Introduction

Good morning, it’s great to be here.

As others have, let me also acknowledge we are meeting on the traditional lands of the Kaurna people.

I pay my respects to their elders past and present and their spiritual relationship to the land, as the custodians of the Adelaide region.

I have been asked to speak to the Commonwealth government’s ‘Future Made in Australia’ agenda (or FMA for short).

This was a centrepiece of the recent federal Budget and is a critical agenda for a range of reasons that I will discuss today.

Importantly, it seeks to respond to the very different economic and strategic landscape that we face over the next decade.

And to set Australia up for success in this new world.

As I am sure everyone in this room is aware, renewable hydrogen has been marked out as a flagship or priority sector under the plan.

This recognises:

- the crucial role that hydrogen will play in both domestic and global decarbonisation efforts

- Australia’s natural comparative advantages in the production of renewable hydrogen – most notably, cheap and abundant renewable energy resources

- the fact there are existing barriers that are inhibiting private investment at the scale necessary to achieve our goals.

That is why, in the recent Budget, the government committed around $8 billion in new hydrogen production incentives.

Other priority sectors include green metals, low carbon liquid fuels, critical minerals processing and clean energy manufacturing.

Future Made in Australia

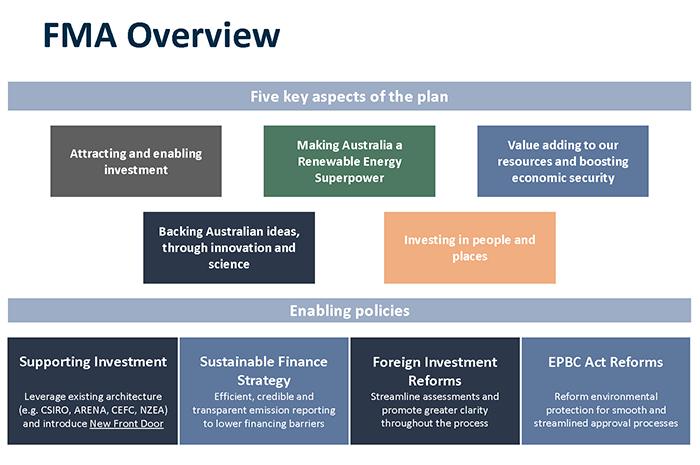

When the federal government talks about a Future Made in Australia, they have a broad agenda in mind.

They talk about building a stronger, more diversified and more resilient economy, powered by clean energy.

They outline 5 key aspects of this plan:

- attracting and enabling investment

- making Australia a Renewable Energy Superpower

- value adding to our resources and boosting economic security

- backing Australian ideas, through innovation and science

- investing in people and places.

There are many individual measures and investments under this broad agenda, but today, I will focus on a few key aspects.

National Interest Framework

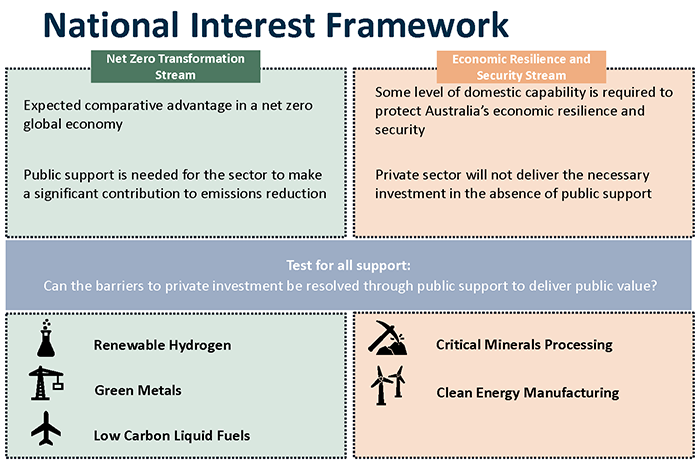

First, I want to highlight the key features of the new National Interest Framework outlined in the Budget.

This Framework has guided the government’s assessment of the national interest and barriers to private investment, including in the hydrogen sector.

It is the result of detailed work and long policy deliberation within the Treasury and across other government departments.

