Prior to 1 May 2011, section 8 of the Freedom of Information Act 1982 (the Act) required the Treasury to report on its organisational structure, functions and decision making powers, the arrangements for public involvement in its work, the categories of documents it holds and how the public can obtain access to these documents. The section 8 statement covers the period 1 July 2010 to 30 April 2011.

From 1 May 2011, an agency subject to the Act is required to publish information on its website as part of the Information Publication Scheme provisions in Part 11 of the Act. This requirement has replaced the former requirement to publish a section 8 statement in an annual report. The Treasury's plan showing the information that is published in accordance with the Information Publication Scheme requirements is accessible from the Treasury's website at www.treasury.gov.au.

The Australian Competition Tribunal is a separate body within the Treasury portfolio but does not publish an annual report. The Tribunal's section 8 information follows the Treasury's information.

Section 8 statement

Information on the Treasury's organisational structure and senior management are set out in Figures 1 and 2 on pages 15 and 16 respectively. The Treasury's functions and the decision-making powers are set out in the Departmental Overview and Corporate Governance sections at pages 9 to 11 and pages 107 to 112 respectively.

The Treasury delegations and authorisations

The Deputy Prime Minister and Treasurer, other ministers and the Secretary to the Treasury delegate certain powers to officials, or authorise officials to act on their behalf, under Acts of Parliament and agreements. These delegations and authorisations remain in force until renewed, and are listed below.

- Under section 23 of the Federal Financial Relations Act 2009, the Treasurer has delegated the power to make payments to the states under section 5 and Part 2 of the Act to the Executive Director, Fiscal Group; General Manager, Commonwealth-State Relations Division; and General Manager, Budget Policy Division.

- Under the Crimes (Currency) Authorisation 2006, the Treasurer has delegated certain powers to the General Manager, Corporations and Capital Markets Division; the Chief Executive Officer, Royal Australian Mint; and the Senior Manager, Note Development, Research and Security, Reserve Bank of Australia, pursuant to the definition of 'an authorised person' in subsection 3(1) of the Crimes (Currency) Act 1981.

- Under the Currency Delegation 2007, the Treasurer has delegated the power to determine the issue price of coins of certain denominations under subsection 14A(2) of the Currency Act 1965, to the General Manager, Corporations and Capital Markets Division and the Chief Executive Officers of the Royal Australian Mint and the Gold Corporation.

- Under the Gold Corporation Agreement Delegation 1999, the Treasurer has delegated authority to approve a range of essentially administrative matters provided for under the Gold Corporation Agreement between the Commonwealth and Goldcorp Australia relating to gold, platinum and silver coins to the Executive Director, Markets Group and the General Manager, Corporations and Capital Markets Division.

- Under subsections 1821A, 22 and 25 of the Foreign Acquisitions and Takeovers Act 1975, and Regulations 3(e) and 3(h), the Treasurer has authorised the General Manager and senior staff from the Foreign Investment and Trade Policy Division to act on his behalf to approve and conditionally approve various proposals and, in specific circumstances, to make an order.

- Under section 22 of the Mutual Assistance in Business Regulation Act 1992, the Treasurer has delegated to the General Manager, Corporations and Capital Markets Division the authorisation to exercise the Treasurer's powers to consider requests raised under the Act from foreign regulators for information, documents or evidence, including the ability to impose conditions on an authorisation.

- The Treasurer has delegated to Treasury officials the authority to vote on the Treasurer's behalf on routine matters arising from the Treasurer's Governorship of the IMF, the World Bank Group, the Asian Development Bank and the European Bank for Reconstruction and Development.

- Under subsection 9A(2) of the Australian Prudential Regulation Authority Act 1988, the Assistant Treasurer and Minister for Financial Services and Superannuation, on behalf of the Treasurer, has delegated power to the Executive Director, Markets Group and the General Manager, Financial System Division to approve APRA to enter into an agreement to provide prudential regulation of advice services for a fee.

- Under subsection 35(1) of the Archives Act 1983, the Assistant Treasurer and Minister for Financial Services and Superannuation, on behalf of the Treasurer, has delegated to the Secretary to the Treasury and Executive Directors, the authorisation to arrange to exempt records from the open access period.

