A CCE becomes a reporting entity at the start of an income year if it carries on an enterprise in Australia and its total annual income in its most recent income year was:

- more than $100 million

- if the entity is a controlling corporation, the combined total income of the members of the controlling corporation’s group for the most recent income year was more than $100 million

- if the entity is a member of a controlling corporation’s group that has a combined income of more than $100 million for the most recent income year, the total income for the member for the most recent income year was at least $10 million

Most recent income year

The most recent income year for an entity will be its previous income year. If relevant, it is also the previous income year of its controlling corporation’s group.

For example, if an entity has total income of over $100 million in its 2020-21 income year and it meets the other eligibility criteria, the entity will be required to report starting in its 2021-22 income year.

Similarly, if an entity has total income of over $10 million in its 2020-21 income year and its controlling corporation’s group has a combined total income of over $100 million in the same income year, the entity will be required to report in 2021-22.

If an entity begins operation and meets the eligibility criteria within its first income year, the Regulator will adopt a similar approach. The entity’s first year of business will be treated as its most recent income year and it will be required to start reporting in its second income year.

Total income

Total income has the same meaning as in section 3C of the Taxation Administration Act 1953.

The scheme applies this meaning of total income to all individual entities. It is not limited to entities that lodge tax returns. In some cases this will mean that an entity which would not ordinarily calculate its ‘total income’ because, for example, it is part of a tax consolidated group structure, lodges a non-corporate income tax return or does not lodge any income threshold.

Total income is an accounting system amount. It generally corresponds to the total of the relevant amounts in an entity’s financial statements or financial records for the income year, as prepared in accordance with Australian accounting standards.

Determining total income

For companies, what comprises ‘total income’ in a given year is explained in the Australian Taxation Office’s ‘Company tax return instructions’, available at the Australian Taxation Office website. Key features of total income for the purposes of the scheme are:

- Total income is a gross figure, calculated in Australian dollars. It is not gross assessable income, taxable income or net accounting profit. It may include exempt income, other non-assessable income and foreign source income. Including these amounts increases total income relative to taxable income and accounting profit.

- Total income includes foreign source income and/or intra-group income. This applies where this income is included in the entity’s actual or notional total income recorded at label 6S of their company tax return.

- Total income does not include the effect of accounting expenses. The total income figure is not reduced by the costs of earning the income or carrying out the entity’s activities.

For individual entities that are not part of a Tax Consolidated Group (TCG), total income generally corresponds to the income it records at label 6S of the company tax return, as prepared in accordance with the ATO’s company tax return instructions.

For entities that are not required to submit an individual company or other tax return, for example an entity that is a member of a TCG:

- Total income generally corresponds to the entity’s notional total income that it would record at label 6S of the company tax return if it was required to prepare one.

- Each entity, including a controlling corporation, needs to determine its notional ‘total income’. This means the income it would report as ‘total income’ if it was required to submit an individual tax return. This includes any intra-group transfers where these are included as income.

For other types of entities that submit non-company income tax returns (e.g. partnerships, trusts):

- Total income generally corresponds to the total of the relevant amounts in the entity's financial statements or financial records for the income year, as prepared in accordance with Australian accounting standards.

Under the scheme, total income needs to be individually determined for each entity. If the entity is a controlling corporation, the combined total income of all members of the group is determined. This is regardless of whether the member is a CCE or a reporting entity. The group’s combined total income is the total of each entity’s notional total income. Any intra-group transfers are not eliminated.

The combined total income of the controlling corporation’s group should include the relevant portion of any new member’s total income. This is determined from when it was acquired or became part of the group during the most recent income year. Where an entity was a member of a group during the most recent income year but is no longer in that group at the start of the income year, the entity’s income should not be included in the group’s combined ‘total income’. This is because it is not a ‘member’ of the controlling corporation’s group at the time of the relevant calculation. See also ‘Treatment of total income for mergers and acquisitions’ for further information on how to determine total income in this situation.

Entities should assess their total income on an annual basis to determine if they are required to commence reporting under the scheme. For an existing reporting entity that falls below the total income threshold, they may apply to cease reporting. They will continue to be a reporting entity until the Regulator determines that they can cease to be a reporting entity (see ‘Ceasing to be a reporting entity’).

Entities may need to seek professional advice in determining their total income under the scheme.

Australian entity examples

Australian entities that are CCEs and carry on an enterprise in Australia are subject to the income test.

Example 1: Controlling corporation is a reporting entity, but members are not

Entity X is an Australian controlling corporation with a total income of $5 million (not a tax consolidated group). There are 15 members of Entity X’s group, each with a total income of $9 million. The combined total income of the group is $140 million. The controlling corporation, Entity X, is a reporting entity because its combined total income is greater than the income threshold of $100 million. This is even though its own total income is $5 million. The $10 million total income threshold does not apply to the controlling corporation as it is not a member. However, the member entities are not reporting entities as they each had a total income of $9 million which is less than the income threshold of $10 million for member entities.

Example 2: Controlling corporation and member entities are all reporting entities

Entity X is an Australian controlling corporation (of a tax consolidated group) with a notional total income of $15 million. Entities Y and Z are members of Entity X’s group, each with a notional total income of $70 million. The combined total income of the group is $155 million. The controlling corporation, Entity X, is a reporting entity because the group’s combined total income is greater than the income threshold of $100 million. The member entities are also reporting entities as they each have a total income of $70 million which is more than the member income threshold of $10 million.

