Minerals Council of Australia and National Native Title Council — Indigenous Community Development Corporation (ICDC) Concept (March 2013)

1. Introduction

This paper provides an overview of the Indigenous Community Development Corporation concept for the purposes of influencing policy and garnering Government support and commitment. It is anticipated that further stakeholder engagement will be required in developing the detail of the ICDC concept for the purposes of implementation. To date the ICDC concept has been developed in partnership between the MCA, NNTC, Indigenous leaders and academics.

2. Overview

The MCA's submissions19 to the Australian Government in response to its consultation paper 'Native Title, Indigenous Economic Development and Tax' dated October 2010 and exposure draft of the Tax Laws Amendment Bill 2012: tax treatment of native title benefits released on 27 July 2012, identified the ICDC concept as an example of a means of managing benefits received by Indigenous communities and groups.

The exposure draft, only applies to native title payments in compensation for acts affecting native title rights and interests. It is suggested that the ICDC concept could apply irrespective of the source of the benefits, including from agreements centred on the statutory compensation entitlements of native title holders or otherwise relating to the impacts of development on traditional lands without materially impacting on the revenue collected by the Australian Taxation Office.

The development of the ICDC concept as a category of tax exempt entity would substantially enhance the effectiveness and efficiency of the existing system, including by:

- shifting the language away from concepts of charity to broader concepts of community and socio- economic development;

- creating greater flexibility within the taxation system for community specific approaches to managing funds for socio economic development;

- providing for a structure that encourages intergenerational and sustainable benefits;

- creating capacity to maximise the delivery of economic and social dividends with minimal administrative burden; and

- recognising the unique multifaceted challenge of Indigenous disadvantage, in line with Government's commitment to 'Closing the Gap'.

This paper provides a further explanation of the key features and benefits of the proposed ICDC concept. An advantage of the ICDC concept is its relative simplicity.

Key features of the ICDC concept are:

- Authorised Purposes — see 5 below for more detail — ICDCs would be authorised to apply funds to purposes that are within the scope of the ordinary concepts of charity and broader community development and support activities. These activities will be consistent with the objectives of 'Closing the Gap' and will be directed to community and socio-economic development purposes, including support for social enterprises. In addition, for those unlikely to benefit directly from those initiatives, ICDCs could make superannuation contributions in limited circumstances, as well as accumulate capital for the benefit of future generations.

- Tax treatment — see 7 below for more detail — Money received (and earned) by ICDCs will be tax exempt to the extent it is applied for authorised purposes. Recipients of superannuation benefits will be taxed on ordinary concessional principles.

- Scope of Functions — see 3.2 and 3.3 below for more detail — The ICDC will be an optional vehicle for Indigenous communities to use to fund authorised purposes. An ICDC will not need to be the only vehicle used by those communities (other 'for profit' entities can be used under the general law) but its flexibility and features are designed for it to be used as an 'omnibus' structure to manage funds from multiple sources. The ICDC is a principally funding provider rather than entity service provider. Its functions will include identifying the most effective mechanism to implement the delivery of authorised purposes.

- Beneficiary communities — see 6 below for more detail — An ICDC can be for the benefit of any Indigenous community, and is not limited to native title or other land holding groups. However, while an ICDC may differentially apply benefits, as to amount, type and time, to different parts of an Indigenous community, the Indigenous community must be wide enough to pass the public benefit test.

- Decision-making control and governance compliance — see 3.1 and 4 below for more detail — Decisions about the use, investment and distribution of ICDC funds are to be made by, or with the concurrence of, the relevant Indigenous community or the narrower group of traditional owners. Minimum governance structures for the ICDC would be prescribed and would include a model constitution, trust deed or rules depending on the relevant legal structure.

2.1 Who will benefit?

Native title claimants and holders — that have negotiated agreements relating to exploration and development, and other agreements, will be beneficiaries of the ICDC.

Future generations of Aboriginal people — the ICDC will enable the accumulation of benefits, which is not encouraged under current legislation.

Other Aboriginal people — will also be able to access the benefits, services and facilities that the ICDC has established.

