Downloads

The effect of company tax arrangements across Australian industries has received relatively little attention.

This article finds evidence that average tax rates vary considerably across industries. The evidence is found to be reasonably robust with external validation used to confirm results.

The average tax rate is found to be relatively high in the finance & insurance industry and relatively low in the most capital-intensive industries, such as electricity, gas & water, and mining.

Variations in average tax rates across industries would be expected to have an impact on the way investment is allocated across industries, potentially with a negative impact on productivity and growth. Changes to the company tax rate would be expected to have differing impacts across industries arising from the variations in average tax rates.

Introduction

Whether company tax affects industries differently in Australia has received little attention. Perhaps the application of a single statutory corporate tax rate to all companies has led to an assumption that corporate tax is neutral in its treatment of income across industries.

Recent times have seen advocacy in support of a reduction in the corporate tax rate — a lower rate is usually considered to raise the quantity of investment.

This article raises the possibility that the corporate tax system might impact differentially across industries — some sectors facing little apparent impact from company tax while others face a relatively big impact. These disparities in tax treatment may distort the allocation or quality of investment, and thereby the economy’s performance. Usually, more investment also means more growth in output and productivity. Capital deepening can raise labour productivity and certain types of capital can lift multifactor productivity through efficiency spillovers and externalities — for example, machinery with new embodied technologies.

Recent OECD work (see Vartia 2008) suggests that the benefits of a reduction in the corporate tax rate may result from a rise in the quality of investment because of a better allocation of a given quantum.

A number of factors have an important influence on the allocation of investment. Potentially, differences in average tax rates across industries could encourage resources into less-productive investments in tax-favoured industries at the expense of more-productive investments in less-favoured industries. If this occurred, it would detract from economic growth.

Tax disparities could also influence the way in which the economy may respond to a lowering of the corporate tax rate. The effects of a tax cut in industries with an already low average tax rate would be less than those in industries with relatively high average rates.

Accordingly, the issue of how company tax arrangements affect different industries could potentially influence the quality of investment as well as how the economy may respond to a cut in the company tax rate.

Industry contributions to corporate tax

In order to examine the impact of the tax system on different sectors there are a number of approaches that can be used.

In this paper we use the so called backward looking approach. That is, analysis is based on actual company tax return data from prior years.

Corporate tax data is sourced from the ATO’s Taxation Statistics 2004-05. Total corporate tax collections have increased over the last decade. The structure of industry contributions has also been changing over this period. The most notable change being the increase in the relative contribution from the finance & insurance industry.

For the 2004-05 financial year, the finance & insurance industry accounts for about 40 per cent of total corporate tax collections. This is not an isolated result — the industry has accounted for an average 36 per cent of corporate tax collections for the decade prior, with an upward trend. The significant contribution of this industry to corporate tax collections, together with its continued growth, raised its profile throughout these investigations.2

Over the decade to 2004-05, the electricity, gas & water (EG&W), mining, construction, transport & storage, and communication services industries together accounted for only one-fifth of corporate tax collections. The most noteworthy of these industries are EG&W and mining.

The EG&W industry contributed a mere 0.2 per cent of corporate tax collections in 2004-05 — with the industry’s contribution over the decade prior being relatively stable at 0.3 per cent. The relative size, level of state ownership and low contribution to corporate tax collections all warranted a closer examination.

The mining industry’s contribution to total corporate tax collections has gradually increased over time. In 2004-05 it accounted for 8 per cent of corporate tax; this being the average for the previous decade. This result is surprising given the start of the mining boom early in this period. A possible explanation could be that the company income tax base is different from economic income. For example, rising prices may have spurred higher investment resulting in increased deductions. Also, tax collections at the Commonwealth level may be adversely influenced by state royalty payments.

Measurement of an average tax rate

Industry contributions to total corporate tax collections provide some insight into whether or not an industry’s contribution to the total is disproportionate to income earned.

Greater insight can be gleaned by comparing each industry’s tax collections with a measure of its corporate income. A common measure of corporate income is gross operating surplus (GOS).

