Secretary's review

The Treasury has continued to pursue its goal of improving the wellbeing of all Australians through providing quality advice to government and assisting in the implementation of key policy initiatives.

Significant achievements in 2010-11

The Treasury's achievements in the past year include the release of the Pre-Election Economic and Fiscal Outlook report, and assisting the Government in delivering the 2010-11 Mid-Year Economic and Fiscal Outlook and the 2011-12 Budget.

During 2010-11, the Treasury made several substantial contributions to the development of the Clean Energy Future package that was announced in July 2011. The Treasury prepared the Strong Growth, Low Pollution: Modelling a Carbon Price report which informed debate on the effects of a carbon price on the economy. The Treasury also contributed to the development of key elements in the package including the design of the carbon price mechanism, the delivery of assistance to households through tax reform and transfer payment increases, and measures to ensure the security of energy supply in the transition to a carbon constrained environment.

Macroeconomic outcomes

The Treasury provided advice on the performance and outlook of the Australian economy in the context of an uncertain international environment. This included advice on the implications for the economy of the devastating natural disasters that hit Australia, Japan and New Zealand in early 2011 and the impact of Australia's high terms of trade and appreciating exchange rate on growth in the mining and non-mining sectors of the economy. In addition to advising on macroeconomic policy to manage demand and ensure stable and sustainable growth, the Treasury continued to provide advice on policies to raise productivity and participation and enhance Australia's medium-term growth potential by expanding the supply side of the economy.

As well as strengthening IMF and World Bank governance and legitimacy, the Treasury worked actively in the G20 to help build a strong, sustainable and balanced global economy, promote Australia's interests and contribute to reforms to global financial architecture which will yield a safer and more resilient global economy. The Treasury was also an active participant in the Financial Stability Board and its efforts to strengthen international regulatory financial arrangements.

Effective government spending arrangements

Effective government spending arrangements are essential to sustaining a strong fiscal outlook, supporting strong sustainable economic growth and improving the wellbeing of Australians.

In early 2010-11, the Treasury, with the Department of Finance and Deregulation, released the Pre-Election Economic and Fiscal Outlook report, consistent with requirements under the Charter of Budget Honesty Act 1998.

The Treasury also assisted the Government in delivering the 2011-12 Budget, and the package of measures announced in January 2011 in response to the natural disasters experienced over the 2010-11 summer period. The natural disasters had a significant impact on the Australian economy and the Government's fiscal position, though the Budget still projected a return to surplus in 2012-13.

The global economic transformation currently underway, and reflected in the rapid growth of China, India and other countries in our region, provides Australia with huge opportunities and some challenges. The Budget outlined the adjustments confronting Australia and highlighted the importance of policies that facilitate, rather than resist, that adjustment. This holds true for both those sectors benefitting directly from the growth of Asia, and those forced to adjust to a higher exchange rate and greater competition for skilled labour. The opportunities available to Australia are significant and should underpin strong medium-term growth.

Given the unprecedented mining investment boom, adherence to the fiscal strategy and fiscal consolidation will be important to supporting strong low inflationary growth.

Early in 2011, the Treasury, with the Department of Finance and Deregulation, provided a submission to the Joint Select Committee on the Parliamentary Budget Office. The 2011-12 Budget also provided funding for the establishment of a Parliamentary Budget Office (PBO) and the department has assisted in the development of the establishing legislation and preparing documented methodology to assist the PBO in its operations. The PBO will provide independent and non-partisan analysis of the budget cycle, fiscal policy and the financial implications of policy proposals.

The Treasury has established a secretariat to support the GST Distribution Review. The Review will consider whether the distribution of the GST and the current form of horizontal fiscal equalisation will ensure that Australia is best placed to respond to long-term trends and structural change in the economy while maintaining confidence in the financial relationships within the Australian Federation.

The Treasury also continues to assist the Government in implementing its agenda in the area of Australia's workforce needs and measures to boost participation, as well as investments in infrastructure, education and the health system.

