The HomeBuilder program is closed to applications and will not reopen.

HomeBuilder formed part of a range of initiatives intended to support confidence in the residential construction sector and encourage families to proceed with purchases or renovations that may have been delayed due to uncertainty caused by the COVID-19 pandemic.

HomeBuilder applications closed at midnight 14 April 2021.

Construction commencement extension

On 17 April 2021, the Government announced an extension to the construction commencement requirement from 6 months to 18 months for all contracts signed 4 June 2020 to 31 March 2021 inclusive.

Deadline to submit supporting documentation being extended

On 27 April 2023, the former Minister for Housing, Homelessness and Small Business, the Hon Julie Collins MP, signed the revised National Partnership Agreement on HomeBuilder on behalf of the Australian Government to extend the deadline to submit supporting documentation from 30 April 2023 to 30 June 2025.

Other HomeBuilder terms and conditions remain unchanged.

This revised National Partnership Agreement has been signed by all jurisdictions.

The HomeBuilder program is closed to applications and will not reopen.

States and territories were responsible for administering HomeBuilder. You should direct your application questions to your relevant state or territory revenue office.

Factsheets

HomeBuilder |

|

HomeBuilder - Frequently asked questions |

State and territory contacts

HomeBuilder was administered by the states and territories.

The Australian Government did not process HomeBuilder applications.

You should direct your application inquiries to your relevant state or territory revenue office.

| State or territory | Website |

|---|---|

| Australian Capital Territory | ACT Revenue Office |

| New South Wales | Revenue NSW |

| Northern Territory | Northern Territory Revenue Office |

| Queensland | Queensland Government |

| South Australia | RevenueSA |

| Tasmania | State Revenue Office of Tasmania |

| Victoria | State Revenue Office Victoria |

| Western Australia | WA Government |

HomeBuilder National Partnership Agreement Review

The former Minister for Housing, Minister for Homelessness, Minister for Small Business, the Hon Julie Collins MP, released the Review of the National Partnership Agreement on HomeBuilder.

The Review considered whether the HomeBuilder National Partnership Agreement (NPA) achieved the agreed objectives and outcomes, and the role of the NPA in facilitating this. It covered the effectiveness of the NPA, roles and responsibilities, the utility of performance indicators and reporting, and the effectiveness and appropriateness of the financial arrangements.

HomeBuilder data

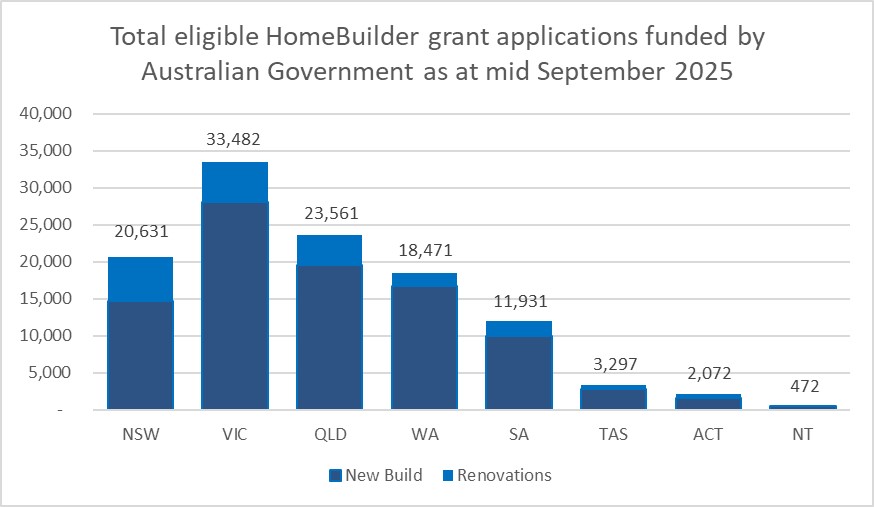

The Commonwealth made the final monthly payment to the states in early September 2025:

$2.64 billion in grant payments were made by the Australian Government to states and territories under the HomeBuilder program.

| Jurisdiction | New Build | Renovations | Total |

|---|---|---|---|

| New South Wales | 14,660 | 5,971 | 20,631 |

| Victoria | 28,070 | 5,412 | 33,482 |

| Queensland | 19,604 | 3,957 | 23,561 |

| Western Australia | 16,670 | 1,801 | 18,471 |

| South Australia | 9,910 | 2,021 | 11,931 |

| Tasmania | 2,799 | 498 | 3,297 |

| Australian Capital Territory | 1,588 | 484 | 2,072 |

| Northern Territory | 432 | 40 | 472 |

| Total | 93,733 | 20,184 | 113,917 |

Data source: data reported by states and territories.

Total eligible HomeBuilder grant applications in the table and chart above refers to applications assessed as eligible by states and territories and grants funded by Australian Government as at mid September 2025.

Application processes may differ across states and territories, limiting cross-state comparisons.