- Under subsection 56(2) of the Archives Act 1983, the Minister for Finance and Deregulation has delegated to the Treasurer, the Secretary to the Treasury and Executive Directors, the authorisation to approve access to records not in the open access period.

- Under subsections 147(2) and 601DC(2) of the Corporations Act 2001, the responsible minister has delegated the powers to consent to a name being available to a body corporate, to ASIC's Chief Executive Officer and Director, Public Information Program — Operations.

- Under the Financial Management and Accountability Act 1997 and the Financial Management and Accountability Regulations 1997, the Minister for Finance and Deregulation has delegated certain powers through the Financial Management and Accountability (Finance Minister to Chief Executives) Delegation 2010 to the Secretary to the Treasury who has sub-delegated them to Treasury officials. The Treasurer holds powers in his own right under the Financial Management and Accountability Act 1997, and he also has delegated certain powers to Treasury officials.

- Under subsection 23(1) of the Freedom of Information Act 1982, the Secretary to the Treasury has authorised senior executive service officers within the Treasury to make decisions regarding initial requests for access to documents. Executive directors are authorised under section 23 to consider and make decisions on applications for internal review.

- In accordance with subsections 33(5), 33A(6) and 36(8) of the Freedom of Information Act 1982, the Treasurer has delegated his powers to the Secretary to the Treasury, in respect of documents of the Treasury.

- Under section 22(1) of the Reserve Bank Act 1959, the Secretary to the Treasury has nominated a senior executive service officer from within the Treasury to attend meetings of the Reserve Bank Board at which the Secretary is not present.

- Under the following legislation, the Secretary to the Treasury has delegated to nominated Treasury officials certain responsibilities and decision-making powers as an employer: Public Service Act 1999; Public Service Regulations 1999; Public Service Classification Rules 2000; Public Service Commissioner's Directions 1999; Long Service Leave (Commonwealth Employees) Act 1976; Maternity Leave (Commonwealth Employees) Act 1973; Safety, Rehabilitation and Compensation Act 1988; and Fair Work Act 2009.

- Under section 7 of the COAG Reform Fund Act 2008, the Treasurer has delegated his powers to vary the Standard Business Reporting — Payroll Tax Arrangements Agreement, to the Executive Director, Markets Group.

Arrangements for outside participat ion

People or organisations outside the Commonwealth administration may participate in forming policy or administering enactments and schemes for which the Treasury is responsible. They can do this by writing to Treasury portfolio ministers, the Secretary to the Treasury, or agencies in the Treasury portfolio. In addition, the Treasury website includes details of current public consultations, reviews and inquiries, with details on how to make submissions.

Consultation arrangements

Community consultation enables the Treasury to be better informed when providing advice to the Government.

The Treasury's consultation is undertaken in accordance with government directives and priorities and in line with the Best Practice Regulation Handbook. Effective consultation is an essential element of best practice regulation making.

As part of the Business Liaison Program, Treasury officers conduct regular discussions with companies and organisations to monitor, analyse and report on economic conditions and prospects. The Treasury also engages in consultation to inform the development and implementation of specific policy proposals, including comprehensive consultation on substantive tax and superannuation policy proposals. By being fully informed of the effects of specific proposals, the Treasury can better advise the Government on how to best meet its objectives and minimise unintended consequences.

With regards to business law changes, the Treasury seeks early and iterative engagement with a broad range of relevant stakeholders, through a mixture of targeted consultation and public consultation. Typically, in the business law field, relevant stakeholders include regulatory agencies, industry associations and other key representatives of relevant parts of industry (including the financial services and professional advisory sectors), and investor or consumer representatives. Among industry, key fund management sectors such as superannuation and insurance may be relevant, as may representatives of issuers and fundraisers more broadly, as well as company directors, company secretaries, lawyers, actuaries, auditors and accountants.

The Treasury generally conducts public consultation on proposed tax changes at both the policy design and legislative design stages. The consultation period is usually four weeks, although on occasions this may be reduced, for example, where introducing the legislation is the priority. Consultation summaries are posted on the Treasury website when new legislation is introduced into Parliament. These summaries provide feedback to consultation participants on the key issues raised in consultation; changes made as a result of consultation; and where possible, why certain suggestions were not adopted. Consultation summaries also invite feedback on the consultation process to provide information for the Treasury to continuously improve its consultation practices and arrangements.

