Downloads

Introduction

Good morning and thank you Miranda for the opportunity to speak today. It’s a tremendous privilege.

We are here to discuss, even celebrate, and from the Treasury it is a celebration, , 100 years of income tax in Australia.

And this is timely, particularly as Australia leaps into a conversation about tax in a rapidly changing economy.

This is a conversation that has been led by the Treasurer, most concretely through his tax discussion paper, Re:Think.

It is one that will help us to understand the challenges and opportunities for Australia, and I hope everyone here today would play a part in this process.

So today I want to take you on brief journey of Australia’s taxation history to show you how we got to where we are now and how this might inform us to where we want to go; to build a tax system for a modern, forward-looking Australia.

PAST

George Santayana made the observation: "Those that fail to learn from history, are doomed to repeat it.”

In saying that, Santayana hit on something we would do well to remember when thinking about the trajectory of tax policy.

At the end of the 19th century the Australian colonies had distinct tax systems, which were almost entirely reliant on customs and excise duties. The design of these tax systems was largely driven by administrative convenience, rather than a sense of equity or efficiency.

These, especially equity, as we all know, are a far more prominent feature of Australia’s tax system today.

In 1901 the new federation removed all duties on goods traded between Australian states.

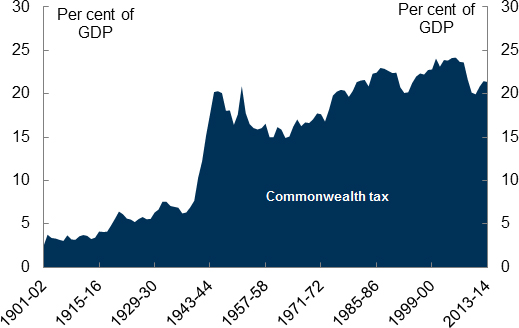

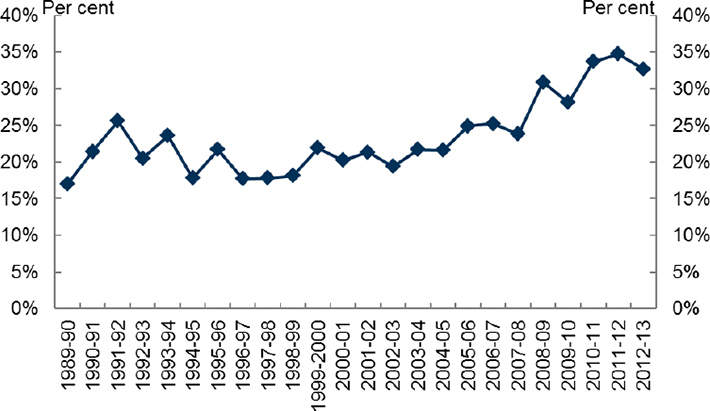

CHART 1: TAX to GDP

As you can see from the chart, Australia’s Commonwealth tax take grew significantly as the role of government expanded over the 20th century. In 1901 Australia’s tax to GDP ratio was around 5 per cent, and this remained constant until federal income tax was introduced in 1915, 100 years ago, to fund the war effort.

Between the two World Wars, income taxes were levied by both the state and federal governments. Both government expenditure and tax revenues grew significantly, and by the beginning of the Second World War the country’s tax take was more than 11 per cent of GDP.

But in 1942 Australia’s tax system changed fundamentally. Income tax was consolidated by the federal government to increase revenue, and the states’ tax bases reduced and replaced by Commonwealth grants.

By the end of the Second World War, tax revenue had grown to over 22 per cent of GDP. The further increase in tax reflected Australia’s involvement in the war and new support programmes, such as the widows’ pension in 1942 and unemployment relief in 1944.

Notably, it wasn’t until 1971 that the federal government gave control of payroll taxes (then a tax with a broad base and a low rate) to the states.

So at one level, by the end of the Second World War Australia had the basic structure of the tax system that we have today. But at another level, at least with regard to rates, the tax system was very different. For example, in 1951 the top personal marginal rate kicking in at 10,000£ was 75 per cent and corporate tax ranged between 42.5 and 47 per cent.