Effective taxation and retirement income arrangements

In 2010-11, 63 tax and superannuation measures were introduced into the Parliament in 25 bills. These included amendments to tax law to: bring certain alternative fuels used for transport purposes into the fuel taxation regime; remove the eligibility for the low income tax offset on unearned income for minors; phase out the dependent spouse tax offset; and make changes to the statutory formula method used to value car fringe benefits.

The Treasury provided advice on proposals for personal tax reform included in the Clean Energy Future package. It also advised on, and implemented legislation for, the first stage of not-for-profit sector reforms, the superannuation components of the stronger, fairer, simpler tax reform and the Stronger Super reforms.

The Treasury also provided secretariat services and policy advice to the Government's Policy Transition Group responsible for the detailed design of the Minerals Resource Rent Tax and the extension to the Petroleum Resource Rent Tax. Following the Government's acceptance of the Policy Transition Group's recommendation, the Treasury consulted on legislation design and released draft legislation and explanatory materials for the Minerals Resource Rent Tax for public consultation. The Treasury continued to provide policy advice on a range of reforms for small business and trust income including increasing the small business instant asset write-off thresholds and providing policy advice on implementing change to the taxation of trust income following the High Court's decision in the Commissioner of Taxation v Bamford (2010) 240 CLR 481.

Achieving well functioning markets

Well functioning markets underpin strong, sustainable economic growth and enhanced living standards. The Treasury supports well functioning markets through providing advice to government on regulatory and competition reforms aimed at improving resource allocation, productivity and international competitiveness.

This includes the implementation of a single national consumer policy framework through the Australian Consumer Law, maintaining the effectiveness of Australia's competition law framework, and promoting the efficient use and development of nationally significant infrastructure, including the National Broadband Network. This work also includes providing advice on the reform of utilities, infrastructure and housing markets, and the regulatory frameworks for securities markets, financial markets, financial advice, corporate governance and consumer credit.

Du

ring 2010-11, the Treasury implemented reforms to strengthen the efficiency, competitiveness and stability of Australia's financial sector through the Government's Competitive and Sustainable Banking package and Stronger Super reforms. The Treasury also worked closely with the Foreign Investment Review Board to ensure that the foreign investment screening framework maintains the right balance between protecting Australia's national interest and ensuring that Australia remains an attractive destination for foreign capital.

Another focus in 2010-11 was the delivery of Standard Business Reporting, a multi-agency initiative led by the Treasury to reduce the compliance reporting burden experienced by business in reporting to government. The Treasury also assisted with the transfer of responsibility for the supervision of Australia's domestic licensed financial markets from the Australian Securities Exchange Ltd to the Australian Securities and Investments Commission and the granting of a licence to a new market operator who is expected to commence trading in late 2011.

2011-12 outlook

The Australian economy continues to benefit from strong growth in Asia, and demand for Australia's mineral resources will continue to support growth in the mining and related industries. However, it is expected that conditions in other parts of the economy will continue to be weighed down by the high exchange rate, cautious household spending behaviour and tightened macroeconomic policy settings. The international economic outlook is extremely volatile, with significant public debt challenges in a number of advanced economies, particularly in Europe and the US. Without strong political leadership in key North Atlantic economies, it is likely this volatility will persist for some time. Indeed, in a worst case scenario, failure to comprehensively respond to the underlying competiveness and structural fiscal problems in the North Atlantic could have significant implications for global economic growth. The Treasury's advice will continue to focus on capitalising on the opportunities presented by strong growth in the Asia region and facilitating associated structural changes taking place in the economy while helping to manage volatility and fallout from the ongoing sovereign debt crisis. The Treasury will also continue to actively pursue Australia's interest in international and regional economic forums.

Ensuring that our financial system remains robust, competitive and dynamic is essential to promoting macroeconomic stability and market confidence. The Treasury will continue monitoring prudential frameworks applying to the banking sector, insurers and superannuation funds, and advising on reforms to improve Australia's productivity and competitiveness. The Treasury will also continue supporting the independent Natural Disaster Insurance Review, which is scheduled to report to the Government by 30 September 2011. The Treasury will also participate in the Council of Financial Regulators' work to strengthen Australia's financial market infrastructure.

In 2011-12, the Treasury will assist the Government to implement its Clean Energy Future package, in particular measures to assist the transition of the energy sector and other industries to an emissions-constrained environment.