As the Treasurer Dr Chalmers has noted, the National Interest Framework seeks to respond to 2 significant global shifts.

The first is the global imperative to reach net zero by 2050, which is driving huge changes across our economy and generating new opportunities in clean energy industries.

The second is the more contested and fragmented global strategic landscape, putting pressure on critical supply chains and driving a global wave of new industrial policies to boost economic resilience.

To use Treasury language, we consider that market failures are present in both cases, supporting a role for government.

In the case of net zero, we don’t yet have strong international markets that recognise and value low emissions products in the way we need, to spur the scale of investment we need, in new green technologies and industries.

Or that can direct capital to the most efficient investments.

Without action, this will lead to an undersupply of products that draw on cleaner, greener production methods, such as hydrogen.

Equally, global markets are not currently capable of fully pricing in the risks associated with a more unstable geopolitical landscape.

Recognising the significant costs of supply chain disruptions and other shocks, nations are increasingly seeking to take out more insurance against these events. In our view, these global shifts, and related market failures, mean there is an important role for government.

We are not alone in reaching this conclusion. It has been recognised by most of our major trading partners.

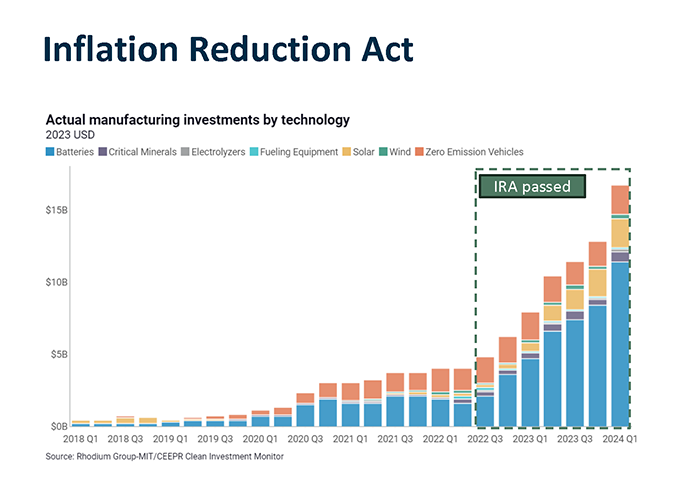

There is the Inflation Reduction Act and the CHIPS and Science Act in the United States, which are estimated to have already spurred over US$250 billion in clean investment.

There is the Green Deal Investment Plan in Europe, worth around 1 trillion Euros over a decade.

There is the Made‑in‑Canada plan, the UK’s Green Finance Strategy.

Japan’s Green Growth Strategy and the Korean Green New Deal.

Not to mention China, whose current 5‑year plan includes around US$6 trillion in climate spending.

All are responses to this new environment we face.

But these major shifts do not represent a blank cheque.

To be effective, public interventions must still be well targeted and build on our inherent advantages — of which we have many.

Government’s primary goal should be to enable private investment at scale, not replace it.

We cannot – and should not – try to out‑spend other countries or spread our efforts too thinly across too many areas.

As the Treasurer made clear in his pre‑Budget Lowy Speech, ‘a Future Made in Australia doesn’t mean a future made alone’.

And ‘the scale of subsidies in the 3 major global economies of course dwarfs anything Australia can offer, which is why we will be smart and strict’.

The National Interest Framework has been designed to achieve this and has guided the government’s development of the FMIA package.

It includes 2 streams — the Net Zero Stream and the Economic Resilience and Security Stream.

It aims to guide actions and impose rigour on public decision making.

Net zero transformation stream

Let me illustrate this by focusing on one stream of the Framework, most relevant to hydrogen. The net zero transformation stream.

Priority sectors under this stream will be those where:

- the industry can make a substantial contribution to meeting domestic and global decarbonisation goals

- Australian industry is expected to have a sustained comparative advantage in a net zero global economy

- public investment is needed for the sector to make a significant contribution to emissions reduction at an efficient cost.

These tests have been designed to ensure that where government does choose to lean in, there is a strong likelihood that Australian industries will be globally competitive without ongoing public support.