Australia also had a classical company income tax system. This meant company tax was in addition to personal tax, making the headline rate of tax on distributed profits almost 90 per cent.

No wonder an undistributed profits tax was needed, given the incentives to retain profits within companies!

Tax revenues tended to fall in the middle of the 20th century after peaking during the war years. They then increased significantly between 1973 and 1975, largely as a result of increased funding for social programmes.

Since the 70s, there has since been a modest rise in Australia’s tax take, similar to the experience of many other OECD countries.

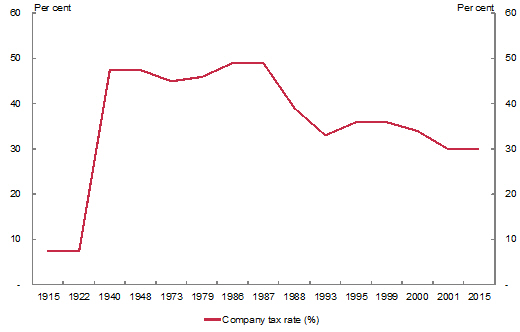

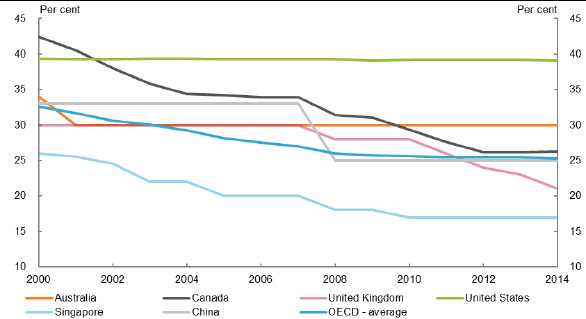

CHART 2: Company income tax rates since 1915

More recently that is, since the mid 80s, there has been significant base broadening in the income tax system. Capital gains tax, fringe benefits tax and the removal of accelerated depreciation have all played their part, while this base broadening in both personal and business taxation has been accompanied by declining rates of taxation.

As the chart shows for company tax, this base broadening has facilitated the reduction in rates from 49% down to 30% in 2001.

Several other reforms during the past 25 years include the changes to the taxation of retirement savings and incomes, and the introduction the GST in 2000 — a move that allowed the replacement of less efficient federal and state indirect taxes.

So this rather brief history brings us to where we are today.

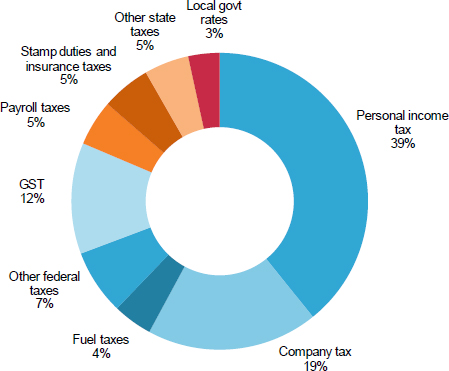

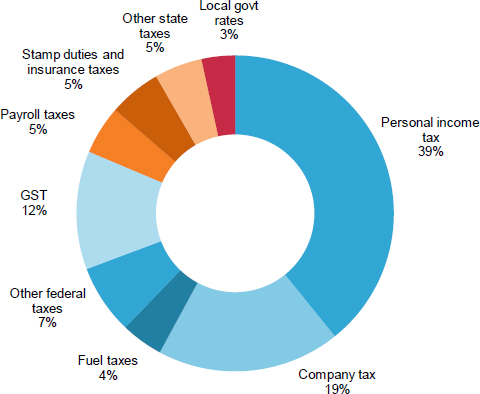

CHART 3: Composition of Australia’s taxes 2013 – 2014 (all taxes inc state)

But, while things have certainly changed, Australia’s reliance on corporate and personal income tax has not. And, as you will hear shortly, it’s unlikely that this will change significantly in the foreseeable future.