The Government held a Tax Forum on 4-5 October 2011 bringing together representatives of the community, business, unions and government, as well as academics and other tax experts, to discuss directions for further tax reform. The Forum built on the work done in the Australia's Future Tax System Review and the tax reforms the Government has already announced. Follow up work from the Forum is expected to be an important element of the Treasury's work during 2011-12.

In 2011-12, the Treasury will also be progressing not-for-profit sector reforms including the establishment of an Australian Charities and Not-for-profits Commission, better targeting of not-for-profit tax concessions and the introduction of a statutory definition of charity.

Our organisation

The Treasury is committed to nurturing and strengthening its core organisational capabilities and is constantly seeking better ways of doing business. Our strengths as a department continue to lie in our highly dedicated and professional staff.

In relation to our financial performance, the Treasury ended 2010-11 with a surplus of $2.4 million, compared to a $5.5 million surplus in 2009-10. The Treasury received an unqualified audit report on the 2010-11 financial statements from the Australian National Audit Office.

Two scholarships were awarded to Australian National University economics students who demonstrated strong economic skills and an interest in pursuing a career in public policy. The scholarships are promoted widely through the Australian National University's networks to increase awareness of the Treasury as an employer of choice for economics graduates. Internships are offered to Treasury scholarship recipients.

Kenneth Lac from the Australian Prudential Regulation Authority was awarded the Young Leaders Program Scholarship to Japan. The program offers potential public sector leaders the opportunity to develop their knowledge of global, regional and Japanese politics and economies, public administration and policies. Participants in the program are encouraged and supported to develop strong long-lasting relationships and networks with Japan and other countries around the world. Kenneth will commence his 12-month program at the National Graduate Institute for Policy Studies in Japan during 2011.

The Treasury has played an active role in the establishment of the Sir Roland Wilson Foundation Scholarship Program. Recipients of the PhD scholarships will be high performing public servants with a strong commitment to public policy and a career in the Australian Public Service. Studies will be undertaken at the Australian National University on topics of relevance and enduring interest to the APS with recipients receiving a scholarship to support their studies and an associated overseas field trip.

Sharon McCluskey was one of two recipients of the EXPAND Senior Executive Assistant / Personal Assistant award in 2010. The award was presented at the EXPAND 2010 Annual Conference and Awards night and places the spotlight on the contribution that Executive Assistants make in the APS on a daily basis.

Our achievements over the past 12 months demonstrate our ongoing commitment to pursue outcomes that will ensure that the wellbeing of future generations of Australians is at least as high as the wellbeing we enjoy today.

I want to thank all Treasury staff for their continuing professionalism, enthusiasm and adaptability in facing the considerable challenges and opportunities that lie before us.

Finally, I would like to recognise the contribution of my predecessor, Dr Ken Henry AC. Dr Henry ably led the Treasury for a decade, including through the turmoil of the global financial crisis. At all times he ensured the Treasury's focus was on the national interest and on the wellbeing of all Australians.

Martin Parkinson

Secretary to the Treasury

Departmental overview

The Treasury's mission

The Treasury's mission is to improve the wellbeing of the Australian people by providing sound and timely advice to the Government, based on objective and thorough analysis of options, and by assisting the Treasury ministers in the administration of their responsibilities and the implementation of government decisions.

Policy outcome

In carrying out its mission, the Treasury has responsibility for the following outcome:

- Informed decisions on the development and implementation of policies to improve the wellbeing of the Australian people, including by achieving strong, sustainable economic growth, through the provision of advice to government and the efficient administration of federal financial relations.

The Treasury has four policy groups that contribute to achiev

ing this outcome:

- Macroeconomic Group;

- Fiscal Group;

- Revenue Group; and

- Markets Group.

Macroeconomic Group

Macroeconomic Group provides advice on a sound macroeconomic environment that is an essential foundation for strong, sustainable economic growth and the improved wellbeing of Australians.

Macroeconomic Group contributes to a sound macroeconomic environment by providing careful monitoring and analysis of economic conditions in Australia and overseas which forms the basis of quality macroeconomic policy advice to portfolio ministers.

