A tale of two crises: reflections on macroeconomic policy responses to the GFC and the pandemic[*]

Introduction

I would like to acknowledge both the Ngunnawal and the Ngambri people, the Traditional Owners and Custodians of the land on which we are meeting today. I pay my respects to their Elders, past, present and emerging. I’d also like to extend that respect to any Aboriginal and Torres Strait Islander people here today.

Thank you to Professor Brian Schmidt for that introduction and interesting discussion of Sir Leslie Melville.

I thank the College of Business and Economics for inviting me to give the 20th Sir Leslie Melville Lecture, following an illustrious lineage including three RBA Governors, three Treasury Secretaries and a current Treasury Minister. The first Melville lecture was given by Ian Macfarlane in the presence of Sir Leslie.[1]

I would also like to acknowledge Selwyn Cornish, the RBA’s in‑house historian as well as Visiting Fellow and former Head of Toad Hall here at ANU. Much of what we know about Melville we have learned from Selwyn.

Melville was the inaugural Professor of Economics at the University of Adelaide. He was the first economist hired by the Commonwealth Bank. The year was 1931, and the Great Depression had taken hold in Australia. More or less simultaneously, Treasury too brought in its first economic adviser, Lyndhurst Giblin from the University of Melbourne.

Both the bank and the Treasury were, as we might say these days, behind the curve, aiming to bring in economic expertise where none existed, to respond to the biggest economic shock the nation had ever faced.

In the 22 years he was at the bank, Melville lived through and had to navigate a set of profound macroeconomic crises and challenges, as well as the Great Depression, the war economy, post‑war reconstruction, and the 1951 recession induced by the Korean War wool boom.[2]

A truly remarkable set of events that puts recent events into perspective.

Tonight, I want to reflect on two recent crises that developed rapidly and which I had close personal experience of, namely the Global Financial Crisis of 2007‑09 and the Coronavirus pandemic of 2020‑22. These were searing events for the millions of Australians caught up in their impacts and, for that reason, for anyone like me who was closely involved in developing responses.

During the GFC, I was a senior official in the Treasury and then a senior economic adviser in Prime Minister Rudd’s Office – and my appointment as Treasury Secretary preceded by a few months the onset of the pandemic. For an economic policy adviser these two crises were truly the best of times amidst the worst of times.

I hope to impart four lessons for macroeconomic policy from these two crises.

First, policy mattered. Australia avoided potentially calamitous outcomes due to the scale and speed of the policy responses during both crises. When there is a large negative shock to the economy the unemployment rate usually rises sharply and returns to its previous level much more slowly. This is a result of labour market ‘scarring’ whereby a loss of a job during a recession can have long‑term consequences for the employment prospects of an individual. The scarring costs foregone during both crises are large and are a testimony to the support provided by all arms of macroeconomic policy. In both instances, robust responses were called for to stabilise the economy and society given the amount of uncertainty. Ex post assessments of the response against some modelled optimal response or counterfactual miss this point.

Second, the GFC and the pandemic required different fiscal responses reflecting their different antecedents and characteristics. For example, the tone and character of the economic response to the pandemic, including the range and type of instruments used, can be characterised as ‘unconventional’, not just aspects of the monetary policy response.

Third, while there was effective coordination between fiscal and monetary policy, the transmission mechanisms for the deployment of fiscal policy were more nuanced and targeted than monetary policy instruments in both crises. The pandemic was notable for the primacy of fiscal policy given that monetary policy was constrained by the zero lower bound.

Fourth, there is a well‑known aphorism that adversity is the true test of character. In my view that applies to institutions as much as it does to individuals. These two crises demonstrated that our leading economic agencies, the Reserve Bank and the Treasury, are able institutions under moments of adversity. But we also saw the importance of building the capability of organisations like the Australian Taxation Office and Services Australia to enable the rollout of key policies. Indeed, both crises demonstrated the strength of cooperation and a team mindset where businesses, workers and communities banded together with common purpose.