Personal income tax

I’ll begin by looking at personal income tax.

This is one area that is unlikely to see any big changes for two reasons.

The first can be seen in this chart: personal income tax is a significant contributor to revenue.

In 2013 it provided 39.2 per cent of total revenue.

The second reason is that it is an effective method of achieving progressivity. In other words, it uses a marginal rate system to tax those with higher income at a higher rate.

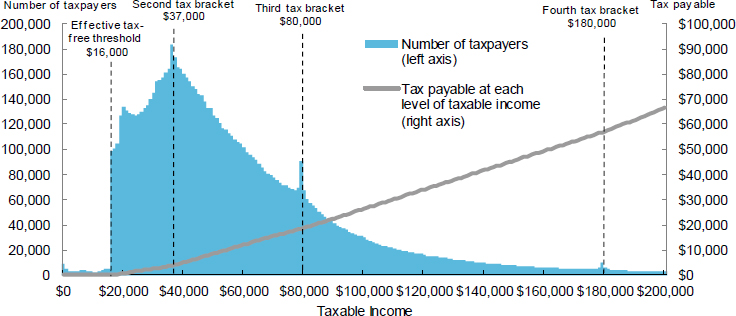

Chart 4: Who paid individuals income tax, 2011–12

This chart has a lot of information. It shows, perhaps unsurprisingly, the vast bulk of taxpayers clustered around low to middle incomes. An interesting feature is the ‘bunching’ of taxpayers just before each of the thresholds.

Tax planning is no doubt part of who we are!

I understand that Australia has one of the more progressive systems in the world, and this raises two questions: what makes Australia’s system so progressive; and is a progressive system a good thing?

Australia’s system is often cited as being progressive because Australia has multiple tax rates and levies high taxes on those who are more able to bear it.

But this is only part of the story.

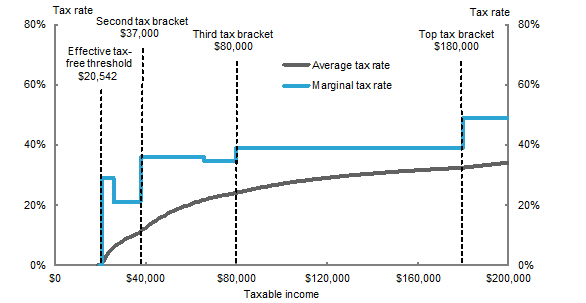

Chart 5: Average and marginal rates, 2014–15

The other part of the story is that Australia’s income tax system does not tax low income earners very much, if at all.

Income below the tax-free threshold of $18,200 is not subject to any income tax. Additionally, the low income tax offset means that most people can have taxable income of up to $20,542 before they pay any tax on that income, as the chart shows.

In comparison, a low-income earner in New Zealand, where there is no tax-free threshold, is paying 10.5 cents in income tax from the first dollar they earn.

But the trade-off for our low average rates and high progressivity is that our effective marginal tax rates are comparatively high. And this is before taking into account of the withdrawal of targeted transfer payments. And made even higher

at some specific points through the medium levy shade in, and the low income tax offset shade out.

| New Zealand $40,000NZD | Australia $40,000AUD | New Zealand $180,000NZD | Australia $180,000AUD | |

|---|---|---|---|---|

| Tax payable | $6,600 NZD | $4,947 AUD | $52,930 | $58,147 |

| Marginal rate | 19% | 36% | 34.45% | 47% |

| Average rate | 17% | 12% | 29% | 32% |

For example, a single person in New Zealand earning NZD$40,000 a year would have a marginal rate of 19 per cent and pay NZD$6,600 in tax. In Australia, someone earning AUD$40,000 would have a marginal rate of 36 per cent but only pay AUD$4,947.

Now let’s compare a single person earning $180,000.

In New Zealand they would be in the top tax bracket of 34.45 per cent and pay total tax of $52,930.

In Australia the next dollar earned would push them into the next tax bracket with a rate of 49 per cent, at least for now. When the Medicare levy is included, the total tax payable would be AUD$58,147.

