Downloads

Introduction

It is a great pleasure to be asked to speak with you this evening, and a particular honour to present a Gruen lecture, named after Fred Gruen, a widely respected Economics professor here at ANU and the father of David Gruen, a close colleague of mine at Treasury. Fred Gruen was an academic economist who had a keen interest in public policy and its impact on ordinary people. His concern to find workable solutions to contemporary policy problems fits very well with what I want to talk about tonight.

I've been lucky enough to have spent a significant part of my working life thinking about tax, from both a policy and law design perspective. It is something that gets more interesting as time goes on, but it certainly doesn't get any easier.

Jean-Baptiste Colbert, a French finance minister in the 17th century, famously quipped that 'The art of taxation consists in so plucking the goose as to obtain the largest possible amount of feathers with the smallest possible amount of hissing'. Taxation is a practical art, and governments will always get hissed at. Tax debates in the public domain are intensely political, and I certainly don't want to stray into such debates given my role as a policy advisor, not a policy maker.

But we all know that for the government to finance needed public services, it needs to raise revenue from taxation. And levying taxes has major economic costs well beyond the costs of collecting the revenue. Taxation has distorting effects on behaviour that will affect individuals' decisions about how much they work, how much and through what vehicles they save, and how much and what they consume, as well as decisions by business about investment and production. The costs of tax, then, stem not from the money it raises - because at least that can be put to good use - but the key economic decisions it changes.

In theory the government could raise much of its revenue from taxes that perfectly correct for external costs of one kind or another, and this could do away with the type of distortions I've just mentioned. But people's preferences are highly heterogeneous and the detailed information needed to set such taxes is in practice not available. It is therefore very difficult for the government to set such 'corrective' taxes in a way that avoids introducing unintended incentives. So this avenue will usually result in some net efficiency losses.

We must also remember that efficiency is not the end of the story. A tax's perceived fairness is a crucial determinant of its social acceptability, and therefore its capacity to remain part of the policy fabric. So we must seek to raise the revenue we need at the lowest possible cost, while recognising that some cost is unavoidable - and the way we do that must be seen as fair.

Moreover, the challenges of an ageing population, even with expenditure restraint, will place further pressure on revenue. Given the many worthwhile things that we citizens will probably want Governments to do more of in future raising the tax revenue needed at the lowest cost to public wellbeing will become increasingly important.

All fairly standard stuff so far. What I would like to drill into is how our system might in future cope with a rapidly changing external environment but to set the scene for this, I would first like to paint a picture of what we know, and just as important, what we don't.

The recent history of tax

Perhaps we should start with some of the recent history of tax.

Before the twentieth century, and in the early part of it, governments' revenue raising options were much constrained by practicality in a world where record keeping and information gathering were more limited than they are now. Distributional concerns were often addressed by taxing tangible things that rich people tended to have more of.

Some of the results were less than wonderful. Window taxes - which was a property tax based on the number of windows in a house - saw windows bricked in and road frontage taxes led to long thin homes.

Unintended Consequences of Tax

These were early lessons that if you change the "rules of the game" to try to extract money from current behaviours, you are likely to change behaviour, put a hole in the tax base and end up with less than desirable outcomes. This is not to deny that taxes can be used effectively to influence behaviour, but the dangers of distorting behaviour when you don't want to are an important lesson, and one that has been hard to learn.

With increases in the administrative capacity of governments, and with demands for war finance, policy was pushed towards the taxation of income generally, rather than tangible proxies for it. The work of Robert Haig and Henry Simons in the 1920s and 30s made the case for comprehensive income taxation, and this remained the dominant paradigm for the next 40 odd years.1

Across developed countries, the need to raise more revenue to meet the demands of the post-war welfare state led to pressure on the personal tax base, and two broad directions emerged. High marginal rates ensued (particularly in the US and Australia) and European countries did the same, as well as pursuing a fairly comprehensive model for taxing consumption via the Value Added Tax. But by the 1970s, at least in Australia, the damaging effects of high marginal rates on personal income became painfully obvious, in terms of incentives to avoid and evade tax. It was clear that change was needed. This led to the McMahon government commissioning the Asprey review in 1972.