Let me now turn to the rest of this address. I will begin by making a distinction between a recession and a crisis. I will then discuss the specifics of the fiscal policy response to the GFC and pandemic including some comparisons with the 1990s recession. I introduce a fourth T for ‘tailored’ to add to the now customary three of ‘timely, targeted and temporary’ in examining the design of fiscal policy. I will then explore the appropriate scale of response in a crisis, focusing on the pandemic, arguing that it needed to be sufficient to quell uncertainty and avoid a damaging downward spiral.

The importance of policy design

A recession is generally defined as a sustained period of weak or negative growth in real GDP that is accompanied by a significant rise in the unemployment rate. The risk in a recession is quantifiable, through a comparison with historical episodes. The 1990s recession is an example of this. A crisis is a situation where there is uncertainty or unquantifiable risk that manifests in large falls in confidence and demand, and often accompanied by concerns about the stability of the economy or certain facets of it. In the GFC the concerns were about the collapse of the banking system, while in the pandemic there were concerns about a spiralling health crisis shutting down essential services like hospitals and supermarkets.

It may be useful to highlight the key differences between the two different crises.

The GFC was a crisis characterised by a period of extreme stress in global financial markets and banking systems. The catalyst was falling house prices in the US, and the trigger for its escalation was the collapse of Lehman Brothers in September 2008. Given the interconnected nature of the global financial system, events in the US flowed into Australia and elsewhere. The resulting credit crunch and collapse in confidence meant banks weren’t willing to lend, businesses weren’t willing to invest, and households weren’t willing to spend.

The pandemic was unlike any other downturn in recent history and precipitated the most severe economic downturn since the Great Depression. It was a health crisis before it became an economic crisis. Public health restrictions and cautious behaviour by people who didn’t want to catch the virus severely disrupted daily life and led to a sharp decline in output.

The economic context ahead of these two crises was very different. The GFC was preceded by a period of strong growth and high inflation, while the pandemic followed a period of lacklustre growth and low inflation. When assessing the policy decisions made during the pandemic there was an additional consideration for policymakers in wanting to not just return to the pre‑pandemic situation, but to surpass it. In contrast, the slowdown during the GFC helped curb the relatively high inflation seen before the crisis and may have influenced the speed at which monetary policy support was withdrawn.

Despite these differences there are a few key fundamentals in both crises that justified the large fiscal responses. They include the high degree of systemic uncertainty raising the risk of a very large and unquantifiable contraction, the risk of contagion financial or biological that meant the situation could escalate rapidly, information asymmetries about which assets were bad or who was infected, and a strong need to stabilise the situation to ensure confidence in the economy.

The underlying cause of the crisis in both cases was large uninsurable risks for individuals in Australia and there was little moral hazard associated with a large fiscal intervention. With this context in mind, I’ll now turn to the principles of good fiscal policy design when contending with a crisis.

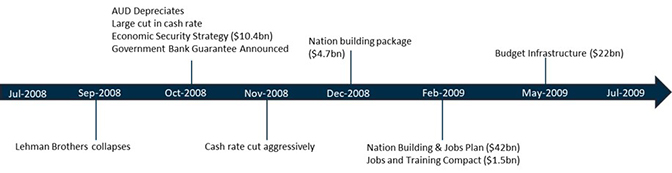

In both the GFC and the pandemic, policymakers were focused on delivering stimulus in a timely fashion, which is illustrated by the following timelines (Chart 1). In the GFC the first stimulus payments were distributed to households via Centrelink within four months of the downturn commencing. In the pandemic the JobKeeper package, the third economic package, was announced around eight weeks after the closure of international borders to non‑residents arriving from China.

In contrast, in the 1990s recession the main fiscal response, One Nation, was announced in February 1992, by which time the economy was in its third quarter of expansion since the trough albeit growing slowly. Policymakers learned from this experience and ensured a timelier response in both of the subsequent crises.[3]

Chart 1 – Timeline of response

Timeline of response to Global Financial Crisis

Timeline of response to COVID‑19 pandemic

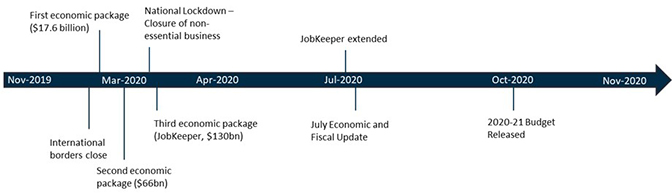

The effects of these timely responses are evident in the consumer and business confidence data. In both cases there is an immediate effect on confidence, with a halt in the decline and then a rise from low levels in the couple of months after the policies were announced (Chart 2).