So I guess the logical question that emerges is: When faced with the choice of working another day or another hour, how does the fact that nearly half of your extra earnings goes to tax sway your decision? Would you consider moving to New Zealand? Or perhaps Singapore?

In Australia, these factors are coupled with the fact that there is no comprehensive social security contribution or comprehensive payroll tax. Transfer payments are also highly targeted based on a household’s means.

It seems that, in many ways, Australia’s high marginal tax rates and high tax free threshold constrain the options available to maintain a highly progressive and targeted tax and transfer system.

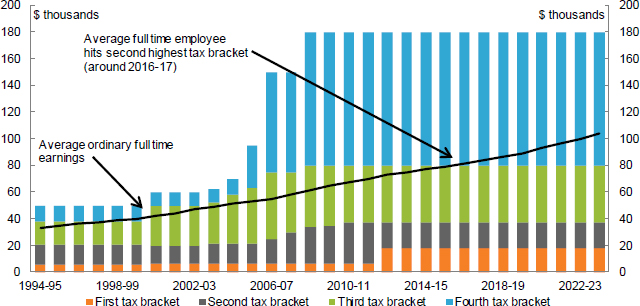

CHART 6: Personal income tax rates and the effects on bracket creep

Another factor in the income tax system affecting progressivity is bracket creep. As the income thresholds do not keep pace with inflation or wages growth, taxpayers will face higher average, and sometimes marginal, tax rates.

As the chart suggests, next year a person on AWOTE will move into the second highest tax bracket. The last time this happened was back in the late ‘90s.

Between 2014–15 and 2024–25, the percentage of taxpayers in the top two tax brackets — or those with a taxable income in excess of $80,000 — is estimated to increase from around 27 per cent to 43 per cent. It is estimated that over 2 million more taxpayers will be in the third income tax bracket — which is for those with a taxable income from $80,000 to $180,000 — in 2024-25 than this year.

For some people, particularly those on relatively low incomes, bracket creep can reduce incentives to work. At higher incomes, bracket creep increases the incentives for tax planning and structuring, and even overseas relocation.

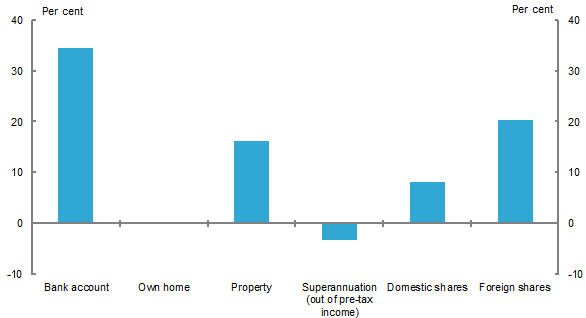

Savings

Of course, interacting with the personal income tax system is the treatment of different forms of savings by individuals. It is an area I need to touch on, but given the time won’t discuss in detail.

CHART 7: Nominal effective marginal tax rates by savings vehicles for an individual on 32.5 per cent marginal tax rate plus 2 per cent Medicare levy (chart 4.1)

As you can see from the chart, bank accounts and debt instruments are subject to tax at full marginal rates, with no allowance for inflation.

Like most other OECD countries, Australia taxes owner-occupied housing more favourably than other types of investment, including dwellings purchased purely for investment. Both the ‘imputed rent’ — in other words, the value of housing services a home owner receives from their own home — and capital gains on the property are exempt from income tax.

The tax treatment of investment properties is the same as it is for investment in any asset that produces a mix of current income and capital gain. That is, the rental income is taxed at the individual’s marginal tax rate as it is earned, while generally only half of the capital gain is taxed, and only when the property is sold or realised in some other way.

Pre-tax contributions to superannuation are more concessionally taxed than other forms of savings for many, but not all, taxpayers. Because superannuation contributions and earnings are generally taxed at flat rates, the level of concessionality differs depending on the individual’s marginal tax rate.

