past due but not impaired for 2010

Note 15E: Liquidity risk

The Treasury's financial liabilities are payables and finance leases. The exposure to liquidity risk is based on the notion that the Treasury will encounter difficulty in meeting its obligations associated with financial liabilities. This is highly unlikely due to the appropriation funding mechanisms available to the Treasury and internal policies and procedures put in place to ensure there are appropriate resources to meet its financial obligations.

The Treasury is appropriated funding from the Australian Government. The Treasury manages its budgeted funds to ensure it has adequate funds to meet payments as they fall due. In addition, the Treasury has policies in place to ensure timely payments are made when due and has no past experience of default.

Maturity of financial liabilities

Note 15F: Market risk

The Treasury holds only basic financial instruments that do not expose the department to certain market risks.

The Treasury's remaining finance leases expired during the current financial year, resulting in no further lease liability. All finance leases entered into bore interest at a fixed interest rate and will not fluctuate due to changes in the market interest rate. There is no implicit interest rate given there are no further finance leases (2010: 5.9 per cent).

Note 16: Income administered on behalf of Government

1 2011 COAG revenue has decreased as revenues and expenses in relation to non-government schools payments are now recorded in the Department of Education, Employment and Workplace Relations' financial statements. (Refer Note 1.26)

Note 17: Expenses administered on behalf of Government

1 HLIC claims expenses include an actuarial adjustment decreasing provision for insurance claims resulting in an offsetting negative expense in 2010.

Note 18: Assets administered on behalf of Government

1 Refer to Note 21 for more information on the IMF new arrangements to borrow.

1 The 2010 Investments balance has been reduced by $750 million to reflect the post dividend equity position of the Reserve Bank of Australia.

2 An administered investment with a nil balance has been recorded to reflect the Australian Government's control of the OzCar SPV. The OzCar SPV was wound up by 30 June 2011 with no outstanding assets or liabilities.

Note 19: Liabilities administered on behalf of Government

1 In 2011 the Treasury changed the accounting policy in relation to the recognition of liabilities under the Natural Disaster Relief and Recovery Arrangements. Refer to Note 1.3 and 1.26 for more information.

Note 20: Administered reconciliation table

Note 21: Administered contingent liabilities and assets

Quantifiable administered contingencies

Quantifiable administered contingencies that are not remote are disclosed in the schedule of administered items as quantifiable administered contingencies.

Unquantifiable administered contingencies

Contingent Liabilities

Housing Loans Insurance Corporation — guarantee

The Australian Government sold HLIC on 12 December 1997 and has assumed all residual contingencies. The contingent liability relates to the HLIC's contracts of mortgage insurance and any borrowings approved by the Treasurer up to the time of sale. The principal amount covered by the guarantee and the balances outstanding cannot be determined accurately.

Terrorism insurance — Australian Reinsurance Pool Corporation

The Terrorism Insurance Act 2003 established a scheme for replacement terrorism insurance covering damage to commercial property including associated business interruption and public liability. The Australian Reinsurance Pool Corporation (ARPC) uses reinsurance premiums paid by insurers to meet its administrative expenses and to build a reserve for claims and purchase retrocession to help meet future claims. The Act provides for an Australian Government guarantee of the liabilities of the ARPC, but the Treasurer must declare a reduced payout rate to insured parties if the Australian Government's overall liability would otherwise exceed $10 billion.

Commitments under expanded IMF New Arrangements to Borrow (NAB)

Australia has made a line of credit available to the IMF under its NAB since 1998. In line with G 20 Leaders' commitments, Australia has joined with other countries to increase its credit line under an expanded NAB. The NAB is a contingent loan to help ensure that the IMF has the resources available to maintain stability and support recovery in the global economy. The funds are drawn upon by the IMF as needed to supplement the IMF's usual quota resources and will be repaid in full with interest.

When the expanded NAB came into effect on 11 March 2011, Australia's NAB credit arrangement increased from SDR801.3 million (AUD$1.2 billion as at 30 June 2011) to SDR4.4 billion (AUD$6.5 billion as at 30 June 2011). On 24 May 2011, Australia met a call of SDR150.9 million (AUD$224.4 million as at 30 June 2011) under the NAB. This call has been recognised as a loan to the IMF in Note 18.