Chart 2 – Confidence response to policy announcements

| ANZ consumer confidence | NAB business confidence |

|---|---|

|

|

Note: The policy announcement date for the Economic Security Strategy in the GFC is 14 October 2008. The announcement date for JobKeeper for COVID‑19 is 30 March 2020. For JobKeeper the monthly business confidence series captures the announcement in March 2020. For consumer confidence monthly ANZ consumer confidence data is used as the weekly series began on 5 August 2008. The JobKeeper announcement was captured in the last week of March, so the announcement date is placed in the month of April as the closest point to the actual date in the monthly series that averages weekly observations.

Sources: ANZ-Roy Morgan and NAB.

One element of the timely response in the pandemic was the important role played by the Australian Taxation Office and Services Australia in rolling out fiscal support. From the announcements of the Coronavirus Supplement and JobKeeper program to the receipt of the first payments was 3 weeks for households receiving the supplement and just over 5 weeks for businesses receiving JobKeeper. We owe that to the ability of these organisations to react quickly, leveraging off the investment they had made in their capability.

In the GFC, the need to get stimulus payments to households ahead of Christmas influenced the decision to deliver them via Centrelink initially because it was the quickest method available. For individuals and households that could not be reached this way, subsequent rounds of stimulus were delivered via ATO cheques. Following the GFC, Services Australia has digitised much of its processes, enabling it to quickly provide household support during the pandemic. Of course, the cost of timeliness is often lower precision. This can be seen in the criticism of the flat payment rate of JobKeeper and issues in the delivery of stimulus cheques during the GFC. In both cases, the circumstances justified lower precision in the early phases of the crises.

Turning now to the second ‘T’, how targeted fiscal measures are, we need to reflect more deeply on the transmission channels of the different shocks. Targeting is particularly important as there is a balance between providing support during crises as needed, and ensuring long‑term fiscal sustainability.

In the GFC the shock was to the functioning of financial markets and the flow‑on effects this had for private demand. The fiscal policy response was targeted at ensuring market functioning (for example, by providing deposit guarantees) and to stimulating or supplementing for deficient private demand via transfers to households and small‑scale infrastructure investment. Following financial crises, it typically takes a reasonably long time for demand for credit to return, and there was an expectation that this would be the case following the GFC. The infrastructure investment and the first homeowner grants were designed to support credit demand over that transition period, and to wind‑down by the time it was expected that private credit demand would have returned.

During the GFC fiscal support was primarily aimed at low‑income households, which tend to have higher propensities to consume out of any additional income they receive. This targeting ensured that those who needed support the most received it, and maximised the stimulus effects of the transfer payments.

In the pandemic the crisis was driven by a health shock. Australia, like many countries, responded by implementing border closures and tough activity restrictions. These health restrictions played a role in reducing demand (particularly for services) but there was also a sharp fall in confidence and increase in precautionary saving by both households and businesses. Against this backdrop the fiscal response was focused initially on stabilisation measures to mitigate the effects of activity restrictions, and on mitigating counter‑party risk through repayment pauses and insolvency moratoriums.

A clear example of targeted policies in the pandemic aimed at stabilisation were the Coronavirus Supplement and JobKeeper support. In tandem they served as a safety net for households whose ability to perform their job was affected by the activity restrictions. They were also targeted to those whose incomes were most at risk. Treasury analysis shows that following the onset of the crisis incomes from employment, income support and welfare payments were higher in the two lowest income quintiles, while falling slightly for those in the highest income quintile.[4] Remarkably, poverty fell in 2020 reflecting again the targeting of transfer payments.[5]

Targeted measures can become distorted when policymakers lose sight of their core objective. Governments are highly sensitive to perceptions of stimulus as waste.[6] The pressure to avoid criticism of waste can lead policymakers in search of the ‘double dividend’ – measures that provide both stimulus and realise a second objective. Any double dividend must be tightly targeted, able to support the timeliness of a response and be directly responding to the characteristics of the shock.

