Downloads

Good afternoon ladies and gentlemen, and thank you for giving me the opportunity to share with you my thoughts on the global financial crisis and the road to recovery.

As you know, last week marked the one year anniversary of the collapse of Lehman Brothers – an event that sent shock waves around the world. And as we now know, this precipitated a global recession.

Recent economic and financial indicators suggest that the global economy may be starting to recover from its deepest recession since the Great Depression. Optimism that the worst of the global recession is over has been reflected in strong rebounds in global equity markets and heightened consumer and business confidence.

While the Australian economy has been less affected by the global recession than other advanced economies, the prospect of recovery is no less welcome here.

With the anniversary of the collapse of Lehman Brothers having just passed, it is an opportune time to reflect on the worst global downturn in 75 years and the road to recovery.

The Global Financial Crisis and its impact on the global economy

As we are all aware, the financial crisis that triggered the global recession emerged from the US housing market – particularly the 'sub-prime' component and the complex financial instruments derived from sub-prime mortgages.

But in broad terms, the scale and scope of the crisis can be attributed to a failure to identify and manage risk, particularly by those financial institutions that turned out to be of systemic significance for the global financial system. Of course, the extent of this problem only began to become apparent as losses associated with the now so-called “toxic assets” started to materialise.

As losses mounted, and a number of financial institutions failed, the remaining institutions lost confidence in each other's solvency – unsure of counterparty exposure to toxic assets. Credit markets began to seize up. This precipitated falls in business and consumer confidence, massive falls in global equity markets, and large declines in global production and trade.

The impact of the crisis has been severe across the globe.

In the period immediately before the crisis, the global economy was growing at its fastest sustained pace in well over thirty years. Since the September quarter 2008, almost all advanced economies have recorded a technical recession. And for 2009, the global economy is expected to experience its first annual contraction in over six decades.

Impact on the Australian economy

Australia was never going to be immune from the global turmoil. Ours is a small economy with significant trade and financial linkages to the rest of the world. And the dramatic downturn in the global economy has had unavoidable consequences for the Australian economy. Growth has slowed; employment has fallen; company profits have taken a substantial hit; and incomes and wealth have declined.

That said, the Australian economy has proved to be remarkably resilient.

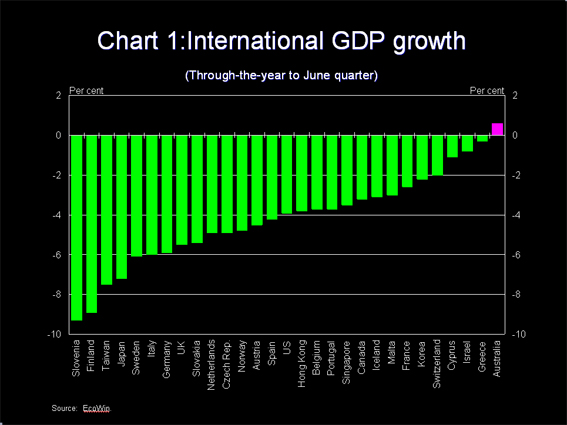

Chart 1 – International growth comparison

As you can see, Australia has performed remarkably well internationally. In fact, Australia is one of only four advanced economies not to have fallen into technical recession. A truly remarkable result.

While there are a number of reasons why the Australian economy has weathered the global storm better than most comparable economies – there are three in particular I would like to mention.

Firstly, Australia's financial system, and in particular the banking system, has remained relatively well-functioning throughout the crisis – providing a buffer from the global financial turmoil.

Overall, Australia's banks have remained profitable and well-capitalised. Importantly, and in contrast to many of their overseas counterparts, Australian banks entered the crisis period with relatively low exposure to high-risk assets. Indeed Australia's four largest bank holding companies are among a group of only nine of the 100 largest banking groups in the world rated “AA” or above (by Standard and Poor's).