Justice Ken Asprey's report, delivered in 1975, provided a coherent set of recommendations to, amongst other things, broaden the income tax base. Much of this vision became a reality through the 1980s as governments introduced reforms that included taxing capital gains, fringe benefits and foreign source income.2

I suspect those in my role were increasingly comfortable with these directions, but not everyone agreed.

Throughout the 80s and 90s and up until now the PIT has continued to be the "workhorse" of the Australian tax system, hauling most of the load but sometimes a little confused about its direction.

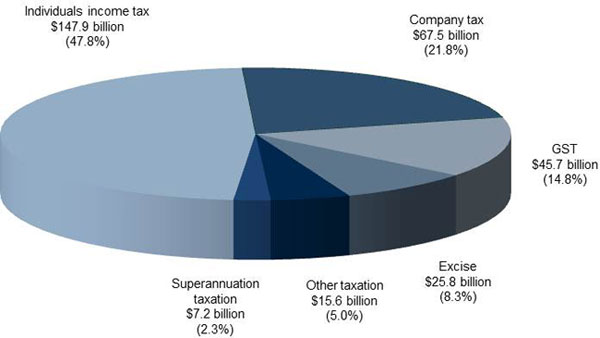

Sources of tax revenue, 2011-12

A central issue for the personal income tax is the concern that a comprehensive income tax will lead to inter-temporal distortions, as it would double tax savings. These ideas were formalised by Nicholas Kaldor and John Hicks and gave rise to recommendations for a broad based personal expenditure tax.3

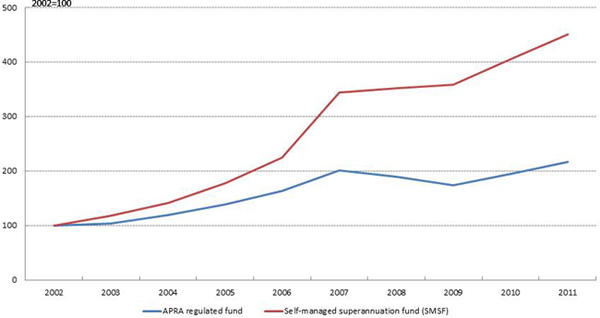

It's interesting to now reflect on the current system. While it is nominally a comprehensive income tax at the personal level, the capital gains tax discount and the treatment of superannuation has shifted it closer to an expenditure tax model. And not surprisingly, people do seem to be adjusting their behaviour to take advantage of the preferential tax treatment of these forms of saving, as the rise in self-managed super funds suggests.

Growth in assets in Super funds

While these developments have been under way on the personal tax side, what has been happening with business tax?

Under either the Haig-Simons or Kaldor-Hicks view, company tax - throughout the common-law countries at least - was seen as a backstop to the personal tax system, reducing the incentive to re-

characterise labour income as business income, and taxing the domestic activity of foreign residents.

Since the late 1970s theory has pushed in two different directions on company tax. The base-narrowing camp argue that by taxing only 'pure profit' or economic rent, and thereby exempting the normal return to capital, investment decisions will not be affected. One of the policy recommendations that sprang from this reasoning was a cash flow tax of the kind proposed by the report of the Meade Committee in the UK in 1978.4 Cash flow tax is often seen as the 'holy grail' of corporate tax. It is, however, limited in its uptake due to its inherent volatility, narrow base and difficulties in transitioning to it from an income tax.

In an effort to find a way through these challenges but still exempt the normal return to capital from tax, a variant known as an allowance for corporate equity was recommended by the Gammie Report in 1991.5 More recently, the Mirrlees Report has also recommended a move to an ACE for the United Kingdom.6

On the other side, those arguing for a broad base, low rate approach to capital taxation, might favour a Comprehensive Business Income Tax. The idea was first articulated by the US Treasury in 1992.7 A CBIT would impose tax on the whole of the return to capital, regardless of how it has been financed. In essence this would mean no deductions for interest expenses and allow a cut in the headline corporate tax rate.