Under the IMF's current 'Resource Mobilization Plan', a maximum of SDR 305.2 million (AUD$453.9 million as at 30 June 2011) could be called by the IMF between the period 1 August 2011 to 30 September 2011. The maximum amount that could be called by the IMF in subsequent periods is SDR 3.9 billion (AUD$5.8 million as at 30 June 2011). However, the principal amount that may be called by the IMF cannot be determined accurately.

Grants to States and Territories

As the Treasury has responsibility for all payments to the states and territories under the Federal Financial Relations Framework, there may exist contingent liabilities which are remote and unquantifiable in relation to some agreements between the relevant agency with policy responsibility and the states and territories. Whilst the Treasury does not bear the risk of the contingent event, the resultant payment would be made by the Treasury under the Federal Financial Relations Framework.

Loan to New South Wales for James Hardie Asbestos Injuries Compensation Fund

The Australian Government has agreed to lend up to $160 million to the State Government of New South Wales (NSW) to support the loan facility to top up the James Hardie Asbestos Injuries Compensation Fund. Draw down on the loan is subject to the James Hardie Asbestos Injuries Compensation Fund requiring funds to meet its liabilities and is contingent on NSW meeting a number conditions under the loan agreement with the Australian Government. The timing and amounts that may be drawn down by NSW cannot be determined accurately. No funds had been drawn down as at 30 June 2011.

Contingent Assets

HIH Claims Support Scheme

As the beneficiary of the HIH Claims Support Trust, the Australian Government is entitled to the residual balance of the Trust, after the collection of recoveries. Due to the inherent uncertainty of future recoveries, it is not possible to quantify these amounts accurately. During 2010-11 the Treasury received distributions from the Trust, however the amount and timing of future recoveries and subsequent distributions is unknown.

International Monetary Fund

Since 1986, the IMF has used its burden sharing mechanism to make up for the loss of income from unpaid interest charges on the loans of debtor members and to accumulate precautionary balances in a Special Contingent Account to protect the IMF against losses arising from the failure of a member to repay its overdue principal obligations.

The mechanism works by providing for additions to the rate of charge on IMF loans and deductions to the rate of remuneration for creditor members such as Australia. Resources collected from individual members under the burden sharing mechanism are refundable to them as arrears cases are resolved, or as may be decided by the IMF. Thus, resources collected for unpaid charges are refunded when these charges are eventually settled.

Likewise, precautionary balances held in the Special Contingent Account would be distributed back to members in proportion to their cumulative contributions when there are no overdue charges or principal balances. The IMF could also decide to make an early distribution.

As there is considerable and inherent uncertainty around the timing and amounts of burden sharing to be refunded to Australia this contingent asset cannot be reliably measured and as such is recorded as an unquantifiable contingent asset.

Significant Remote administered contingencies

Guarantees

The following borrowings have been guaranteed by the Australian Government and are the Treasury's responsibility:

1 Under the terms of the Commonwealth Bank Sale Act 1995, the Australian Government has guaranteed various liabilities of the Commonwealth Bank of Australia (CBA), and the Commonwealth Bank Officers' Superannuation Corporation (CBOSC). The guarantee for the CBA relates to both on and off balance sheet liabilities. The guarantee of the CBOSC covers the due payments of any amount that is payable to or from Officers' of the Superannuation Fund (the Fund), by CBOSC or by CBA, in respect of a person who was a member, retired member or beneficiary of the Fund immediately before 19 July 1996. The guarantee of the CBA and CBOSC reflected in the above table is the value at 31 December 2010.

2 All guaranteed liabilities of the OzCar SPV were settled prior to 30 June 2011.

3 The contingent liability for the RBA, relates to the Australian Government's guarantee of the liabilities of the RBA. It is measured as the Bank's total liabilities excluding the Bank's distribution to the Commonwealth and Australian Government deposits. The major component of the Bank's liabilities are notes (that is, currency) on issue.

Guarantee Scheme for Large Deposits and Wholesale Funding

The Australian Government announced the guarantee of eligible deposits and wholesale funding for authorised deposit taking institutions from 12 October 2008 under the Guarantee Scheme for Large Deposits and Wholesale Funding.

