A ‘reporting entity’ must submit a Payment times report in accordance with the Act.

The reporting requirement applies to large businesses that:

- are constitutionally covered entities

- carry on an enterprise in Australia

- have a total income which exceeds a certain income threshold.

A controlling corporation and some or all of the members of the controlling corporation’s group can be ‘reporting entities’.

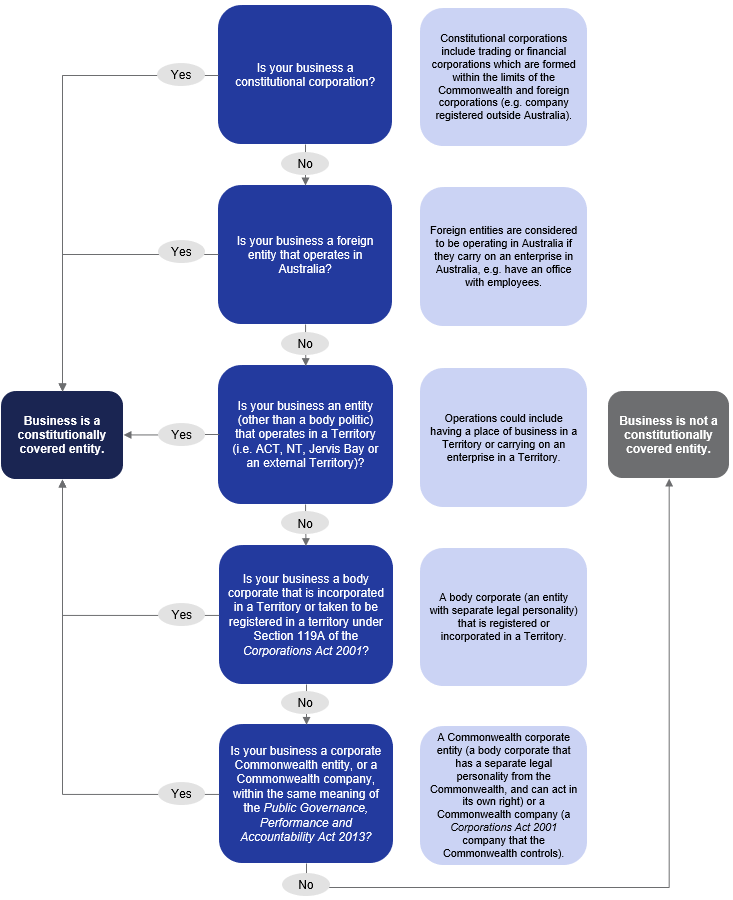

A constitutionally covered entity (CCE) is:

- a constitutional corporation (a trading or financial corporation formed within the limits of the Commonwealth)

- a foreign entity

- a corporate Commonwealth entity or a Commonwealth company within the meaning of the Public Governance, Performance and Accountability Act 2013

- an entity, other than a body politic, that carries on an enterprise in a territory

- a body corporate incorporated in a territory

- a body corporate registered in a territory under section 119A of the Corporations Act 2001

CCEs could include private/public companies, trusts, partnerships, joint ventures, sole traders, etc.

Businesses may have a wide array of corporate structures. They should seek professional advice as to whether their particular structure falls under the CCE definition.

A CCE that is a reporting entity will need to report on their small business payment terms and practices.

For example, an entity may be a CCE because it carries on an enterprise in a territory. If so it needs to report on all its business activities in Australia not just on those conducted in the territory.

An entity that is not constitutionally covered or registered under the Australian Charities and Not for Profits Commission Act 2012 is not a reporting entity.

Constitutional corporation

The Australian Constitution defines constitutional corporations as ‘foreign corporations, and trading or financial corporations formed within the limits of the Commonwealth’. A foreign corporation does not need to be formed within the limits of the Commonwealth or be a trading or financial corporation to be classified as a constitutional corporation.

These constitutional corporations can include publicly listed companies in Australia. They may also include private companies, incorporated joint ventures, corporate trustees, etc.

In determining whether an entity is a trading and/or financial corporation an entity should first consider whether it is incorporated.

An entity should then apply the ‘activities test’. This considers:

- whether the entity is engaged in trading and/or financial activities

- whether the trading and/or financial activities are a substantial and not merely peripheral activity of the entity

‘Trading’ is the activity of providing, for reward, goods or services, and extends to business activities carried on with a view to earning revenue. An example of a trading activity may include a transport or health authority providing transport or health services for a fee, although possibly not if the fee is set by statute. ‘Financial’ is the activity of commercial dealing in finance, including transactions in which the subject is finance, such as borrowing and lending money.

If the income an entity receives from trading or financial activities is substantial it may be considered to be a constitutional corporation. This is even if the income is only a small proportion of the entity’s overall income.

An incorporated entity engaged in trading or financial activities that generates a significant or substantial income is likely to be a trading and/or financial corporation.

Foreign entities

Foreign entities are a CCE. Foreign entities are those formed outside of Australia and that carry on an enterprise in Australia.

Whether a foreign entity is carrying on an enterprise in Australia depends on each particular case, with relevant considerations being whether the entity has a physical presence in Australia, or otherwise provides goods or services to persons located in Australia.