Macroeconomic Group also provides advice to government on a range of international economic policy issues, including strengthening multilateral regimes underpinning open trade and capital flows, supporting developing countries' development aspirations and shaping the evolution of regional economic architecture.

Macroeconomic Group is also responsible for payments to international financial institutions as outlined in Program 1.2 on pages 87 and 88.

Fiscal Group

Fiscal Group provides advice on effective government spending arrangements that contribute to the overall fiscal outcome, influence strong sustainable economic growth and improve the wellbeing of Australians.

Effective spending measures should meet their stated objectives, minimise behavioural distortions and deliver significant economic and other benefits compared with costs.

Fiscal Group provides policy advice to portfolio ministers to promote government decisions that further these objectives.

Fiscal Group takes a whole-of-government and whole-of-economy perspective in developing its advice on the fiscal strategy and spending arrangements across and within portfolios.

Fiscal Group is also responsible for the efficient payment of general revenue assistance, National Specific Purpose Payments and National Partnership Payments to the States and Territories as outlined in programs 1.4 to 1.10 on pages 91 to 104.

Revenue Group

Revenue Group provides advice on effective tax and retirement income arrangements that contribute to the overall fiscal outcome, influence strong sustainable economic growth and lead to the improved wellbeing of Australians.

Tax measures should meet revenue or other public policy objectives and meet the principles of economic efficiency, horizontal and vertical equity, and transparency whilst minimising compliance and administrative costs. By meeting these objectives, tax measures contribute to wellbeing, either directly or by providing the revenue base to finance government services.

Revenue Group provides policy advice to government to promote government decisions that further these objectives.

Revenue Group takes a whole-of-government and whole-of-economy perspective in developing its tax and retirement income policies.

Markets Group

Markets Group provides advice on well functioning markets that contribute to improving national productivity and promoting stronger economic growth, thereby enhancing the living standards of all Australians.

Well functioning markets enable the most efficient use of resources and maximise consumer confidence in markets, thereby enhancing community benefits from economic activity.

Markets Group provides advice on policies that promote competitive, efficient markets that work to enhance consumer wellbeing, a secure financial system and sound corporate practices, and foreign investment consistent with Australia's national interest.

Markets Group also maintains the operations of the Australian Government Actuary, the Financial Reporting Panel and the Takeovers Panel, and provides business management for Standard Business Reporting.

Markets Group is also responsible for payments to support markets and business as outlined in Program 1.3 on pages 89 and 90.

Treasury support services

To support the Treasury's policy outcomes, Corporate Services Group and the Organisational Strategy Unit provide key services to assist with systems and facilities which provide essential support and organisational backup to the groups.

Corporate Services Group is responsible for providing corporate services, products and advice including accommodation and facilities management; management of administrative support; financial management; human resource management, training and development; information management and technology services; media management and monitoring; ministerial and parliamentary support; procurement; print and web publishing; internal and external communications; security; travel and managing freedom of information requests.

The Organisational Strategy Unit functions include facilitating high level policy coordination and whole-of-department corporate strategy; providing support to the Secretary, the Executive Board and the Audit Committee, including oversight of departmental structures and systems; designing and facilitating whole-of-department policy discussions; coordinating organisational strategy initiatives; overseeing the risk management framework; and undertaking and assisting with departmental reviews.

Treasury people values

Treasury people are skilled professionals, committed to providing quality advice, thinking analytically and strategically, and striving to achieve long-term benefits for all Australians. We uphold the important values and behaviours that shape the Treasury culture. These values influence all aspects of the way we work.

Treasury people:

- strive for excellence;

- value teamwork, consultation and sharing of ideas;

- value diversity among our people;

- treat everyone with respect;

- exhibit honesty in all our dealings; and

- treat colleagues with fairness.

Treasury people management principles are:

- open, two-way communications at all levels;

- clearly define accountabilities;

- work performance is the basis for remuneration, which is determined by fair and transparent processes; and

- facilitation of an appropriate work and private life balance.