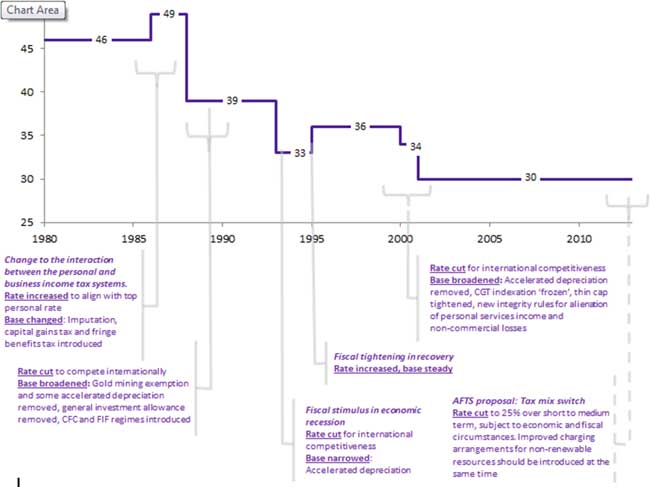

Australia's experience has been a mix of approaches. At the broad level, the reductions in the corporate tax rate from the mid 80s onwards and, most notably, those arising from the Ralph Review in 1999, have all been funded through broadening the company tax base, principally by removing accelerated depreciation.8 So we seem to have been expanding the base in order to cut rates.

Timeline of company tax changes

A closer inspection, however, might suggest a different conclusion.

Traditionally the alternatives for the company income tax have been a residence base (that is, taxing residents on their world-wide income) or a source base (that is, taxing income where production takes place).

The decision implemented in 2006 to largely exempt non-residents from CGT, for example, seems to have the curious effect of gradually converting our source based income tax to a weakened residence based tax, which exempts foreign source income. And that's before we confront the full challenges of globalisation!

Of course Australia, with its abundant natural resources and several strong oligopolistic sectors of the economy that earn large location specific economic rents, is really a country that needs to protect its source based income tax. But this has continued to be difficult.

So far I've tried to paint a picture of where we sit vis-à-vis our personal and company income tax. There are many other taxes we could discuss, but I think leaving it at these two for the moment will be enough.

I would now like to touch briefly on the incentive effects of these two taxes and then where the changing external environment might push them.

Before we begin, we should note that when we are thinking about policy in our information rich environment, it is important to be clear about what we know and what we don't. And where there is genuine uncertainty, as there often is, policy design should be robust rather than engineered to fit a particular state of the world.

Personal Tax

On personal tax we have a lot of information.

We have information about individual and family incomes, education, family circumstances and the like. And we can say for a hypothetical individual or family in a particular circumstance what a change will mean.

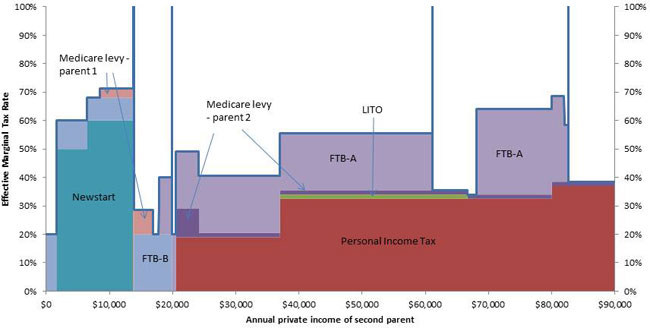

For example, we can model the interactions of the tax and transfer systems on any particular family type.

Effective Marginal Tax Rates

Couple with children aged 13 and 15, 2012-13

People might be familiar with this STINMOD-type chart. From it we can see that the EMTR faced by a second income earner who is earning $21,000 and thinking about working a little more, would be 49 per cent, made up of withdrawal of Family Tax Benefit Part A (20 per cent), personal income tax (19 per cent) and Medicare levy shade in (10 per cent).

But for all this knowledge and detailed modelling there is still a lot we do not know.

For example, we know that a policy change will change incentives but it is hard to predict just how individuals will react. A tax increase will change the relative costs of labour and leisure, but how will this change an individual's labour supply decision? Will their labour supply curve continue to slope upwards or will it start to bend backwards? And will the demand for their labour remain unchanged? And what about the family? Might the labour supply decision be made jointly? We cannot give much of an answer to these questions.