The third ‘T’ is temporary. A key tension fiscal policymakers have to balance is not just how quickly stimulus gets out the door but how nimble they can be in withdrawing stimulus during the recovery phase. Withdrawing fiscal stimulus in a timely manner is just as vital as implementing it quickly – if done too slowly it can end up contributing to an overshoot in activity and higher inflation, exacerbating fluctuations in the economic cycle. There are also compositional effects of fiscal policy, where continuing to provide additional government spending or investment past the point where private demand has recovered can crowd out private demand, lowering spending effectiveness and leading to higher debt.

A difficulty with implementing this ‘T’ in practice is that the core data that we use to assess how the economy is tracking is largely only available on a monthly or quarterly basis, and generally with a lag. Deciding whether to extend fiscal stimulus is a judgement call. In times of uncertainty like the GFC and the pandemic it’s hard to get this balance right.

A notable feature of the pandemic was the availability of more timely data, with close to real‑time card spending and payroll data. As an example, policy makers could track switches between JobKeeper and JobSeeker on a fortnightly basis. This meant we could monitor key transitions, such as the tapering and narrowing of JobKeeper after September 2020.

A second difficulty is that withdrawing a temporary measure can be a difficult juggling act for government as removing stimulus is always far less popular than providing it. This was a difficulty faced by governments in both crises.

The final ‘T’ I want to discuss today is the new one I’m proposing – ‘tailoring’ the overall stimulus package to a given crisis or recession. Different situations call for different measures – every unhappy situation is unhappy in its own way.

The range of measures adopted during the pandemic were segmented across different types of households and different types of businesses. There were transfer payments, tax expenditures, incentive payments and JobKeeper, a fiscal program for which there was no precedent in Australia.

The need for something like JobKeeper was anticipated in a Treasury paper colleagues and I wrote in 2006 which emphasised “a role for government in promoting an environment in which people can quickly resume economic activity once a pandemic begins to dissipate”. Much of that paper was inspired by earlier modelling that Jong Wha Lee and Warwick McKibbin had done on the global economic impact of SARS.[7]

JobKeeper was tailored to the pandemic, but it would have been inappropriate during the GFC or even more so in the 1990s recession where it would have stymied needed structural changes and resource reallocation.

In fact, an expectation that countercyclical wage subsidies like JobKeeper would be provided in every crisis or recession could risk creating a moral hazard for businesses by discouraging them from preparing adequately for the risks of future downturns in the economy, as well as preserving less productive jobs and slowing down the process of labour reallocation.

The literature suggests that countercyclical wage subsidy measures are most effective in circumstances where there is a high degree of firm‑specific human capital, in countries where there is stringent employment protection legislation (increasing the costs of hiring and firing) and in downturns where the fall in demand is large and short‑lived and there is no structural shift requiring any reallocation of labour.[8]

The pandemic was a clear example of a large temporary shock, which is likely why some countries introduced countercyclical wage subsidies for the first time. But the importance of how highly regulated the labour market is may explain why wage subsidy measures were not widely used by advanced economies outside Europe before the pandemic, as many of these countries, including Australia, have less regulated labour markets.

One country that had used a wage subsidy of this type in the past, but which did not have a heavily regulated labour market was New Zealand. New Zealand had developed and implemented its policy in response to the Christchurch earthquake and this left it well placed because it had experienced a crisis in which the instrument had already been used.

The US, which has a very flexible labour market, used unemployment benefits and household cash transfers rather than a wage subsidy scheme to provide support during the pandemic. It seems likely that this has complicated the US labour market recovery creating several frictions with low unemployment but lower participation than pre‑pandemic.[9]

The takeaway for me is that policy must be tailored not just to the circumstances of the crisis in question, but also tailored to your institutional framework.