The Treasury's role and capabilities

The Treasury's mission statement reflects the breadth of its ministers' responsibilities and underscores the key importance for the Treasury of a strong relationship with its ministers, built on trust and effective advice. As a central policy agency, the Treasury is expected to anticipate and analyse policy issues with a whole-of-economy perspective, understand government and stakeholder circumstances, and respond rapidly to changing events and directions. As such, the Treasury's interests are broad and diverse.

The Treasury is engaged in a wide range of issues that affect the lives of Australians, from macroeconomic policy settings to micro-economic reform, climate change to social policy, as well as tax policy and international agreements and forums. The Treasury has a program delivery role in supporting markets and business, and providing Commonwealth payments to the State and Territory governments.

A review of the Treasury's wellbeing framework was undertaken during 2010-11. A key objective of the review was to further develop the department's understanding of wellbeing and thereby build capacity to deliver its mission.

In undertaking its mission, the Treasury takes a broad view of wellbeing as primarily reflecting a person's substantive freedom to lead a life they have reason to value.

This view encompasses more than is directly captured by commonly used measures of economic activity. It gives prominence to respecting the informed preferences of individuals, while allowing scope for broader social actions and choices. It is open to both subjective and objective notions of wellbeing, and to concerns for outcomes and consequences as well as for rights and liberties.

The Treasury brings a whole-of-economy approach to providing advice to government based on an objective and thorough analysis of

options. To facilitate that analysis, we have identified five dimensions that directly or indirectly have important implications for wellbeing and are particularly relevant to the Treasury. These dimensions are:

- The set of opportunities available to people. This includes not only the level of goods and services that can be consumed, but good health and environmental amenity, leisure and intangibles such as personal and social activities, community participation and political rights and freedoms.

- The distribution of those opportunities across the Australian people. In particular, that all Australians have the opportunity to lead a fulfilling life and participate meaningfully in society.

- The sustainability of those opportunities available over time. In particular, consideration of whether the productive base needed to generate opportunities (the total stock of capital, including human, physical, social and natural assets) is maintained or enhanced for current and future generations.

- The overall level and allocation of risk borne by individuals and the community. This includes a concern for the ability, and inability, of individuals to manage the level and nature of the risks they face.

- The complexity of the choices facing individuals and the community. Our concerns include the costs of dealing with unwanted complexity, the transparency of government and the ability of individuals and the community to make choices and trade-offs that better match their preferences.

These dimensions reinforce our conviction that trade-offs matter deeply, both between and within dimensions. The dimensions do not provide a simple checklist: rather their consideration provides the broad context for the use of the best available economic and other analytical frameworks, evidence and measures.

The Treasury utilises and develops its technical expertise, knowledge base and support systems to deliver on our priorities. To maximise our potential, we nurture and strengthen our core organisational capabilities and consistently seek better ways to do business.

Our organisational capabilities are:

- Deep understanding: understanding our mission, the economic and policy environment, and the views of our stakeholders.

- Collaboration: collaborating with internal and external stakeholders to develop effective policy.

- Proactivity and vision: anticipating policy, implementation and organisational issues.

- Influence and reputation: building trust with the Government and other stakeholders, and influencing the policy agenda.

- Improvement and adaptability: being flexible, adaptable and innovative.

- Efficiency and productivity: managing costs, allocating resources and enabling efficiencies.

Financial performance

The Treasury received an unqualified audit report on the 2010-11 financial statements from the Australian National Audit Office. These statements can be found in Part 4 on pages 149 to 262.

Departmental

The Treasury ended 2010-11 with an attributable surplus of $2.4 million, compared to a $5.5 million surplus in 2009-10. Employee expenses increased by $0.9 million from 2009-10, which was associated with a small staffing increase.

The Treasury's net asset position decreased by $1.7 million in 2010-11, mainly due to a small reduction in other payables.

The Treasury has sufficient cash reserves to fund liabilities as and when they fall due.

Administered

The Treasury incurred $87 billion in administered expenses in 2010-11 compared to $89 billion in 2009-10. The $2 billion decrease relates to a small reduction in grants paid to the States and Territories that the Treasury provides under the Intergovernmental Agreement on Federal Financial Relations.

The Treasury's administered net assets reduced by $10 billion in 2010-11. This is mainly due to a decrease in the value of financial assets and a decrease in payables.