Where possible, the Treasury seeks to consult on tax changes at the initial policy design stage. To facilitate this consultation, in 2009, the Treasury established, by tender, a Tax Design Advisory Panel which now comprises five accounting firms, five law firms, one economic research and modelling house, and one legal academic and research organisation. Establishing this panel also allows the Government to develop important tax and superannuation legislation by teams involving the Treasury, the ATO and the private sector, as represented by panel members.

On occasions, conflicts arise between the need to consult and draft measures for introduction, particularly in integrity and budget measures. This is due to budget tax measures generally remaining confidential until their announcement, and public consultation follows the announcement. However, the Government may consult confidentially with members of the Tax Design Advisory Panel prior to announcing these measures.

Proposed consultation arrangements are set out in the Government's forward work program for tax measures. The forward work program also indicates which measures are proposed for introduction in the next sittings of Parliament. The Government periodically releases an updated forward work program and publishes it on the Treasury website at www.treasury.gov.au.

Additionally, the following allow bodies outside the Australian Government administration to advise on policy and administer enactments or schemes.

Australian Office of Financial Management Advisory Board

The AOFM Advisory Board, a non-statutory advisory body established in 2000, primarily advises on operational debt. The board comprises seven members: the Secretary to the Treasury, the AOFM Chief Executive Officer, a senior Treasury official, a senior officer from the Department of Finance and Deregulation and three experts drawn from the financial sector. The outside appointments are for three years and members may be reappointed.

The AOFM Advisory Board is accountable to the Secretary to the Treasury who chairs the board. The board has an advisory role and does not possess executive powers or decision-making authority in its own right. It provides general counsel and guidance to the Secretary to the Treasury on all aspects of operational debt policy matters and AOFM performance generally. It reviews the financial statements, legislative and policy compliance, and management recommendations on matters requiring ministerial approval.

Board of Taxation

The Board of Taxation, a non-statutory advisory body established in 2000, advises on the design and operation of Australia's tax laws, ensuring full and effective community consultation in designing and implementing tax legislation.

The Board comprises ten members; seven are drawn from the non-government sector, including the chair. These members are appointed on a part-time basis and on the basis of their personal capacity, with regard to their ability to contribute to the tax system. The appointments are for up to three years and members may be reappointed. The Secretary to the Treasury, the Commissioner of Taxation and the First Parliamentary Counsel serve as ex-officio members.

The Board of Taxation provides advice to the Treasurer on:

- the quality and effectiveness of tax legislation and processes for its development, including community consultation and tax design;

- improvements to the general integrity and functioning of the tax system;

- research and other studies it commissions on topics approved or referred to it by the Treasurer; and

- other tax matters referred to it by the Treasurer.

The Treasury provides secretariat support to the Board.

Commonwealth Consumer Affairs Advisory Council

The Commonwealth Consumer Affairs Advisory Council is a non-statutory, expert advisory body established in 1999. Its primary role is to provide the relevant minister with independent advice on consumer affairs.

Members of the Commonwealth Consumer Affairs Advisory Council are appointed by the Minister and come from a range of industries and backgrounds. All serve as individuals, rather than as representatives of organisations.

The Commonwealth Consumer Affairs Advisory Council meets regularly to identify and advise on new and emerging consumer issues, and investigate, advise and report on consumer issues referred to the council by the Parliamentary Secretary to the Treasurer who is responsible for competition and consumer policy.

Corporations and Markets Advisory Committee

The Corporations and Markets Advisory Committee is a body corporate established under Part 9 of the Australian Securities and Investments Commission Act 2001 (ASIC Act).

The Corporations and Markets Advisory Committee comprises part-time members appointed by the responsible minister. Members are selected from throughout Australia on the basis of their knowledge of, or experience in business, company administration, financial markets, law, economics or accounting. Under section 147 of the ASIC Act, the chairman of ASIC is an ex-officio member of the Advisory Committee.