Governments — the ICDC will be able to more effectively 'tell the story' of funds provided through native title agreements to inform policy development and will reduce compliance costs in government due to increased governance delivering the effective management of funds held.

Mining companies — the ICDC will provide stronger confidence in the governance of funds and the purposes for which funds are used which may assist them to meet their public accountability requirements.

Regional Australia — the ICDC will provide increased economic diversity and increased resilience.

2.2 Why is it required?

The ICDC concept will:

- provide a vehicle to generate sustainable and long term social and economic benefits for Indigenous communities;

- provide more flexibility so that agreement funds can genuinely be used for the broad range of community development initiatives to achieve Closing the Gap and regional development outcomes. Currently a substantial proportion of these funds are allocated to and 'locked into' charitable trusts that prohibit their optimal use to achieve community development outcomes in both the short and longer term;

- create the opportunity to accumulate funds to deliver genuine wealth creation opportunities for Indigenous people in the longer term; and

- provide sufficient incentives for stronger governance requirements to maximise effective use and administration of agreement funds.

Long term economic and social development activities and the accumulation of benefits are effectively disincentivised under current legislation which is working against the policy objective of 'closing the gap' and delivering positive inter- generational change for Indigenous people.

Whilst some agreements provide significant benefits over two decades or more, it is more often the experience of native title owners that they have a number of smaller payments from a number of mining agreements which singularly aren't able to contribute to closing the gap or regional development outcomes. The ICDC will permit the accumulation of funds for use in delivering a substantial service or facility for Indigenous people rather than the collective value of these benefits being lost through individual distributions.

3. Policy Drivers

Opportunity exists to leverage on the increased economic activity associ

ated with mineral wealth to enhance institutional and economic capacity by which Indigenous people can become long term contributors to, and drivers of, regional and community development through wealth creation. The demographic trends in remote Australia20 amplify the need for urgency in creating this long term regional development through a coordinated, collaborative approach from all stakeholders.

As outlined above, there is broad recognition from government that the social and economic policy framework in Australia has failed to create sufficient progress towards economic independence for Indigenous people and is in need of a radical readjustment. The MCA and NNTC consider that payments under agreements, or as royalty equivalents are closely aligned to existing mainstream economic activities such as land development and provide a platform for the long term investment of such monies to ensure sustainable, intergenerational benefit to Indigenous communities.

From the Government's perspective, there is a political imperative to commit to strategies closely aligned with the Closing the Gap targets on addressing Indigenous health, housing, education and livelihoods; the seven COAG endorsed building blocks to address disadvantage under the National Indigenous Reform Agreement; and the Indigenous Economic Development Strategy (IEDS). In delivering the 2008 Mabo Lecture,21 the Minister for Families, Housing, Community Services and Indigenous Affairs (FaHCSIA), Jenny Macklin called for a new approach to Native Title including how payments that flow to Native Title holders and claimants should be allocated and administered. In reference to the resources boom at the time Minister Macklin noted the 'potential for millions of dollars to be harnessed for the economic and social advancement of Native Title holders, claimants and their communities'.22

Limitations of charitable trusts

While charitable trusts have been used by many Aboriginal communities to manage the funds from native title related agreements and other compensation and benefit sharing packages with communities, it is clear that these are not a neat fit. This largely due to the following core issues:

- The continued use of the term charity which is aligned to a welfare rather than a development approach.

- The limitations on organisations with DGR status being focused on a single charitable purpose.

- Accumulation of funds (including superannuation) has not been specifically discussed or identified as an allowable activity.

- The current ATO practice of limiting the number of years the tax concession can be applied for the purpose of holding funds, which is contrary to the objective of intergenerational benefit and may in fact be a shorter.

- Period than the life of many agreements.

- Economic development for Indigenous Australians has not been identified as an allowable activity and is considered by Treasury to be inconsistent with the focus of proposed reforms in relation to the adoption of a statutory definition for charity.

4. Legal Status

4.1 Legal structure

The definition of an ICDC for tax exemption purposes would be: A not for profit organisation established by an Aboriginal or Torres Strait Islander Community for the purpose of providing benefits for the promotion, development, advancement and maintenance of that Aboriginal Community, their Traditional Owners, their land and the broader region, now and into the future. Depending on the level of annual or total revenue, the ICDC could either operate as a trust structure with a corporate or independent professional trustee or be incorporated (under any relevant regime) without a trust structure. Further consideration needs to be given to the circumstances appropriate for the use of different legal structures.

