Status: Completed

Date: 2016–2022

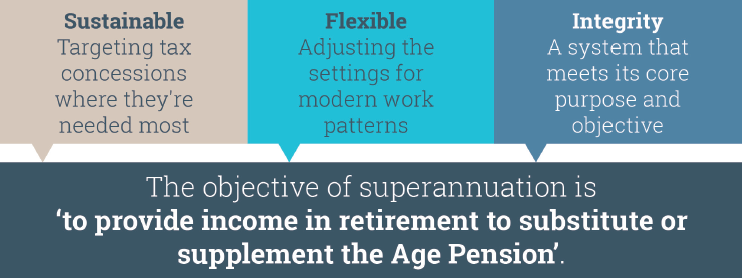

Legislation to implement the Government's superannuation reforms passed the Parliament on 23 November 2016. The superannuation reform package was announced in the 2016-17 Budget and amended following consultation. The changes improve the fairness, sustainability, flexibility and integrity of the superannuation system. On 9 November 2016, the Government introduced the Superannuation (Objective) Bill 2016, which will enshrine the objective of superannuation in legislation. It sets out a clear objective for superannuation: 'to provide income in retirement to substitute or supplement the Age Pension', which guided the superannuation changes. The Objective Bill is being considered by the Economics Legislative Committee, which is due to report on 14 February 2017. This website explains the Government’s reforms to the superannuation system. Most measures will take effect from 1 July 2017. Better targeted tax concessions will make the superannuation system more sustainable as the population ages and fiscal pressures increase. Savings also enable reforms that allow the system to work better for all Australians and increase its flexibility to align with the changing work–life patterns of modern Australia.

Consultation

Public consultation on three tranches of draft legislation and explanatory material was conducted between 7 September and 23 October 2016. A total of 156 submissions were received. 60 submissions were received on tranche 1, 69 on tranche 2 and 27 on tranche 3. Consultation roundtables were held in Melbourne, Sydney and Canberra on 5 October 2016, 6 October 2016 and 18 October 2016.

2016–17 Budget and related superannuation reforms include:

- Legislating the objective of superannuation

- Introducing a $1.6 million superannuation transfer balance cap

- Reforming the taxation of concessional superannuation contributions

- Lowering the annual non–concessional contributions cap

- Introducing the Low Income Superannuation Tax Offset (LISTO)

- Improving access to concessional contributions

- Allowing catch–up concessional contributions

- Extending the spouse tax offset

- Removing barriers to innovation in retirement income stream products

- Improving the integrity of transition to retirement income streams (TRIS)

- Abolishing the anti–detriment rule

- Streamlining administrative processes

Legislating the objective of superannuation

What is it?

- To enhance stability in the superannuation system, the Government will legislate that the primary objective of the superannuation system is “to provide income in retirement to substitute or supplement the Age Pension”.

How does it work?

- From 1 July 2017, a statement of compatibility must be prepared for any Bill or regulation relating to superannuation which sets out how the proposed legislation or regulation is consistent with the objective of superannuation. This will ensure that all proposed changes to superannuation in the future are better aligned with the objective of the superannuation system.

- The Government has also identified subsidiary objectives to support the primary objective of the superannuation system. The subsidiary objectives provide a framework for assessing the compatibility of a Bill or regulation with the objective of the superannuation system.

- The Financial System Inquiry recommended the Government seek broad agreement and legislate the primary objective of the superannuation system.

Who is affected?

- The objective of superannuation has been an important anchor for the superannuation reforms the Government announced in the 2016–17 Budget and on 15 September 2016.

Introducing the transfer balance cap

A factsheet is available on this topic.

What is it?

- From 1 July 2017, there will be a $1.6 million transfer balance cap on the total amount of accumulated superannuation an individual can transfer into the tax–free retirement phase. Subsequent earnings on balances in the retirement phase will not be capped or restricted.

- Savings beyond this can remain in an accumulation account (where earnings are taxed at 15 per cent) or outside the superannuation system.