The committee, on its own initiative or when requested by the Minister, provides advice and recommendations on such matters connected with:

- a proposal to make or amend corporations legislation (except excluded provisions);

- the operation or administration of the corporations legislation (except excluded provisions);

- law reform on corporations legislation (except excluded provisions);

- companies or a segment of the financial products and financial services industry; and

- a proposal to improve the efficiency of financial markets.

In fulfilling these functions, the committee seeks to stimulate and lead public debate to enhance the standards for corporations and participants in financial markets, and propose suitable regulatory reform when necessary.

The committee is assisted by its legal committee.

Financial Sector Advisory Council

The Financial Sector Advisory Council is a non-statutory body established in April 1998 as part of the Government's response to the Financial System Inquiry. The council provides advice to the Government on policies to facilitate the growth of a strong and competitive financial system. The Treasurer appoints members in their personal capacity for two years, subject to their continued involvement in the relevant area of the financial sector.

Financial Sector Advisory Council submissions and recommendations to Treasury portfolio ministers are confidential.

The Treasury provides secretariat support to the council.

Foreign Investment Review Board

The Foreign Investment Review Board is a non-statutory body that advises the Government on foreign investment policy and its administration. The board comprises five members; four, including the chair, are drawn from the business and community sectors. These members are appointed on a part-time basis. The General Manager of the Foreign Investment and Trade Policy Division also serves on the board as an Executive Member. The Board:

- examines proposed investments that are subject to Australia's Foreign Investment Policy or the Foreign Acquisitions and Takeovers Act 1975, and makes recommendations to the Treasurer on these proposals;

- advises the Government on foreign investment matters generally;

- fosters an awareness and understanding, both in Australia and abroad, of Australia's foreign investment policy;

- provides guidance, where necessary, to foreign investors so their proposals conform with the policy and legislation; and

- monitors compliance with foreign investment policy.

The Board's functions are advisory only. Responsibility for making decisions on foreign investment policy and proposals rests with the Treasurer.

Council of Financial Regulators

The Council of Financial Regulators is the coordinating body for Australia's main financial regulatory agencies. Its membership comprises the:

- Reserve Bank of Australia, which chairs the Council;

- Australian Prudential Regulation Authority;

- Australian Securities and Investments Commission; and

- the Treasury.

The Council contributes to the efficiency and effectiveness of financial regulation by providing a high-level forum for cooperation and collaboration among its members. It operates as an informal body in which members are able to share information and views, discuss regulatory reforms or issues where responsibilities overlap and, if the need arises, coordinate responses to potential threats to financial stability. The council also has a role in advising the Government on the adequacy of Australia's financial system architecture in light of ongoing developments.

Categories of documents held by the Treasury

The Treasury holds:

- correspondence, analysis and policy advice by Treasury officers, comments on Cabinet submissions and drafts of these and other documents;

- representations made to Treasury portfolio ministers on matters falling within their portfolio responsibilities and documents dealing with policy and administration in areas falling within the responsibilities of the Treasury portfolio detailed in the annual report. Every six months, the Treasury posts an indexed list of its policy file titles at www.treasury.gov.au;

- documents relating to staff, the organisation and operations including personnel records, organisation and staffing records, financial and expenditure records, and internal operations, such as office procedures and instructions; and

- documents relating to grants that the Government provides to other levels of government and to organisations under the programs it administers.

Facilities for access to documents

Information on obtaining access to documents held by the Treasury is on the Treasury website at www.treasury.gov.au. Members of the public can contact:

Freedom of information

The Treasury

Langton Crescent

PARKES ACT 2600

Email: FOI@treasury.gov.au

Telephone: 02 6263 2800

Freedom of information activity

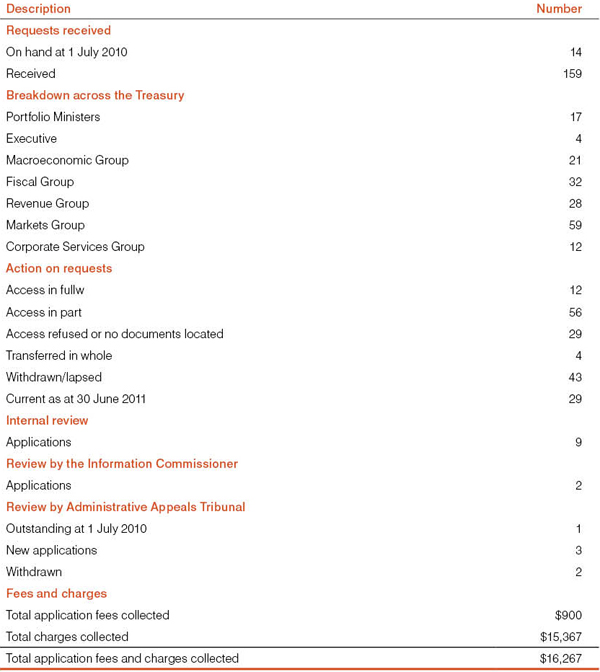

In 2010-11, the Treasury and the portfolio Ministers received 159 requests for access to documents under the Freedom of Information Act 1982, compared with 63 requests in the previous year. There was a significant increase in the number of requests following changes to the legislation from 1 November 2010. Details are set out in Table 10 on page 275.

Table 10: Freedom of information statistics for 2010

Australian Competition Tribunal

The tribunal is an agency within the Treasury portfolio. As it does not publish an annual report; its section 8 statement follows.

Establishment

The tribunal was established under the Trade Practices Act 1965 and continues under the Competition and Consumer Act 2010.

Organisation

The tribunal consists of a president and as many deputy presidents and other members as the Governor-General appoints. All presidential members must be judges of the Federal Court of Australia. Other members must have knowledge of, or experience in, industry, commerce, economics, law or public administration. For the purposes of hearing and determining proceedings, the tribunal is constituted by a presidential member and two non-presidential members.

The Federal Court of Australia manages the tribunal's funds and provides registry services and administrative support. The registry receives documents, arranges tribunal sittings and undertakes general administration.

Functions and powers

The tribunal is mainly a review body that rehears or reconsiders matters. It may perform all the functions and exercise all the powers of the original decision-maker to affirm, set aside or vary the original decision.

The tribunal hears applications for review of determinations of the ACCC, granting or revoking authorisations permitting conduct and arrangements that would otherwise be prohibited under the Competition and Consumer Act due to their anticompetitive effect. The tribunal also hears applications for authorisation of company mergers and acquisitions which would otherwise be prohibited under the Competition and Consumer Act.

In addition, the tribunal hears applications to review decisions on access matters under the Competition and Consumer Act's regime to facilitate third party access to the services of certain essential facilities of national significance. The tribunal also hears applications for review of the ACCC's exclusive dealing determinations and certain decisions under the Competition and Consumer Act's regime for non-conference ocean carriers.

Arrangements for outside participation

Tribunal review proceedings, except under special circumstances, are public.

When a new review application is made to the tribunal, the tribunal ascertains who made submissions to, or registered their interest with the ACCC or the National Competition Council on the decision. The tribunal directs the applicant to serve the application on each interested party. At the same time, these parties are advised when the application will first come before the tribunal, and consider whether they have leave to intervene in the proceedings.

The tribunal may permit a person to intervene in the proceedings before it. Participants may appear on their own behalf or represent a firm or association, subject to the tribunal's approval, or, be represented by a barrister or solicitor.

Categories of documents the tribunal holds

The tribunal maintains the following categories of documents:

- documents lodged with the registrar on particular proceedings, including applications, notices of appearance, statements of facts and contentions, witness statements and submissions;

- correspondence concerning particular tribunal proceedings;

- tribunal decisions and reasons;

- reports on tribunal inquiries into shipping matters;

- register of applications made to the tribunal;

- documents concerning administrative and financial aspects of the tribunal's operations; and

- general correspondence.

The public may inspect the following categories of documents free of charge (except where the Act or the tribunal restricts public access due to confidentiality):

- documents lodged with the registrar on particular proceedings;

- tribunal decisions and reasons;

- reports on tribunal inquiries into shipping matters; and

- register of applications made to the tribunal.

The public can obtain copies of the above four categories of documents after paying the fees set out in the Competition and Consumer Regulations 2010.