And the message on policy design I hope you take away from this discussion is that an effective tool in one crisis may not be optimal in a different crisis. Policymakers need to learn from the past but also recognise the unique circumstances they are faced with.

Fiscal stabilisation vs fiscal stimulus

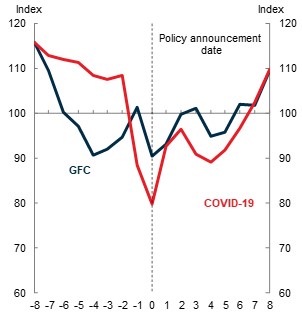

I’ve already touched on some of the aspects of the fiscal policy response that were ‘unconventional’ in the pandemic. Now I want to expand a bit on the interaction of monetary and fiscal policy. A key difference between the economic environment ahead of the pandemic compared with the GFC was the level of the cash rate going into the shock (Chart 3). The cash rate was lowered by 425 basis points during the GFC, but for COVID‑19, where there was a significantly larger fall in economic activity, the cash rate was only lowered by 65 basis points because of the constraint of the zero lower bound. The RBA estimates that the bond purchase program reduced long‑term AGS yields by around an additional 30 basis points and lowered the spread of yields on semis to AGS by between 5 and 10 basis points,[10] but the size of the monetary response in the pandemic clearly still falls far short of the response to the GFC.

Chart 3 - Cash rate response to downturns

Source: Reserve Bank of Australia.

Note: Midpoint of target band between January 1990 and July 1990

Given these limits on the monetary policy response, there was naturally the need for a bigger role for fiscal policy to play in providing macroeconomic stabilisation during COVID‑19. But even absent the constraints on monetary policy there would have been a clear role for fiscal policy, because of the need for the government to provide insurance against the high degree of uncertainty through preserving employee‑employer relationships. A monetary policy response, whatever the size, could not have provided the kind of certainty that JobKeeper did for firms and employees, knowing they could resume their production and labour as normal once the crisis had passed.

There is a clear distinction between fiscal policy for economic stabilisation, such as in a crisis like the pandemic, and fiscal policy as economic stimulus, such as when there is weak private demand in a more typical recession. We are familiar with stimulus in recessions and have tried and tested methods for assessing its effectiveness. There are reasonably well understood methods through which such policy transmits to the economy, and an academic literature to draw on in terms of estimating a counterfactual to assess the effect the policy has on the economy.

The total estimated effect of a fiscal stimulus policy on the economy is generally referred to as a fiscal multiplier. The policies enacted later in the pandemic (roughly from the October 2020 Budget onwards) can be thought of as falling into this category of fiscal stimulus.[11]

Fiscal policy targeted at stabilising the economy in the face of a crisis and uncertainty, as there was during the early days of the pandemic, is much harder to calibrate in real‑time and to assess ex post. This is because it is very difficult to forecast or assess ex post the counterfactual outcome.

In the period before JobKeeper was announced, when countries were closing borders and imposing activity restrictions to prevent the virus spreading and preventing hospitals from becoming overrun, as they were in Italy and New York, there was real fear in the community. There was a possibility that if the fiscal response fell short the economy could spiral downwards, businesses could become insolvent, people could lose their jobs and all demand (not just those forms limited by health restrictions) could collapse. In the face of these risks the question on policymakers’ minds was not “what will the multiplier of this spending be” but rather “how much do I need to spend to prevent the worst from happening”.

We can see how this played out in early 2020, where the first economic response package was introduced on March 12, the second package just under a fortnight later, and the third package – which finally met the community expectations of sufficiency – just a week after that.

In assessing the efficacy of policy in these circumstances you have to start by acknowledging the high uncertainty prevailing at the time and accept that it’s not possible to identify a sensible counterfactual of how the economy might have fared absent support during that initial period of the crisis.