And finally, investment in equities, or company shares, generally produces two types of income. The first is dividend income from business profits; the second is capital gains from changes in the value of the share. Both of these are subject to individuals’ income tax to some extent.

So this is all quite complex and clearly distorts savings choices. Do these distortions lead to positive overall outcomes? I might leave that to others to talk through.

Company tax

I’d like to turn now to company tax.

CHART 8: Composition of Australia’s taxes 2012 – 2013

Following personal income tax, the second biggest source of revenue is company tax, making up 19 per cent of revenue collected in 2012-2013.

But we are quite exposed to a range of fragilities given the high amount of company tax paid by a small number of companies.

CHART 9

The ‘spike’ in the mid-late 2000s is exacerbated by consolidation, but the concentration is, nonetheless, concerning.

Australia relies on a source based taxation system, which means income arising within our borders is taxed regardless of the residence of the taxpayer. Another way of putting it is both residents and non-residents are taxed on income derived within Australia.

Due to Australia’s abundance of natural resources and their importance to our economy, Australia is unlikely to move away from a source based taxation system in the foreseeable future.

However as I am sure you are all aware, the world is changing and this is putting pressure on Australia’s reliance on this approach. In particular the rise of intangibles and large multi nationals and a worldwide trend of lowering tax rates means our corporate tax system may need to adjust.

As you can see from the chart, Australia’s company tax rate is high by global standards, particularly given that many other countries have substantially reduced their corporate tax rates:

CHART 10

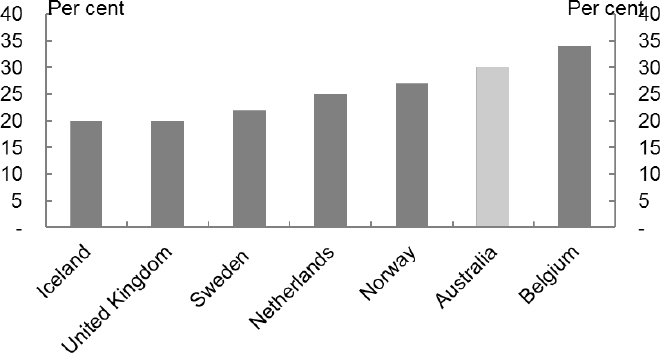

Also notable is that compared with some selected European countries, including some Nordics, our corporate rate is very high. Worth noting that Denmark is in the process of reducing its rate to 22% and Finland is at 20%.

CHART 11

Corporate tax rate

So Australia has a relatively high corporate tax rate when compared to the OECD and some of our regional neighbours. Lowering our

corporate tax rate could act to reduce the incentives that companies have to profit shift. Lowering the corporate tax rate could also drive productivity growth.

How the Government raises revenue affects economic growth. Taxes change relative prices and therefore influence the decisions of individuals and entities. But, let’s be clear, taxes have negative consequences for economic growth. In the context of a capital importing, small open economy such as Australia, higher taxes can reduce the size of the economy.

These costs to living standards can be measured as the “marginal excess burden”, being the cost to household welfare of raising an additional dollar of revenue by way of a particular tax.

We could boost productivity growth by considering how the tax system could be weighted away from taxes which have relatively high marginal excess burdens. Our company tax is such a tax.

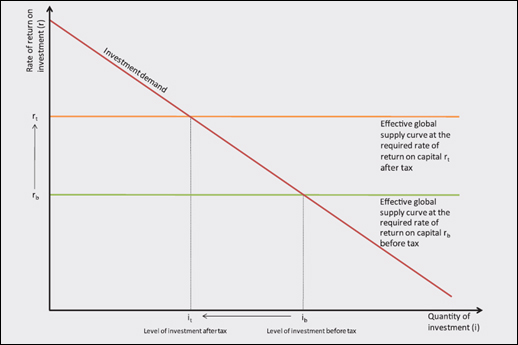

CHART 12

High company tax means that Australia loses economic value because some investment opportunities become unviable. This is a particular issue for a small open, capital importing economy such as Australia’s, where the investors, especially foreign investors, can easily decide to allocate their capital to opportunities in other jurisdictions.