Where a foreign entity is subject to income reporting to the Australian Taxation Office, this may indicate that the entity is carrying on an enterprise in Australia for the purposes of the scheme.

Corporate Commonwealth entity or company

Refers to a Commonwealth corporate entity or a Commonwealth company under the Corporations Act 2001 that the Commonwealth controls.

Entities that carry on an enterprise in a territory

Entities that carry on an enterprise in a territory are a CCE. This may cover partnerships, superannuation funds that are trusts, sole traders, etc. that operate in a territory.

Territories include:

- the Australian Capital Territory

- the Northern Territory

- Jervis Bay

- an external territory

Carrying on an enterprise in a territory includes doing anything in the commencement or termination of the enterprise. This includes activities done in the form of a business, as well as some other activities. For example, the trade of goods or services in a territory to generate income. See Glossary.

In most cases if an entity is formed in and has a physical presence in a territory it will be considered to be carrying on an enterprise in a territory.

For further information on carrying on an enterprise see Glossary. If you are unsure if your entity is carrying on an enterprise in a territory you should seek professional advice.

Body corporate that is incorporated or registered in a territory

The term body corporate covers any artificial legal entity having a separate legal personality. These entities have perpetual succession. They also have the power to:

- act

- hold property

- enter into legal contracts

- sue and be sued in their own name

These are entities that are a legal entity:

- formed under a territorial jurisdiction

- that is registered in a territorial jurisdiction

Figure 1: Flowchart to assess whether a business is a constitutionally covered entity.

State and territory government entities

A state or territory government entity may be a CCE if they are a constitutional corporation. This means they need to be incorporated and involved in either trading or financial activities to a significant extent.

The government entities most likely to be constitutional corporations are:

- government business enterprises

- partly privatised government entities

See Constitutional corporation.

Under the scheme, government departments are not CCEs.

Local government bodies

Local government bodies are not considered to be CCEs under the scheme. However, business entities owned by local government could be required to report if they are CCEs and meet the eligibility criteria.

Joint ventures

A joint venture that creates an incorporated joint venture entity is likely a CCE. It will also have its own ABN. An incorporated joint venture entity will therefore be a reporting entity if it also:

- carries on an enterprise in Australia

- meets the income thresholds

An incorporated joint venture entity that is a controlling corporation is also a reporting entity if it meets these requirements.

An unincorporated joint venture (UJV) is not an entity within the meaning of Payment Times Reporting Act 2020. It is therefore not a CCE or a reporting entity.

While a UJV is not a reporting entity, the UJV manager or member(s) may be if they meet the requirements. If they are reporting entities the UJV manager and the UJV member would submit their own Payment times reports. They would not report on behalf of the UJV.

The UJV may appoint a manager or operator to conduct the day-to-day operations of the UJV. In this case, the entity may have to report on transactions in its capacity as manager of the UJV. This is dependent on the contractual relationship of the UJV.

In some cases, two or more UJV members may hold a joint contract with a small business supplier. They may also make payments to the supplier from a joint bank account. In this situation, the UJV members must report on their agreed proportion of invoice payments to the supplier. That is the amount that has been attributed to their entity through the agreed UJV arrangements. It is the amount they have a legal obligation to pay. For example, it may be 50% of all invoice payments to the supplier.

In other cases, an appointed manager may hold the contract for the UJV. They therefore have the contractual obligation to make the payment. In this case, if they are a reporting entity they would report on the payment(s) made under that contract. They would not need to attribute amounts provided by UJV members.

Trusts and trustees

Both a trust and the trustee(s) can be reporting entities if they meet the eligibility requirements, by:

- being a CCE

- carrying on an enterprise in Australia

- meeting the income thresholds

Trusts and trustees should be considered as separate entities in determining if they meet the reporting obligation. This means the total income of a trust should not be imputed to the trustee to determine the total income of the trustee. See Income threshold.

A trust can be a CCE if it:

- is a foreign entity

- carries on an enterprise in a territory

While a trust may be required to report, the Act imposes the reporting obligation on the trustee(s). This is because the trust itself does not have a legal personality.

A trustee may also be a CCE where it is incorporated (i.e. a corporate trustee).

To meet the reporting requirements, the corporate trustee would report on its own payment information.

By contrast, a trustee reporting on behalf of the trust would report on the payment information of the trust.

A corporate trustee can be a member of a controlling corporation’s group. It can also be a controlling corporation. This applies where it is a body corporate and is not a subsidiary of any other Australian body corporate.

By contrast, a trust cannot be a controlling corporation. This is because it does not meet the criteria of being a body corporate. It can also not be a member of a controlling corporation’s group.

An unincorporated trustee (i.e. an individual trustee) is not an entity within the meaning of Act. It is therefore not a CCE or a reporting entity.

Partnerships

A partnership may be a CCE where it is:

- an incorporated partnership

- a foreign partnership

- a partnership that carries on an enterprise (other than a body politic) in a territory.

As a CCE, a partnership may be a reporting entity where it also:

- carries on enterprise in Australia

- meets the income thresholds

While the partnership may be required to report, the Act imposes the reporting obligation on the individual partners. This is because the partnership itself does not have a legal personality.