The estimation of standard multipliers during the pandemic is complicated by the fact that activity restrictions prevented some types of economic activity from occurring. Some of our peers lowered their assessment of multipliers because they expected that activity restrictions and heightened precautionary savings would mean less spending from stimulus than usual.[12] However, there was also an argument that spending out of the stimulus might still occur at the normal rate, just at a longer lag. Additionally, empirical evidence suggests that fiscal multipliers may be larger when monetary policy is constrained by the zero lower bound, in which case monetary policy does not act to offset fiscal spending,[13] and in deep recessions, in which case there is less crowding out of consumption and investment.[14] Both of these were true during the COVID‑19 period.

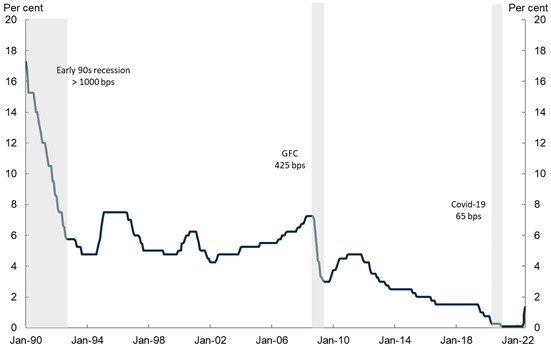

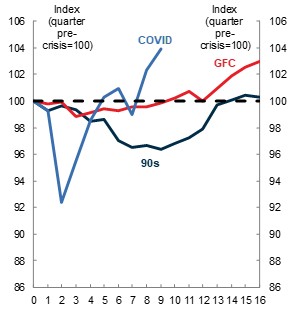

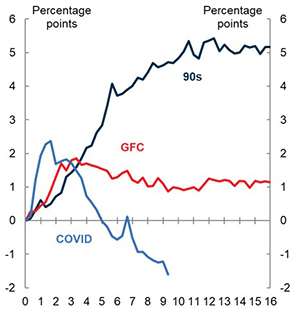

Given the difficulty of estimating multipliers, particularly during the COVID‑19 period, I will now show a few simple, stylised comparisons to try and consider the scarring in the 1990s recession and the two crises. While both real GDP and the unemployment rate deteriorated rapidly in the early months of the pandemic, the recovery was significantly shorter than in the 1990s (Chart 4). In the GFC, it is likely that the policy response contributed to averting the type of decline seen in the 1990s.

Different combinations of fiscal and monetary policy were in play in the two crises. This in part reflects policy design responding to the circumstances prior to both crises. As I noted earlier, the concerns preceding the GFC was inflation possibly reflecting an economy operating beyond full employment and financial risks in some countries not being appropriately priced. While for the pandemic, concerns related to low inflation and an economy not operating at full employment.

In the case of the GFC, monetary policy began to tighten a year after the initial shock, while for the pandemic it was more than two years. Further, conditions following the initial shocks have been different, and in the case of the pandemic the economy has been hit by subsequent shocks including the Ukraine War, COVID waves and natural disasters.

Chart 4 - Deviation from pre‑crisis level

| Real GDP per capita | Unemployment rate |

|

|---|---|---|

|

|

|

| Quarters post crisis | Quarters post crisis | |

| Note: Quarter = 0 is pre‑crisis quarter: September quarter 1989 for 1990s; September quarter 2008 for GFC; December quarter 2019 for COVID Source: ABS National Accounts | Note: 0 refers to the monthly unemployment rate trough preceding each recessionary period: November 1989 for 1990s; August 2008 for GFC; February 2020 for COVID‑19. Source: ABS Labour Force | |

One way of interpreting the rapid recoveries in the labour market is as scarring costs foregone from fiscal policy support. Scarring effects of crises and recessions can be large. The empirical literature finds that unemployment spells generally increase the likelihood of future unemployment and make it harder to get a job when unemployed.[15] And for graduates entering a weak labour market, they may miss out on high‑quality employment opportunities and suffer lower wage growth than if they had entered in more normal economic conditions.[16]

There is a balance to be struck between preventing excessive labour market scarring and ensuring the response is proportionate so that long‑term fiscal sustainability is preserved. The larger role for fiscal policy in the pandemic can be seen in the size of the fiscal cost across the two crises. Spending on key support measures in the wake of the GFC was around $80 billion, roughly 6 per cent of GDP at the time. This has been eclipsed by the economic support provided during the COVID pandemic of $314 billion or about 15.2 per cent of GDP.[17],[18]

