Revised 1 October 2024

Satisfactory Tax Record (STR) requirements

Which Commonwealth Government entities are required to comply with this policy?

All non‑corporate Commonwealth entities must comply with this policy.

Corporate Commonwealth entities and Commonwealth companies are encouraged to adopt this policy.

The Department of Finance flip chart can be used to assist in determining whether a Commonwealth entity is non‑corporate, corporate or a company.

Which tenders does this policy apply to?

This policy only applies to procurements conducted through an open tender where the total value of all contracts awarded under the procurement is estimated to be $4 million or more (including GST).

This policy does not apply to limited tenders, or tenders which do not reach or exceed the $4 million threshold.

Does this new STR requirement apply to existing Commonwealth contracts?

The original policy, which commenced 1 July 2019, does not require Commonwealth entities to amend existing contracts or deeds of standing offer that were in place prior to 1 July 2019.

The revised policy, which commenced 1 October 2024, applies to Commonwealth entities undertaking open tenders for procurements estimated to be $4 million or more, which close on or after 1 October 2024. For example, if a Commonwealth entity commenced a procurement through an open tender on 23 September 2024 and tender closes on 4 October 2024, the revised policy will apply.

What should a Commonwealth Procurement Officer do if the tenderer says they have issues when seeking an STR?

Tenderers should be directed to contact the ATO on:

- 13 28 66 (for businesses)

- 13 72 86 (for registered agents)

Checking STR requirements

Do Commonwealth Procurement officers need to undertake an analysis of whether a tenderer has a satisfactory STR?

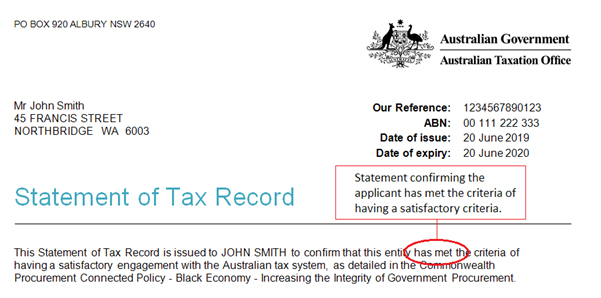

No. The STR provided by the tenderer will clearly indicate if the tenderer met the criteria of having a satisfactory engagement with the Australian tax system.

Example:

What happens if a STR expires before awarding the contract or during the contract?

STR expires before awarding the contract

Once the procuring Commonwealth entity receives all valid and satisfactory STRs from a tenderer – as per the policy, the minimum requirements under this policy are satisfied.

However, successful tenderers are required to maintain up‑to‑date satisfactory STRs during the course of the contract. As such, the Commonwealth entity must outline in the “request documentation” that if an STR expires after the close of the tender yet before the awarding of the contract, that a renewed STR is required. The contract will not be awarded if the tenderer fails to comply with the conditions included in the “request documentation”.

STR expires during the contract

Where an STR expires during the contract a renewed satisfactory STR is required as set out in the “request documentation”. Such records must be made available to the Commonwealth entity on request. The consequences of contravening this requirement will also need to be clearly outlined in the “request documentation” and contract terms.

Ensuring compliance and consequences

What are the consequences for tenderers if they do not provide a valid and satisfactory STR by the close of tender?

The provision of all valid and satisfactory STRs is required to be included in “request documentation” as a minimum content and format requirement. If a tenderer does not provide all valid and satisfactory STRs at close of tender, the Commonwealth entity has the following options:

- the tender is not considered further and excluded from the procurement process; or

- if the failure is a result of an unintentional error of form, the tenderer may be provided an additional 10 business days to provide all valid and satisfactory STRs.

If a tenderer is provided an additional 10 business days to correct unintentional errors of form, this same opportunity must be provided to all tenderers who applied and made unintentional errors of form.

Following the 10 business days, if tenderers still fail to provide a valid and satisfactory STR, they must be excluded from the procurement process.

Contract value

What if the original estimate of the procurement value was under $4 million including GST (therefore no STR is required) but the resulting contract value ends up being more than that?

At the time of approach to market the estimated procurement value determines whether the policy applies, this is in accordance with paragraph 9.2–9.6 of the Commonwealth Procurement Rules. Commonwealth entities should document how the estimated value was determined. In the above scenario, no STRs are required to be submitted by tenderers even if the resulting contract value is equal to or above the $4 million (including GST) threshold. This is consistent with the approach taken when considering the broader economic benefits in procurement.

Subcontractors

Do Commonwealth Procurement officers need to hold the satisfactory STRs of first tier subcontractors?

No. However, the Commonwealth entity must require, in the “request documentation” and/or the contract (if applicable), that the prime contractor hold copies of satisfactory STRs for any first tier subcontractors that the tenderer has or will engage to deliver goods or services as part of a procurement with an estimated value of $4 million or more inclusive of GST.

The Commonwealth entity may request copies of the first tier subcontractor’s STRs from the successful tenderer. These STRs may either be the ones obtained during the procurement process, if the tenderer had already engaged with the subcontractor, or the STRs obtained at the time of entry into the subcontract.

Do first tier subcontractors need to maintain valid and satisfactory STRs for the life of the subcontract?

The Commonwealth entity has discretion about whether to require first tier subcontractors maintain valid and satisfactory STRs for the life of the subcontract. If this discretion is exercised, it must be clearly indicated in the contract and “request documentation”.

What is a first tier subcontractor under this Procurement Connected Policy?

A first tier subcontractor for the purposes of this policy is a business who undertakes a portion of the contract from the prime contractor directly engaged by the contracting entity. This policy only applies to first tier subcontractors under contract to the prime contractor. The prime contractor is the entity with the direct contract relationship with the Commonwealth entity.

Example:

Panel arrangements

Why is it necessary to have STRs submitted at the point of establishing a panel when the panel member may not end up having any work orders of $4 million or more inclusive of GST?

This was considered to be the most efficient and practical approach and is consistent with the approach taken when considering the broader economic benefits in procurement.

When a panel established after 1 July 2019 is refreshed to include new panel members, satisfactory STRs will need to be provided by all new tenderers.

Is it necessary for tenderers to submit STRs when a panel originally established prior to 1 July 2019 is refreshed?

No. This policy applies to the process to establish a panel arrangement from 1 July 2019, or to refresh a panel established after that date, when a total value of orders under the arrangement is collectively estimated to be $4 million or more (including GST).

For existing panels, including panels established before 1 July 2019, but that are refreshed or renewed from 1 July 2019, there is no requirement to obtain a satisfactory STR unless requested by the Commonwealth entity.

Privacy

Can a Commonwealth Procurement Officer contact the ATO to confirm a tenderer’s details or their tax history?

No. Secrecy provisions in tax laws do not allow the ATO to divulge any taxpayer information to a third party, including to its own procurement staff.