Example 3: Controlling corporation with foreign income and a member entity are all reporting entities

Corporation A is an Australian controlling corporation (not a tax consolidated group). It earns $50 million in the USA. It also earns $40 million in Australia, which it reported as total income in its Australian tax return in accordance with the ATO’s company tax return instructions. Its subsidiary business, Subsidiary B, earns $20 million in Australia. The group, comprising Corporation A and Subsidiary B, has a combined total income of $110 million. As Corporation A is a CCE and the group has a combined total income greater than the income threshold of $100 million, Corporation A is a reporting entity. Subsidiary B is also a reporting entity as it is a member entity with a total income which is more than the member income threshold of $10 million.

Example 4: Controlling corporation and member entities are not all reporting entities

Entity X is an Australian controlling corporation (of a tax consolidated group) with a notional total income of $15 million. Entities Y and Z are members of Entity X’s tax consolidated group. Entity Y has a notional total income of $90 million and Entity Z has a notional total income of $8 million. Entity X reports a combined total income for the tax consolidated group of $105 million as reported at label 6S of the tax return (eliminating intercompany transfers as required). However, under the scheme, Entity X determines a combined total income for the group of $113 million. This is the summation of Entity X’s notional total income and the notional incomes of Entity Y and Entity Z.

The controlling corporation, Entity X, is a reporting entity because the group’s combined total income was $113 million, which is greater than the income threshold of $100 million. Member Entity Y is a reporting entity as it had a notional total income of $90 million which is more than the member income threshold of $10 million. Member Entity Z is not a reporting entity as it had a notional total income of $8 million which is less than the member income threshold of $10 million.

Example 5: Trusts with corporate trustees

A trust, which is a CCE because it is carrying on an enterprise in a territory, has a corporate trustee i.e. a company that acts as trustee. The trust’s reporting obligations are fulfilled by the corporate trustee. While the corporate trustee is reporting on behalf of the trust, the trust’s income is not imputed to the trustee. The corporate trustee may also have reporting obligations in relation to its own total income. The corporate trustee does not combine its income with the trust’s income when assessing whether it has separate reporting obligations.

Foreign entity examples

Foreign entities that are CCEs are subject to the income test and may be reporting entities. A foreign entity is one which, while based overseas, carries on an enterprise in Australia. For example, through an Australian-based office.

Example 1: Foreign head entity is not a reporting entity, but local Australian operation is

Entity X is a foreign entity that has a local Australian operation in Entity Y, which is an Australian corporation that operates in the ACT. Entity X’s total income was $5 million. This was earned in Australia. Entity Y had a total income of $150 million. While Entity X is not a controlling corporation, it is a CCE and carries on an enterprise in Australia, but it is not a reporting entity as it does not meet the income threshold of $100 million. Entity Y is a reporting entity as it meets the income threshold of $100 million.

Example 2: Foreign head entity is a reporting entity, but local subsidiary is not

Corporation A is a foreign corporation. It earns $50 million in the USA and earns $140 million in Australia. Its Australian subsidiary, Subsidiary B, earns $20 million in Australia.

The group earns a combined total income of $210 million. However only $140 million was recorded as total income in Corporation A’s Australian tax returns at label 6S and $50 million was recorded as income in the USA.

Corporation A can only be a controlling corporation if it meets the requirements of a controlling corporation under the Act. A foreign corporation cannot be a controlling corporation as it is formed outside of Australia and is not a body corporate incorporated in Australia. Corporation A is therefore not a controlling corporation.

As Corporation A is not a controlling corporation under the Act, the group’s combined total income is not considered. However, Corporation A is still a reporting entity because it is a CCE that is carrying on an enterprise in Australia and has a total income greater than $100 million. Subsidiary B is not a reporting entity because its total income is below the $100 million income threshold.

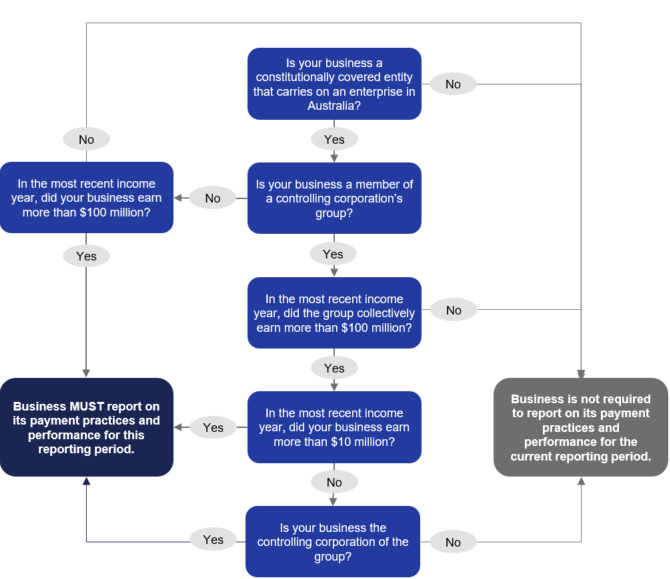

Is your business a reporting entity?

Figure 2: Flowchart to assess whether a business is a reporting entity