One of the costs of this scarring foregone is higher debt. Given the choices faced by policymakers in March 2020, my view is that the scale of the initial fiscal support provided was warranted at the time to deliver stability and has delivered better returns than we expected. Clearly, we are now around full employment, and it is appropriate for fiscal consolidation to now occur and for monetary policy to normalise. Creating the fiscal space for interventions is important, and now is the time for us to rebuild our fiscal buffers so these options remain open to us in future.

All this leads me to a big question that fiscal policymakers are pondering currently: what is the future role of countercyclical fiscal policy? We’re seeing the beginning of a normalisation of monetary policy right now, but there is an open question about whether we remain in an environment where interest rates may remain structurally low. If this is the case, it’s more likely that fiscal policy will need to respond to future crises or sharp downturns. At the same time, elevated debt levels across most of the developed world have brought fiscal sustainability back into focus.

Outside of a crisis fiscal policy often has long lags as it takes time for measures to be approved through parliamentary processes. Monetary policy is likely to remain better placed for demand management, as has been the case for many years. However, should fiscal policy be required, recent experiences suggest it should be designed around the four T’s – timely, targeted, temporary and tailored to the situation.

Moreover, there are still important questions to consider about the interaction of monetary and fiscal policy, regardless of future circumstances, something the recently announced review of the RBA will consider.

Concluding remarks

In preparing this evening’s remarks I wondered what Melville would have made of our times and whether his legacy persists in the modern world.

In his obituary, Melville is characterised as “the man governments of both persuasions turned to when some knotty problem arose”.[19] I’d say that is because of his great reputation as a pragmatist and problem‑solver in times of crisis.

Reflecting on his experiences during the 1930s and ‘40s, Melville said of himself and his peers such as Giblin, Wilson and Nugget Coombs, that we “were all pragmatists, dealing with applied economics, applied to practical problems that were developing very rapidly”.[20]

I think this is one of Melville’s and his colleagues’ great legacies for public institutions in Australia. Our public institutions are not riven with ideological schisms nor are they hollowed out as is occasionally claimed. They remain capable, pragmatic and problem‑focused. And they stand ready to serve governments of both persuasions as they did in the GFC and the pandemic.

Thank you for the opportunity to speak with you tonight.

References

European Commission (2010). ‘Short time working arrangements as response to cyclical fluctuations’, Occasional Papers, 64.

Auerbach A and Gorodnichenko Y (2012). ‘Measuring the Output responses to fiscal policy’, American Economic Journal: Economics Policy, 4(2):1‑27.

Borland (2020) ‘Scarring effects: A review of Australian and international literature’ Australian Journal of Labour Economics, 23(2):173‑187.

Andrews, Deutscher, Hambur and Hansell (2020) ‘The career effects of labour market conditions at entry’. Treasury working paper.

Caggiano V, Castelnuovo E, Colombo V and Nodari G (2015) ‘Estimating fiscal multipliers: News from a non‑linear world’, Economic Journal, 125(584):746‑76.

Castelnuovo E and Lim G (2019) ‘What do we know about the macroeconomic effects of fiscal policy? A brief survey of the literature on fiscal multipliers’, The Australian Economic Review, 52(1):78‑91.

Christiano L, Eichenbaum M and Rebelo S (2011). ‘When is the government spending multiplier large?’, Journal of Political Economy, 119(1): 78‑121.

Cornish S (1999) ‘Sir Leslie Melville: Keynesian or pragmatist?’, History of Economics Review, 30(1):126‑150.

Farquharson J (2002) 'Melville, Sir Leslie Galfreid (1902‑2002)', Obituaries Australia, National Centre of Biography, Australian National University, accessed 21 July 2022.

Goode E, Liu Z and Nguyen, T.L (2021). ‘Fiscal multiplier at the zero bound: Evidence from Japan’, FRBSF Economic Letter, accessed May 24, 2021.