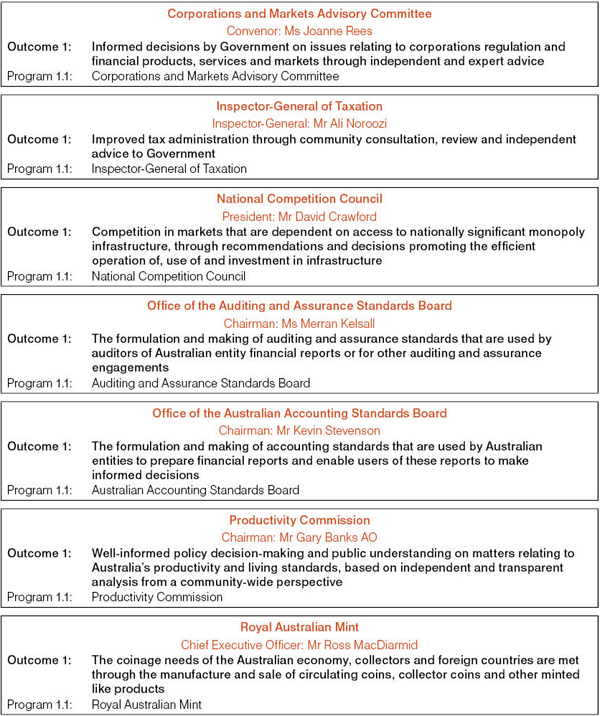

Figure 1: Treasury senior management structure (as at 30 June 2011)

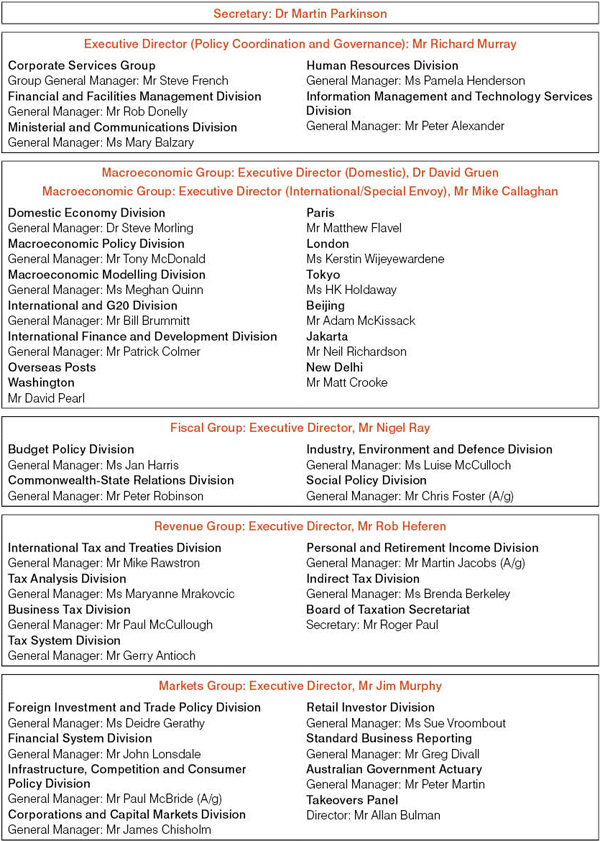

Figure 2: Treasury outcome and program structure (as at 30 June 2011)