The Scheme closed to new deposits from 31 March 2010. Since then, Australian authorised deposit-taking institutions have been prohibited from issuing any new guaranteed wholesale funding or accepting new guaranteed deposits above $1 million. Existing guaranteed wholesale funding is guaranteed to maturity. Depositors who covered their balances above $1 million under the Guarantee Scheme can have those funds covered to maturity for term deposits up to five years, or until October 2015 for at call deposits.

The expected liability for deposits under the Guarantee Scheme is remote and unquantifiable. Australia's financial system is considered among the strongest and best regulated in the world. Authorised deposit taking institutions are subject to prudential regulation by APRA in accordance with international standards, which are designed to ensure that financial institutions have the capacity to meet their financial obligations. This framework requires institutions to be adequately capitalised and have appropriate risk management systems in place.

Government expenditure would arise under the large deposit guarantee only in the unlikely event that an institution failed to meet its obligations with respect to a commitment that was subject to the guarantee and the guarantee was called upon. In such a case, the Government would likely be able to recover any such expenditure through a claim on the relevant institution. The impact on the Government's budget would depend on the extent of the institution's default and its ability to meet the Government's claim.

As at 30 June 2011, total liabilities covered by the Guarantee Scheme were estimated at $118 billion, including $3.9 billion of large deposits and $114.1 billion of wholesale funding.

Guarantee of State and Territory Borrowing

The Guarantee of State and Territory Borrowing commenced on 24 July 2009 and closed to new issuances of guaranteed liabilities on 31 December 2010. Securities covered by the guarantee will continue to be guaranteed until these securities either mature or are bought back and extinguished by the issuer.

The expected liability under the guarantee is remote and unquantifiable. Government expenditure would arise under the guarantee only in the unlikely event that a State or Territory failed to meet its obligations with respect to a commitment that was subject to the guarantee and the guarantee was called upon. In such a case, the Government would likely be able to recover any such expenditure through a claim on the relevant State or Territory at a future date. The impact on the Government's budget would depend upon the extent of the default and the State or Territory's ability to meet the Government's claim.

As at 30 June 2011, the face value of state and territory borrowings covered by the guarantee was $39.5 billion.

The principal activities of each of the Treasury's administered investments are as follows:

Development Banks

The European Bank for Reconstruction and Development (EBRD) was established in 1991 to assist former Soviet eastern European countries committed to the principles of multi-party democracy, pluralism and market economies, to develop their private sector and capital markets. The EBRD currently operates in 29 countries from Central Europe to Central Asia. It provides project financing for banks, industries and businesses, both new ventures and investments in existing companies. It also works with publicly owned companies, to support privatisation, restructuring state-owned firms and improvement of municipal services. The EBRD uses its close relationship with governments in the region to promote policies that will bolster the business environment.

The Asian Development Bank (ADB) was established in 1966 and has a mandate to reduce poverty and promote general development in its developing member countries. The ADB does this by financing (through a mix of loans, grants, guarantees and co-financing activities with both other donors and the private sector) public sector and private sector activities. It also provides technical assistance to developing member countries so they can improve their policy and business investment environments. A significant portion of the ADB's activities are focused in the infrastructure and energy sectors.

The World Bank was established in 1944 and comprises the International Bank for Reconstruction and Development (IBRD), the International Development Association (IDA), the International Finance Corporation (IFC) and the Multilateral Investment Guarantee Agency (MIGA). The IBRD provides financing and technical assistance to middle income countries and lends on harder terms than the IDA. The IDA provides concessional finance and technical assistance to low income countries. The IFC supports the development of the private sector by providing direct finance to private sector operations. MIGA provides guarantee services for projects, which reduce the risks for other co-financing partners including the private sector.

International Monetary Fund

The IMF is an organisation of 187 countries, working to foster global monetary cooperation and exchange rate stability, facilitate the balanced growth of international trade, and provide resources to help members in balance of payments difficulties or to assist with poverty reduction. The IMF undertakes surveillance and annual economic assessments, and provides technical assistance to developing countries.

Australian Government entities