- Transitional arrangements will apply. People already retired with balances below $1.7 million on 30 June 2017 will have 6 months from 1 July 2017 to bring their retirement phase balances under $1.6 million.

- The transfer balance cap will be indexed and will grow in line with CPI, meaning the cap will be around $1.7 million in 2020–21.

How does it work?

- Agnes, 62, retires on 1 November 2017. Her accumulated superannuation balance is $2 million. Agnes can transfer $1.6 million into a retirement phase account. The remaining $400,000 can remain in an accumulation account where earnings will be taxed at 15 per cent.

- Alternatively, Agnes may choose to remove all or part of the extra $400,000 from superannuation.

- Subsequent earnings on balances in the retirement phase will not be capped or restricted. The minimum drawdown will apply.

Who is affected?

- Less than one per cent of Australia’s superannuation account holders will be affected by the transfer balance cap.

- A balance of $1.6 million is approximately twice the level of assets at which a single homeowner currently loses entitlement to the Age Pension.

- The average balance for a 60–year old is expected to be $240,000 in 2017–18.

Reforming the taxation of concessional superannuation contributions

A factsheet is available on this topic.

What is it?

- From 1 July 2017, the threshold at which high income earners pay additional contributions tax (Division 293) will be lowered from $300,000 to $250,000.

- The Government will also reduce the annual cap on concessional (before–tax) superannuation contributions to $25,000 (currently $30,000 for those aged under 49 at the end of the previous financial year and $35,000 otherwise).

How does it work?

- In 2017–18, Madeline earns $260,000 in salary and wages. In the same year she has concessional su perannuation contributions of $30,000. Madeline’s fund will pay 15 per cent tax on these contributions. Madeline will pay an additional 15 per cent tax on $25,000 of the concessional contributions, resulting in these amounts effectively being taxed at 30 per cent.

- The $5,000 of contributions in excess of the cap will be treated as income taxed at her marginal rate. Madeline pays $1,600 income tax on her excess contribution. Madeline can choose to leave this excess in her superannuation (as a non–concessional contribution) or remove it from super.

Who is affected?

- Around 1 per cent of Australia’s superannuation account holders will be affected by the reduced Division 293 threshold.

- Around 3.5 per cent of Australia’s superannuation account holders will be affected by the lower annual concessional contributions cap.

Lowering the annual non–concessional contributions cap

A factsheet is available on this topic.

What is it?

- From 1 July 2017, the Government will lower the annual non–concessional contributions cap to $100,000 and will introduce a new constraint such that individuals with a balance of $1.6 million or more will no longer be eligible to make non–concessional contributions. As is currently the case, individuals under age 65 will be eligible to bring forward up to 3 years of non–concessional contributions.

- This is in place of the $500,000 lifetime non–concessional contributions cap announced in the 2016–17 Budget.

How does it work?

- The $1.6 million eligibility threshold will be based on an individual’s balance as at 30 June the previous year. This means if the individual’s balance at the start of the financial year (the contribution year) is $1.6 million or more they will not be able to make any further non–concessional contributions. Individuals with balances close to $1.6 million will only be able to access the number of years of bring forward to take their balance up to $1.6 million.

- Transitional arrangements will apply. If an individual has not fully used their non–concessional bring forward before 1 July 2017, the remaining bring forward amount will be reassessed on 1 July 2017 to reflect the new annual caps.

- Individuals aged between 65 and 74 will be eligible to make annual non–concessional contributions of $100,000 if they meet the work test (that is they work 40 hours within a 30 day period each income year). As per current arrangements, they will not be able to access the three year bring forward of contributions.

Who is affected?

- This measure is expected to affect less than 1 per cent of fund members.

Introducing the Low Income Superannuation Tax Offset (LISTO)

A factsheet is available on this topic.

What is it?

- From 1 July 2017, the Government will replace the Low Income Superannuation Contribution (LISC) with the Low Income Superannuation Tax Offset (LISTO).

How does it work?