Based on our analysis of Australia’s comparative advantages, this is most likely to be the case if the industry:

- is energy‑intensive and can take advantage of our abundant renewable energy resources

- has output that embodies low carbon emissions and can help contribute to decarbonisation in other areas of the economy

- can leverage Australia’s highly skilled workforce, using technological improvements to reduce labour intensity

- is able to achieve economies of scale in Australia

- aligns with our international trading partners’ current or future needs and complements actions taken by our strategic partners.

Renewable hydrogen

Renewable hydrogen met these tests.

It is well acknowledged that there are still many challenges to deploying renewable hydrogen at scale and across borders.

But in a future net zero economy, hydrogen will be critical.

Both as a source of direct energy and emissions reduction, and as a foundational input to other emerging sectors such as green metals.

It aligns with many of our expected comparative advantages.

And while there is much private investment underway, there are still clear barriers to unlocking private investment at the scale needed.

Given the technology is still scaling up, early movers face higher costs and risks, with ‘fast followers’ getting the benefit of their learnings.

Renewable hydrogen is currently more expensive than unabated gas, both to generate and transport.

While it is expected to become cost‑competitive over time as the cost of production declines and the cost of emissions grows, there is a temporary role for public support to bridge this gap.

To better align market signals with broader public value.

2024–25 Budget package

The measures related to hydrogen in the recent Budget were designed to address these specific challenges.

The commitment to an additional $1.3 billion round of the Hydrogen Headstart program over 10 years run by ARENA will encourage early movers.

This will maintain momentum in the sector and ensure important lessons can be shared without penalising those first‑movers.

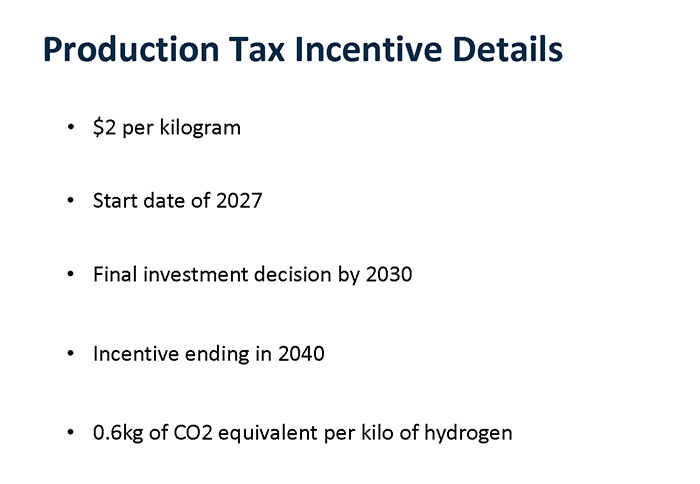

This is followed by the introduction of a temporary uncapped and refundable production tax incentive.

This will support the broader industry to invest and grow at scale.

Providing certainty and reducing the cost gap between renewable hydrogen and competing higher emissions sources of energy.

Details of the production tax incentive are subject to consultation.

However, the government’s expectation is that the incentive will be set at $2 per kilogram, to align with the current cost gap between renewable hydrogen and market alternatives.

The start date of 2027 will allow time for project planning and aligns with when significant projects are expected to move into the production phase.

It will also give the government time to set up robust administrative arrangements through the Guarantee of Origin scheme.

That said, the government is looking to bring on investment quickly.

That is why the government has proposed that projects will need to reach final investment decision by 2030, to be eligible for support, with the incentive ending in 2040.

Finally, the government is looking to build a genuinely renewable hydrogen industry.

To ensure this, it is consulting on setting an emissions threshold of 0.6kg of CO2 equivalent per kilo of hydrogen, broadly in line with benchmarks set in other comparable countries.

We will look forward to receiving your feedback on the design aspects of this proposal.

Let me now turn briefly to a few other aspects of the FMA plan that Treasury has been involved in and that will be of interest to the hydrogen industry, as well as other sectors more broadly.

New front door for investors

In the Budget, the government announced it would establish a new front door for investors with major, transformational proposals related to the FMA agenda.

The goal is to make it simpler to invest in Australia and to attract more global and domestic capital into priority sectors.