But, you might say, at least it's a start.

The current "accepted wisdom" with respect to high marginal tax rates is that they are a disincentive to labour force participation, and possibly a disincentive to people accumulating high levels of human capital, and are thereby a negative influence on productivity. We might also suspect that high rates of personal income tax may encourage mobility of labour, i.e. emigration. But is this the case for Australia? As I mentioned earlier, in the 50s and 60s both the US and Australia had unsustainable top marginal rates above 90 per cent 70 per cent respectively. But back then the challenge was the availability of different structures to avoid tax. That challenge is still with us today but we also face much greater international mobility of labour.

The data we currently have do not suggest our PIT rate schedule is pushing people overseas. But how confident can we be that this will remain the case in the future?

Business taxation

Turning to business tax, we should remember that, while business and personal tax are often regarded as separate domains of policy, they are intimately related and the inter-relationship between them has become more important and complex over time.

With the introduction of dividend imputation in 1987, the corporate and personal tax systems became more closely integrated so that investment income would not be double taxed for domestic investors.9 This meant that the tax rate on dividend income for domestic investors would be their marginal tax rate on personal income. However, capital gains realised by individual taxpayers have received a 50 per cent concession since 1999, which provides an incentive to convert income to capital gains where possible.

Other structures complicate matters further because the way an investment is held and the timing of activities can significantly change tax outcomes. Assuming owners respond to these incentives, business managers are also likely to do so.

One of the largest and most rapidly growing legal structures is superannuation. While capital income, such as dividends, would otherwise be taxed at marginal personal rates, superannuation contributions are taxed at a flat 15 per cent rate, earnings are generally taxed at 15 per cent and most benefits paid out over age 60 are tax free. Accordingly, a super fund investing in a company and then receiving

franked dividends would be entitled to a refund of 15 per cent, and can then drive its earnings tax to zero.

The total income of superannuation funds rose from $50 billion in 2001-02 to $143 billion in 2006-07, before falling to $112 billion in 2009-10. Superannuation funds own roughly 30 per cent of the ASX.10 Given the refundability of franking credits, it's not surprising that super funds demand the distribution of fully franked dividends. This is great for shareholders in the short term, but a challenge for companies because it eats into retained earnings that may otherwise be used to finance investment. The tax free treatment of superannuation investment returns during the retirement phase adds another twist, with potential implications for business decisions.

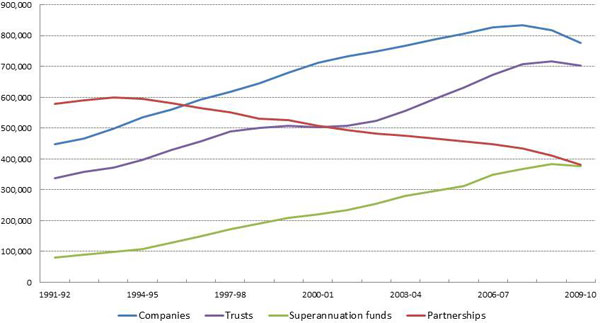

Trusts other than superannuation funds have also become an integral part of the tax system. Their number has increased from a little over 500,000 in 2001-02 to a little over 700,000 in 2009-10.11 The total net income of trusts rose from $57 billion in 2001-02 to $190 billion in 2006-07, before falling to $123 billion in 2009-10 due to the financial crisis.12 The net capital gains earned through trusts rose dramatically from under $10 billion in 2003-04 to over $30 billion each year from 2005-06 to 2007-08, spiking to over $60 billion in 2006-07. Since then, they have fallen back as capital losses have offset these gains.

Growth in different business structures

Many small businesses have a trust structure combined with a company and possibly a self-managed super fund which allows them to effectively manage their taxes. For example, income could be derived as labour income, or paid out as a dividend and routed through the trust, or reinvested to build up the capital value of the business and, perhaps, rolled over into the self-managed super fund when the business is sold.

Complex? Certainly is. And in trying to examine questions of fairness it just gets harder.