- The LISTO effectively refunds the tax paid on concessional contributions by individuals with a taxable income of up to $37,000 – up to a cap of $500.

- This avoids the situation where low income earners pay more tax on contributions to superannuation than on their take home pay.

- The amount of the LISTO that an individual is eligible for will be paid into the individual’s superannuation account.

Who is affected?

- It is estimated that around 3.1 million low income earners will benefit from the LISTO, including around 1.9 million women.

Improving access to concessional contributions

A factsheet is available on this topic.

What is it?

- From 1 July 2017, the Government will allow all individuals under the age of 65, and those aged 65 to 74 who meet the work test, to claim a tax deduction for personal contributions to eligible superannuation funds up to the concessional contributions cap.

How does it work?

- Currently, an income tax deduction for personal superannuation contributions is only available to people who earn less than 10 per cent of their income from salary or wages. This limits the ability for people in certain work arrangements to benefit from concessional contributions to their superannuation. Under the new arrangements, more individuals will be able to make concessional personal contributions up to the annual cap.

- Chris has started his own online merchandise business but continue to work part-time at an accounting firm earning $10,000 as his business is growing. His business earns $80,000 in his first year and he would like to contribute $15,000 of his $90,000 income to his superannuation. He currently could not claim a tax deduction for any personal contributions. Under the changes, Chris could claim a tax deduction for his $15,000 of superannuation contributions.

Who is affected?

- This reform will benefit individuals who are partially self–employed and partially wage and salary earners – such as self–employed contractors, individuals employed by small businesses or freelancers – and individuals whose employers do not offer salary sacrifice arrangements.

- Around 800,000 working Australians are expected to benefit from this measure.

Allowing catch–up concessional contributions

A factsheet is available on this topic.

What is it?

- From 1 July 2018, the Government will help people ‘catch–up’ their superannuation contributions by allowing individuals with a total superannuation balance of less than $500,000 just before the beginning of a financial year to carry forward unused concessional cap space (for up to 5 years) to use if they have the capacity and choose to do so.

How does it work?

- Cassandra has a superannuation balance of $200,000 but did not make any concessional superannuation contributions in 2018–19 as she took time off work to care for her child. In 2019–20 she has the ability to contribute $50,000 in concessional (before-tax) contributions into superannuation ($25,000 under the annual concessional cap and $25,000 from her unused 2018–19 concessional cap which she can carry forward).

Who is affected?

- In 2019–20, this will help around 230,000 Australians who take time out of work, whose income varies considerably from one year to the next, or who find their circumstances have changed (e.g. mortgage payments or school fees have ceased) and are in a position to increase their contributions to superannuation.

- Individuals aged 65 to 74 who meet the work test will be eligible to access these new arrangements.

Extending the spouse tax offset

A factsheet is available on this topic.

What is it?

- The Government will make the current spouse tax offset available to more couples so they can support each other in saving for retirement.

How does it work?

- Currently, a tax offset of up to $540 is available for individuals who make superannuation contributions to their spouses with incomes up to $10,800. The Government will allow more people to access the offset by extending eligibility to those whose recipient spouses earn up to $40,000.

- There are no changes to the current aged based contribution rules. The spouse receiving the contribution must be under age 70 and meet a work test if they are aged 65 to 69.

Who is affected?

- It’s estimated that an additional 5,000 Australian families are expected to make use of this opportunity which will mostly benefit women who are more likely to be the lower income earner in families and have lower superannuation balances.

Removing barriers to innovation in retirement income stream products

A factsheet is available on this topic.

What is it?

- From 1 July 2017, the Government will extend the tax exemption on earnings in the retirement phase to products such as deferred lifetime annuities and group self–annuitisation products.

How does it work?

- Extending the tax exemption to deferred or pooled income stream products will encourage providers to offer a wider range of products. This will provide more flexibility and choice for retirees and help them to manage consumption and risk in retirement better – particularly longevity risk, to avoid people outliving their savings.

Who is affected?