Across the country there are a whole range of projects — existing and planned — that have the capacity to be transformational.

We have already heard this morning about some of the big plans around hydrogen here in South Australia and Western Australia.

The Commonwealth is engaging with these regional projects through the Net Zero Economy Authority (NZEA) and the Hydrogen Hubs program.

Both the Upper Spencer Gulf in South Australia and the Pilbara and Kwinana in WA have been designated as priority regions by NZEA.

Other priority regions include Gladstone, Newcastle and the Hunter, and the Latrobe Valley.

The front door will build on this by:

- providing a single point of contact for investors and companies with major investment proposals

- delivering a joined‑up approach to investment attraction and facilitation — essentially a ‘concierge‑like’ service to priority projects to support them to navigate government processes

- support accelerated and coordinated approvals decisions

- better connect investors with the government’s specialist investment vehicles, such as ARENA, the NAIF and the CEFC.

The Treasury has been tasked with consulting on the final design of this investment front door and again, we look forward to hearing from the people in this room over the coming months.

Accelerated approvals

I mentioned that one of the functions of the new front door will be to help strengthen and streamline approvals decisions.

This is a critical point, and one of the most common concerns raised with me when I discuss the task ahead of us.

If we are to rapidly transform our economy to be successful in the new net zero world, we need projects to move ahead.

Slow and uncertain approvals processes are in no‑one’s interest.

In the Budget, as part of the FMA plan, the government announced $182.7 million to fund improvements in this area, particularly in relation to priority renewable industries and critical minerals projects.

This included:

- $19.9 million to process assessments for priority renewable energy related projects

- $20.7 million to improve engagement with communities involved in the energy transition

- $15.7 million to deliver a stronger, more streamlined, and more transparent approach to foreign investment

- $17.7 million to reduce the backlog and support administration of complex applications under the Aboriginal and Torres Strait Islander Heritage Protection Act.

Further, through the government’s nature positive agenda:

- $24.5 million to work with state and territory governments to improve planning in 7 priority regions, so it’s clearer to business where development can more easily occur and where the ‘no go’ areas are

- and more support for staff to assess project proposals from business, and more tailored support to help business more effectively comply with environment law.

Sustainable finance

Finally, I wanted to flag the steps the government is taking to build up the financial architecture that will mobilise and direct private capital towards the transition to net zero.

In the Budget, the government committed a further $17.3 million to implement a comprehensive Sustainable Finance Strategy.

Key features of the Strategy include:

- mandating climate disclosures for large corporations, in line with global standards

- developing an investment product labelling regime for financial products marketed as sustainable

- providing guidance on best practices for net zero transition plan disclosures by businesses.

Along with the direct investments and tax incentives I have already discussed, these measures to improve the broader investment environment in Australia will help to spur private investment.

Conclusion

To conclude, the FMA plan outlined in the recent Budget responds to the major changes facing Australia in the coming decade.

It is a broad and ambitious plan, but at its core is a rigorous National Interest Framework that aims to ensure that public support is well targeted and plays to Australia’s long‑term needs and strengths.

Renewable hydrogen has been marked out as a priority sector and the government has announced substantial measures to boost private investment in the sector.

In Treasury, we look forward to working with the sector to settle the final design of these supports.

Thank you.

Text descriptions

Image 1 text description

The image is titled ‘FMA Overview’, and graphically lays out the 5 key aspects of the FMA plan, and the enabling policies.

The image is split horizontally into 2 sections. In the top section, the subheading is ‘Five key aspects of the plan’. Underneath this subheading, 5 boxes contain the following information:

- Attracting and enabling investment

- Making Australia a Renewable Energy Superpower

- Value adding to our resources and boosting economic security

- Backing Australian ideas, through innovation and science

- Investing in people and places

In the bottom section, the subheading is ‘Enabling policies’. Underneath this subheading, 4 boxes contain the following information.

- Supporting Investment: Leverage existing architecture (for example, CSIRO, ARENA, CEFC, NZEA) and introduce New Front Door.

- Sustainable Finance Strategy: Efficient, credible and transparent emission reporting to lower financing barriers.

- Foreign Investment Reforms: Streamline assessments and promote greater clarify throughout the process.