4.2 Omnibus fund rather than an implementation entity

An objective of the ICDC approach to the management of benefits for Indigenous communities is to minimise duplication and administrative inefficiency by facilitating the establishment of a single fund that receives funds from a number of sources and then applies them in accordance with its objects to a potentially wide range of purposes.

Consistently with this objective, the primary function of ICDCs will be to receive, manage and apply funds to the objects of the ICDC rather than to have the day to day conduct of programmes, works or operations in the implementation of the funded objects.

The emphasis on ICDC's as principally funding providers rather than service providers is important because:

- The funds of an ICDC may be applied to a wide class of purposes, involving a multiplicity of skills. The role of the ICDC in having oversight of the funding of these purposes and ensuring that the funding is used in accordance with the funding conditions is a significant and potentially onerous one. Implementing the various funded activities will involve additional skills, which are likely to require specialist expertise. Attempting to roll all these functions into a single entity will encourage waste and inefficiency and the development of bureaucratic organisations.

- The activities funded by an ICDC may involve financial as well as other risk. If the ICDC is responsible for service provision for all of the activities it funds — in one entity — risks created by one activity will expose the whole structure. The funding of separate entities to undertake activities within the objects of the ICDC may reduce the risk and liability created by those activities.

- Unlike other not for profit entities, decision-making in ICDCs is likely to be carried out or influenced by persons who form part of the community that will benefit from the ICDC's funds — although those persons may not strictly be members or owners of the ICDC, depending on its structure. This relationship may give rise to a risk of inherent conflicts of interest, which will be more difficult to manage if the implementation of programmes is undertaken by the same entity that is responsible for having primary governance oversight of the use of the funds.

- ICDCs are intended to enable and develop the building of capacity within the Indigenous communities they benefit. Capacity building would be enhanced by the implementation of programmes, projects and initiatives by the community using different entities managed by a diversity of community members.

- ICDC may attract funding from other sources (relates to DGR status).

- The ICDC will need to be able to conduct some administration and support functions in delivering on its funding role.

4.3 Use is voluntary — Opt in.

The use of an ICDC to receive 'native title' or other payments in connection with agreements about land use would be voluntary and other structures (that are not tax exempt) could be used. However, the flexibility and tax- exempt status of an ICDC would strongly encourage their use by Indigenous groups.

Indigenous communities can choose whether or not they want their agreement payments to be managed by an ICDC or whether they wish to continue with current practices which include a mixture of individual distributions and the establishment of charitable and discretionary trusts.

5. Governance and Regulation

Minimum governance standards for ICDCs would be prescribed.

5.1 Model Constitution, Trust Deed, Rules

Depending on the structure of the ICDC there must be a model constitution, trust deed or rule book containing the fundamental requirements necessary to ensure a robust, transparent and flexible structure covering the following areas:

- Decision Making Processes

- Integrity Measures

- Capacity Measures

- Investment Plan / Distribution Plan

- Professional Investment Managers

- I

ndependent experienced Board Directors

Decisions about how the funds of the ICDC are used, invested and distributed would be made by or with the concurrence of the relevant Indigenous community. Additional governance compliance conditions must be met to ensure that good governance occurs in compliance with the ICDC's model constitution, trust deed or rule book. Importantly, the additional governance requirements would not detract from the decision making function of the Indigenous community or group.

Both small and large ICDC's would have the same degree of governance but at some point in time the quantum of funds held may warrant the appointment of professional independent trustees to support enhanced accountability to the decisions made by traditional owners.

ICDCs that are holding significant funds will have higher levels of accountability. Smaller ICDCs will still be required to comply with strong governance structures but will retain some flexibility in how the more rigorous components are complied with.

In order to assure strong governance and management processes the model constitution, trust deed or rule book will be constructed on the basis of the following key principles:

- Decision making would rest with native title owners and Director would be appointed through an approved and transparent process.