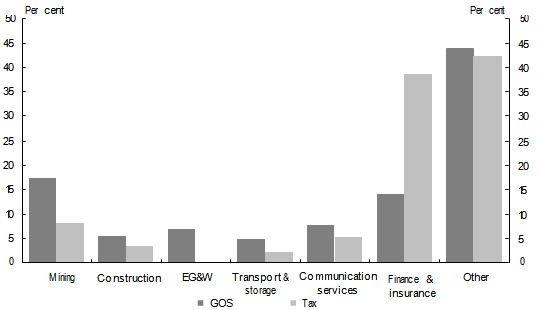

Chart 1: 2004-05 industry shares of GOS and corporate tax collections

Source: Australian Bureau of Statistics and ATO Taxation Statistics 2004-05.

While Chart 1 is for the 2004-05 year, it is also representative over the prior decade. With the exception of the finance & insurance industry, all industries pay a less than proportionate amount of tax, relative to their contributions towards GOS. The standout industries are mining and EG&W — the latter is of particular note with a contribution of less than 1 per cent to corporate tax collections for the 2004-05 financial year, but 7 per cent of corporate GOS.

Corporate tax collections are highly reliant on the finance & insurance industry. In 2004-05, the industry contribution to total GOS was 14 per cent, while the industry provided about 40 per cent of total tax.

These results raise some questions regarding the operation of corporate tax arrangements, including the measurement of income.

Chart 1 implies a difference in average tax rates (ATRs) across industries. There is an important distinction between statutory and average tax rates. The two differ due to differences between taxable income and GOS as a measure of economic income. At the industry level, this results from the differing impact of general tax provisions as a consequence of the industry’s characteristics as well as industry-specific taxation measures.

GOS is a commonly used measure of corporate income, however it excludes some components that are included in taxable income. A better measure of corporate income should be similar to the conceptual base upon which income tax is levied. This paper uses the income measure derivation by Clark, Pridmore and Stoney (2007) — termed ‘net operating income’. This measure of income adjusts for the excluded components of GOS.

GOS is a measure of the surplus from the pro

duction of goods and services available for distribution to those that hold a claim to corporations (ABS 2000). However, GOS is not the most appropriate measure of a corporate income tax base as it excludes income unrelated to production — such as property income, land and natural resource rents, net interest receipts, and capital gains or losses — which rightly forms part of company income and profits. In addition, GOS excludes depreciation whereas the corporate income tax base allows a deduction for depreciation — for tax purposes, depreciation is calculated at historical cost.3

Data is sourced from the ABS and ATO, starting from GOS. Adjustments are made to GOS to add:

- depreciation;

- net property income of the corporate sector,

- in particular, debt-servicing interest expenses, interest receipts, and land and natural resource rents;

- holding gains or losses in trading stock and realised capital gains and losses in the assets and liabilities of the corporate sector; and

- the part of the income from financial intermediation excluded from GOS.

In relation to the last point, the national accounting framework decomposes interest payments and receipts into the payment of a pure interest flow and the payment of an imputed service charge (see ABS 2000). This imputed service charge is included in the calculation of GOS alongside any explicit charges imposed by lending institutions. In contrast, the full amounts of net interest payments are recognised for accounting and taxation purposes.

For the purposes of the analysis, ATR estimates are presented and interpreted relative to the average ATR for all industries. It is recognised that estimates of ATRs may be subject to inaccuracies in the measurement of some variables. However, the objective of this paper is to investigate whether the corporate tax system impacts differently across industries, rather than focusing on the actual levels of average corporate tax rates.

There is greater uncertainty about the accuracy in measurement of industry ATRs than of an aggregate ATR. There is a reasonable level of certainty in relation to the totals of these variables. However, the need to distribute these variables across industries introduces the possibility of a misallocation error that does not exist at the aggregate level.