The red line shows the demand for investment in Australia. It is downwards sloping, reflecting the diminishing returns to capital. As the capital stock increases, the rate of return on investment opportunities declines.

The chart assumes that as a small open economy Australia faces the after-tax global required rate of return on capital which is fixed (the green line). That is, the return to foreigners is invariant to the tax system. What matters for investment is the before-tax rate of return which varies inversely with the company income tax rate.

Capital flows from foreign investment into the domestic economy will continue until the demand and supply of investment equal at the required before-tax rate of return. This point is shown as ib on the chart for the case where there is no company income tax (that is before taxes are levied).

So now we come along and impose the company tax.

An increase in the company income tax rate increases the before-tax rate of return. This will cause an outflow of foreign capital.

The capital outflow will continue until the after-tax rate of return is equalised with the globally required rate of return.

The imposition of company tax means that the total amount of investment in the economy is lower (shown by the move from ib to it) than it would be if there were no company tax.

A lower capital stock reduces capital income. It also makes existing workers less productive and so reduces household income, which further reduces spending on goods and services.

Now, some caveats. Can all investments be neatly mapped like this? Of course not. But for this story to be broadly true, what are the necessary conditions?

Firstly, we need fewer investment opportunities with high rates of return, and more investment opportunities with lower rates of return.

Secondly, we need foreign investors who have a profit motive.

Thirdly, we need a tax that broadly taxes company profits.

We have all of these — at least to a degree – so the story is broadly true.

So, a higher level of investment should increase the capital available for existing labour (that is, capital deepening) and thereby increase labour productivity. This should, in turn, raise wages.

In short, reducing company tax increases the prosperity of Australian workers.

So then, what are the problems? Why isn’t every country doing this? Or are they?

Well, one reason why some countries aren’t is that while a reduction in the statutory company tax rate will attract additional investment capital, it will also provide a windfall gain for existing investments — one that already met the required after-tax rate of return at a higher company tax rate.

This does not apply so much to projects funded by domestic investors. This is because Australians are still taxed at their marginal rate on company dividends through the imputation system. However, existing foreign investors would receive the windfall gain, and if investors repatriate this gain the Australian economy gets no benefit.

Another reason is that reducing the company tax rate reduces tax revenue in the short term. In the long term, of course, the decline would be partially balanced by increased economic activity as a result of additional capital investments. A recent analysis by the UK Treasury found that between 45 and 60 per cent of the cost to revenue from a company tax cut will eventually be offset by increased economic activity.

But we should all bear in mind that this has a long lead time. And let’s be clear: the study is about the UK, not Australia, and 45 to 60 per cent isn’t 100 per cent.

Nonetheless, this is an important element for the national discussion.

I’d now like to turn to a brief discussion of a very topical issue: Tax Avoidance by multinationals.

Some of you might have been following this debate as it has played out over last few years, and sharpening in Australia with the current Senate Inquiry. I’ve certainly followed it, and been part of it, and it can be a frustrating exercise because the technical issues are so complex it’s hard for a common basis for discussion.

Most will agree that our increasingly globalised and digitalised economy, together with increasing values of intangibles, means that companies have greater choice about where to locate their activities and assets. This has increased the opportunities for multinational companies to use legal means to minimise their tax liabilities and this has very clear implications for our tax system.

To assist with this discussion I’d like to try the ‘modellers’ approach of simplifying the issues to extract some insights.

So I’d like to postulate that there are three broad categories of tax avoidance prevalent in the debate.

The first is profit shifting by claiming excessive interest deductions.

The current system treats returns on debt, or interest, as deductible, while returns on equity, as dividends are not. By capitalising an Australian subsidiary with a high amount of debt relative to equity, a company can reduce the tax payable in Australia.

Of course, claiming a deduction for interest and expenses on business loans is standard tax policy. But where the arrangement appears contrived and appears to be just a tax minimisation arrangement Governments need to act. The Australian Government’s recent changes to Australia's thin capitalisation rules are targeted at such contrived debt deductions.