- The Board will be compliant with, and have the competencies as required by, a relevant corporate regime.

- The appointment of Independent and experienced Directors will be encouraged.

- Audits and reviews will be undertaken by an independent and qualified auditors.

- There will be public disclosure requirements.

- Approved accumulation investment and accumulation distribution plans will be mandatory for assets and income over a predetermined threshold

- The appointment of a licensed professional Trustee to provide advice and/or manage the accumulation fund. (This principle will be a requirement of Tier 2 ICDCs).23

- The separation of investment and operational management processes will be encouraged.

- The development of capacity building and succession plans as well as an internal dispute resolution process will be required.

An ICDC will also be required to co-invest in the costs associated with the operations of any Prescribed Body.

Corporate when the monies received are over a specified threshold.

5.2 Register of an ICDC

Having a register of ICDCs enables a way for providing the model constitution, maintaining standards, capturing information regarding activities and the success of ICDCs, sharing information between ICDCs and delivering governance training and other support.

5.3 Built In Accumulation

The concept of accumulation is well recognised within the philanthropic community as a means by which a benefactor can accumulate a large capital amount to be preserved with the income generated from that preserved amount available for the trustees to use to further the specified trust purpose.

Subject to independent financial advice, the ICDC is obliged to accumulate funds towards a future fund to support

ICDC's activity for future generations. This would involve:

- the provision of Accumulation Guidelines with a mandatory minimum and maximum level requirement;

- for asset protection purposes, the Future Fund to be held by a qualified professional institution on behalf of the ICDC; and

- an approved customised Accumulation Plan, designed to take account of the particular facts, circumstances, and predicted income flows etc.

These more specific measures would ensure:

- benefits are applied in a sustainable manner having regard to the circumstances of the relevant Indigenous community or group;

- inter-generational benefits from agreements;

- the interests and views of the Indigenous community who benefits from the ICDC or the relevant traditional owner group are reflected and accounted for in a transparent manner. Decisions about how the funds of the ICDC are used, invested and distributed would be made by or with the concurrence of the relevant Indigenous community or group of traditional owners;

- to ensure that governance occurs in compliance with the ICDC's constituent documents and the law, additional governance compliance conditions must be met, but in a way which does not divest the general decision-making function from the relevant Indigenous community or group of traditional owners; and

- the persons responsible for the governance of the ICDC may include persons with suitable skills and experience to discharge their responsibilities. It may also include a professional independent trustee who will be responsible for ensuring governance standards are met. Further consideration will need to be given to in what circumstances each of these governance structures applies.

6. Purposes and Scope of Activities

An ICDC would authorise the use of funds for community and socio-economic development purposes (including support for social enterprises) as opposed to direct individual personal gain, except where individuals benefit incidentally from the ICDC's pursuit of its community and socio-economic development purposes and except for the superannuation and pensions purposes outlined below.24 In this way, except for the superannuation and pensions purposes, an ICDC is intended to be a not for profit entity. That is, an entity which is carried on for the benefit of community and socio-economic development purposes, rather than the benefit of members or owners; and which cannot distribute its profits or assets to persons in their capacity as members or owners except as genuine remuneration for services or reimbursement for reasonable expenses.25

The permitted scope of authorised purposes essentially houses in the one entity a mix of purposes which ought as a matter of public policy to be income tax exempt — in large part because many of the individual purposes are currently tax exempt:

- Ordinary charity — Things that fall within charitable objects recognised by the general law. Charitable institutions and charitable funds are currently eligible to obtain income tax exemption.26

- Community development — Other community development objects that may not fall within the general law concepts of 'charity' but address community health, education, employment and training, aged care infrastructure and services, community services and infrastructure, community housing, environmental and land care, and the conduct of cultural activities. These purposes would not extend to direct personal gain or income (such as 'sitting fees'). Many of the community development activities would fall within the concept of 'community service purposes' in the sense that they would directly deliver practical help, benefits or advantages to the relevant communities. Organisations established for these purposes are currently eligible to obtain income tax exemption.27