- Retirees wanting more flexibility and choice in retirement products will benefit from this change.

Improving the integrity of transition to retirement income streams

A factsheet is available on this topic.

What is it?

- The Government will remove the tax exempt status of income from assets supporting TRIS. These earnings will now be taxed concessionally at 15 per cent. Individuals will also no longer be allowed to treat certain superannuation income stream payments as a lump sum for tax purposes.

- This will help ensure that TRIS are fit for purpose and not used as a tax minimisation strategy.

How does it work?

- Sebastian is 57 years old and has reduced his working hours. As a result, his earnings fall from $80,000 to $60,000. Sebastian commences a TRIS that pays him $20,000 per year. Currently, Sebastian pays tax on his income ($60,000) but his superannuation fund pays no tax on the earnings on assets supporting his TRIS. Under the Government’s changes, the earnings on Sebastian’s superannuation assets supporting TRIS will be taxed at 15 per cent.

- The tax treatment of income streams in the hands of the individual will not be changed. For most individuals this will mean they are tax free, or taxed at the individual’s marginal tax rate less a 15 per cent offset.

Who is affected?

- Around 110,000 people will be affected by these changes.

Abolishing the anti–detriment rule

What is it?

- From 1 July 2017, the Government will remove the anti-detriment provision which allows superannuation funds to claim a tax deduction for a portion of the death benefits paid to eligible dependants. This provision is outdated and inconsistent with other parts of the tax law.

How does it work?

- An anti-detriment payment is an amount that can be included when a lump sum death benefit is paid to a dependant. The payment represents a refund of the 15 per cent tax on contributions that has been paid by the deceased member over their lifetime.

- Superannuation funds will no longer be able to claim a tax deduction for anti–detriment payments made to eligible dependants.

Who is affected?

- This change will provide consistent treatment of death benefits across all superannuation funds. Lump sum death benefits paid to eligible dependants will continue to be tax free.

Streamlining administrative processes

What is it?

- From 1 July 2017, the Government will:

- clarify that the Commissioner of Taxation can issue taxpayers with a single notice for all of their tax liabilities in a financial year;

- remove the compulsory obligation for superannuation providers to calculate an end benefit cap for certain defined benefit members; and

- align the objection rights that apply to discretionary decisions made by the Commissioner in respect of non-concessional contributions with the objection rights that apply to discretionary decisions in respect of concessional contributions.

- From 1 July 2018, the Government will replace the existing release authority arrangements with standardised timeframes and processes, and introduce a default process for individuals who do not make an election (or who wish to undertake the default process) when dealing with all release amounts from superannuation.

How does it work?

- A single notice will make it less confusing and easier for taxpayers to seek advice on all of their tax liabilities at the one time. In determining whether an individual’s notices should be combined, the Commissioner of Taxation (the Commissioner) will take into account the benefits to the taxpayer from consolidating them.

- Superannuation providers will only be required to calculate an end benefit cap for certain defined benefit members when they become entitled to an end benefit when an individual has a deferred Division 293 tax liability with the ATO. This measure also removes the need for individuals with defined benefit superannuation interests to provide the Commissioner with an individual end benefit notice.

- Aligning the objection rights corrects an inconsistency in the law to ensure that individuals have the same objection rights when they disagree with a discretionary decision made by the Commissioner in respect of non‑concessional contributions as they currently do for discretionary decisions made by the Commissioner in respect of concessional contributions.

- Changes to the release authority regime introduce a common framework for the release of amounts from superannuation in relation to excess contributions to superannuation, tax liabilities related to these contributions and Division 293 tax (excluding amounts relating to Division 293 tax debt account discharge liabilities). Amounts can still be released from superannuation in similar circumstances as they were previously, but this occurs under a common simplified framework for both individuals and superannuation providers.

Who is affected?

- These measures reduce the compliance burden on taxpayers and superannuation providers and improves efficiency in the superannuation system.

- Aligning the objection rights ensures procedural fairness for individuals when dealing with the Commissioner.