Gruen D (2009) ‘The Return of Fiscal Policy’, speech to the Australian Business Economists Annual Forecasting Conference 2009, 8 December.

Keynes JM (1936) ‘The General Theory of Employment, Interest and Money’, Palgrave Macmillan, London.

Leet J.W. and McKibbin W (2004) ‘Estimating the Global Economic Costs of SARS’, Institute of Medicine (US) Forum on Microbial Threats.

Lydon R, Matha T and Millard S (2019) ‘Short‑time work in the Great Recession: firm‑level evidence from 20 EU countries’, IZA Journal of Labor Policy, 8(1):1‑29.

OECD (Organisation for Economic Co‑operation and Development) (2020) ‘Flattening the unemployment curve? Policies to support workers’ income and promote a speedy labour market recovery’, OECD Economic Outlook, 20(1)

OECD (2020) ‘Job retention schemes during the COVID‑19 lockdown and beyond’, OECD Publishing, Paris.

Phillips B, Gray M and Biddle N (2020) ‘COVID‑19 JobKeeper and JobSeeker impacts on poverty and housing stress under current and alternative economic and policy scenarios’.

Reserve Bank of Australia (2020) ‘Box A: Using Wage Subsidies to Support Labour Markets Through the COVID‑19 Shock’, August 2020 Statement on Monetary Policy.

Seliski, J, Chen YG, Lee J, Betz A, Demirel U.D. and Nelson J (2020) ‘Key methods that CBO used to estimate the effects of pandemic‑related legislation on output’, CBO Working Paper 2020‑07.

Kent, C (2022) ‘From QE to QT – The next phase in the Reserve Banks Bond Purchase Program’, Speech at the KangaNews DCM Summit, 23 May.

The Treasury (2021) ‘Insights from the first six months of JobKeeper’, The Treasury, accessed 21 July 2022.

Woodford, M. 2011. ‘Simple analytics of the government expenditure multiplier’, American Economic Journal: Macroeconomics, 3(1):1‑35.

[*] I would like to express my appreciation to Mark Cully and Rachael McCririck for their assistance in preparing this address.

[1] Ken Henry in 2003, and John Fraser in 2017. Martin Parkinson gave the lecture in 2010 as the Secretary of the Department of Climate Change, ahead of being appointed Treasury Secretary. The Hon Andrew Leigh MP, Assistant Minister for Competition, Charities and Treasury gave the lecture in 2015.

[2] After leaving the bank, he became the second Vice Chancellor of the ANU, through to 1960. He was subsequently also a board member of the RBA between 1960 and 1975.

[3] Gruen (2009).

[4] The Treasury (2021).

[5] Phillips et al (2020).

[6] Keynes’s example of people being paid to dig and then refill holes was in fact strongly advocating for simple transfer payments, Keynes (1936).

[7] Lee and McKibbin (2004).

[8] OECD (2010), European Economy (2010), Lydon et al (2019), RBA SMP Box (August 2020).

[9] OECD (2020).

[10] Kent (2022).

[11] Any calculations of multipliers of such policies are complicated by the proximity we are still at to the pandemic and the distortionary, subsequent shocks as a result of supply chain problems and the war in Ukraine, which make it difficult to get a clean read on the data.

[12] See for instance the Congressional Budget Office’s approach to incorporating the effects of pandemic related legislation, where they account for the effects of social distancing on demand multipliers (Seliski et al, 2020).

[13] Woodford (2011), Christiano et al (2011) and Goode et al (2021).

[14] Caggiano et al (2015), Auerbach and Gorodnichenko (2012) and Castelnuovo and Lim (2019).

[15] Borland (2020).

[16] Andrews et al (2020).

[17] GFC GDP denominator is assumed to be through the year to June 2009 in seasonally adjusted terms.

[18] GFC measures include The Economic Security Strategy, the Nation Building Package, Nation Building and Jobs Plan, Jobs and Training Compact and Budget Infrastructure while the COVID‑19 measures include all COVID‑19 economic support measures up to Budget 2022‑23.

[19] Farquharson (2002).

[20] Cornish (1999).