Estimates of average tax rates for industries

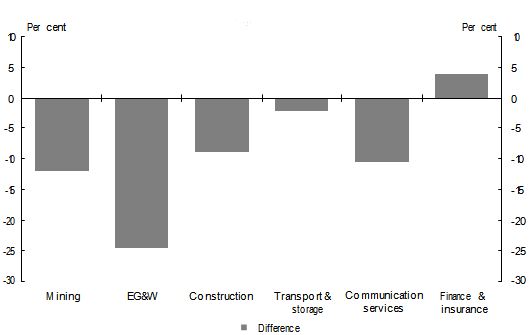

The pattern of corporate tax could have just as important implications for Australia’s economic performance as the aggregate level of corporate tax. Industry estimates of ATRs highlight that it is not only the level of corporate tax that matters but also the pattern in which corporate tax operates — specifically, the uneven way in which tax applies to different companies in different parts of the economy (see Chart 2).

Chart 2: 2004-05 industry ATR deviations from the mean

Source: Australian Treasury.

Chart 2 presents industry ATRs as a deviation from the industry-wide ATR for 2004-05.4

The ATR of the finance & insurance industry is above the industry-wide average, consistent with its strong contribution to total corporate tax. The high ATR may relate to the high level of domestic ownership within the industry, coupled with its implications arising from the imputation system.5 Furthermore, its rapid growth is consistent with high profitability. Another factor contributing to its high ATR could be the absence of industry-specific tax breaks, or little opportunities for large depreciation deductions.

Relative to other industries, the ATRs of the EG&W and mining industries are below average, and very much so in the case of EG&W. ATRs are also below average in construction, transport & storage, and communication services.

Further investigations of the calculation of net operating income and taxation data reveal several issues that may account for some of the disparity in ATRs, the most prominent being the influence of reconciliation items.6 The mining and transport & storage industries have an above average level of reconciliation items, as does the EG&W industry by a large margin.

Industry comparisons highlight the correlation between capital intensive industries — such as EG&W, construction, transport & storage, mining, and communication services — and below average ATRs. While not conclusive, there is evidence that generous depreciation allowances may be a factor. In addition, these industries have an above average reliance on debt versus equity finance. Sørenson and Johnson (2009) demonstrate that average marginal tax rates are strongly negative when debt financing is used as opposed to equity financing.

The EG&W industry is of particular interest because its measured ATR is so low. This appears to be due to a combination of general and industry-specific factors. Examples include the generous treatment of some assets for tax purposes and high usage of interest deductions. These features, coupled with large tax losses and large deductions for the decline in value of depreciating assets, have all contributed to the low ATR of the industry.7

Contrary to expectations, the mining industry’s ATR appears to be relatively low. Mining’s proportional contribution to corporate tax collections does not appear to have risen, despite the boom conditions beginning around 2003-04. Similar to EG&W, the industry receives generous deductions for the decline in value of depreciating assets, including the immediate expensing of exploration expenditure, certain infrastructure expenses, and site rehabilitation. The industry draws an above average advantage from such provisions through its capital intensity. These factors result in large deductions, allowing such firms to reduce their taxable income below their actual economic income.

External validation of the evidence

As mentioned, there are uncertainties about the accuracy of the derived ATRs. Given the importance of the measured dispersion of ATRs to the possible implications, additional and independent evidence was pursued to confirm the existence of disparities in ATRs across industries.

Three sources of external validation were examined. The first of these measures uses data from the Bloomberg Professional service for publicly listed companies for the 2006-07 financial year. Relative ATRs are well below average for the mining and EG&W industries, while construction, transport & storage, and communication services are now all above average, as is finance & insurance.

Markle and Shackelford (2009) estimate the ATRs of publicly listed firms from their annual reports for the period 2003 to 2007. All industries have below average ATRs, except for finance & insurance. The mining industry ATR is notable for its large deviation from the average. EG&W and communication services are not included in their calculations.

An ATR figure was also calculated using ATO Taxation Statistics profit data. These estimates give a similar set of results to those above. Mining, and especially the EG&W industry, have low ATRs relative to the industry average. Interestingly, finance & insurance is also below average, while construction and communication services are above average. It is worth noting that these above average measures are also above the statutory tax rate of 30 per cent, reflecting the differences between this measure and taxable income.