- Superannuation and pensions — Related to the aged care purpose, an ICDC would be able to make superannuation contributions to an already established and recognised superannuation fund on behalf of individuals with low ongoing superannuation contributions — for instance by permitting contributions up to a capped amount28 in circumstances where the person would meet an appropriate income test.29 Any contributions to the trustee of a superannuation fund would potentially be taxed in the fund when made in the same way that employer contributions would be

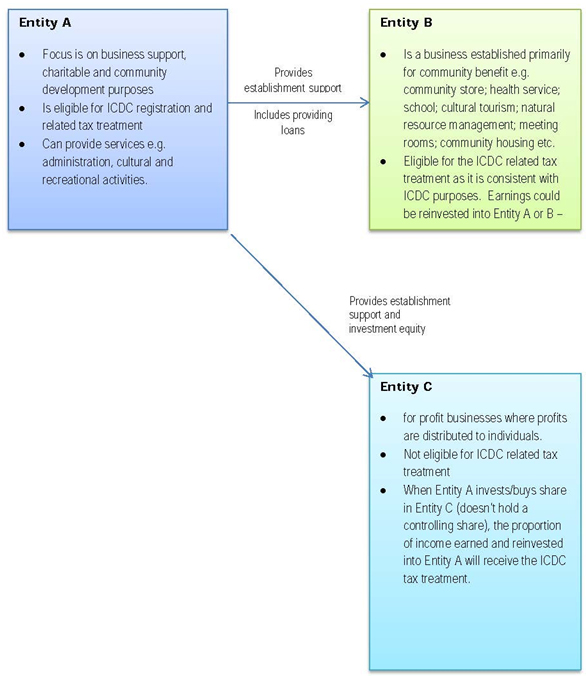

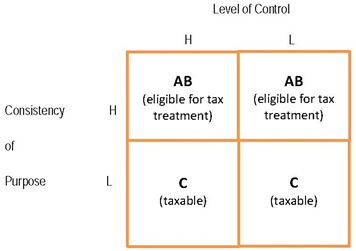

taxed in the fund.30 These payments would also be received in the hands of individuals subject to ordinary tax and social security laws. Pension payments will also be allowed as a direct distribution made from the ICDC. - Socio-economic development and support purposes — An ICDC will be able to provide administration services, and undertake/support the above community development activities toward the purpose of Closing the Gap. Support will also be provided to Indigenous businesses that are established for community benefit; and to Indigenous families to participate in the mainstream economy (see Figure 1 and 2).

Support provided to Indigenous community businesses can include facilitating the provision of advice (such as financial or business planning advice) and small loans to purchase equipment etc. These support activities would not involve large monetary figures and would be predicated on achieving the purpose of Closing the Gap. Some of these support purposes would meet the current test for charitable purposes, as demonstrated by cases which accept that the promotion of industry and commerce can be charitable.31

The MCA and NNTC consider that the role of an ICDC does not extend to the actual conduct of commercial activity (i.e. a 'for-profit' business that does not reinvest profits back into the ICDC). Community organisations are well placed to support the growth and development of commercial activities but the actual conduct of those commercial activities can often complicate and frustrate the ability of the community organisation and its governing body from fulfilling its goals and visions for the entire community.

- Accumulation for intergenerational benefits — As an incidental power to the above purposes, the ICDC should also mandate the accumulation and investment of funds for future generations once the funds held exceed a minimum threshold. To the extent permitted by law, accumulation within tax exempt entities such as charitable institutions and charitable trusts is currently income tax exempt. It is proposed that, contrary to current ATO practice, accumulation should be permitted in order to benefit future generations without the imposition of an arbitrary tax time limit, provided that significant amounts of ICDC assets are in fact applied each income year to the purposes set out above.

The class of authorised community development and support activities would be prescribed.

7. Connected Communities and Groups

An ICDC would direct the purposes set out above to the benefit of an Indigenous community or group, such as:

- the Indigenous persons resident in a locality or region;

- a group or groups of Indigenous persons with a shared traditional identity; and

- in some cases, a native title or statutory land rights holding or claimant group.

The relevant community or group would need to be wide enough to pass the public benefit test that applies to charities.

Persons outside the relevant Indigenous community or group (including non-Indigenous persons) may incidentally benefit from the infrastructure or services established by an ICDC but could not receive direct benefits.