While companies are the legal entities that actually remit company tax to the ATO, they are not the ones that actually bear the economic burden of company tax. Indeed they are not able to do so. Ultimately, the economic burden of any tax must be borne by individuals in their capacity as workers, consumers or the owners of capital.

In the company income tax context, the burden of the tax is often passed to shareholders by way of lower dividends or retained earnings, or to consumers, by way of higher prices.

The burden of company income tax may also be passed to workers by way of lower wages than they would otherwise receive. When company tax is changed, capital owners or customers are likely to face the entire short term burden or enjoy the entire short term benefit because, among other things, changes in the capital stock happen over an extended period and wages take time to adjust. However, in the longer run firms are much more willing and able to change their investments, so that a large portion of the company tax burden will actually fall on workers.

This is the case for most businesses, but we need to remember that in cases where the company income tax taxes pure profit - that is, the profits that shareholders enjoy beyond the level they need to maintain their investment in the business - theory tells us the burden should fall on shareholders.

How the long run costs are shared between shareholders, consumers, and wages depends on the nature of the particular factor and product markets that the business operates in. The mobility of tax burdens is essential to understanding the impact of our taxes, and is becoming more crucial as Australia becomes more and more closely integrated into a global economy.

As Alan Auerbach notes in "The Mirrlees Review: A US perspective" taxing corporations is a complex issue, and has become more complex since Meade first suggested shifting the corporate tax to a rent tax.

He identifies three issues for the US.

First, the growth in importance of multinational enterprises (which now account for around 25% of world GDP) has made the treatment of international capital flows a key issue of first-order importance.

Second, financial innovation has increased the ability of corporations to exploit differences in the tax treatment of debt and equity.

Finally, the corporate-noncorporate boundary has shifted, with a much greater share of business activity and income escaping the traditional corporate form and the corporate income tax.13

For Australia, these issues are even more profound.

As multinationals have considerable latitude in choosing where to locate their production, they are likely to be more sensitive than other businesses to the tax rates that apply to them. Of course, other factors are important too: the quality of the labour force, infrastructure, the rule of law, and access to both raw materials and markets.

Despite rules to contain profit shifting, multinationals also have some latitude about where to locate their profits - and here tax is likely to be a, if not the, primary driver.

So setting tax policy to deal with multinational enterprises is an increasingly difficult task. There are a range of conflicting objectives. Policy should support innovation and attract investment but also help uphold the integrity of the corporate tax system. Yet policy makers must take into account how other countries tax multinationals as well as the wide range of successful tax planning strategies available.

We can see these difficulties in transfer pricing rules. When a firm 'trades' with itself across borders, we want to ensure it is using the prices an independent party would have paid, rather than manipulating prices to gain a tax advantage. But this principle can be very difficult to enforce in practice. There are many goods which are either proprietary or rarely traded, so there may be no market price for the asset.

With regard to financial innovation, it is now easier than ever to move funds between jurisdictions at little cost and to re-characterise financial assets from debt to equity or vice versa. These options place further pressure on the system and support entities seeking to minimise their worldwide tax. Australia, and many other countries, treat debt and equity differently for tax purposes. One of the problems is we do not all define them the same. And Australia has added a further quirk. Our ToFA regime provides the capacity for financial institutions to account for tax on an accrual basis, not a realisation basis. More arbitrage opportunities. And with regard to Auerbach's third point, about the corporate/non-corporate boundary, my earlier reference to the increase in the use of trusts is pertinent.

From an Australian perspective, we should perhaps add a couple of other issues to Auerbach's three: the increasing role of intangibles in developed and emerging economies, and the growing importance of Asia in the world economy.