These additional sources of industry specific ATRs confirm the main analysis in this paper — that is, the corporate tax system impacts differently across industri

es, with a significant variance in ATRs.

Implications

Australia’s corporate tax system operates in a more complex and uneven fashion than is widely understood.

In particular, consideration of the average impact of the corporate tax system is not the only issue as this paper shows that there is a large variation in ATRs across industries.

Disparities in ATRs across industries would tend to distort the allocation of investment. More investment in a low-tax industry would be at the expense of worthwhile investment in other industries. This would result in over-investment in the tax advantaged industry at the same time as under-investment in the other industries.

For example, it is possible that the low ATRs in EG&W have contributed to poor productivity performance in the industry.8 Multifactor productivity has declined since 2000 on the back of more rapid growth in inputs of labour and capital, combined with slower growth in output. The acceleration of investment growth in the industry has been strong in both non-dwelling construction, and machinery and equipment (ABS 2007).

There is an important distinction between ‘average levels’ of tax burden and ‘disparities’ in average tax rates across industries and asset types. They have different implications for economic performance.

Arguments in favour of lower tax rates refer to average levels. It is argued that a lower general level of tax would bring benefits such as more investment, capital deepening, higher labour productivity, and higher wages. But does this mean that low ATRs at least in a few industries could be a good thing for economic performance? The short answer is, ‘No’.

There may well be capital deepening, increased labour productivity, and higher wages in the low-tax industry. But the more important question is whether there would be even more capital deepening and even higher productivity and wages, in aggregate, if the allocation of investment was not distorted by tax disparities. Unless ‘by chance’ the marginal efficiency of capital was highest in the tax advantaged industry, the disparity would lead to an inferior performance outcome.

The findings of this article imply that the performance response to a lowering of the statutory tax rate may be more modest than previously thought — at least in some major sectors of the economy. To illustrate, the relatively low ATR of the EG&W industry would signify that any reduction of the statutory tax rate would make little difference to the average burden of taxation. Similarly, the relatively low ATRs of other major capital-intensive industries — mining, construction, transport & storage, and communication services — signify that their responsiveness to changes in the statutory tax rate will be below the average, all other things equal.9

An industry with an above average burden of taxation — such as finance & insurance — would suggest a relatively high response to statutory tax rate changes, all other things being equal. However, other features of the industry — its regulation and its high use of the imputation system by domestic firms — complicate the picture by limiting in different ways the potential responsiveness of foreign and domestic firms to changes in the statutory rate.

The disparities in average rates of corporate tax could be having adverse incentive and resource allocation effects which, if addressed, could have beneficial effects on long term growth and productivity performance in the Australian economy. If a reduction in disparities in ATRs were judged to be worth addressing, it could be achieved by broadening the tax base through a review of deductions, concessions, allowances, and loss offset provisions — particularly with respect to better aligning economic depreciation and tax depreciation. Alternatively, lowering the statutory corporate tax rate could also reduce the significance of disparities across companies.

Inter-industry tax differentials could also be significantly reduced by moving the tax system to a business level expenditure tax, such as the Allowance for Corporate Equity (ACE), as proposed for Australia by Sørenson and Johnson (2009). Under this approach, debt and equity are treated consistently, and the timing of deductions and allowances becomes less important.

Clear implications for the imputation system do not emerge from the paper and its findings. Its effect on reducing the disparity in effective taxation of debt and equity was a rationale for its introduction. To the extent that it achieves this, it likely serves to reduce the bias in favour of capital-intensive industries.10 On the other hand, imputation reduces the cost of capital to domestic firms and, where used intensively, such as in finance & insurance, may restrict the investment response of foreign firms and capital to changes in statutory tax rates.

While examining the ATRs of the mining industry, it became apparent that the corporate tax system was limited in its ability to capture increases in resource rents.