An ICDC would be directed to community benefit, other than incidental personal gain (with substantive personal gain being pursued through other, non-tax exempt, structures). Individual monetary payments would only be made in limited circumstances within the purposes of the ICDC.

7.1 Sub-Fund Capacity

An ICDC should be in a position to accommodate and hold funds for smaller groups and individuals and be the recipient of multiple funding sources. This offers an opportunity to maximise the governance framework and administrative structures and to avoid duplication.

8. Tax Treatment

Contributions to an ICDC and income or capital gains in the hands of an ICDC would be tax exempt.

Funding paid by an ICDC for the community development purposes of the ICDC (other than income support via superannuation) would also be tax exempt in the hands of the recipient.

Payments for the benefit of an individual in the form of superannuation would be taxed concession basis applying the ordinary tax and social security laws. Other benefits (including grants for defined purposes such as the purchase of equipment or services) provided in accordance with the prescribed community development purposes would be tax exempt and not counted towards means testing for social security purposes.

Support provided to Indigenous businesses for private benefit can include establishment assistance (as described previously) and investment equity (the ICDC cannot hold a controlling share). Profits will receive the normal tax treatment.

The tax deductible status (and GST treatment) of payments made to an ICDC, in accordance with an agreement that provides the consent of an Indigenous community or group to development, must be confirmed.

Further, FBT exemption status could assist in ensuring that the ICDC, where relevant, can offer market competitive salaries to attract skilled and talented employees essential to assist good administration.

7 March 2013

Figure 1 — ICDC support towards Business Development

Figure 2 — Determining eligibility for the ICDC tax treatment

19 Dated 30 November 2010 and 31 August 2012.

20 Key trends include an increasing Indigenous population with a younger age profile than non-Indigenous Australians; a narrow range of industry's offering employment opportunities, highlighting the critical role of the minerals industry; the absence of a normally functioning economy and therefore reduced employment opportunities and restrictions on the availability of services; and a higher reliance on social welfare.

www.facsia.gov.au/internet/jennymacklin.nsf/print/beyond_mabo_21May08.htm.

www.facsia.gov.au/internet/jennymacklin.nsf/print/beyond_mabo_21May08.htm.

23 Larger ICDCs (Tier 2) will be required to appoint a qualified and independent trustee to provide advice and manage the accumulation fund. The fund will operate as a Trust. Small to medium sized (Tier 1) ICDCs will be able to choose whether or not to establish a trust and/or appoint a qualified and independent trustee. Further consideration will need to be given to determining how the tiers are defined e.g. funds held vs annual turnover. New Zealand currently applies a three tiered model to charity which is small (less than $2 million); medium (between $2 and $30 million) and large (over $30 million).

24 Even then, incidental benefits would not be permitted to be significant.

25 If constituted as a trust, an ICDC, being a purpose trust, would have no 'beneficiaries'.

26 Income Tax Assessment Act 1997 (Cth) items 1.1, 1.5, 1.5A and 1.5B, s 50-5.

27 Income Tax Assessment Act 1997 (Cth) item 2.1, s 50-10. See, eg, FCT v Wentworth District Capital Ltd [2011] FCAFC 42 [33], [42]-[43] (Gilmour and Gordon JJ) (facilitation of face-to-face banking services); Victorian Women Lawyers' Association Inc v FCT [2008] FCA 983 (French J) [163].

28 For instance, by applying the concessional contributions cap under Income Tax Assessment Act 1997 (Cth) s 292-20(1).

29 For instance, either the higher income threshold used for government co-contributions (Superannuation (Government Co-Contribution for Low Income Earners) Act 2003 (Cth), ss 6 and 10A) – proposed to be up to $46,920 as indexed from 1 July 2012; or the level of adjusted taxable income used for low income super contributions, which is $37,000 (Superannuation (Government Co-Contribution for Low Income Earners) Act 2003 (Cth), s 12C).

30 Income Tax Assessment Act 1997 (Cth), s 296-160.

31 Tasmanian Electronic Commerce Centre Pty Ltd v FCT (2005) 142 FCR 371; FCT v Triton Foundation (2005) 147 FCR 362.