- EPBC Act Reforms: Reform environmental protection for smooth and streamlined approval processes.

Image 2 text description

The image is titled ‘National Interest Framework’, and graphically lays out the differences between the Net Zero Transformation Stream and the Economic Resilience and Security Stream.

The image is split vertically into 2 sections. The left section is highlighted green, and the subheading is ‘Net Zero Transformation Stream’. Under this subheading is the text: “Expected comparative advantage in a net zero global economy. Public support is needed for the sector to make a significant contribution to emissions reduction”. Underneath is the text “Test for all support: Can the barriers to private investment be resolved through public support to deliver public value?”. Below that is the text: “Renewable Hydrogen (with a small image of a conical flask); Green Metals (with a small image of a crane picking up a box); Low Carbon Liquid Fuels (with a small image of a plane).

The right section is highlighted orange, and the subheading ‘Economic Resilience and Security Stream’. Under this subheading is the text: “Some level of domestic capability is required to protect Australia’s economic resilience and security. Private sector will not deliver the necessary investment in the absence of public support”. Underneath is also the text: “Test for all support: Can the barriers to private investment be resolved through public support to deliver public value?”. Below that is the text: “Critical Minerals Processing (with a small image of a pickaxe hitting a rock); Clean Energy Manufacturing (with a small image of a wind turbine).

Image 3 text description

The image is stacked column chart titled ‘Inflation Reduction Act’, with the subheading ‘Actual manufacturing investments by technology’ and below that ‘2023 USD’. Below that is a legend conveying the corresponding colour in the stacked column chart for different investments: Batteries (blue), Critical Minerals (purple), Electrolysers (grey), Fuelling Equipment (aqua), Solar (yellow), Wind (green), Zero Emissions Vehicles (orange).

The vertical axis represents the actual manufacturing investments by technology, in 2023 USD, ranging from $0 billion to $15 billion. The increments of $0 billion, $5 billion, $10 billion and $15 billion are labelled. The horizontal axis represents the financial quarter, ranging from 2018 Q1 2024 Q1. All quarters are included, but only Q1 and Q3 of each year are labelled in the chart.

The total actual manufacturing investment starts close to $0 billion in 2018 Q1, and remains so until 2019 Q3. From 2019 Q4 to 2020 Q4 there is a consistent rise to around $3 billion. Subsequently there are only marginal increases through to 2021 Q2, and then a steady rise to around $4 billion by 2022 Q2.

From 2022 Q3 to 2024 Q1 total actual manufacturing investment appears to increase by around $1-$2 billion per quarter, with the most significant increase of around $3 billion from 2023 Q4 to 2024 Q1. Total actual manufacturing investment sits at around $16 billion at 2024 Q1. The columns from 2022 Q3 to 2024 Q1 are outlined by a box with the heading ‘IRA passed’, illustrating that the increase in investment correlated with the IRA passing.

The most significant contributors to the increase in investment appears to have come from Batteries, which increased from aroundd $2 billion in 2022 Q3 to around $11 billion in 2024 Q1, and Solar, which increased from roughly $0 billion in 2022 Q3 to $2 billion in 2024 Q1. While Zero Emission Vehicles contributed around $2 billion in 2024 Q1, it negligibly increased in size from 2022 Q3.

Image 4 text description

The image is titled ‘Net Zero Comparative Advantage’. On the left side of the image is a large blue arrow with the following text inside: “Australia’s expected comparative advantages, in a net zero world”. The arrow is pointing to the following list:

- Energy Intensive: Leverage our abundant renewable energy resources

- Embodies low carbon emissions: Help contribute to decarbonisation in other areas of the economy

- Australia’s highly skilled workforce: Using technological improvements to reduce labour intensity

- Economies of scale: Scope to become an internationally competitive export industry

- Aligns without international partners: Meets their current or future needs

Image 5 text description

The image is titled ‘Production Tax Incentive Details’. It lists the following dot points:

- $2 per kilogram

- Start date of 2027

- Final investment decision by 2030

- Incentive ending in 2040

- 0.6kg of CO2 equivalent per kilo of hydrogen