The resilience of Australia's banking sector is in no small part due to the quality of our financial regulatory system, which has benefited from significant reforms undertaken by successive governments.

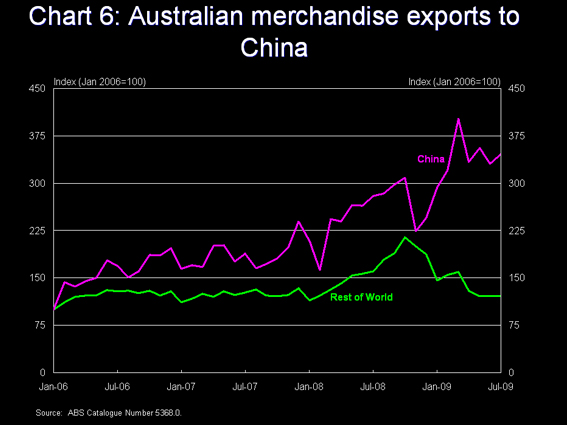

The second reason I would mention is China's continuing strong demand for our commodity exports. The aggressive stimulus measures put in place by the Chinese Government have largely targeted infrastructure investment, boosting China's demand for Australian commodities such as iron ore and coal. This, in part, explains why, despite the global downturn, our export volumes have remained remarkably buoyant – increasing by around 2 per cent since the September quarter 2008. I will come back to the importance of China to the Australian economy a little later.

The third reason for Australia having weathered things so well is the significant and timely policy responses of the Government and the Reserve Bank of Australia – including discretionary fiscal policy, monetary policy easing, and financial market initiatives such as the Government guarantees of bank liabilities.

Government action

Policy advisers around the world have been challenged by the mental gymnastics required to execute the enormous leap from the pre-crisis world to a post-Lehman landscape. Partly for that reason, in many countries, the fiscal response has come much later than it should. This is a particular concern because in a global recession, there are large spill-over benefits from coordinated action.

With regard to the Government's fiscal stimulus measures, considerable thought was given to the structure and timing of various policies, based on the well-accepted tenets of good discretionary fiscal policy: that it be timely, temporary and targeted.

The first phase of fiscal measures was designed to provide immediate support to growth – largely through transfer payments targeting the most cash-constrained households. Subsequent measures are largely investment-related, most notably infrastructure investment under the Nation Building and Jobs Plan. As the impact of the transfers wanes, the investment-related phases will continue to support growth, giving a recovery in the private sector time to take hold.

It is clear that the cash transfers have provided support to household consumption. Recent surveys conducted on the effectiveness of the transfers suggest that a large proportion of the transfers have already been spent. For the June quarter 2009, we estimate that the transfers contributed just over 1 percentage point to consumption growth. It is also worth noting that the confidence effects on consumers from the broader policy responses, and from the fact of Australia's general economic performance being so good relative to the rest of the world, may have boosted the impact on consumption.

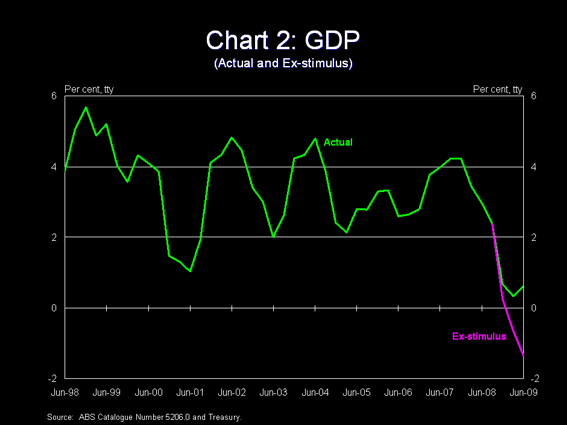

Chart 2 – Impact of stimulus on GDP growth

The Australian economy grew in the first half of this calendar year, with GDP growth at 0.6 per cent through the year to the June quarter. We estimate that were it not for the fiscal stimulus measures, the economy would have contracted in each of the December, March and June quarters, with GDP falling by 1.3 per cent over the year.