The second is profit shifting by inflating the price of related party transactions.

As we all know tax is payable on taxable income and taxable income is calculated, very broadly, as assessable income less allowable deductions.

So let’s say you buy something for $500 and that whole $500 is assessable to the Australian company. The Australian company bought the item from a subsidiary in a low tax jurisdiction for $480 – leaving them with a taxable income in Australia of only $20.

The fact that nowadays significant value is being held in intangible assets – which can be located anywhere in the world – makes this problem particularly hard to tackle.

Lets say the item I bought for $500 dollars the other day was an electronic device – how much of the value is for the actual physical device I can hold in my hand?

How much for the software that makes it work?

How much for the brand? And where are they located? The values can be difficult to pin down in practice.

D

oes the breakdown of the values represent true market value outcomes or contrived outcomes that produce favourable tax outcomes? This is an open question that is being considered by governments and tax authorities all around the world.

Australia has recently updated its transfer pricing rules based on OECD best practice to help manage the risk to the tax base from such profit shifting. This is also a key focus of the work currently underway at the OECD under the leadership of the G20.

Thirdly, companies may avoid tax by avoiding a taxable presence in Australia.

By using certain structures some multinationals are avoiding a taxable presence in Australia while still providing services to Australian consumers. There is at least one publicly known example of a multinational tech company which used to seemingly use the so-called 'double Irish Dutch sandwich'. As well as a lack of a taxable presence in Australia, they not only avoid Australian tax but also avoid tax in other jurisdictions. While this is an extraordinarily complex area, there may be scope for further action and, amongst other things, the G20 sponsored OECD is working through these issues.

Of course this is a simplification of a variety of very complex problems and there are no simple solutions. Our tax system needs to adapt to these challenges, and as noted, there are some changes that have already been made, some in progress and others being considered.

Last week The Chancellor of the Exchequer, the Rt. Hon. George Osborne, and our Treasurer of Australia, the Hon. Joe Hockey, announced during the course of the G20 meeting the urgent establishment of a joint working group to further consider and develop initiatives in relation to diverted profits by multinational enterprises.

Australia has also taken a leadership role in the automatic exchange of tax information, recently signing an agreement with Switzerland, based on the OECD’s common reporting standard.

Of course there are also trade-off involved, if our regulatory response is very complex and leads to high compliance costs, we may discourage foreign investment which would lead to lower living standards than would otherwise be the case.

Lowering the corporate rate would reduce the incentive to profit shift both debt dumping and inflating prices to related parties for goods or services. It would also facilitate capital deepening. But would it be “giving in” to companies not paying their fair share? Or would it be a pragmatic response to the increasingly globalised world? In a practical sense, given the Budget position, it’s all a bit academic but worth deliberating.

Conclusion

Australia’s tax system has come a long way since the first federal income tax was introduced 100 years ago.

We’ve seen taxes raised, taxes lowered, taxes given to the states and taxes abolished.

We’ve seen the income tax base broadened through CGT, FBT, taxing super, then not taxing super. We’ve seen the sales tax come, and we’ve seen it replaced by the GST.

It has been a 100 year journey, and now Australia is readying herself for the next phase.

Where to next? It’s a question we should all think about over the next year or so, and I hope I’ve given you a few thoughts worth pondering.

While I think Australia’s reliance on personal and corporate income tax is not likely to change significantly in the foreseeable future, elements of both systems are under pressure and are ripe for a rethink.

Bracket creep, high marginal tax rates and the resulting impact on participation as well as the treatment of savings perhaps warrant particular attention in the personal tax system. Base erosion and profit shifting as well as mobile assets and capital mean the rate and structure of corporate tax may need to change.

Reform in these areas will of-course involve trade-offs. Who pays tax and how much of the burden they bear, have always been fundamental questions for the Australian community to consider. But the world is changing and we need to look at these things afresh with a clear eye on the future.

The Government’s tax white paper process is all about making sure the community is involved in this conversation over the coming months as we progress through the process of tax reform.

What will happen? We will have to wait and see.