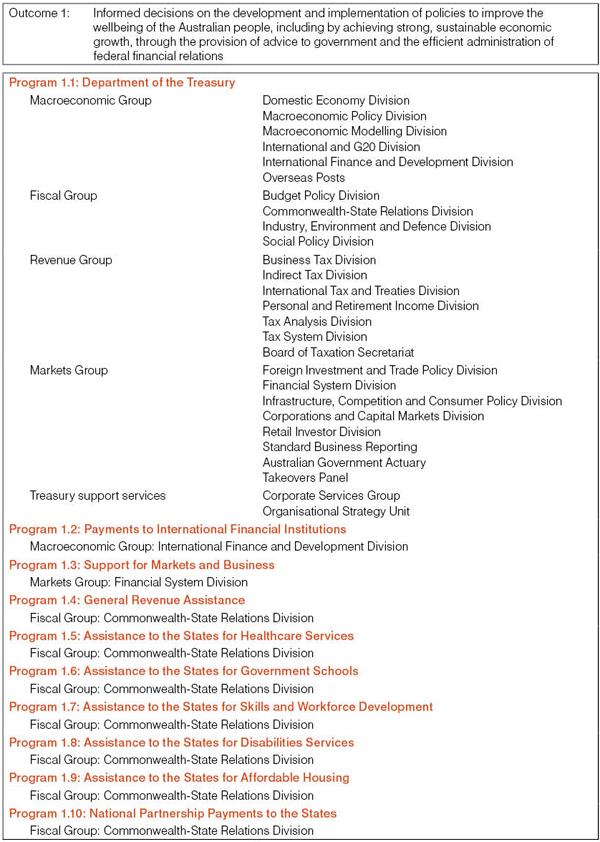

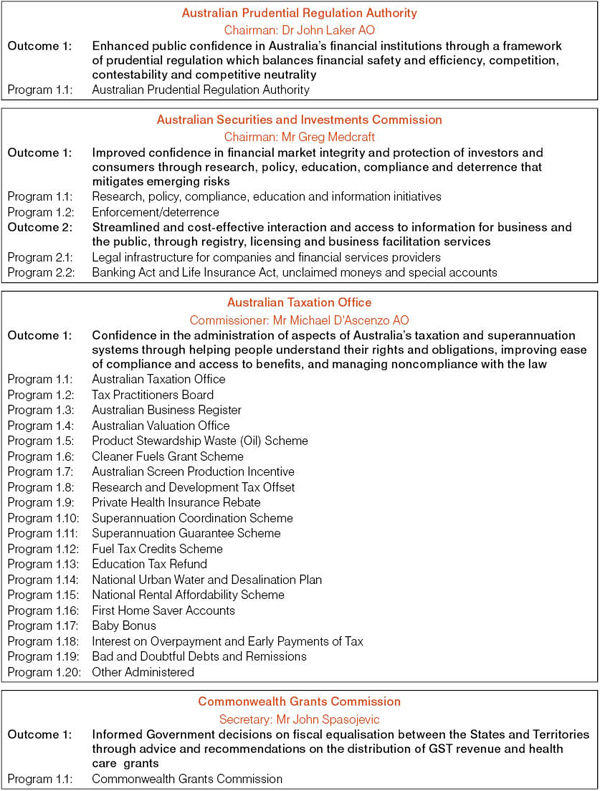

Figure 3: Treasury portfolio outcome and program structure (as at 30 June 2011)

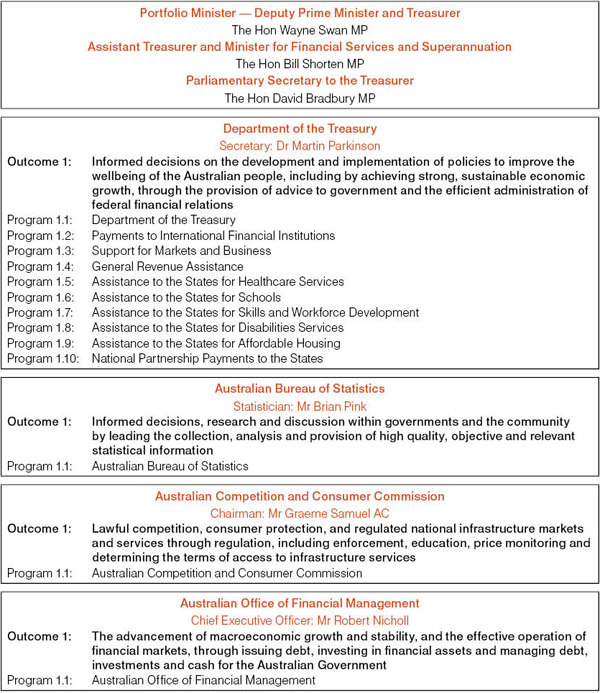

Figure 3: Treasury portfolio outcome and program structure (continued)

Figure 3: Treasury portfolio outcome and program structure (continued)