Intangible assets include brands, intellectual property, customer lists, internal processes, and copyrights which are often the result of investments such as R&D and marketing. Investment in intangible assets is growing faster than investment in tangible assets.14 As these assets have no fixed physical form, it is much easier to relocate them to low-tax jurisdictions than it is to relocate people or machinery. For example, Pfizer and Microsoft have relocated a considerable part of their R&D to Ireland while Shell's central brand management is located at its Swiss affiliate which charges royalties to operating s

ubsidiaries worldwide.15

For Australia, rapid growth in Asian economies has produced a resources boom which has highlighted the taxation of non-renewable natural resources. You can't move these resources: your choice is when to develop the site or to leave it in the ground and profitability often depends on natural factors, such as the ore grade. While resource prices were very low in the late 1990s, they are now relatively high and are expected to remain well above historical averages for some years to come. This means resource firms are making profits which are well above the level needed to make these projects a worthwhile investment. Taxing the gap between expected profit and the level needed to induce investment will not discourage investment and this is the rationale behind the Mineral Resources Rent Tax as a means of securing greater public return on the resources boom.

Tax design and reform

So how should Australia's tax system respond to these global pressures?

A natural place to start is to consider how other small, open economies have been adjusting to globalisation.

OECD work has suggested that for the average OECD country a change in the tax mix away from income taxes and towards potentially less mobile and distorting bases would have economic benefits.16 Other work suggests that small and open economies, as a group, have configured their tax systems so as to rely less on income taxes and more on taxes that are levied on less mobile bases.17

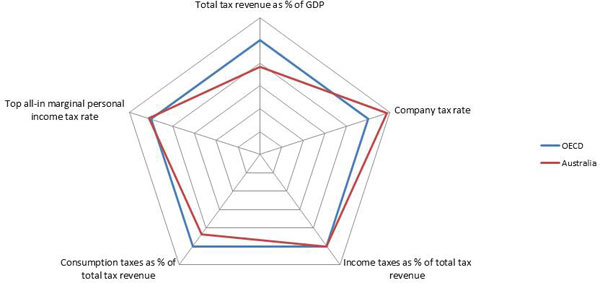

How Australia compares to OECD

This common feature reflects the fact that in smaller economies policy changes cannot affect the global price of products or factor inputs, and capital and labour may be more mobile than in larger economies. So in small open economies, the deadweight costs of taxes on income derived from those factors may be higher because taxpayer responses at the relevant decision margins are greater.

Therefore small economies have to live with a more mobile tax base and rely relatively more on less mobile sources of revenue, such as resource rents, land, consumption and possibly, labour, which are possibly more sound from an efficiency point of view. However, raising taxes on some immobile bases, most notably consumption, may also have implications for the fairness of the tax system, its social acceptability and the ability of the government to redistribute income.

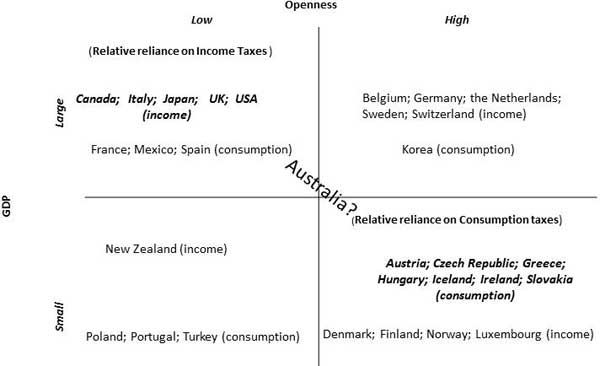

Where should Australia sit?

The chart is an attempt to characterise a number of countries and their tax systems. As with any such characterisation, there is considerable room for debate around each country's relative reliance on income or consumption taxes. The main point here is not the location of any individual country but the framework overall.

Where should Australia sit?

On the Hines-Summers configuration, Australia's longer-term tax mix would be consistent with less reliance on income tax.

In the longer term, if we opt to keep relying on mobile bases for a high proportion of revenue, we may see increased risks for tax base erosion and stronger disincentives for capital investment and for individuals to acquire productivity-enhancing skills.

Tax reform that envisages a sustainable re-balancing of tax bases would need to gain community acceptance as to how best to use these bases. This would be a difficult process. For many people, tax reform has come to mean personal tax cuts. Raising taxes or making any individual tax less progressive usually meets strong community resistance.

Since many people consider progressivity to be the most important measure of the fairness of the system, any such change would require a long and carefully designed transition path.

Are there other options we might consider?