The global recovery

The policy responses by governments and central banks around the world have certainly supported global growth, and there are now some signs that the global economy is beginning to recover.

There has been a marked improvement in global fin

ancial conditions since the beginning of the year, with the degree of stress in the world's key financial systems having fallen to the lowest levels since mid-2007.

Global equity markets have rebounded strongly, albeit from very depressed levels. Credit spreads are narrowing - reflecting both a perceived decline in counterparty-risk among financial institutions and expectations of a global recovery. Wholesale funding markets, which effectively shut down for a period after the Lehman Brothers collapse, are showing encouraging signs of recovery.

Recent economic data suggest that the bottom of the downturn may already have passed. Following three quarters of contraction, the OECD area recorded a flat outcome in the June quarter. Importantly for Australia, growth among some of our major trading partners in the Asian region bounced-back strongly in the June quarter – following some severe contractions in the December and March quarters. More recent partial data provide further evidence of a recovery, with ongoing improvements in measures of industrial production, trade flows and consumer and business confidence.

These developments have led to the IMF forecasting a nascent economic recovery in 2010. While the IMF downgraded its global growth forecast for 2009 to a 1.4 per cent contraction in its July update, it upgraded its growth forecast for 2010 to 2.5 per cent.

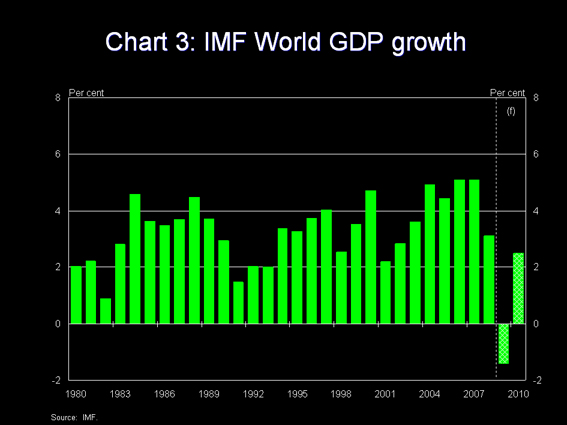

Chart 3 – IMF forecasts

Significantly, this upgrade follows five downgrades over the previous nine months. And the IMF has foreshadowed that it will be announcing another upward revision for 2010 in October.

Notwithstanding these positives, there is still considerable uncertainty surrounding the global outlook; the global economy remains fragile. Critically, just as the improvement in conditions reflects concerted policy action, the sustainability of a global recovery is heavily reliant on the continued implementation of stimulus commitments.

The Australian recovery

As is the case for the global economy, there are tentative signs that the Australian economy is recovering, and that the downturn is likely to be less severe than thought earlier in the year.

At Budget, we were expecting GDP to decline by ½ of a per cent in 2009-10. But recent indicators suggest a more optimistic outlook. GDP outcomes for the March and June quarters have surprised on the upside, buoyed by policy stimulus. Measures of business and consumer confidence have surged in recent months - in some cases, to levels above those prior to the onset of the global financial crisis. And employment growth has not slowed to the extent that was expected.

However, the key to a broad and sustainable recovery is the restoration of private demand. Government stimulus will provide further support to aggregate demand in the near term, but private sector demand needs to gather momentum. While the encouraging economic indicators are cause for optimism, significant challenges remain for the Australian economy in the critical phase ahead.

A key risk to the timing and speed of a recovery in private demand is the near-term weakness in income growth – something that is not often given the same degree of attention as real economy developments.

Income growth is expected to be very weak in 2009-10 – with declining corporate profits and subdued household income growth. This largely reflects significant price falls for Australia's non-rural commodity exports, which have driven a decline in the terms of trade of over 15 per cent.