Conclusions

Average corporate tax rates differ substantially across industries. Although the information base does not permit precise estimates, it is clear that the most capital-intensive industries are favoured through generous deductions and concessions associated with investment in capital. This is demonstrated by the relatively low ATRs of the EG&W, mining, construction, communication services, and transport & storage industries. In addition, the mining industry is further favoured by industry-specific measures, such as the ability to expense immediately some expenditure that would normally be considered to be of a capital nature.

Similarly, the EG&W industry has been able to make more use of tax deductions and adjustments through its high use of debt finance, generous depreciation provisions, deductions for write-downs in asset values, and substantial tax adjustments in some years.

The relatively high average tax rate, income and profits of the finance & insurance industry are one of the reasons this industry is a major contributor to corporate tax collections.

The usual argument for lowering corporate tax rates is that current rates are holding back the quantity of investment and therefore growth in productivity and living standards. This paper points to another argument, average tax rates differ markedly across different industries. This elevates the importance of the effects on resource allocation in considerations of the current system and possible reforms to it. Improvements in the quality of investment involve a better allocation of a given quantity. Addressing the dispersion of ATRs across industries would bring gains in productivity and living standards.

In order to achieve a reduction in the disparity in average tax rates, a viable option would be to broaden the tax base through a review of deductions, concessions and allowances — particularly with respect to better aligning economic depreciation and tax depreciation. Alternatively, a cut in the corporate tax rate would also reduce average rate disparities. Another option could be to tax corporate income on an expenditure basis, such as an ACE.

References

Auerbach, A, Devereux, M P and Simpson, H 2007, ‘Taxing corporate income’, Working

Papers 0705, Oxford University Centre for Business Taxation.

Australian Bureau of Statistics 2000, Australian national accounts: Concepts, sources and methods, 2000, cat. no. 5216.0, ABS, Canberra.

Australian Bureau of Statistics 2007, Information paper: Experimental estimates of industry multifactor productivity, cat. no. 5260.0.55.001, ABS, Canberra.

Clark, J, Pridmore, B and Stoney, N 2007, ‘Trends in aggregate measures of Australia

’s corporate tax level’, Economic Roundup, Winter, pp 1-28.

Markle, K and Shackelford, D 2009, ‘Do multinationals or domestic firms face higher effective tax rates?’, NBER Working Paper Series, No. 15091, June.

Sørenson, P B and Johnson, S M 2009, ‘Taxing capital income — options for reform in Australia’, paper presented for the Australia’s Future Tax System Conference, University of Melbourne, 18-19 June.

Vartia, L 2008, ‘How do taxes affect investment and productivity?: An: industry-level analysis of OECD countries’, OECD Economics Department Working Paper, No. 656, OECD, Paris.

1 The authors are from Business Tax Division, the Australian Treasury. This article has benefited from comments and suggestions provided by Paul McMahon and Shane Johnson. The views in this article are those of the authors and not necessarily those of the Australian Treasury.

2 This trend and the relative importance of the finance & insurance industry for revenue collections has also been observed in the United States and United Kingdom (Auerbach, Devereux and Simpson 2007).

3 The ABS measures depreciation as the real change in value of an asset for a period.

4 Figures are estimated for a decade prior and results and conclusions are consistent across time.

5 Some argue that the imputation system encourages domestic firms to pay tax as investors value fully franked dividends.

6 Reconciliation items are the differences between accounting profits and taxable income and include capital gains and losses, franking credits, deductions for loss of asset value, R&D tax concessions, and tax losses.

7 Another possible explanation is the degree of state ownership within the industry. A sensitivity analysis using private sector data still demonstrates an ATR with the largest deviation from the industry-wide average.

8 The level of government ownership and heavy regulation are other possible reasons.

9 This is true to the extent that these backward looking ATRs are good predictors of future ones. As already noted, the industry ATRs are reasonably stable over time.

10 Where there are higher levels of foreign ownership, such as for the mining and EG&W industries, regardless of the imputation system, there is a significant bias between debt and equity.