Some leading academics have suggested that policy makers need to think more about a different base for corporate tax. Rather than the traditional alternatives of a residence base, or a source base, or an uncomfortable mixture of the two. What has been suggested is a destination based tax, which is levied where the sale to a final consumer is made. This tax would be a source-based tax which would make border adjustments that eliminate the incentives for companies to shift location or earnings to other countries.18 Auerbach argues that 'the appeal of destination-based taxation may grow over time as the mobility of rents put further downward pressure on tax rates under existing source-based systems'.

Such a system may seem quite remote from our current situation, particularly given the preponderance of location specific rents in the Australian economy, but we should not underestimate the power of structural change in the global economy to shape policy in new and unexpected ways.

Conclusion

As the Asian century continues to rearrange the global economic landscape, Australia's current tax system, which relies heavily on income taxes, will come under increasing pressure. Reforms to the way taxes are raised will be needed, particularly with an ageing population. But in thinking about specific changes, we need to think carefully about how they would affect the whole of the system.

Changing part of the system often results in unwanted changes elsewhere that are hard to anticipate and correct. We can shuffle a number of decisions without realising it. We also have many highly paid people trying to find these gaps and make money from them. For that reason, attempting to fine tune outcomes through better modelling alone is likely to be inadequate for developing robust policy responses.

Future governments will need to strike a new balance between raising sufficient revenue and lowering the economic costs of taxation. By speeding up the process of globalisation with its associated pressures and opportunities, the Asian century makes the case for ongoing tax reform more compelling. While reducing the efficiency costs of the tax system is clearly a worthy goal in any circumstances, the unfolding developments in Asia increase the need to make genuine progress towards this end.

1 Haig, Robert 1921 'The Concept of Income - Economic and Legal Aspects' and Simons, Henry 1938 'Personal Income Taxation: the Definition of Income as a problem of Fiscal Policy'.

2 Taxation Review Committee, 1975 'Full Report January 31 1975' Australian Digital Collections website

3 Kaldor, Nicolas 1955 'An Expenditure Tax' London: Allen & Unwin

4 Institute for Fiscal Studies, 1978 'The Structure and Reform of Direct Taxation'

5 Institute for Fiscal Studies, 1991 'Equity for Companies: A Corporation Tax for the 1990's'

6 Institute for Fiscal Studies, 2011 'Mirrlees Review: Tax by Design'

7 US Treasury 1992, 'Integration of the Individual and Corporate Tax Systems: Taxing Business Income Once'

8 Review of Business Taxation 1999 'Review of Business Taxation: A Tax System Redesigned'

9 Companies paid $86.7

billion in dividends in 2009-10, of which $77.5 billion were franked dividends. This approximately 90 per cent ratio of franked dividends has held for the last decade. ATO Taxation Statistics 2009-10

10 Super funds to dominate ASX: AVCAL, the Investor Daily website.

11 ATO Taxation Statistics 2009-10

12 Net capital gains explain most of the discrepancy for before and after financial crisis. ATO Taxation Statistics 2009/10.

13 Auerbach, A 2012 'The Mirrlees Review: A U.S. Perspective' National Tax Journal, June 2012, page 15

14 Productivity Commission, 2009 'Investments in Intangible Assets and Australia's Productivity Growth' Staff Working Paper

15 Dischinger, M & Riedel, N 2009 'Corporate Taxes and the Location of Intangible Assets within Multinational Firms' Working Paper, Version November 6 2009.

16 OECD Tax Policy Studies 2010, 'Tax Policy Reform and Economic Growth'

17 Hines, James R. and Summers, Lawrence H. 2009 'How Globalization Affects Tax Design' NBER Working Paper No. w14664. They found that countries with a 10 per cent smaller population in 1999 have a 1 per cent smaller ratio of personal and corporate income tax collections to total tax revenues. These results were supported in Fuceri, Davide and Karras, Georgios 'Tax Design in the OECD: A test of the Hines-Summers Hypothesis' MPRA Paper No. 23358 June 2010

18 Auerbach, A 2012 'The Mirrlees Review: A U.S. Perspective' National Tax Journal, June 2012