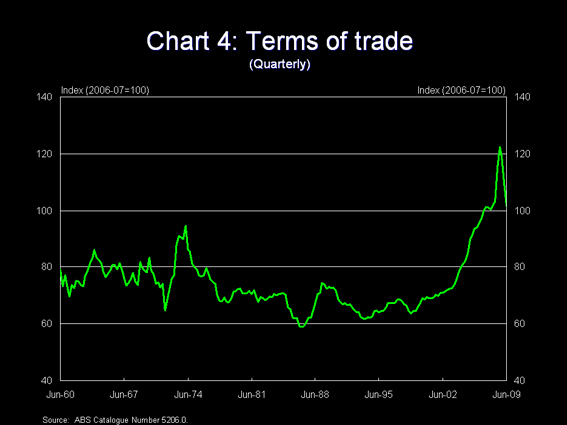

Chart 4 – Terms of trade

Overall, the unwinding of commodity prices represents almost a $20 billion fall in export income, and thus nominal GDP. We would expect that this will weigh on business investment and household consumption going forward.

A rebound in private investment, particularly business investment, is crucial to any sustained recovery. But the outlook for business investment remains very uncertain. In aggregate, it is expected to remain very weak in the near term, with investment-related stimulus measures providing some degree of offset.

Overall, business conditions remain challenging - the large rebound in business confidence notwithstanding - with low levels of capacity utilisation and subdued forward orders, coupled with declining profits. For small business, credit growth remains below pre-crisis levels, reflecting reduced demand for funds for both investment and operational purposes, and tighter borrowing conditions at the margin.

However, as was the case prior to the global recession, business investment is a tale of two sectors. Resource-related investment is expected to fare relatively well over the period ahead, supported by some truly massive projects – particularly in Western Australia. In contrast, the outlook for the commercial property sector remains tough. Credit constraints and rising vacancy rates – which are expected to worsen in the near term – represent significant dampeners on growth in this sector.

Slower domestic economic activity will continue to weigh on the demand for labour, household incomes and thus consumption. Employment is forecast to contract through to early-2010, with the unemployment rate expected to peak in late 2010. However, the unemployment rate is now not expected to reach the peak of 8½ per cent forecast at Budget.

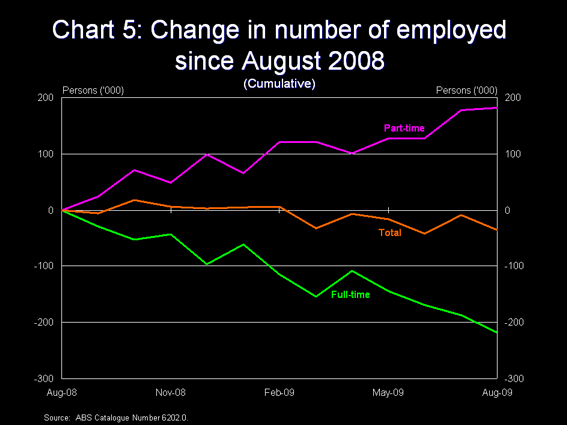

An important feature of the current downturn has been that employers have refrained from widespread labour shedding, by reducing staff working hours – significantly cushioning the unemployment rate. This is reflected in the relative movements in full-time and part-time employment. Over the last year, more than 200,000 full-time jobs have been lost, but part-time employment has increased by more than 180,000 over the same period. As a result, the unemployment rate has only risen to 5.8 per cent – one of the lowest among all advanced economies.

Chart 5 – Full-time and part-time employment

While total employment has fallen only slightly, the switch from full-time to part-time employment has led to a substantial fall in total hours worked. In fact, the fall in hours over the last year is equivalent to the loss of more than 230,000 full-time jobs. Thus, the modest rise in unemployment masks a more severe income effect from the fall in hours worked.

As I mentioned earlier, China has provided support for our commodity exports during the global recession - largely reflecting the Chinese Government's infrastructure-focused stimulus measures. In fact, since September 2008 our merchandise exports to China have increased by 16 per cent in value terms, partially offsetting the 36 per cent fall to the rest of the world.

Chart 6 – Merchandise exports

Aside from the stimulus measures, increased commodity demand from China may reflect some inventory building. In addition, there are reports that Chinese industry may be substituting away from domestic commodities to imports – with some Chinese commodity production going off line due to pricing pressures and safety concerns.

While this is all good news for Australia's commodity exports, our increased reliance on China also represents a key short-term risk - particularly given that not all o

f the aforementioned effects can be considered permanent, and the fact that China's demand does not extend across all our export industries. Sustained and broad export growth over the period ahead will require a widespread global economic recovery.

Withdrawal of the stimulus

As is the case for many other economies, a sustained recovery in the Australian economy is reliant on the continued implementation of existing stimulus commitments.

There has been significant public discussion around the recent strength of the economy and the need for the next phase of fiscal stimulus measures, particularly in light of stronger-than-expected growth outcomes. However, I would caution against the conclusion that the success of the stimulus to date is an argument for winding back that which is still in the pipeline.

The fiscal stimulus has been designed so that it withdraws gradually, having a reduced impact on growth going forward. The impact of the stimulus is estimated to have reached its peak in the June quarter, and will diminish in the quarters that follow, as an anticipated recovery in private sector activity begins. Withdrawing the stimulus more quickly would risk stalling the economy and causing a steeper rise in the unemployment rate.

It should be further noted that even with the stimulus measures in place, and taking into account the run of recent good economic news, growth is still expected to be sluggish going forward – with the Australian economy expected to record below trend growth in both 2009-10 and 2010-11, and to be operating significantly below capacity for some time after that.

Closing

While a modest recovery in global growth appears to be underway, the nature of the current economic crisis continues to demand that countries take coordinated policy action. To this end, Australia is working closely with other countries and within international fora to help stabilise the global financial system, to restore global economic growth, and to strengthen international financial institutions.

Just as importantly though, we cannot allow the present crisis to excuse slippage in the progress of longer-term reforms in Australia.

When the shock waves of the global financial crisis hit our shores in 2008 they struck a continent undergoing massive structural change. The global recession and domestic economy weakness has obscured the intensity and scale of that structural change, but it will become sharply evident as growth resumes.

As the global financial crisis hit, the Australian economy was being transformed by four very large long-term developments.

First the information and communications technology revolution, which had dramatically lowered barriers to globalisation, facilitated the rapid deployment of new production processes in virtually all industries, and massively accelerated the servicisation of our industrial landscape – including in the traded sectors of the economy.

Second, climate change, which appeared already to be having a significant impact on this driest inhabited continent on earth – challenging strong assumptions about the sustainability of various forms of land use in many parts of the country and forcing all Australians to confront the form and implications of climate change mitigation strategies.

Third, the re-emergence of China and India, which had reversed, in spectacular fashion the 30-year trend decline in Australia's terms of trade following the global oil price shock of 1973: and had exposed capacity constraints in almost all forms of economic infrastructure, attracted unprecedented inflows of foreign capital, pushed up the value of the Australian dollar, and started raising big questions about the longer-term competitiveness of some of our non-resource based export and import-competing businesses.

And fourth, profound demographic change, due to the collapse in the Australian fertility rate in the 1960s and 1970s, which had provided a 30 year boost to our GDP per capita and government tax revenues, but which was just about to start having precisely the opposite effects. At the same time, partly because of a recent slight increase in the fertility rate, but mostly because of a considerable increase in net immigration flows, we had been revising upward our peak population estimates – with the latest projections of our mid-century population being fully 25% larger, at 35 million, than the previous official figure – raising even stronger questions about land use sustainability and infrastructure requirements, both economic and social.

Four big long-term developments, together implying a structural revolution in the Australian economy.

And all of them providing a strong case for large-scale structural policy reforms.

These structural policy challenges are not going to go away simply because we are experiencing a global recession.

Thank you.